Kansas 1099 Form

Kansas 1099 Form - Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain information returns. Instead, payers reporting withholding information for 51 or more employees. If you’re looking for additional assistance with your state tax filing this year, our team here at tax2efile is ready to. Web file the following forms with the state of kansas: Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. Web kansas form 1099 filing requirements. Entities reporting for 51 or more employees or payees must file by. One for your lump sum and 1 for your regular. File the state copy of.

Web what are the deadlines for kansas 1099 reporting? Entities reporting for 51 or more employees or payees must file by. Filers may input withholding information using the webtax input forms or upload data from files in the. File specifications can be found below. For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain information returns. Web file the following forms with the state of kansas: Web kansas form 1099 filing requirements. One for your lump sum and 1 for your regular. Web the kansas department of revenue will not accept 1099 informational returns filed on magnetic media. File the state copy of.

Filers may input withholding information using the webtax input forms or upload data from files in the. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. One for your lump sum and 1 for your regular. Instead, payers reporting withholding information for 51 or more employees. Web what are the deadlines for kansas 1099 reporting? If you’re looking for additional assistance with your state tax filing this year, our team here at tax2efile is ready to. Web the kansas department of revenue will not accept 1099 informational returns filed on magnetic media. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account File the state copy of. Entities reporting for 51 or more employees or payees must file by.

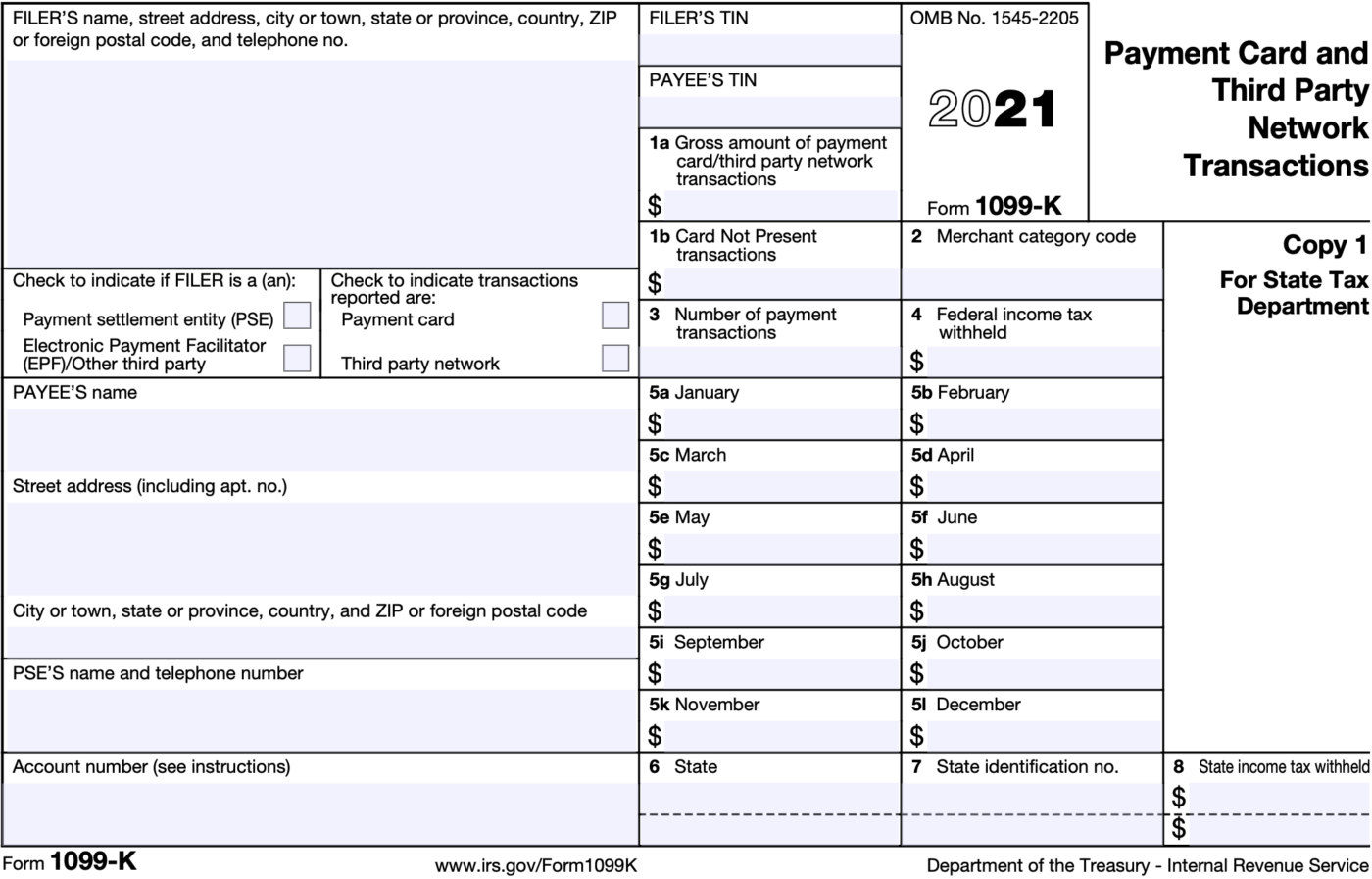

Understanding Your Form 1099K FAQs for Merchants Clearent

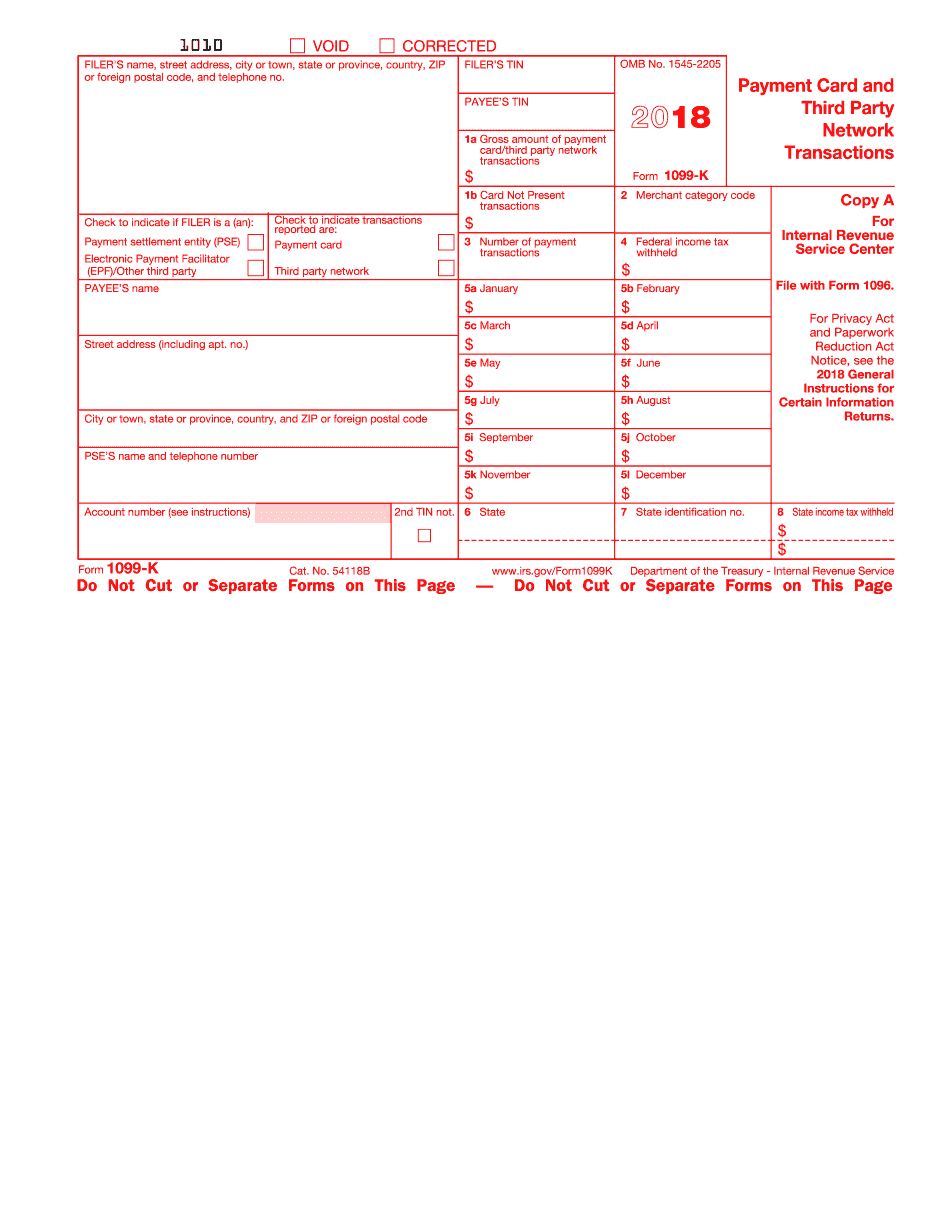

Web kansas form 1099 filing requirements. Web the kansas department of revenue will not accept 1099 informational returns filed on magnetic media. Web for internal revenue service center file with form 1096. If you’re looking for additional assistance with your state tax filing this year, our team here at tax2efile is ready to. Instead, payers reporting withholding information for 51.

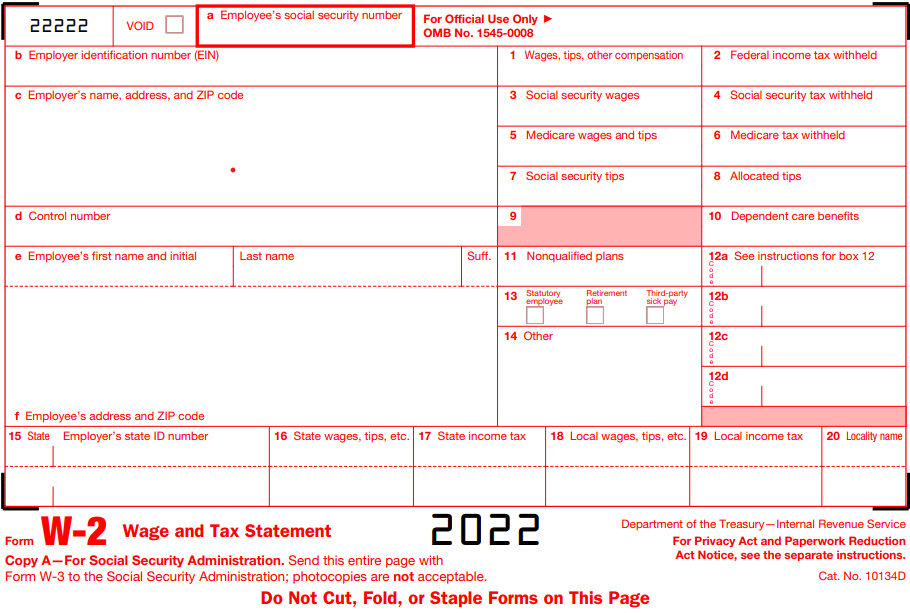

How To File Form 1099NEC For Contractors You Employ VacationLord

Web the kansas department of revenue will not accept 1099 informational returns filed on magnetic media. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. If you’re.

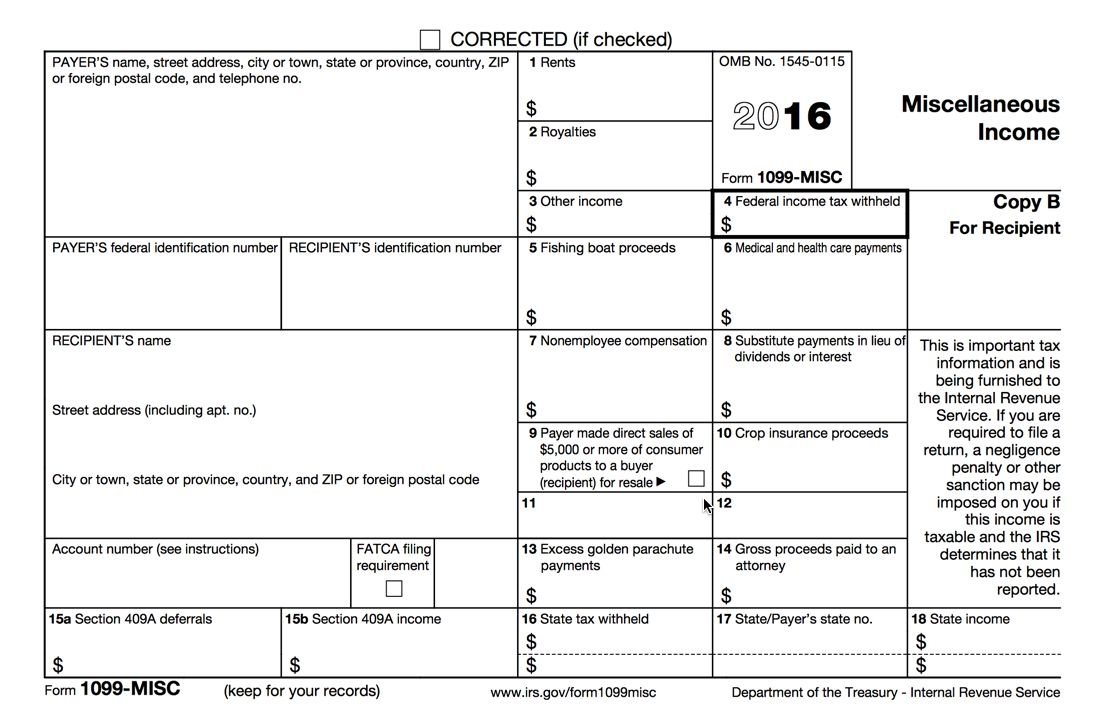

Free Printable 1099 Misc Forms Free Printable

Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web the kansas department of revenue will not accept 1099 informational returns filed.

1099Kform1400x897 Maine SBDC

One for your lump sum and 1 for your regular. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,. Web what are the deadlines for kansas 1099 reporting? Web kansas form 1099 filing requirements. Filers may input withholding information using the webtax input.

Kansas W2, 1099 Forms Filing Requirements EFile Taxes Now

Filers may input withholding information using the webtax input forms or upload data from files in the. Web the kansas department of revenue will not accept 1099 informational returns filed on magnetic media. If you are a new retiree and took a partial lump sum, you'll get 2. Entities reporting for 51 or more employees or payees must file by..

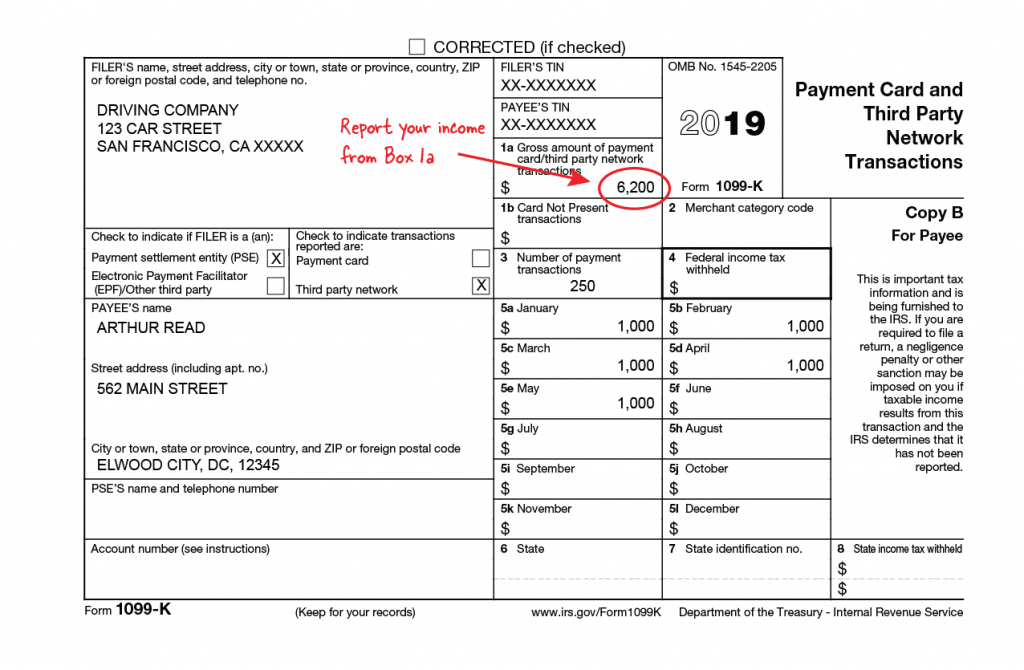

Tax Form 1099K The Lowdown for Amazon FBA Sellers

Filers may input withholding information using the webtax input forms or upload data from files in the. Web kansas form 1099 filing requirements. Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web the kansas department of revenue.

Free Printable 1099 Misc Forms Free Printable

If you’re looking for additional assistance with your state tax filing this year, our team here at tax2efile is ready to. If you are a new retiree and took a partial lump sum, you'll get 2. Instead, payers reporting withholding information for 51 or more employees. Web for internal revenue service center file with form 1096. Web you should attend.

Uber Tax Forms What You Need to File Shared Economy Tax

One for your lump sum and 1 for your regular. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. If you are a new retiree and took a partial lump sum, you'll get 2. If you’re looking for additional assistance with your state tax filing this year, our team here at tax2efile is.

Form 1099K Fill Online, Printable, Fillable Blank

File specifications can be found below. File the state copy of. Instead, payers reporting withholding information for 51 or more employees. Web for internal revenue service center file with form 1096. Web kansas form 1099 filing requirements.

KARA Kansas Dept. of Labor guidance for fraudulent, disputable, 1099

Web file the following forms with the state of kansas: Web kansas form 1099 filing requirements. Web what are the deadlines for kansas 1099 reporting? If you are a new retiree and took a partial lump sum, you'll get 2. Web the kansas department of revenue will not accept 1099 informational returns filed on magnetic media.

Web For Internal Revenue Service Center File With Form 1096.

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web kansas form 1099 filing requirements. Web the kansas department of revenue will not accept 1099 informational returns filed on magnetic media. Traditionally, the filing deadlines for kansas are as follows:

Instead, Payers Reporting Withholding Information For 51 Or More Employees.

File specifications can be found below. File the state copy of. Web what are the deadlines for kansas 1099 reporting? Filers may input withholding information using the webtax input forms or upload data from files in the.

Web File The Following Forms With The State Of Kansas:

For privacy act and paperwork reduction act notice, see the 2021 general instructions for certain information returns. If you’re looking for additional assistance with your state tax filing this year, our team here at tax2efile is ready to. If you are a new retiree and took a partial lump sum, you'll get 2. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online.

Entities Reporting For 51 Or More Employees Or Payees Must File By.

One for your lump sum and 1 for your regular. Web you should attend this webinar if you accept payment cards or accept payments from third party payment apps and online marketplaces in your small business,.