Irs Qualified Disclaimer 2518 Form

Irs Qualified Disclaimer 2518 Form - Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept an. Web section 2518(a) provides that, if a person makes a qualified disclaimer with respect to any interest in property, then for purposes of the estate and gift tax the. Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to. Web due to the variation of standards governing disclaimer between the states, congress enacted internal revenue code section 2518 in the tax reform act of 1976 to create a. Web ( 1) in general. Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in. For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply. Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner.

Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in. Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept an. If you were assessed a penalty under section 6700, 6701, or 6694, you may file a claim for. How does a qualified disclaimer work?. Web section 2518 of the irc permits a beneficiary of an estate or trust to make a qualified disclaimer so that it is as though the beneficiary never received the property,. Web file form 6118 with the irs service center or irs office that sent you the statement(s). Web due to the variation of standards governing disclaimer between the states, congress enacted internal revenue code section 2518 in the tax reform act of 1976 to create a. Web this ruling discusses whether a beneficiary's disclaimer of a beneficial interest in a decedent's ira is a qualified disclaimer under section 2518 of the code even though. For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply. (1) the disclaimer is in writing;

Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. How does a qualified disclaimer work?. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to. Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in. Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Web due to the variation of standards governing disclaimer between the states, congress enacted internal revenue code section 2518 in the tax reform act of 1976 to create a. For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply. Web file form 6118 with the irs service center or irs office that sent you the statement(s). Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. Web section 2518 of the irc permits a beneficiary of an estate or trust to make a qualified disclaimer so that it is as though the beneficiary never received the property,.

How Qualified Disclaimers Make Estate Planning More Flexible

If you were assessed a penalty under section 6700, 6701, or 6694, you may file a claim for. Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. Web file form 6118 with the irs service center or irs office that sent.

Ckgs Form Fill Online, Printable, Fillable, Blank pdfFiller

Web this ruling discusses whether a beneficiary's disclaimer of a beneficial interest in a decedent's ira is a qualified disclaimer under section 2518 of the code even though. Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner. Web (.

Circular 230 Disclaimer No Longer Necessary DeFoor Business Services

Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to. Web a disclaimer of a specific.

Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form Resume

Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. 2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in property, but only if: Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in..

Bill Of Sale Form Mississippi Boat Bill Of Sale Templates Fillable

Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner. Web file form 6118 with the irs service center or irs office that sent you the statement(s). Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified.

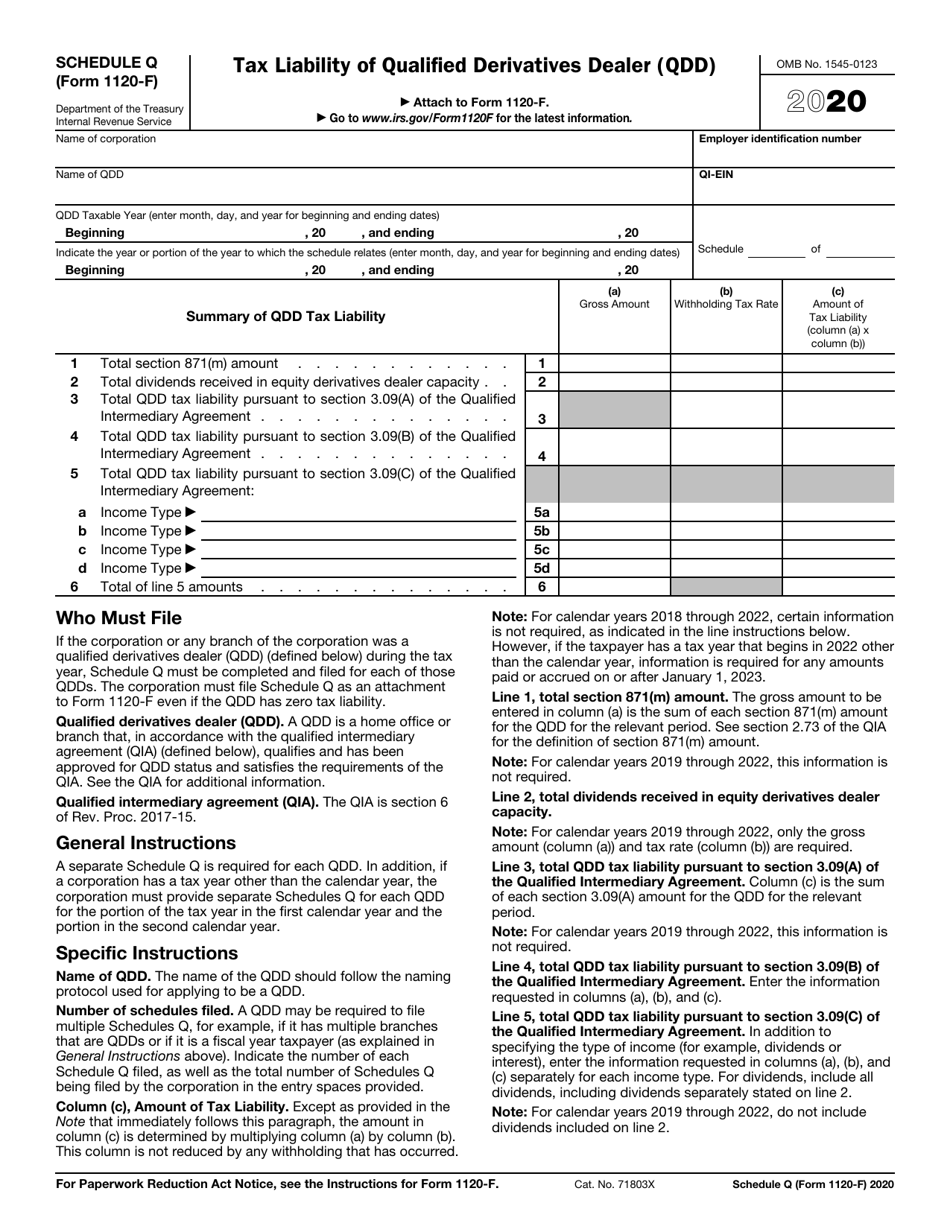

IRS Form 1120F Schedule Q Download Fillable PDF or Fill Online Tax

Web due to the variation of standards governing disclaimer between the states, congress enacted internal revenue code section 2518 in the tax reform act of 1976 to create a. § 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to. Web a disclaimer of a.

Redirecting...

Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply. Web section 2518 of the irc permits a beneficiary.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Web due to the variation of standards governing disclaimer between the states, congress enacted internal revenue code section 2518 in the tax reform act of 1976 to create a. (1) the disclaimer is in writing; For purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply. Web file.

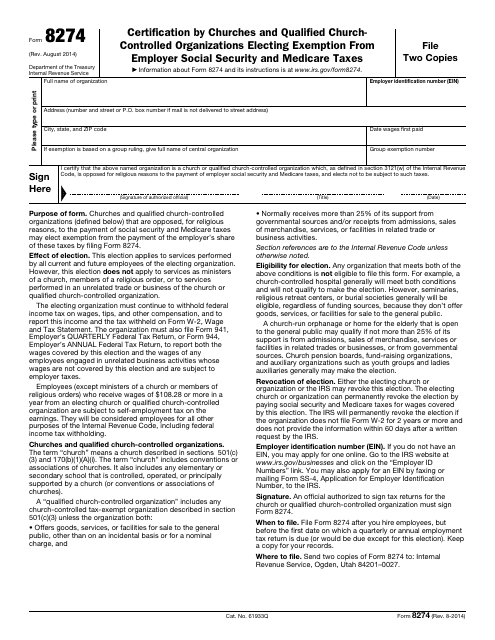

IRS Form 8274 Download Fillable PDF or Fill Online Certification by

Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document. Web (b) qualified disclaimer defined for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to accept an. Web due to the variation of standards governing disclaimer between the states, congress enacted.

IRS Qualified Appraisers and Appraisals Matter The Green Mission Inc.

Web ( 1) in general. How does a qualified disclaimer work?. Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. 2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in.

For Purposes Of This Subtitle, If A Person Makes A Qualified Disclaimer With Respect To Any Interest In Property, This Subtitle Shall Apply.

Web this ruling discusses whether a beneficiary's disclaimer of a beneficial interest in a decedent's ira is a qualified disclaimer under section 2518 of the code even though. Web sample qualified disclaimer form i,________________________________________________ (disclaimant), in. Web ( 1) in general. How does a qualified disclaimer work?.

(1) The Disclaimer Is In Writing;

2518 provides that a qualified disclaimer is an irrevocable and unqualified refusal by a person to accept an interest in property, but only if: Web a disclaimer of a specific pecuniary amount out of a pecuniary or nonpecuniary bequest or gift which satisfies the other requirements of a qualified disclaimer under section 2518. If you were assessed a penalty under section 6700, 6701, or 6694, you may file a claim for. Web file form 6118 with the irs service center or irs office that sent you the statement(s).

Web (B) Qualified Disclaimer Defined For Purposes Of Subsection (A), The Term “Qualified Disclaimer” Means An Irrevocable And Unqualified Refusal By A Person To Accept An.

§ 2518 (b) qualified disclaimer defined — for purposes of subsection (a), the term “qualified disclaimer” means an irrevocable and unqualified refusal by a person to. Disclaimers (a) general rule for purposes of this subtitle, if a person makes a qualified disclaimer with respect to any interest in property, this subtitle shall apply with. Web section 2518(a) provides that, if a person makes a qualified disclaimer with respect to any interest in property, then for purposes of the estate and gift tax the. Web a qualified disclaimer is a formal refusal to accept interest in property bequeathed in a will or similar document.

Web Due To The Variation Of Standards Governing Disclaimer Between The States, Congress Enacted Internal Revenue Code Section 2518 In The Tax Reform Act Of 1976 To Create A.

Use this form if you are a beneficiary and would like to claim or disclaim your benefit from a lpl financial llc (“lpl”) sponsored ira account with a deceased owner. Web section 2518 of the irc permits a beneficiary of an estate or trust to make a qualified disclaimer so that it is as though the beneficiary never received the property,.