Is Form 8300 Bad

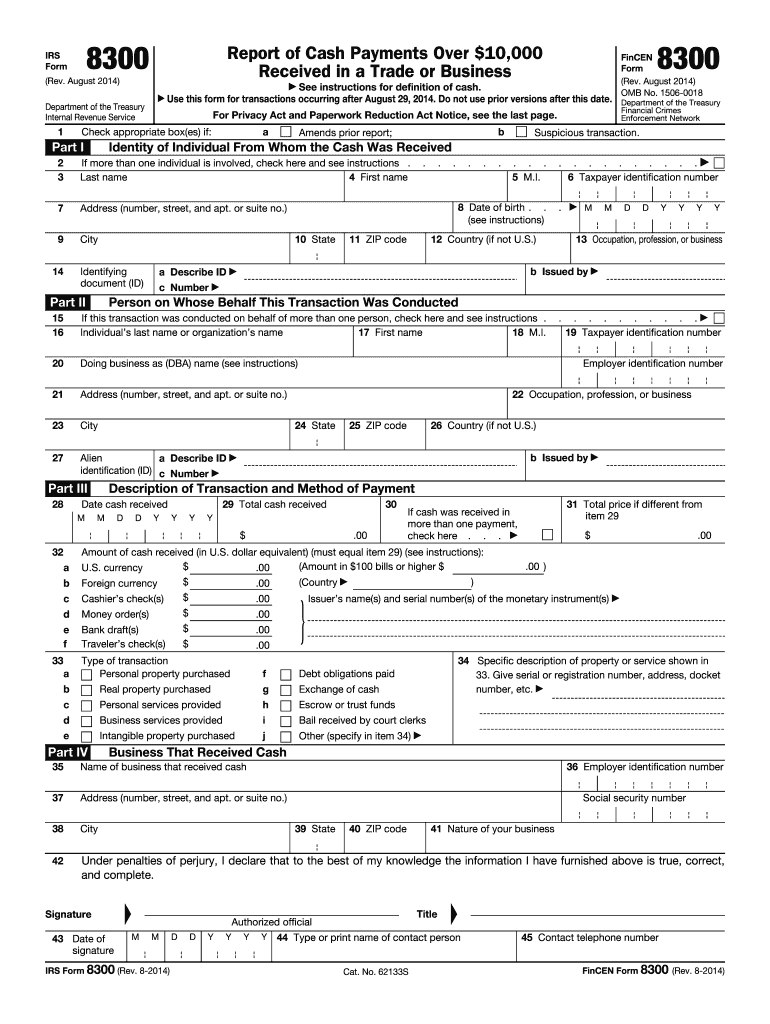

Is Form 8300 Bad - Fitch cut the us's credit rating tuesday, citing rising debts and an erosion of governance. Web a form 8300 must be filed with the irs within 15 days of receiving cash (or cash equivalent) exceeding $10,000. Though schroyer’s report focused on colorado, the irs’s interest in form 8300 is likely. Web the irs uses form 8300 to detect individuals or entities that attempt to evade taxes as well as to detect money laundering and underlying criminal activities. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Web the dow's recent winning streak is a worrying sign, david rosenberg says. Web in the case of form 8300, the irs isn't inherently taking any action, and the form is not directly linked to income taxes or any other process the irs manages. The irs even has a list of faqs regarding reporting cash. Web angel hernandez is back umpiring mlb games after missing most of the season due to a medical issue.

Drug dealers and terrorists often have. Fitch cut the us's credit rating tuesday, citing rising debts and an erosion of governance. Web the irs uses form 8300 to detect individuals or entities that attempt to evade taxes as well as to detect money laundering and underlying criminal activities. Web form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000. If the 15 th day falls on a weekend or holiday, the. Additionally, failing to file on time will. Web a form 8300 must be filed with the irs within 15 days of receiving cash (or cash equivalent) exceeding $10,000. Web there's also special cash reporting, on irs form 8300 for reporting cash payments of over $10,000. Web program scope and objectives. Web angel hernandez is back umpiring mlb games after missing most of the season due to a medical issue.

Web tips to avoid form 8300 penalties: Web a form 8300 must be filed with the irs within 15 days of receiving cash (or cash equivalent) exceeding $10,000. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Drug dealers and terrorists often have. However, under a separate requirement, a donor often must obtain a. Web failing to file form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the irs. Web deliberately failing to file the form carries a much higher financial cost. Web the penalties for violating the rules around 8300 are serious and heavy. Tax laws require taxpayers to file an 8300. The irs even has a list of faqs regarding reporting cash.

Form 8300 Do You Have Another IRS Issue? ACCCE

This irm section describes basic information and examination techniques for specific industries that are required to file form 8300, report. Web deliberately failing to file the form carries a much higher financial cost. Web a person who must file form 8300 includes an individual, company, corporation, partnership, association, trust or estate. Web angel hernandez is back umpiring mlb games after.

Form 8300 Explanation And Reference Guide

Web deliberately failing to file the form carries a much higher financial cost. Additionally, failing to file on time will. You must file form 8300 with the. The index was up 28% at this point in 1987, but virtually erased its gains by the year's end. Web in the case of form 8300, the irs isn't inherently taking any action,.

If I am paying cash for a car, why do they need to run a credit report

Web in the case of form 8300, the irs isn't inherently taking any action, and the form is not directly linked to income taxes or any other process the irs manages. Web you can report such activity by completing irs form 8300. Web deliberately failing to file the form carries a much higher financial cost. Web angel hernandez is back.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Drug dealers and terrorists often have. Web in the case of form 8300, the irs isn't inherently taking any action, and the form is not directly linked to income taxes or any other process the irs manages. Web you can report such activity by completing irs form 8300. Web deliberately failing to file the form carries a much higher financial.

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

Web as provided by the irs: Additionally, failing to file on time will. Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. You and the person paying you will need to provide the details of the transactions on the form. The irs even has a list of faqs regarding reporting.

Understanding How to Report Large Cash Transactions (Form 8300) Roger

Web the dow's recent winning streak is a worrying sign, david rosenberg says. Web you can report such activity by completing irs form 8300. However, under a separate requirement, a donor often must obtain a. Web the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Web the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash payments over. Though schroyer’s report focused on colorado, the irs’s interest in form 8300 is likely. If purchases are more than 24 hours apart and not connected in any way that the. Web.

Filing Form 8300 for 2020 YouTube

Web there's also special cash reporting, on irs form 8300 for reporting cash payments of over $10,000. Web program scope and objectives. Web the law requires that trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form 8300, report of cash payments over. Web angel hernandez is back umpiring mlb games after.

IRS Form 8300 Reporting Cash Sales Over 10,000

Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act. The irs imposes a penalty of $25,000 or the actual amount of the transaction up to $100,000 for each. Web the law requires that.

EFile 8300 File Form 8300 Online

Web in the case of form 8300, the irs isn't inherently taking any action, and the form is not directly linked to income taxes or any other process the irs manages. This irm section describes basic information and examination techniques for specific industries that are required to file form 8300, report. The irs imposes a penalty of $25,000 or the.

Web The Irs Uses Form 8300 To Detect Individuals Or Entities That Attempt To Evade Taxes As Well As To Detect Money Laundering And Underlying Criminal Activities.

You must file form 8300 with the. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Web the form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes. Web angel hernandez is back umpiring mlb games after missing most of the season due to a medical issue.

Web A Person Who Must File Form 8300 Includes An Individual, Company, Corporation, Partnership, Association, Trust Or Estate.

Web there's also special cash reporting, on irs form 8300 for reporting cash payments of over $10,000. Web in the case of form 8300, the irs isn't inherently taking any action, and the form is not directly linked to income taxes or any other process the irs manages. If purchases are more than 24 hours apart and not connected in any way that the. Web as provided by the irs:

Additionally, Failing To File On Time Will.

You and the person paying you will need to provide the details of the transactions on the form. Web the penalties for violating the rules around 8300 are serious and heavy. Web a form 8300 must be filed with the irs within 15 days of receiving cash (or cash equivalent) exceeding $10,000. Web form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000.

However, Under A Separate Requirement, A Donor Often Must Obtain A.

Drug dealers and terrorists often have. Web failing to file form 8300 within 15 days after you receive the funds will lead to you or your business being penalized by the irs. If the 15 th day falls on a weekend or holiday, the. Web the irs form 8300 cash reporting rule is enforced by both the irs and the us patriot act.