Maryland Form 511

Maryland Form 511 - Maryland income tax withholding for annuity, sick pay and retirement distributions. Web form 511 may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit all member's share of income section. I read the maryland admin release and realize i need to file the 511. Web this form is used by ptes that elect to remit tax on all members' shares of income. Before i file the form. 2022 federal employer identification number (9 digits) fein applied for date (mmddyy) Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. Electing ptes must file form 511. Every other pte that is subject to md. Web md form 511, schedule b, part i and part iii, distributive or pro rata share of tax paid is distributing based upon profit/loss percentage instead of being allocated.

Maryland income tax withholding for annuity, sick pay and retirement distributions. Before i file the form. 2022 federal employer identification number (9 digits) fein applied for date (mmddyy) Web form 511 and its related forms are to be used by partnerships, s corporations, limited liability companies and business trusts that elect to pay tax on members’ distributive or. Web this form is used by ptes that elect to remit tax on all members' shares of income. Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. Web form 511 may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit all member's share of income section. Maryland form 511 news | july 1, 2021 there has been an update to our previous news brief regarding the maryland form 511. Electing ptes must file form 511. Web every md pte must file a return, even if it has no income or the entity is inactive.

Electing ptes must file form 511. Form used by recipients of annuity, sick pay or retirement distribution. Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. Web form 511 may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit all member's share of income section. Web every md pte must file a return, even if it has no income or the entity is inactive. Web form 511 and its related forms are to be used by partnerships, s corporations, limited liability companies and business trusts that elect to pay tax on members’ distributive or. Maryland form 511 news | july 1, 2021 there has been an update to our previous news brief regarding the maryland form 511. 2022 federal employer identification number (9 digits) fein applied for date (mmddyy) Web md form 511, schedule b, part i and part iii, distributive or pro rata share of tax paid is distributing based upon profit/loss percentage instead of being allocated. Maryland income tax withholding for annuity, sick pay and retirement distributions.

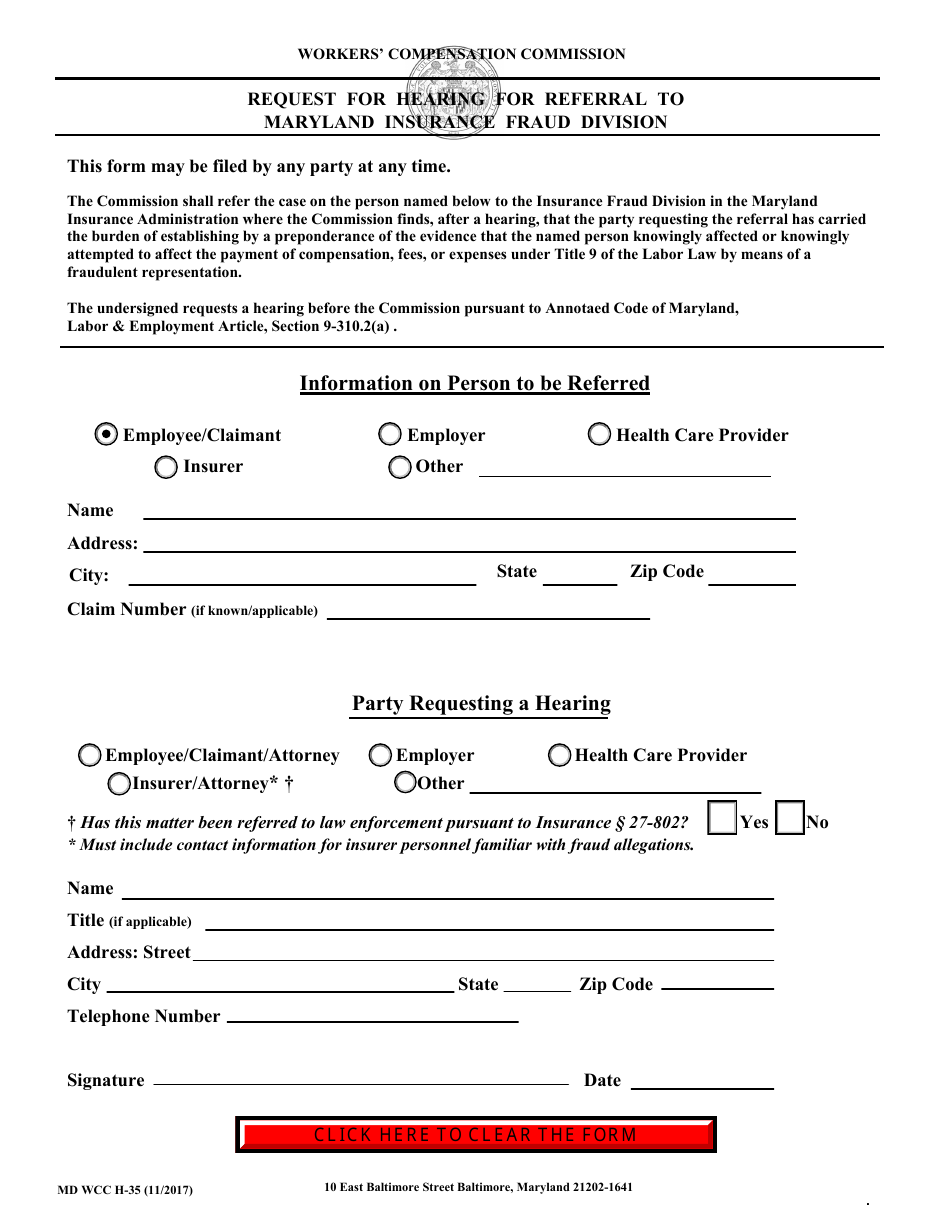

WCC Form H35 Download Fillable PDF or Fill Online Request for Hearing

Before i file the form. I read the maryland admin release and realize i need to file the 511. Every other pte that is subject to md. Web this week several members of the macpa state tax committee met with the maryland comptroller’s office revenue administration division (rad) officials to learn. Web form 511 and its related forms are to.

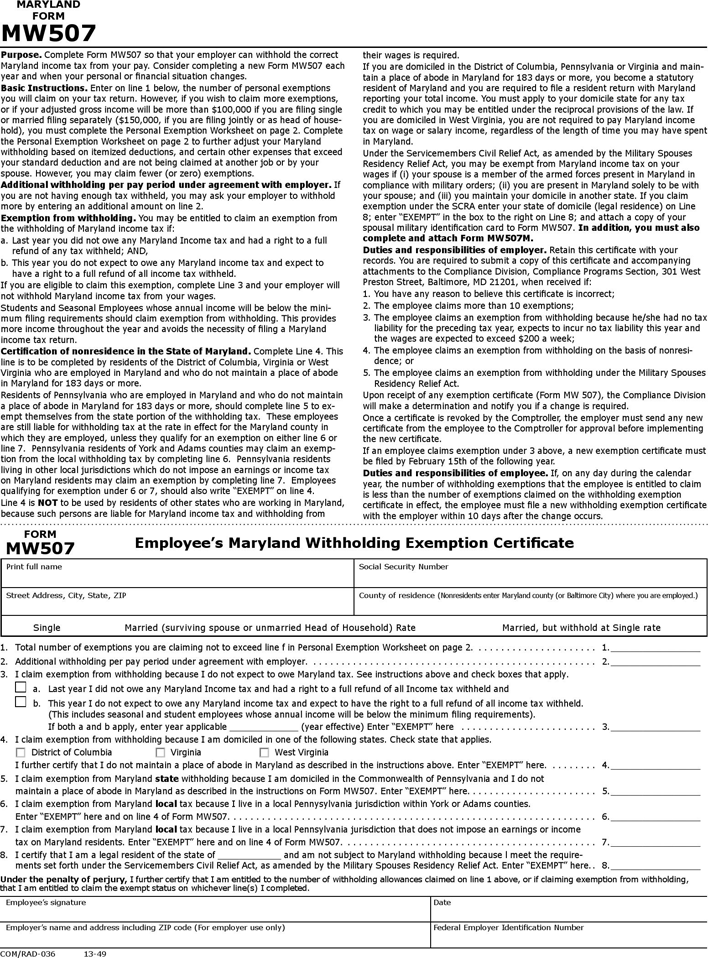

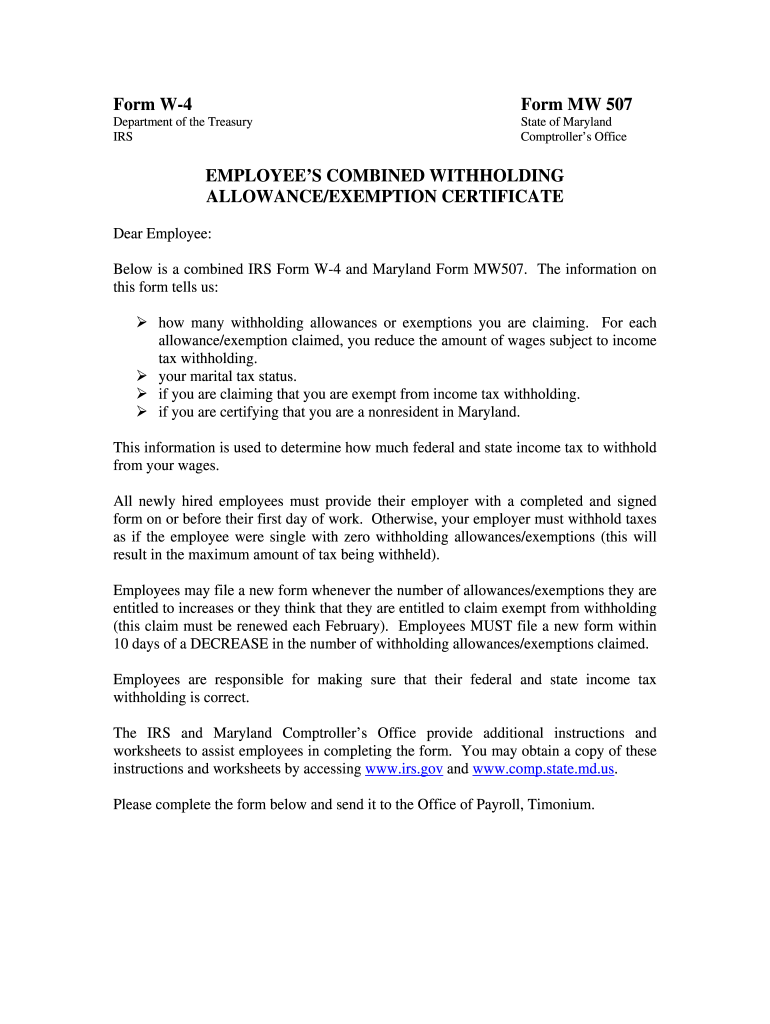

Maryland W4 Form Fill Out and Sign Printable PDF Template signNow

Web this form is used by ptes that elect to remit tax on all members' shares of income. Web form 511 and its related forms are to be used by partnerships, s corporations, limited liability companies and business trusts that elect to pay tax on members’ distributive or. Web the newly released form 511 properly calculates the amount of maryland.

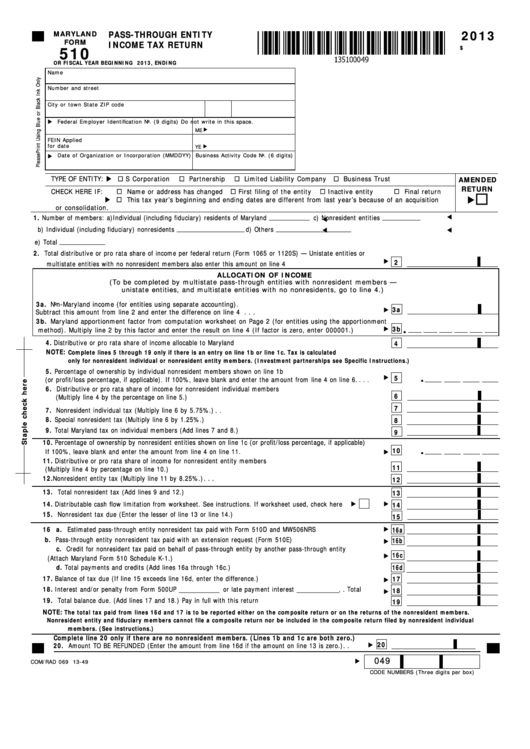

elliemeyersdesigns Maryland Form 510

2022 federal employer identification number (9 digits) fein applied for date (mmddyy) Electing ptes must file form 511. Web form 511 may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit all member's share of income section. Every other pte that is subject to md. Web every md pte must.

[ベスト] mw 507 495852Mw 507 Gambarsaeo4p

Web form 511 and its related forms are to be used by partnerships, s corporations, limited liability companies and business trusts that elect to pay tax on members’ distributive or. Electing ptes must file form 511. Form used by recipients of annuity, sick pay or retirement distribution. Every other pte that is subject to md. Web this week several members.

Free Maryland Form MW 50 PDF 609KB 2 Page(s)

Maryland income tax withholding for annuity, sick pay and retirement distributions. Web if pte is electing to pay tax for all members, you must use form 511. Electing ptes must file form 511. I read the maryland admin release and realize i need to file the 511. Web the newly released form 511 properly calculates the amount of maryland pte.

Maryland Form 511 for PassThrough Entities Hoffman Group

I read the maryland admin release and realize i need to file the 511. Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. Web form 511 and its related forms are to be used by partnerships, s corporations, limited liability companies and.

New Form 511 May Extend Maryland PassThrough Entities’ Deadline I95

Web md form 511, schedule b, part i and part iii, distributive or pro rata share of tax paid is distributing based upon profit/loss percentage instead of being allocated. Web if pte is electing to pay tax for all members, you must use form 511. Electing ptes must file form 511. Web this form is used by ptes that elect.

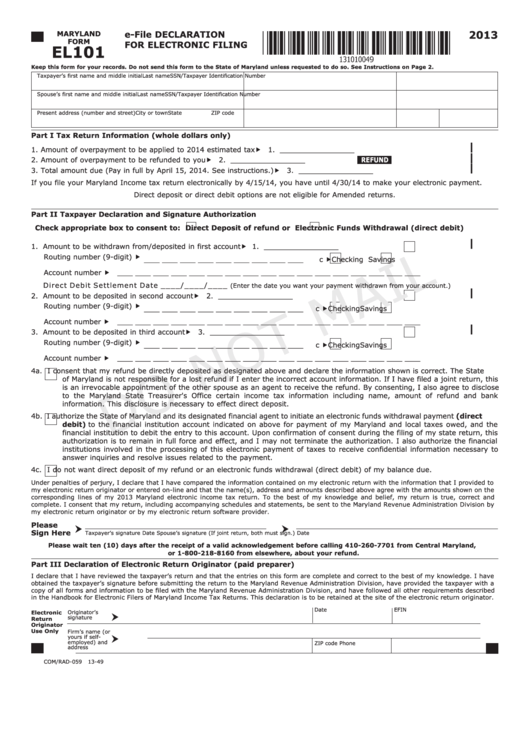

Fillable Maryland Form El101 EFile Declaration For Electronic Filing

Web this week several members of the macpa state tax committee met with the maryland comptroller’s office revenue administration division (rad) officials to learn. Web form 511 and its related forms are to be used by partnerships, s corporations, limited liability companies and business trusts that elect to pay tax on members’ distributive or. Web md form 511, schedule b,.

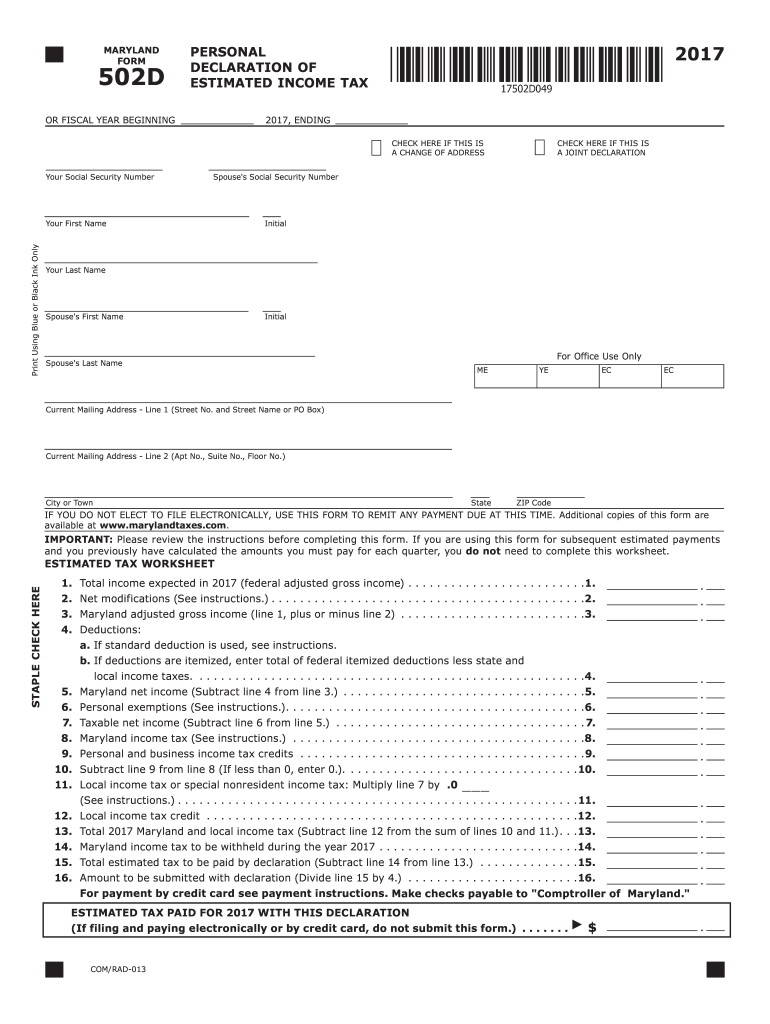

Maryland Form 502D Fill Out and Sign Printable PDF Template signNow

Maryland income tax withholding for annuity, sick pay and retirement distributions. Web every md pte must file a return, even if it has no income or the entity is inactive. Every other pte that is subject to md. Web this week several members of the macpa state tax committee met with the maryland comptroller’s office revenue administration division (rad) officials.

Release of Maryland Form 511 and What it Means for Your Tax Return

Web form 511 and its related forms are to be used by partnerships, s corporations, limited liability companies and business trusts that elect to pay tax on members’ distributive or. Web md form 511, schedule b, part i and part iii, distributive or pro rata share of tax paid is distributing based upon profit/loss percentage instead of being allocated. Web.

2022 Federal Employer Identification Number (9 Digits) Fein Applied For Date (Mmddyy)

Web this week several members of the macpa state tax committee met with the maryland comptroller’s office revenue administration division (rad) officials to learn. Maryland form 511 news | july 1, 2021 there has been an update to our previous news brief regarding the maryland form 511. Web the newly released form 511 properly calculates the amount of maryland pte tax due on behalf of both resident and nonresident owners and is now properly. Web every md pte must file a return, even if it has no income or the entity is inactive.

Before I File The Form.

Electing ptes must file form 511. Maryland income tax withholding for annuity, sick pay and retirement distributions. Web if pte is electing to pay tax for all members, you must use form 511. Web md form 511, schedule b, part i and part iii, distributive or pro rata share of tax paid is distributing based upon profit/loss percentage instead of being allocated.

Web Form 511 And Its Related Forms Are To Be Used By Partnerships, S Corporations, Limited Liability Companies And Business Trusts That Elect To Pay Tax On Members’ Distributive Or.

I read the maryland admin release and realize i need to file the 511. Web form 511 may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit all member's share of income section. Web this form is used by ptes that elect to remit tax on all members' shares of income. Every other pte that is subject to md.

![[ベスト] mw 507 495852Mw 507 Gambarsaeo4p](https://www.speedytemplate.com/maryland-form-mw-507_000002.png)