Late Filing Form 966

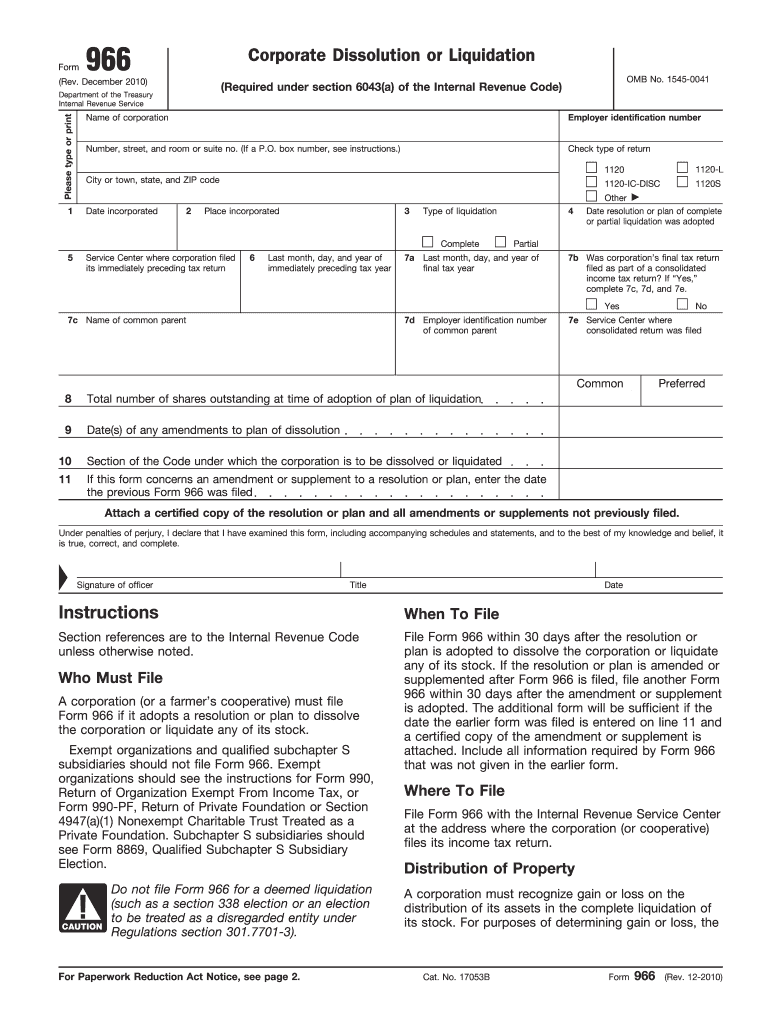

Late Filing Form 966 - Complete, edit or print tax forms instantly. Web common questions about form 966 corporate dissolution or liquidation for form 1120s. The corporation must file irs form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web when to file file form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If the resolution or plan is amended. Web nevertheless, the treasury regulations offer a form of relief allowing a late election, commonly known as section 9100 relief. two types of relief are offered by regs. Go to screen 51, corp.dissolution/liquidation (966). If the resolution or plan is amended. Web the basic penalty for failing to file a form 966 within 30 days of adopting the resolution to dissolve is $10 per day.

Web the liquidating corporation must timely file form 966, “corporate dissolution or liquidation,” (or its successor form) and its final federal corporate income tax return. Web when and where to file.—file form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Web there are several ways to submit form 4868. Web nevertheless, the treasury regulations offer a form of relief allowing a late election, commonly known as section 9100 relief. two types of relief are offered by regs. However, the maximum penalty for the organization. File a final return and related forms you must file a final return for the year you close your business. Go to screen 51, corp.dissolution/liquidation (966). Get ready for tax season deadlines by completing any required tax forms today. Web the basic penalty for failing to file a form 966 within 30 days of adopting the resolution to dissolve is $10 per day. Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock.

Check the box labeled print form 966. Web although irc sec. Web file form 966 within 30 days after the resolution orplan is adopted to dissolve the corporation or liquidateany of its stock. Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation. Web when and where to file.—file form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If the resolution or plan is. Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Ad access irs tax forms. Form 966 is filed with the internal. 6043(a) requires a corporation to file a form 966 within 30 days of adopting a plan of liquidation or dissolution, there does not appear to be any.

2010 Form IRS 966 Fill Online, Printable, Fillable, Blank PDFfiller

However, the maximum penalty for the organization. Complete, edit or print tax forms instantly. Web there are several ways to submit form 4868. Web the liquidating corporation must timely file form 966, “corporate dissolution or liquidation,” (or its successor form) and its final federal corporate income tax return. In this situation, you are responsible for notifying all.

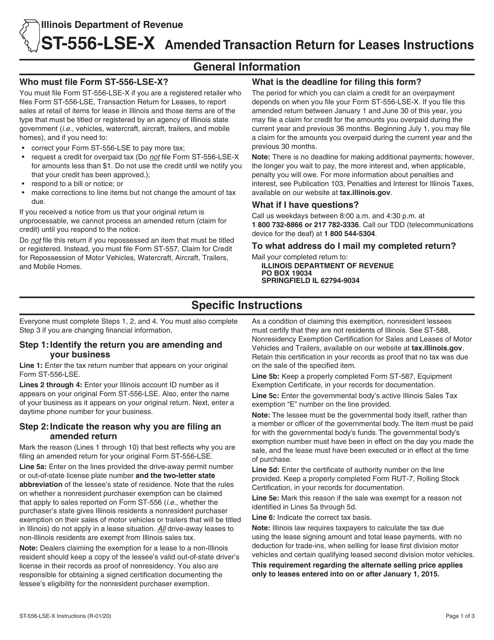

Download Instructions for Form ST556LSEX, 966 Amended Transaction

Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. In this situation, you are responsible for notifying all. Web there are several ways to submit form 4868. Solved • by intuit • 6 • updated 1 year ago. Check the box labeled print form 966.

Law Document English View Ontario.ca

Check the box labeled print form 966. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. If the resolution or plan is amended. Complete, edit or print tax forms instantly. Web [1] in accordance with this provision, the internal revenue service has adopted a regulation requiring a dissolving corporation to.

How to Write a Form 990 Late Filing Penalty Abatement Letter 50,000

Web there are several ways to submit form 4868. Solved • by intuit • 6 • updated 1 year ago. Go to screen 51, corp.dissolution/liquidation (966). Web form 966 must be filed within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. File a final return and related forms you.

Form 966 How 5471 Penalty can Stem from an IRS Form 966 Corporate

Web there are several ways to submit form 4868. Web [1] in accordance with this provision, the internal revenue service has adopted a regulation requiring a dissolving corporation to file a return on form 966 (corporate dissolution or. Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation..

Irs Form 1099 Late Filing Penalty Form Resume Examples

However, the maximum penalty for the organization. Web although irc sec. Get ready for tax season deadlines by completing any required tax forms today. Web nevertheless, the treasury regulations offer a form of relief allowing a late election, commonly known as section 9100 relief. two types of relief are offered by regs. Web are you going to dissolve your corporation.

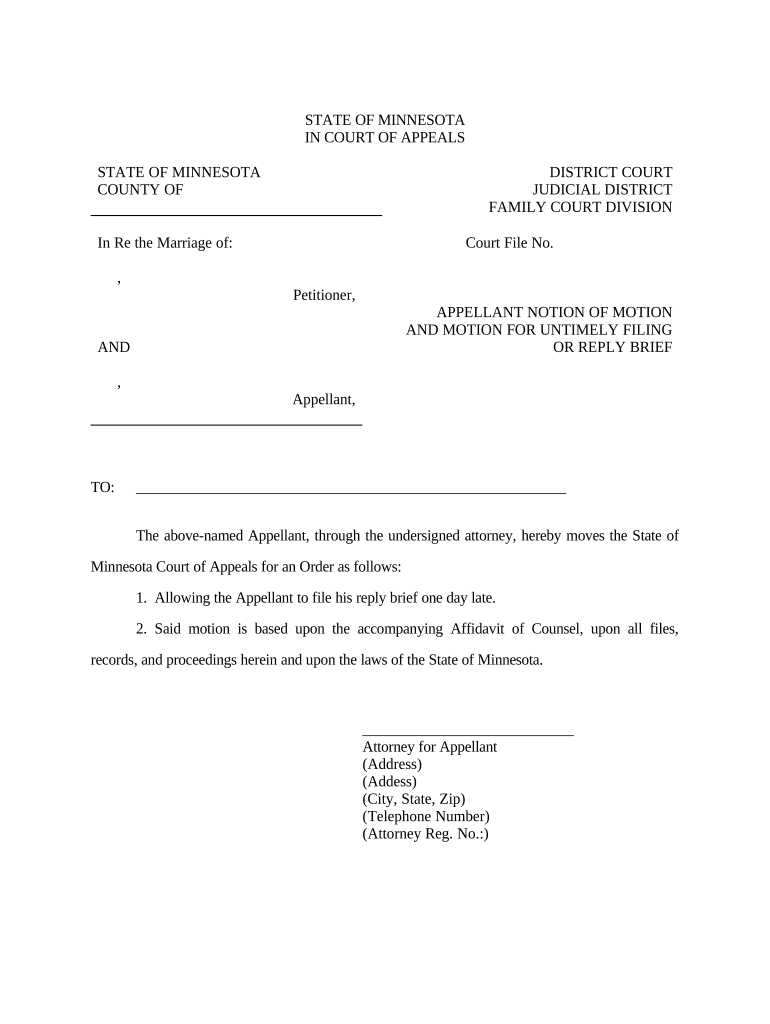

Motion Late Filing Form Fill Out and Sign Printable PDF Template

Ad access irs tax forms. Web [1] in accordance with this provision, the internal revenue service has adopted a regulation requiring a dissolving corporation to file a return on form 966 (corporate dissolution or. Check the box labeled print form 966. Web the basic penalty for failing to file a form 966 within 30 days of adopting the resolution to.

Form 966 (Rev PDF Tax Return (United States) S Corporation

6043(a) requires a corporation to file a form 966 within 30 days of adopting a plan of liquidation or dissolution, there does not appear to be any. Web file form 966 within 30 days after the resolution orplan is adopted to dissolve the corporation or liquidateany of its stock. However, the maximum penalty for the organization. Web because the liquidation.

Valid IRS Reasons for Late Filing of Form 2553 Bizfluent

Form 966 is filed with the internal. Solved • by intuit • 6 • updated 1 year ago. File a final return and related forms you must file a final return for the year you close your business. Make sure to file irs form 966 after you adopt a plan of dissolution for the corporation. Web [1] in accordance with.

SBA Form 503/504 Liquidation Wrap Up Report Stock Photo Image of

Web they must file form 966, corporate dissolution or liquidation, if they adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. Web are you going to dissolve your corporation during the tax year? Web there are several ways to submit form 4868. The corporation must file irs form 966 within 30 days after the.

Solved • By Intuit • 6 • Updated 1 Year Ago.

Web form 966 corporate dissolution or liquidation is the irs form that must be filled out when closing down an s corporation. If the resolution or plan is amended. File a final return and related forms you must file a final return for the year you close your business. 332 liquidations, did not nullify the liquidation but could subject the corporation to criminal.

Web The Basic Penalty For Failing To File A Form 966 Within 30 Days Of Adopting The Resolution To Dissolve Is $10 Per Day.

Ad access irs tax forms. Web when and where to file.—file form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. However, the maximum penalty for the organization.

If The Resolution Or Plan Is.

Web common questions about form 966 corporate dissolution or liquidation for form 1120s. Web although irc sec. Form 966 is filed with the internal. In this situation, you are responsible for notifying all.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web the liquidating corporation must timely file form 966, “corporate dissolution or liquidation,” (or its successor form) and its final federal corporate income tax return. Web there are several ways to submit form 4868. Complete, edit or print tax forms instantly. The corporation must file irs form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock.