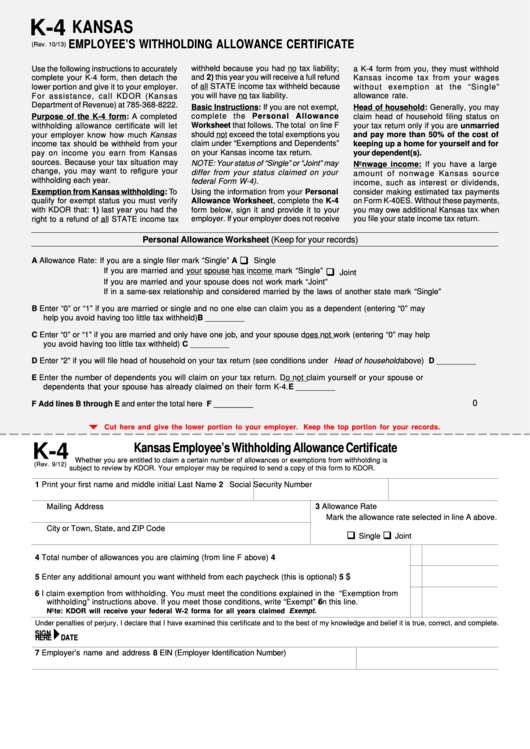

Kansas Form K-4

Kansas Form K-4 - This form is for income earned in tax year 2022, with tax returns due in april. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. The form can be filed electronically or on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form must be filed with the employee’s employer. Department of the treasury internal revenue service. This form is for income earned in tax year. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. If you have indicated that you have or will receive bonus pay from your employer, fill out this form to provide more information. Web this form enables an employee to estimate the percentage of services performed in kansas.

Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. If you have indicated that you have or will receive bonus pay from your employer, fill out this form to provide more information. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form must be filed with the employee’s employer. This form is for income earned in tax year 2022, with tax returns due in april. There are a few situations in which you can want to request. The form can be filed electronically or on. This form is for income earned in tax year. Web this form enables an employee to estimate the percentage of services performed in kansas. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on.

The form can be filed electronically or on. This form is for income earned in tax year 2022, with tax returns due in april. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. If you have indicated that you have or will receive bonus pay from your employer, fill out this form to provide more information. Web this form enables an employee to estimate the percentage of services performed in kansas. This form must be filed with the employee’s employer. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. However, due to differences between state and. This form is for income earned in tax year.

Form K 40 Kansas Individual Tax YouTube

This form is for income earned in tax year. This form must be filed with the employee’s employer. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. If you have indicated that you have or will receive bonus pay from your employer, fill out this form to.

Kansas K4 App

If you have indicated that you have or will receive bonus pay from your employer, fill out this form to provide more information. However, due to differences between state and. Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. There are a few.

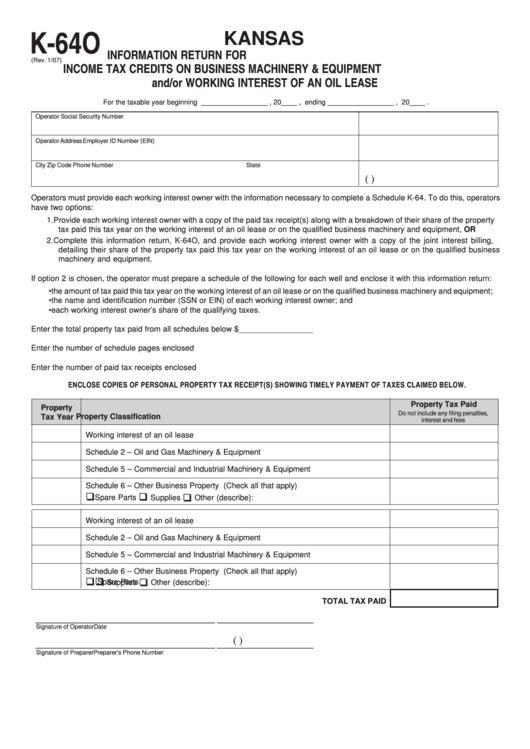

Fillable Form K64o Kansas Information Return For Tax Credits

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Department of the treasury internal revenue service. If you have indicated that you have or will receive bonus pay from your employer, fill out this form to provide more information. This form must be filed with the employee’s employer. The.

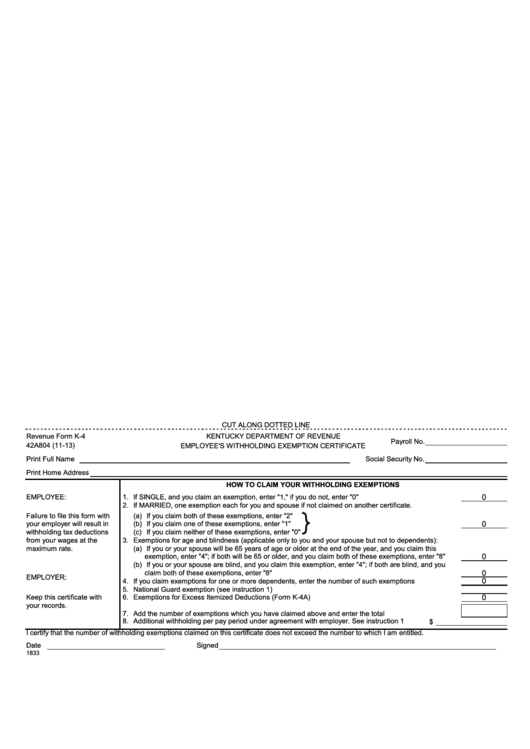

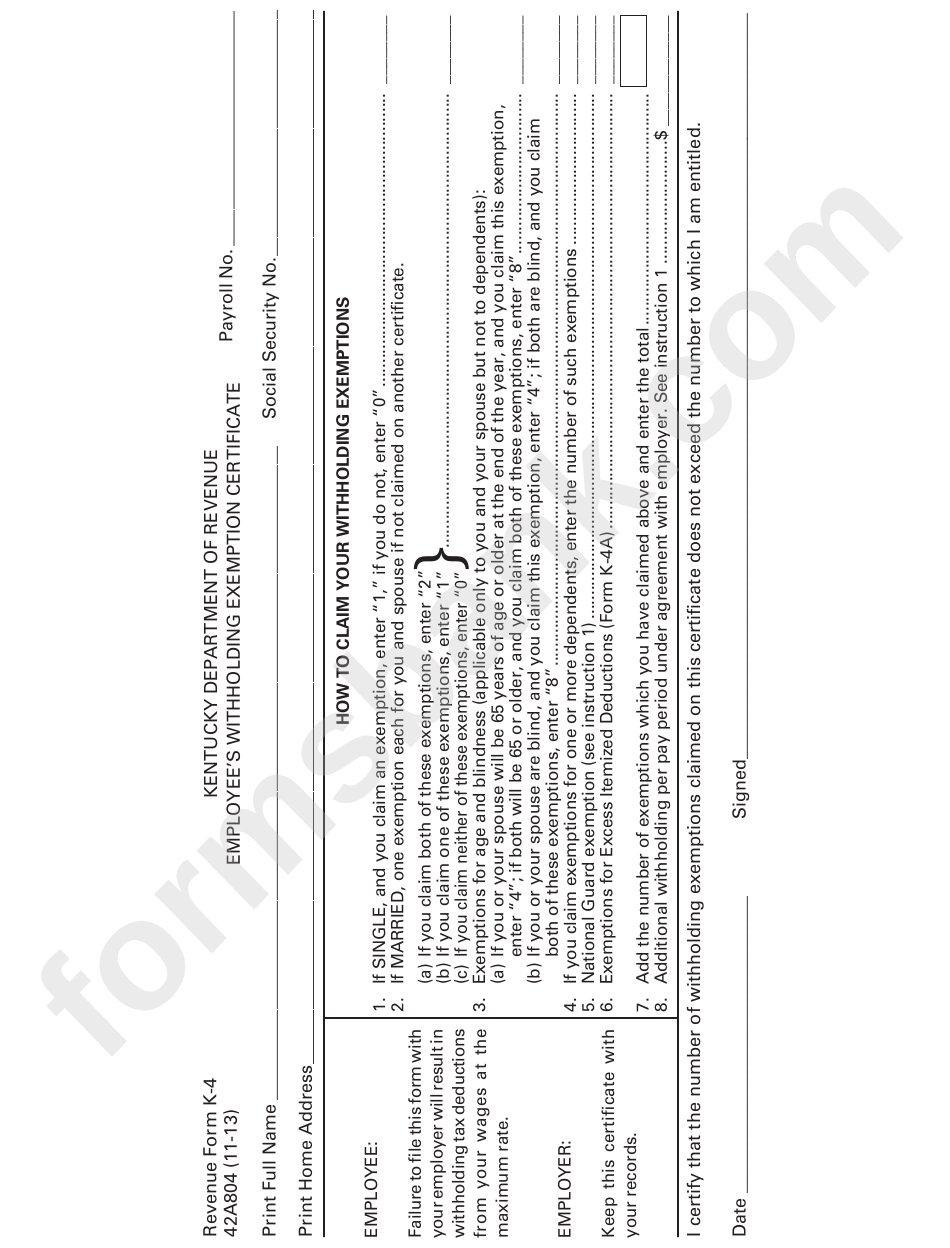

Top Kentucky Form K4 Templates free to download in PDF format

However, due to differences between state and. The form can be filed electronically or on. This form must be filed with the employee’s employer. This form is for income earned in tax year. This form is for income earned in tax year 2022, with tax returns due in april.

Kansas Withholding Form K 4 2022 W4 Form

Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form must be filed with the employee’s employer. There are a few situations in which you can.

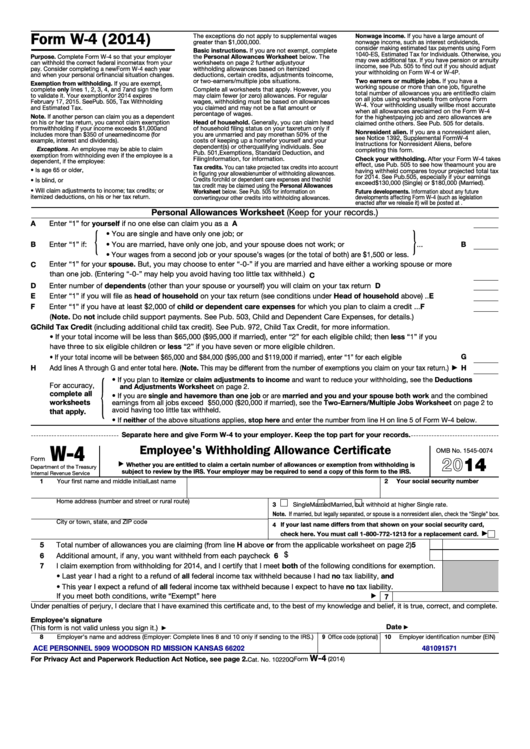

Fillable Forms W4 Employee'S Withholding Allowance Certificate

However, due to differences between state and. This form is for income earned in tax year 2022, with tax returns due in april. If you have indicated that you have or will receive bonus pay from your employer, fill out this form to provide more information. A completed withholding allowance certificate will let your employer know how much kansas income.

Revenue Form K4 Employee'S Withholding Exemption Certificate 2013

This form must be filed with the employee’s employer. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. Web this form enables an employee to estimate the percentage of services performed in kansas. If you have indicated that you have or will receive bonus pay from your employer, fill.

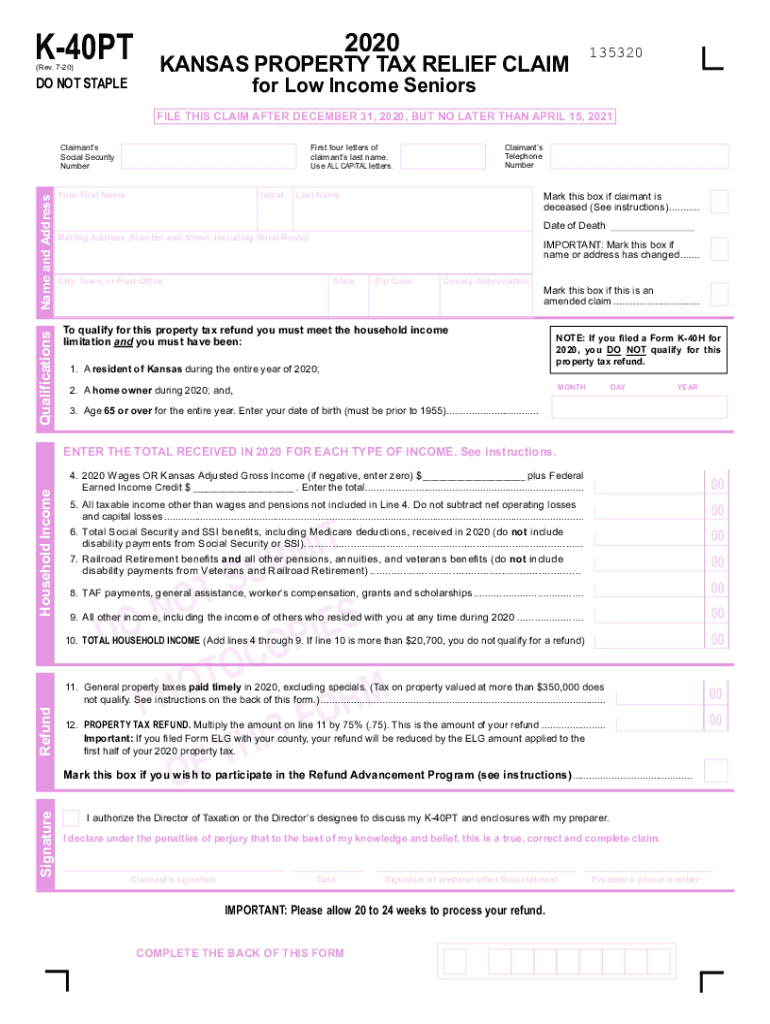

K 40pt Form Fill Out and Sign Printable PDF Template signNow

Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. However, due to differences between state and. This form is for income earned in tax year 2022, with tax returns due in april. The form can be filed electronically or on. There are a.

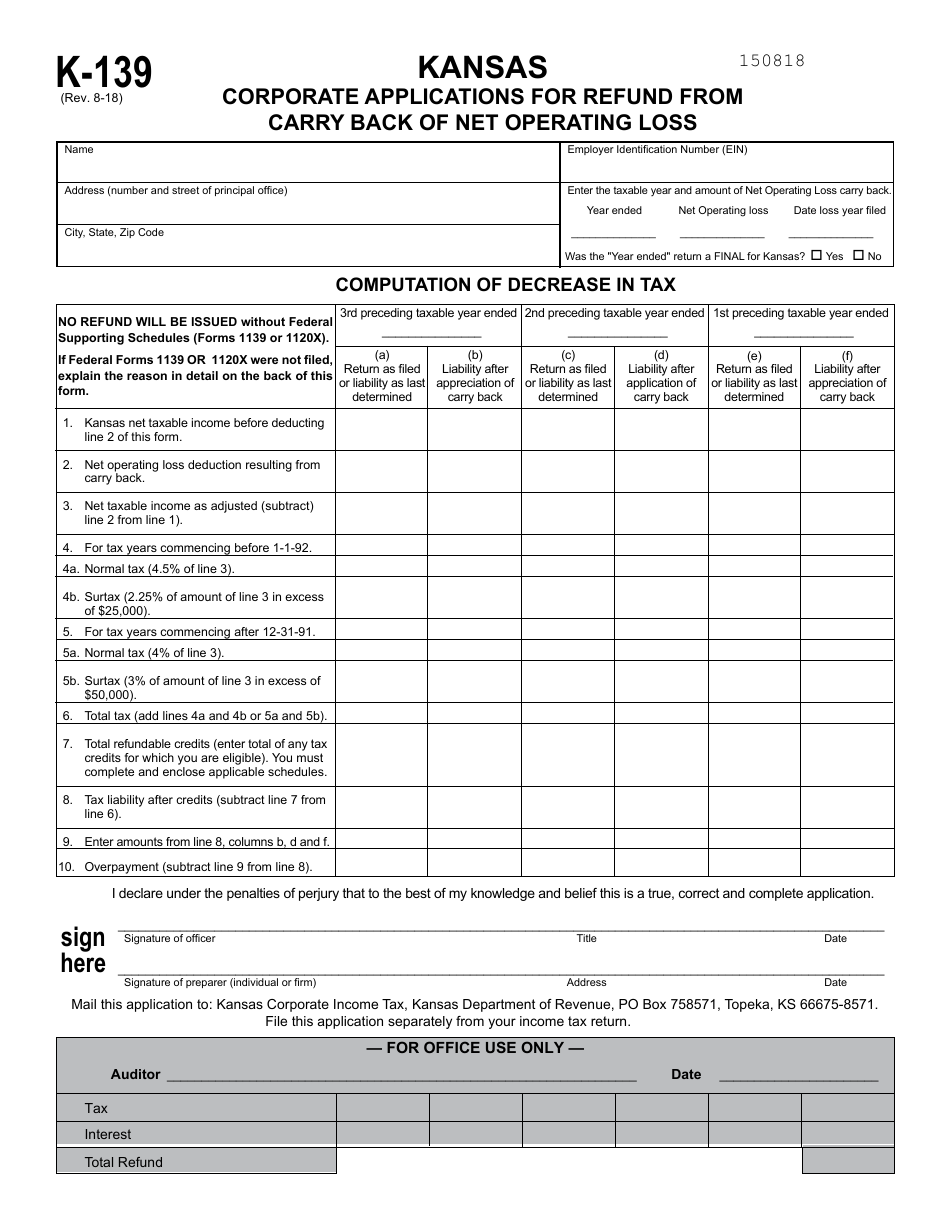

Form K139 Download Fillable PDF or Fill Online Kansas Corporate

This form must be filed with the employee’s employer. This form is for income earned in tax year. A completed withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. There are a few situations in which you can want to request. This form is for income earned in tax.

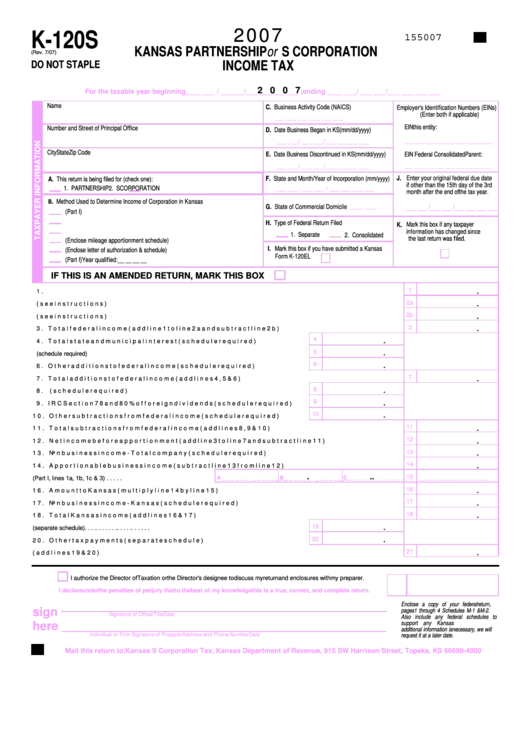

Form K120s Kansas Partnership Or S Corporation Tax printable

Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. The form can be filed electronically or on. Department of the treasury internal revenue service. This form must be filed with the employee’s employer. A completed withholding allowance certificate will let your employer know.

Department Of The Treasury Internal Revenue Service.

There are a few situations in which you can want to request. Withholding allowance certificate will let your employer know how much kansas income tax should be withheld from your pay on. This form must be filed with the employee’s employer. However, due to differences between state and.

A Completed Withholding Allowance Certificate Will Let Your Employer Know How Much Kansas Income Tax Should Be Withheld From Your Pay On.

Web kansas form k 4 is used to report the total kansas taxable income and tax liability of a single person or married couple filing jointly. This form is for income earned in tax year. This form is for income earned in tax year 2022, with tax returns due in april. The form can be filed electronically or on.

If You Have Indicated That You Have Or Will Receive Bonus Pay From Your Employer, Fill Out This Form To Provide More Information.

Web this form enables an employee to estimate the percentage of services performed in kansas.