Irs Letter 12C Response Template

Irs Letter 12C Response Template - Web order the ultimate communicator now the letters you write on behalf of your clients make a huge difference in the results you can achieve for them. Show details how it works browse for the irs letter 12c sample customize. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. To minimize additional interest and penalty. Web july 18, 2021 irs just received the irs letter 12c? Allow at least 30 days for a response from the irs. Sign it in a few clicks draw your. Where can i see all the supporting documents that turbotax already. This might be a form you receive from an employer or health. Web a reply is needed within 20 days from the date of this letter.

If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to comply: Full name and spouse's full name if applicable. Web july 18, 2021 irs just received the irs letter 12c? Where can i see all the supporting documents that turbotax already. Web 1 min read the irs sent letter 12c to inform you that additional information is needed to process the return filed. To minimize additional interest and penalty. Along the course of your tax life, you are bound to receive many notices from the irs, one of which may be a. Web how to write a response letter to the irs (with examples) published on: This letter is frequently used to reconcile payments of the. Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs.

Sign it in a few clicks draw your. July 25, 2022 | last updated on: Web july 18, 2021 irs just received the irs letter 12c? May 25, 2023 by real person taxes content provided. Web a reply is needed within 20 days from the date of this letter. Show details how it works browse for the irs letter 12c sample customize. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply: Web how to write a response letter to the irs (with examples) published on: Allow at least 30 days for a response from the irs. This might be a form you receive from an employer or health.

Example Of Irs Letter Template printable pdf download

May 25, 2023 by real person taxes content provided. Web use a irs letter 12c response template template to make your document workflow more streamlined. Ssn here (if you and your spouse filed jointly, use the ssn that appears first. Edit your irs letter 12c sample online type text, add images, blackout confidential details, add comments, highlights and more. The.

IRS Audit Letter 12C Sample 1

Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. Where can i see all the supporting documents that turbotax already. If you have questions, call the telephone number in.

IRS Audit Letter 324C Sample 1

Web let the irs know of a disputed notice. Have a copy of your tax return and the. Web sections of letter 12c. Show details how it works browse for the irs letter 12c sample customize. Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs.

How to Respond to IRS Letter 12C SuperMoney

Web let the irs know of a disputed notice. If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to comply: Web what should you do in response to letter 12c? Allow at least 30 days for a response from the irs. Web if your irs.

IRS Letter 12C Missing Form 8962 YouTube

Web a reply is needed within 20 days from the date of this letter. This might be a form you receive from an employer or health. Web let the irs know of a disputed notice. If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to.

Irs Name Change Letter Sample / 12 INFO IRS TAX NOTICE LETTER 12C PRINT

Where can i see all the supporting documents that turbotax already. Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs. Keep a copy for yourself & send the original to the irs by. If you have questions, call the telephone number in the letter. To minimize additional interest.

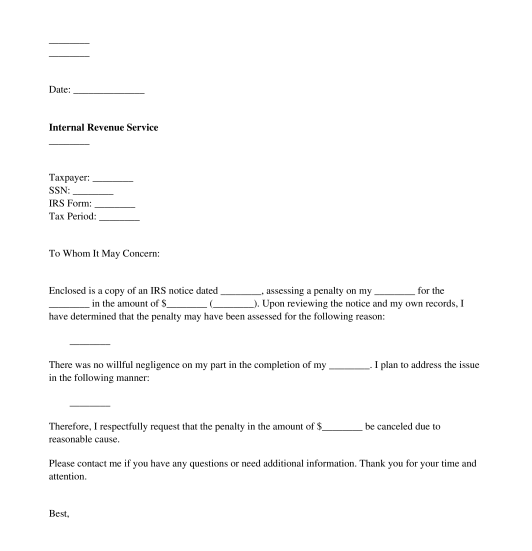

How To Write An Irs Abatement Letter

Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs. Web respond to letter 12c if the irs is asking for a signature, just sign the attestation clause attached to the letter 12c. Show details how it works browse for the irs letter 12c sample customize. If the irs.

TaxAudit What Should I Do With An IRS Letter 12C? TaxAudit Blog

If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to comply: Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. Sign it in a few clicks.

Irs Tax Attorney Austin Tx Irs Notice Cp523 Intent To Terminate Your

This letter is frequently used to reconcile payments of the. Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs. If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to comply: May 25, 2023.

Written Explanation Sample Letter To Irs slide share

Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. Web how to write a response letter to the irs (with examples) published on: Web a reply is needed within 20 days from the date of this letter. Web sections of letter.

Web Let The Irs Know Of A Disputed Notice.

Web july 18, 2021 irs just received the irs letter 12c? Web a reply is needed within 20 days from the date of this letter. Web use a irs letter 12c response template template to make your document workflow more streamlined. This might be a form you receive from an employer or health.

This Letter Is Frequently Used To Reconcile Payments Of The.

Ssn here (if you and your spouse filed jointly, use the ssn that appears first. Web sections of letter 12c. Web if your irs problem is causing you financial hardship, you’ve tried repeatedly and aren’t receiving a response from the irs, or you feel your taxpayer rights aren’t. Web respond if your notice or letter requires a response by a specific date, there are two main reasons you’ll want to comply:

Web Order The Ultimate Communicator Now The Letters You Write On Behalf Of Your Clients Make A Huge Difference In The Results You Can Achieve For Them.

If your notice or letter requires a response by a specific date (typically it is 30 days), there are two main reasons you’ll want to comply: Keep a copy for yourself & send the original to the irs by. Web how to write a response letter to the irs (with examples) published on: May 25, 2023 by real person taxes content provided.

Show Details How It Works Browse For The Irs Letter 12C Sample Customize.

Allow at least 30 days for a response from the irs. If the irs doesn’t receive a response from you, an adjustment will be made on your account that may. Web may 6, 2022 1:35 pm last updated may 06, 2022 1:35 pm i got a letter 12c from the irs. If you have questions, call the telephone number in the letter.