Ky Extension Form

Ky Extension Form - Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Cccccccccd aaaaaaaaab 720ext 2020 form. Kentucky individual income tax returns are due by the 15th day of the 4th month following the close of the tax year — for calendar year. Web file your personal tax extension now! Web the requirements may be met by attaching federal form 4868 (automatic extension) and/or form 2688 (approved extension) to the kentucky return. Taxpayers who request a federal extension are not required to file a separate kentucky extension,. Web use this form if you are requesting a kentucky extension of time to file. Interest at the annual rate of 5. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Web must apply separately to this agency for an extension of time within which to file their local tax return.

This form is for income earned in tax year 2022, with tax. Web only extension requests received by the due date of the occupational license fee and business license renewal return form and filed according to the form's instructions. Cccccccccd aaaaaaaaab 720ext 2020 form. To access the kentucky application for. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. To access this form, in the kentucky state main menu,. Web the university of kentucky cooperative extension service provides practical education you can trust to help people, businesses, and communities solve problems, develop. Interest at the annual rate of 5. Web page 1 include all applicable federal forms, schedules and statements with return for office use only annual occupational fee &. Web use this form if you are requesting a kentucky extension of time to file.

This application must be submitted by the 15th day of the fourth month. This form is for income earned in tax year 2022, with tax. Web only extension requests received by the due date of the occupational license fee and business license renewal return form and filed according to the form's instructions. Web page 1 include all applicable federal forms, schedules and statements with return for office use only annual occupational fee &. Web use this form if you are requesting a kentucky extension of time to file. Web the university of kentucky cooperative extension service provides practical education you can trust to help people, businesses, and communities solve problems, develop. Interest at the annual rate of 5. Web file your personal tax extension now! Kentucky individual income tax returns are due by the 15th day of the 4th month following the close of the tax year — for calendar year. Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension.

Warren County Extension Office to celebrate a new beginning

Taxpayers who request a federal extension are not required to file a separate kentucky extension,. Interest at the annual rate of 5. Web commonwealth of kentucky department of revenue corporation/llet extension2020 ¬please cut on the dotted line. Web use this form if you are requesting a kentucky extension of time to file. Web only extension requests received by the due.

Newport Ky. 9 extension needs funding in 2017

To access the kentucky application for. Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. Interest at the annual rate of 5. Employers in covington are required to withhold 2.45% on all compensation paid to. To access this form, in the kentucky state main menu,.

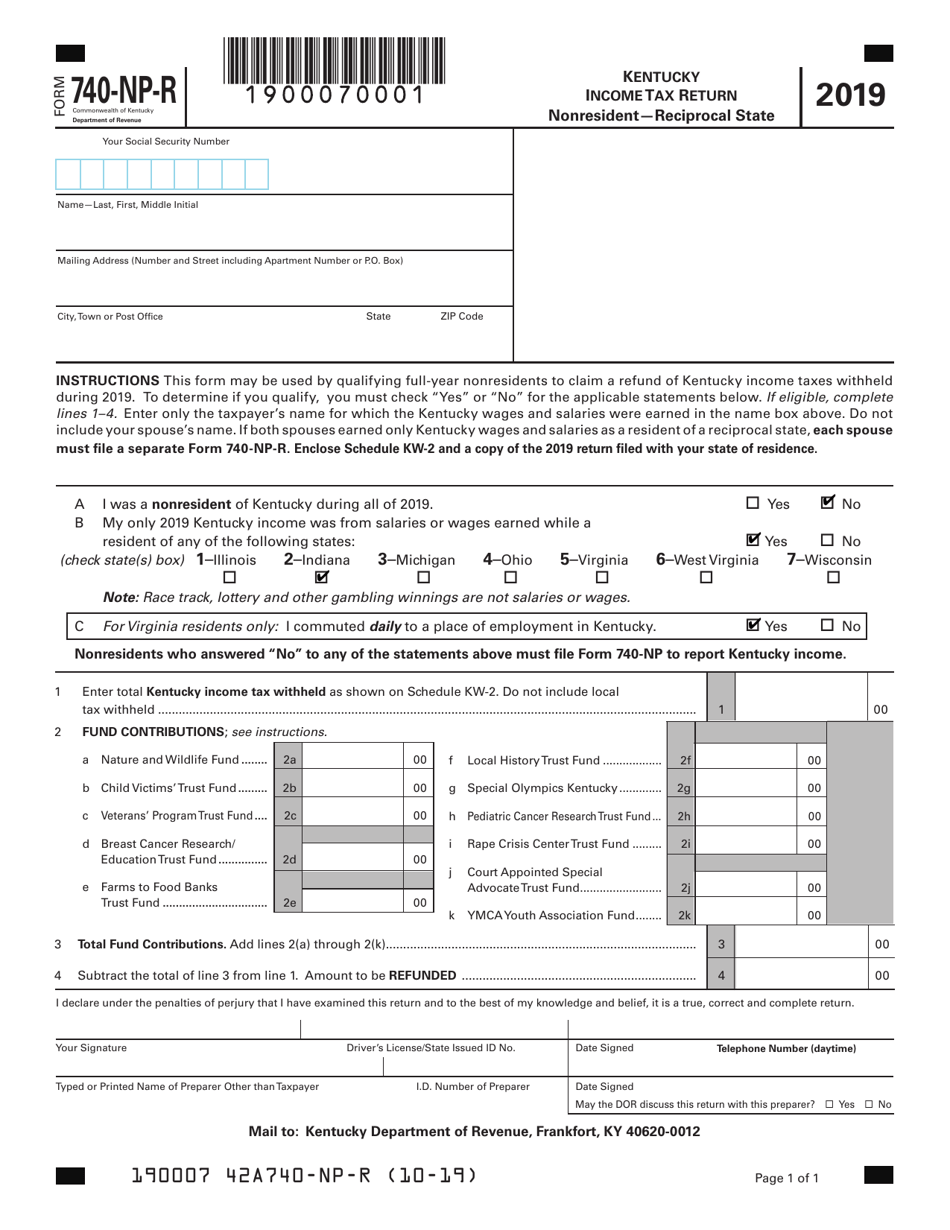

Form 740NPR Download Fillable PDF or Fill Online Kentucky Tax

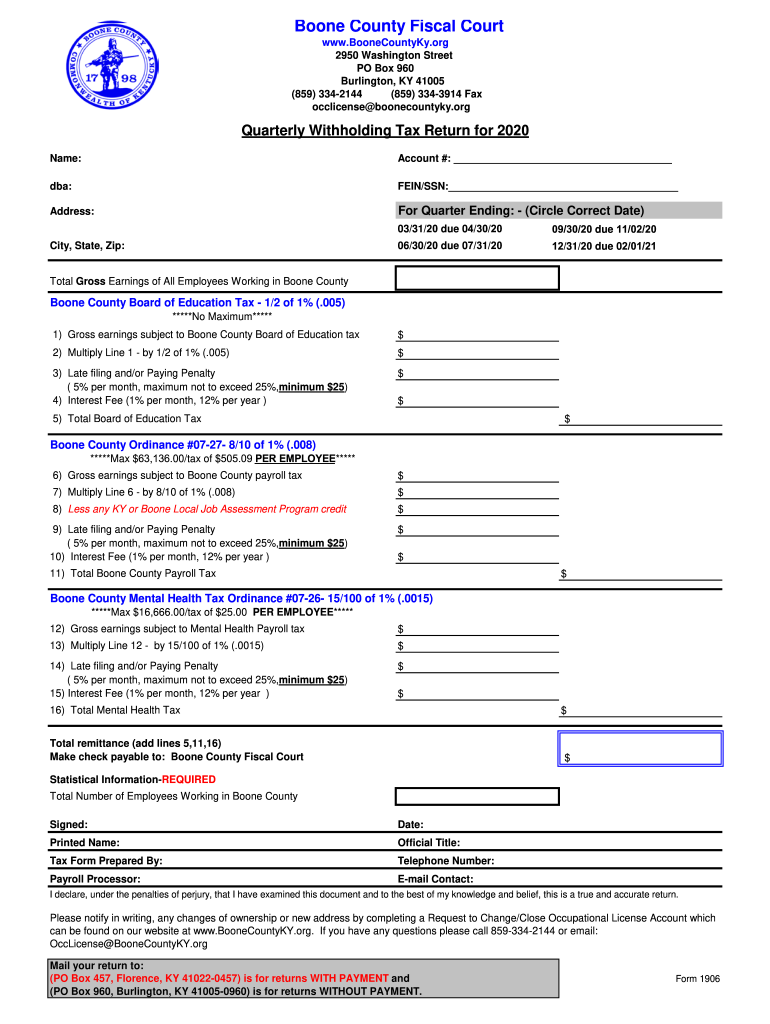

Employers’ license fee withheld (payroll tax): Web file your personal tax extension now! Web if additional tax is due or a federal extension has not been filed, use form 740ext to request an extension. Web use this form if you are requesting a kentucky extension of time to file. Employers in covington are required to withhold 2.45% on all compensation.

Update on the Hardin County Extension Office

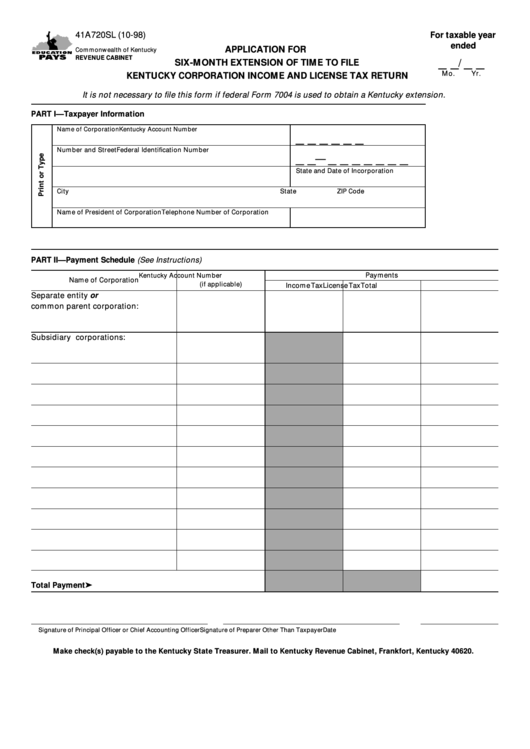

Interest at the annual rate of 5. Web commonwealth of kentucky department of revenue corporation/llet extension2020 ¬please cut on the dotted line. This application must be submitted by the 15th day of the fourth month. Kentucky individual income tax returns are due by the 15th day of the 4th month following the close of the tax year — for calendar.

2018 Form SC DoR SC4868 Fill Online, Printable, Fillable, Blank pdfFiller

Web the university of kentucky cooperative extension service provides practical education you can trust to help people, businesses, and communities solve problems, develop. Web kentucky state general business corporation tax extension form 720ext is due within 4 months and 15 days following the end of the corporation reporting period. Web only extension requests received by the due date of the.

2016 03 22 Ky Extension Collection YouTube

This form is for income earned in tax year 2022, with tax. This application must be submitted by the 15th day of the fourth month. Interest at the annual rate of 5. Employers’ license fee withheld (payroll tax): Web use this form if you are requesting a kentucky extension of time to file.

Ky Quarterly Tax Fill Out and Sign Printable PDF Template signNow

Taxpayers who request a federal extension are not required to file a separate kentucky extension,. To access the kentucky application for. Web only extension requests received by the due date of the occupational license fee and business license renewal return form and filed according to the form's instructions. This form is for income earned in tax year 2022, with tax..

ky_extension_slatecopy Kettle's Yard

Web commonwealth of kentucky department of revenue corporation/llet extension2020 ¬please cut on the dotted line. Web 66 rows welcome to the forms resource page for the division of motor vehicle licensing. Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. This application must be submitted by the.

Fillable Form 41a720sl Application For SixMonth Extension Of Time To

Web the university of kentucky cooperative extension service provides practical education you can trust to help people, businesses, and communities solve problems, develop. Web the requirements may be met by attaching federal form 4868 (automatic extension) and/or form 2688 (approved extension) to the kentucky return. Web file your personal tax extension now! Web kentucky state general business corporation tax extension.

740 2008 Kentucky Individual Tax Return Form 42A740

To access the kentucky application for. This application must be submitted by the 15th day of the fourth month. Web the requirements may be met by attaching federal form 4868 (automatic extension) and/or form 2688 (approved extension) to the kentucky return. Web must apply separately to this agency for an extension of time within which to file their local tax.

Interest At The Annual Rate Of 5.

Web use form 740ext, application for extension of time to file, to request an extension for cause of up to six months. Web the requirements may be met by attaching federal form 4868 (automatic extension) and/or form 2688 (approved extension) to the kentucky return. Kentucky individual income tax returns are due by the 15th day of the 4th month following the close of the tax year — for calendar year. This application must be submitted by the 15th day of the fourth month.

This Form Is For Income Earned In Tax Year 2022, With Tax.

Web 66 rows welcome to the forms resource page for the division of motor vehicle licensing. Web only extension requests received by the due date of the occupational license fee and business license renewal return form and filed according to the form's instructions. Web commonwealth of kentucky department of revenue corporation/llet extension2020 ¬please cut on the dotted line. Taxpayers who request a federal extension are not required to file a separate kentucky extension,.

Web Kentucky State General Business Corporation Tax Extension Form 720Ext Is Due Within 4 Months And 15 Days Following The End Of The Corporation Reporting Period.

Employers in covington are required to withhold 2.45% on all compensation paid to. Cccccccccd aaaaaaaaab 720ext 2020 form. Web the university of kentucky cooperative extension service provides practical education you can trust to help people, businesses, and communities solve problems, develop. To access the kentucky application for.

Web Page 1 Include All Applicable Federal Forms, Schedules And Statements With Return For Office Use Only Annual Occupational Fee &.

Web must apply separately to this agency for an extension of time within which to file their local tax return. To access this form, in the kentucky state main menu,. Web file your personal tax extension now! Employers’ license fee withheld (payroll tax):