Kyc Full Form

Kyc Full Form - Web know your client (kyc) are standards used in the investment and financial services industry to verify customers and know their risk and financial profiles. You may refer to the following articles to learn more about finance: Kyc makes it easier for an institution to authenticate its consumer identity and address details. Web know your customer ( kyc) are guidelines and regulations in financial services that require professionals to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. Web this article guides the full form of kyc and its definition. If you are wondering about what is kyc, then it is an acronym whose full form is 'know your customer.'. Kyc ensures a customer is who they say they are. Kyc or kyc check is the mandatory process of identifying and verifying the client's identity when opening an account and periodically over time. Hence it is aptly called “know your customer.” the strategy to combat financial fraud, terrorist financing, and money laundering. The bank or nbfc will.

Kyc makes it easier for an institution to authenticate its consumer identity and address details. Know your customer is the process of verifying all consumers and clients by banks, insurance companies, and other institutions before or while performing transactions with their customers. Web kyc is the method of a company that verifies the customer’s identity and assesses possible risks to the business relationship from criminal intentions. If you are wondering about what is kyc, then it is an acronym whose full form is 'know your customer.'. It is an authentication process mandated by the reserve bank of india. Essentially, the meaning of kyc is to establish an individual's identity and address through relevant supporting documents. The full form of kyc is know your customer. Here, we learn the purpose, requirements, and procedures to register kyc (know your customer) and its importance and advantages. Three components of kyc include the. The full form of kyc is “know your customer.” it is a process used by financial institutions such as banks to verify the identity of their customers.

You may refer to the following articles to learn more about finance: Essentially, the meaning of kyc is to establish an individual's identity and address through relevant supporting documents. Hence it is aptly called “know your customer.” the strategy to combat financial fraud, terrorist financing, and money laundering. Kyc makes it easier for an institution to authenticate its consumer identity and address details. Web what is kyc? Here, we learn the purpose, requirements, and procedures to register kyc (know your customer) and its importance and advantages. Web know your customer ( kyc) are guidelines and regulations in financial services that require professionals to verify the identity, suitability, and risks involved with maintaining a business relationship with a customer. In other words, banks must ensure that their clients are genuinely who they claim to be. Web kyc means know your customer and sometimes know your client. It is an authentication process mandated by the reserve bank of india.

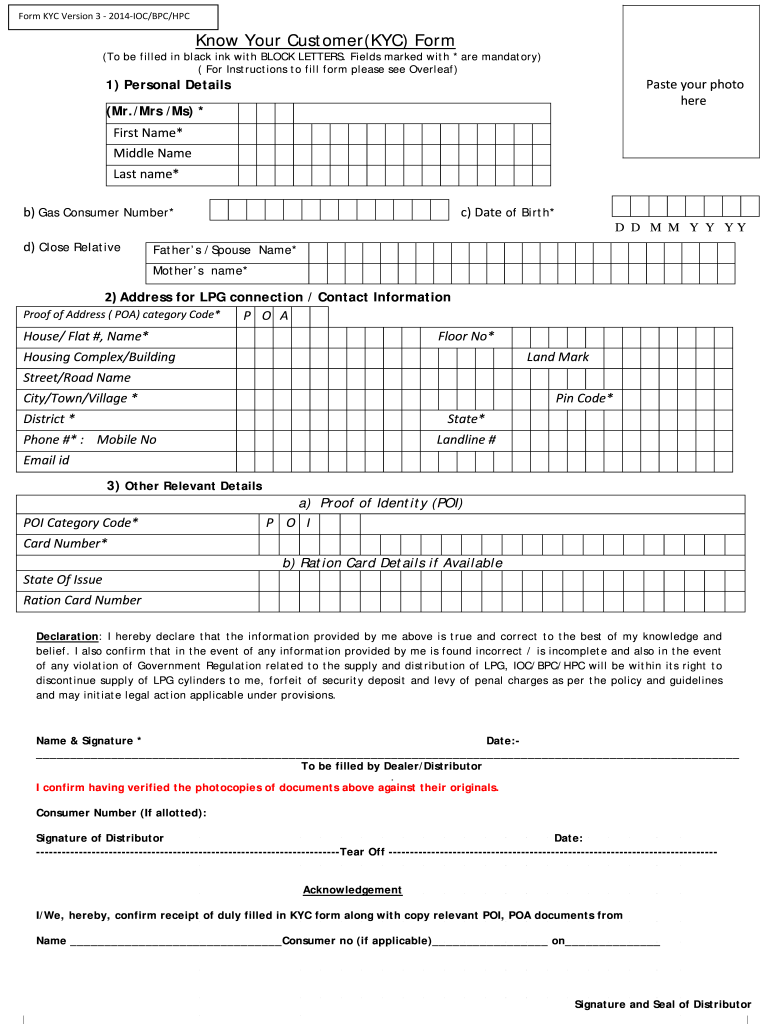

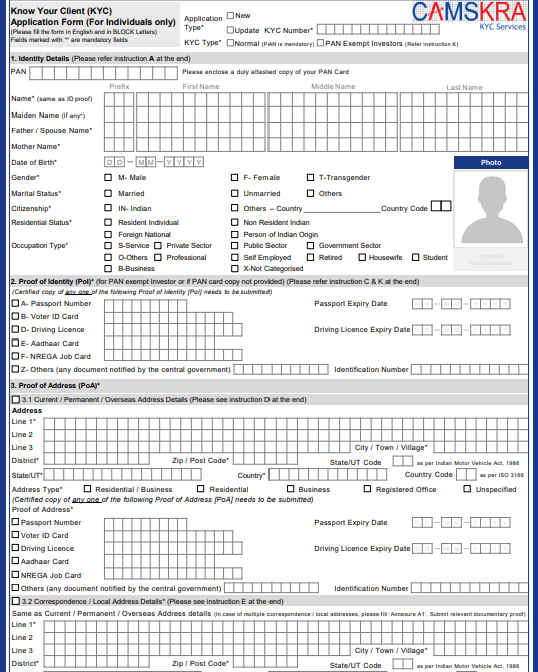

Kyc Form Fill Out and Sign Printable PDF Template signNow

Three components of kyc include the. Web know your client (kyc) are standards used in the investment and financial services industry to verify customers and know their risk and financial profiles. Web kyc means know your customer. it is a due diligence process financial companies use to verify customer identity and assess and monitor customer risk. If you are wondering.

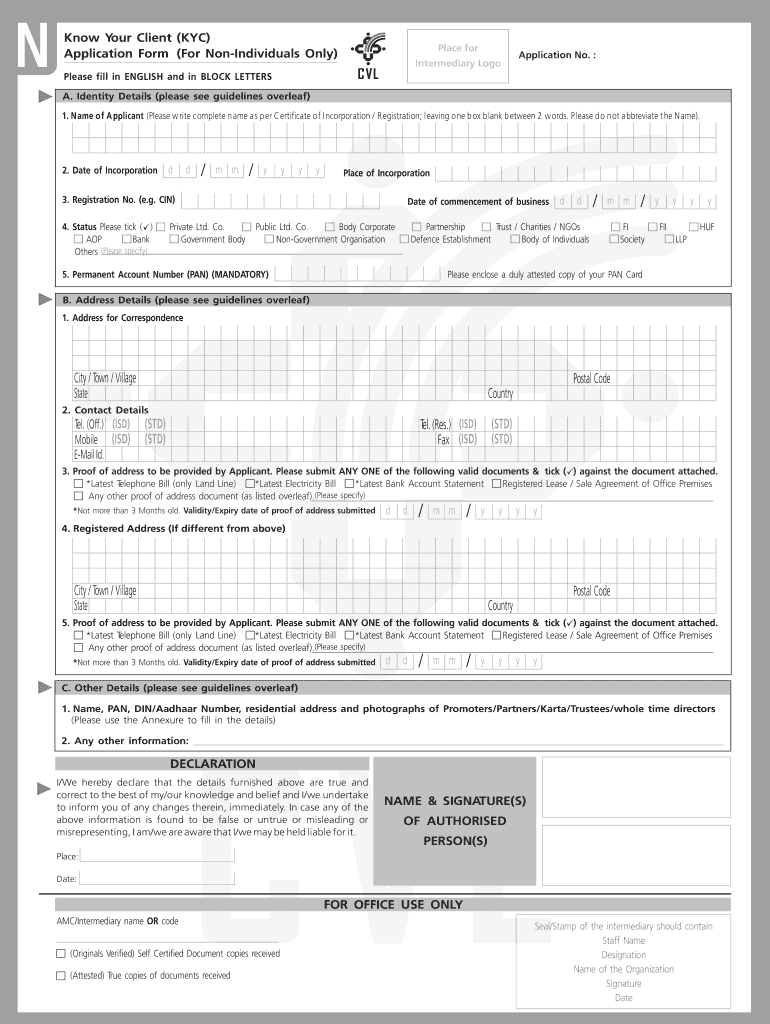

KYC Form PDF PDF Identity Document Business

The full form of kyc is know your customer. Web kyc is the method of a company that verifies the customer’s identity and assesses possible risks to the business relationship from criminal intentions. Web kyc means know your customer. it is a due diligence process financial companies use to verify customer identity and assess and monitor customer risk. Know your.

Kyc Form Fill Out and Sign Printable PDF Template signNow

Kyc makes it easier for an institution to authenticate its consumer identity and address details. Web what is the full form of kyc? Web kyc means know your customer and sometimes know your client. Hence it is aptly called “know your customer.” the strategy to combat financial fraud, terrorist financing, and money laundering. Web know your customer ( kyc) are.

KYC Full Form केवाईसी की फुल फॉर्म और केवाईसी क्या है

It is an authentication process mandated by the reserve bank of india. Web kyc is the method of a company that verifies the customer’s identity and assesses possible risks to the business relationship from criminal intentions. Here, we learn the purpose, requirements, and procedures to register kyc (know your customer) and its importance and advantages. Web this article guides the.

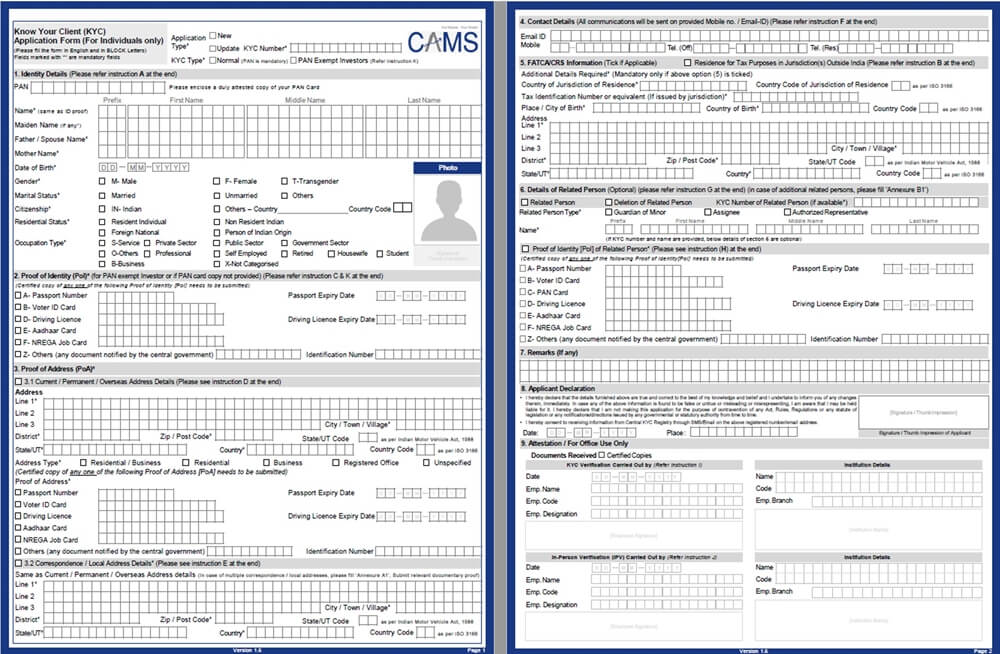

CAMS KRA Form Online KYC Status Check CAMS KRA Services

The bank or nbfc will. Know your customer is the process of verifying all consumers and clients by banks, insurance companies, and other institutions before or while performing transactions with their customers. You may refer to the following articles to learn more about finance: Essentially, the meaning of kyc is to establish an individual's identity and address through relevant supporting.

KYC full form and details full form

The full form of kyc is “know your customer.” it is a process used by financial institutions such as banks to verify the identity of their customers. Web what is kyc? In other words, banks must ensure that their clients are genuinely who they claim to be. It is an authentication process mandated by the reserve bank of india. Web.

Download KYC Form for Free Page 2 FormTemplate

All financial institutions must ensure their customers are kyc compliant. Kyc makes it easier for an institution to authenticate its consumer identity and address details. Here, we learn the purpose, requirements, and procedures to register kyc (know your customer) and its importance and advantages. The full form of kyc is “know your customer.” it is a process used by financial.

Full form of KYC

Web kyc is the method of a company that verifies the customer’s identity and assesses possible risks to the business relationship from criminal intentions. Know your customer is the process of verifying all consumers and clients by banks, insurance companies, and other institutions before or while performing transactions with their customers. Web kyc stands for know your client or know.

KYC Full Form in Hindi KYC क्यों जरुरी है A to Z Classes

Web kyc means know your customer. it is a due diligence process financial companies use to verify customer identity and assess and monitor customer risk. Web this article guides the full form of kyc and its definition. Know your customer is the process of verifying all consumers and clients by banks, insurance companies, and other institutions before or while performing.

How to do KYC for Mutual Funds? Its quick and easy!

Web kyc stands for know your client or know your customer. Web what is the full form of kyc? Web this article guides the full form of kyc and its definition. Web kyc means know your customer. it is a due diligence process financial companies use to verify customer identity and assess and monitor customer risk. Three components of kyc.

Web Kyc Means Know Your Customer. It Is A Due Diligence Process Financial Companies Use To Verify Customer Identity And Assess And Monitor Customer Risk.

The full form of kyc is “know your customer.” it is a process used by financial institutions such as banks to verify the identity of their customers. Web what is kyc? Web kyc means know your customer and sometimes know your client. Web this article guides the full form of kyc and its definition.

Web Kyc Stands For Know Your Client Or Know Your Customer.

The full form of kyc is know your customer. If you are wondering about what is kyc, then it is an acronym whose full form is 'know your customer.'. Web what is the full form of kyc? Three components of kyc include the.

Kyc Ensures A Customer Is Who They Say They Are.

All financial institutions must ensure their customers are kyc compliant. In other words, banks must ensure that their clients are genuinely who they claim to be. Essentially, the meaning of kyc is to establish an individual's identity and address through relevant supporting documents. Here, we learn the purpose, requirements, and procedures to register kyc (know your customer) and its importance and advantages.

Hence It Is Aptly Called “Know Your Customer.” The Strategy To Combat Financial Fraud, Terrorist Financing, And Money Laundering.

The bank or nbfc will. Web know your client (kyc) are standards used in the investment and financial services industry to verify customers and know their risk and financial profiles. Kyc or kyc check is the mandatory process of identifying and verifying the client's identity when opening an account and periodically over time. You may refer to the following articles to learn more about finance: