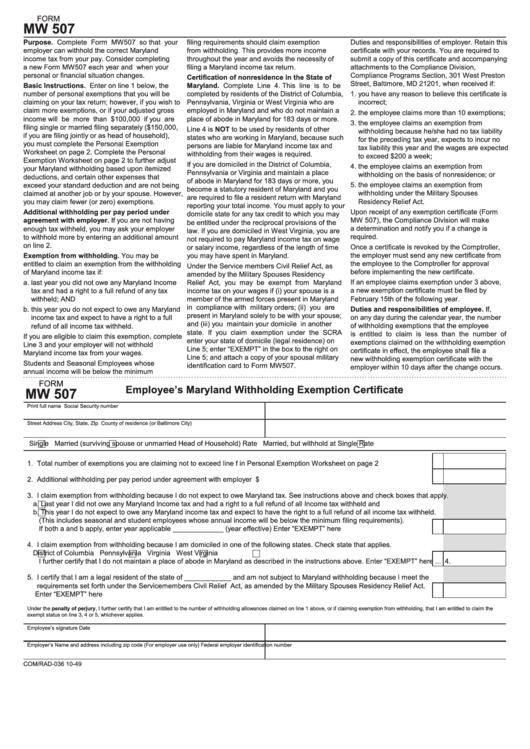

Md 507 Form 2023

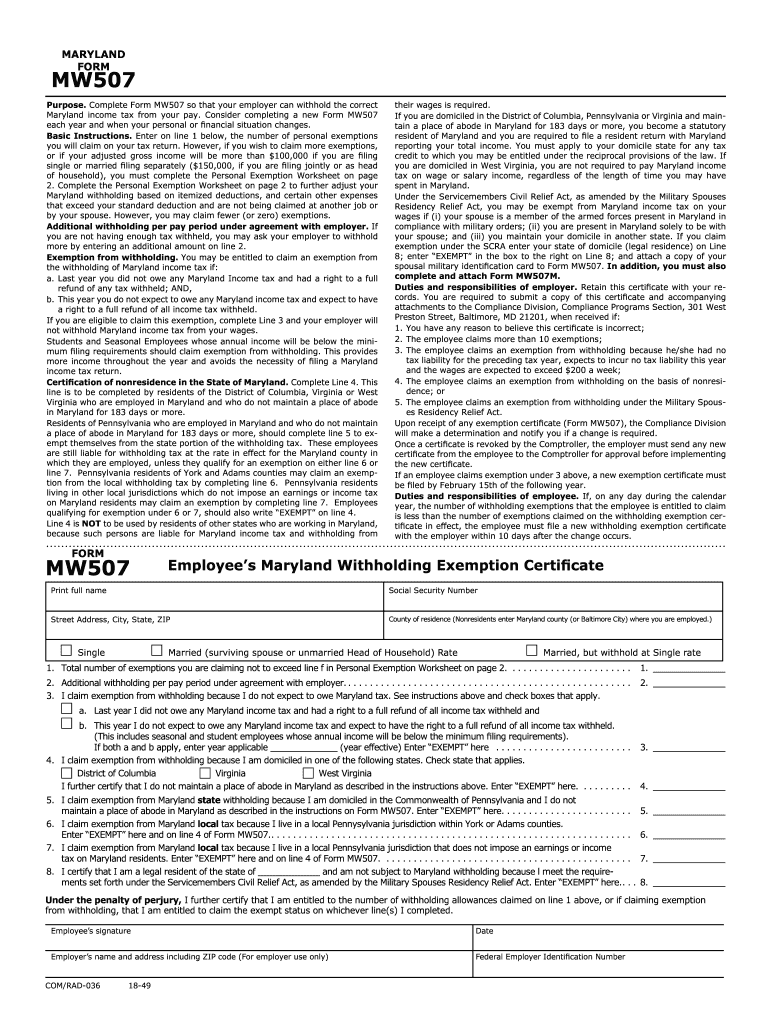

Md 507 Form 2023 - Web 1100 walnut street, suite 1500 kansas city, mo 64106 need assistance? About mdot new hires welcome to the new hire entry package page the following forms must be typed, printed, and signed with your original wet signature. Web i certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the. Payment voucher with instructions and worksheet for individuals sending check or. This form is for income earned in tax year 2022, with tax returns due in april. Web form mw507 and mw507m for each subsequent year you want. Brian c law, md, faaos: Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Learn about the application process here:. Web timothy l keenen, md, faaos:

Web the fall 2024 application cycle will open august 1, 2023. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Save or instantly send your ready documents. Personal tax payment voucher for form 502/505, estimated tax and extensions. Consider completing a new form mw507 each year and. Brian c law, md, faaos: Learn about the application process here:. This line is to be completed by residents of the district of columbia,. Should you sign the form 5564 that is attached to agree to the new. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay.

To continue the exemption from maryland withholding. Form used by employers who have discontinued or sold their business. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. To be mailed with the mw506 or mw506m. Brian c law, md, faaos: This line is to be completed by residents of the district of columbia,. About mdot new hires welcome to the new hire entry package page the following forms must be typed, printed, and signed with your original wet signature. This form is for income earned in tax year 2022, with tax returns due in april. Should you sign the form 5564 that is attached to agree to the new. Save or instantly send your ready documents.

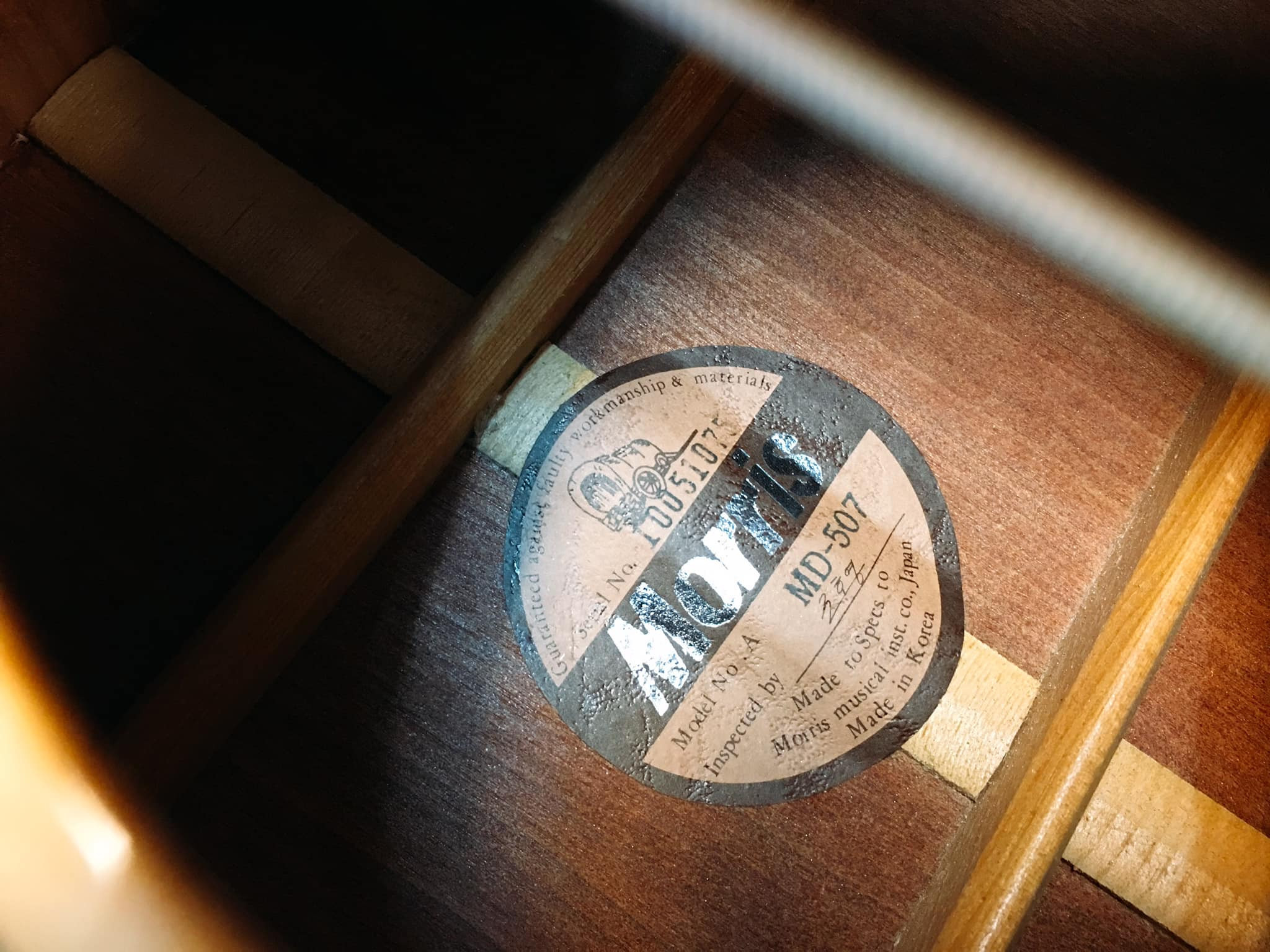

Morris MD507 (MO023)

Learn about the application process here:. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web form mw507 and mw507m for each subsequent year you want. To be mailed with the mw506 or mw506m. Understand what the irs notice of deficiency means.

Morris MD507 (MO023)

Web form mw507 and mw507m for each subsequent year you want. This line is to be completed by residents of the district of columbia,. About mdot new hires welcome to the new hire entry package page the following forms must be typed, printed, and signed with your original wet signature. Web the fall 2024 application cycle will open august 1,.

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

Web form mw507 and mw507m for each subsequent year you want. Certification of nonresidence in the state of maryland. Web we last updated maryland mw507 in january 2023 from the maryland comptroller of maryland. Understand what the irs notice of deficiency means. The deadline to submit all application materials is november 1, 2023.

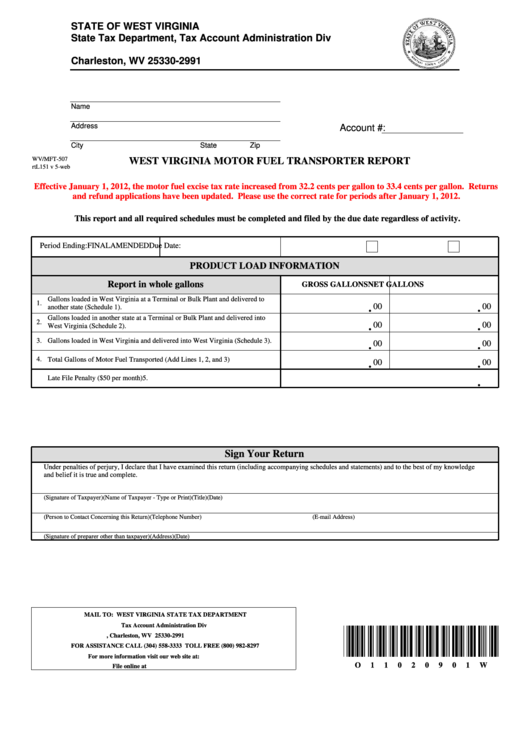

Fillable Form Wv/mft507 West Virginia Motor Fuel Transporter Report

The deadline to submit all application materials is november 1, 2023. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Easily fill out pdf blank, edit, and sign them. Learn about the application process here:. Web filing a maryland income tax return.

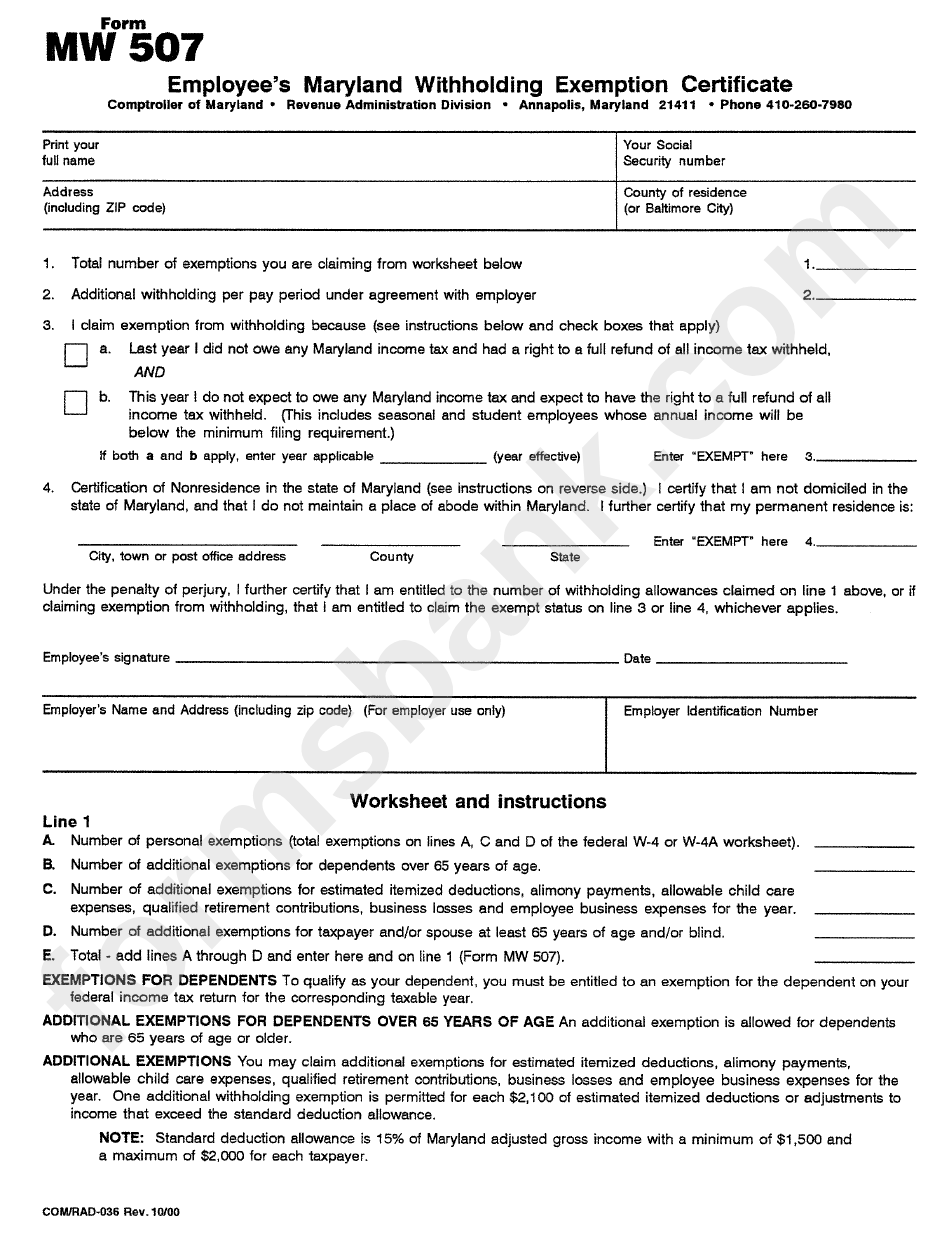

2011 Form MD Comptroller MW 507 Fill Online, Printable, Fillable, Blank

The deadline to submit all application materials is november 1, 2023. This form is for income earned in tax year 2022, with tax returns due in april. This line is to be completed by residents of the district of columbia,. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web because such.

Morris MD507N ElectroAcoustic Guitar South Korea Catawiki

Web form mw507 and mw507m for each subsequent year you want. Understand what the irs notice of deficiency means. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Personal tax payment voucher for form 502/505, estimated tax and extensions. Web 1100 walnut street, suite 1500 kansas city, mo 64106 need assistance?

[ベスト] mw 507 495852Mw 507 Gambarsaeo4p

Payment voucher with instructions and worksheet for individuals sending check or. This line is to be completed by residents of the district of columbia,. Easily fill out pdf blank, edit, and sign them. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. To continue the exemption from maryland withholding.

Arizona Insurance License Print Financial Report

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web form mw507 and mw507m for each subsequent year you want. 2023 mw 507 keywords 2023 form. Payment voucher with instructions and worksheet for individuals sending check or. To continue the exemption from maryland withholding.

How To Fill Out Mw507 Personal Exemptions Worksheet

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Payment voucher with instructions and worksheet for individuals sending check or. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web i certify that i am a legal resident of thestate of and am not.

Mw507 Fill Out and Sign Printable PDF Template signNow

Form used by employers who have discontinued or sold their business. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Web 1100 walnut street, suite 1500 kansas city, mo 64106 need assistance? Consider completing a new form mw507 each year and. Web timothy l keenen, md, faaos:

Web The Fall 2024 Application Cycle Will Open August 1, 2023.

Form used by employers who have discontinued or sold their business. This line is to be completed by residents of the district of columbia,. 2023 mw 507 keywords 2023 form. Consider completing a new form mw507 each year and.

The Due Date For Renewing Forms Mw507 And Mw507M Is.

Web because such persons are liable for maryland income tax and withholding from their wages is required. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Learn about the application process here:. Web form mw507 and mw507m for each subsequent year you want.

If You Are Domiciled In The District Of Columbia, Pennsylvania Or Virginia And.

Understand what the irs notice of deficiency means. Web i certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the. This form is for income earned in tax year 2022, with tax returns due in april. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay.

Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Your Pay.

Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Should you sign the form 5564 that is attached to agree to the new. To continue the exemption from maryland withholding. Certification of nonresidence in the state of maryland.

![[ベスト] mw 507 495852Mw 507 Gambarsaeo4p](https://www.speedytemplate.com/maryland-form-mw-507_000002.png)