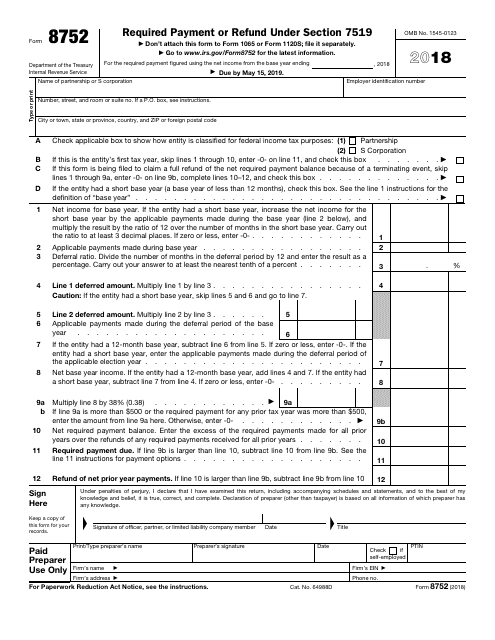

Irs Form 8752

Irs Form 8752 - Required payment or refund under section 7519 1993 form 8752: Get ready for tax season deadlines by completing any required tax forms today. Doesn’t that just sound like a blast?. For your base year ending in. Web file form 8752 at the applicable irs address listed below. Ad access irs tax forms. Web the way to complete the irs 8752 online: Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. A partnership or s corporation must file form 8752 if it made a. Web form 8752 is a federal other form.

For your base year ending in. The form is used for. Web s corporation that has elected under section 444 to have a tax year other than a required tax year. Get ready for tax season deadlines by completing any required tax forms today. Click the button get form to open it and start modifying. Ad access irs tax forms. It is expected that the new forms will be mailed to taxpayers by march 15, 1991. Ad access irs tax forms. Fill out all needed fields in the document making use of our professional pdf. Form 8816, special loss discount account and special estimated tax payments for insurance companies:

Web hello i filed a form 8752 and i expect a refund of deposits paid of about 8000 dollars how can i check the status of my deposit refund. Ad access irs tax forms. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Fill out all needed fields in the document making use of our professional pdf. If the entity's principal place of business or principal office or agency is located in. Web the way to complete the irs 8752 online: I would not have filled it out the way they. Web s corporation that has elected under section 444 to have a tax year other than a required tax year. Web form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs).

3.11.249 Processing Form 8752 Internal Revenue Service

Complete, edit or print tax forms instantly. Form 8816, special loss discount account and special estimated tax payments for insurance companies: Required payment or refund under section 7519 1994 form 8752: Required payment or refund under section 7519 1993 form 8752: I would not have filled it out the way they.

IRS Form 8752 Download Fillable PDF or Fill Online Required Payment or

Web form 8752, required payment or refund under section 7519: If the entity's principal place of business or principal office or agency is located in. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

Form 8752 Required Payment or Refund under Section 7519 (2015) Free

Web the way to complete the irs 8752 online: Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Form 8816, special loss discount account and special estimated tax payments for insurance companies: Web for applicable election years beginning in 2022, form 8752.

3.12.249 Processing Form 8752 Internal Revenue Service

In general, the term “applicable payments” means any amount deductible in the base year. Web the new form 8752 replaces the old form 720, which should no longer be used. If the entity's principal place of business or principal office or agency is located in. Click the button get form to open it and start modifying. A partnership or s.

IRS FORM 13825 PDF

Complete, edit or print tax forms instantly. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Fill out all.

3.11.249 Processing Form 8752 Internal Revenue Service

For your base year ending in. Web form 8752 is a federal other form. Ad access irs tax forms. I would not have filled it out the way they. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752.

Fill Free fillable IRS PDF forms

In general, the term “applicable payments” means any amount deductible in the base year. Web form 8752, required payment or refund under section 7519: The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Fill out all needed fields in the document making use of our professional pdf. It is expected that the new.

3.11.249 Processing Form 8752 Internal Revenue Service

The form is used for. In general, the term “applicable payments” means any amount deductible in the base year. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be mailed and the required payment made by may 15, 2020. Web s corporation that has elected under section 444 to have a tax year.

2.3.59 Command Codes BMFOL and BMFOR Internal Revenue Service

Web mailing addresses for forms 8752. In general, the term “applicable payments” means any amount deductible in the base year. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752. Web.

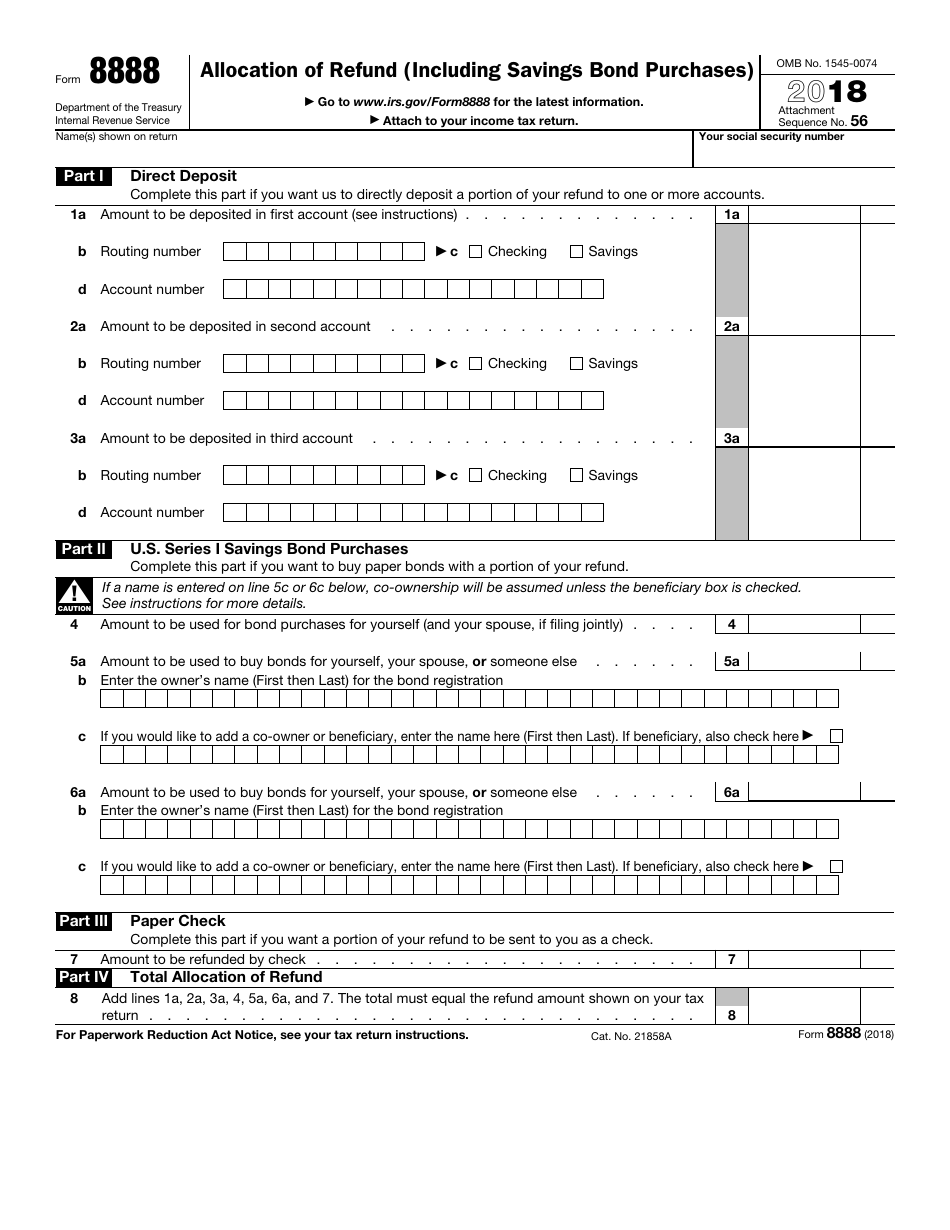

IRS Form 8888 Download Fillable PDF or Fill Online Allocation of Refund

Web mailing addresses for forms 8752. It is expected that the new forms will be mailed to taxpayers by march 15, 1991. Form 8816, special loss discount account and special estimated tax payments for insurance companies: Complete, edit or print tax forms instantly. Web per irs instructions, the 2019 form 8752 (required payment or refund under section 7519) must be.

Web Form 8752, Required Payment Or Refund Under Section 7519:

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the. Web form 8752 (required payment or refund under section 7519) is a federal tax form designed and processed by the internal revenue service (irs). If the entity's principal place of business or principal office or agency is located in. The irs asks fiscal year, s corporation s, and partnership s to file a form 8752.

Web For Applicable Election Years Beginning In 2022, Form 8752 Must Be Filed And The Required Payment Made On Or Before May 15, 2023.

Doesn’t that just sound like a blast?. Ad access irs tax forms. It is expected that the new forms will be mailed to taxpayers by march 15, 1991. Get ready for tax season deadlines by completing any required tax forms today.

Web Mailing Addresses For Forms 8752.

For your base year ending in. Form 8816, special loss discount account and special estimated tax payments for insurance companies: Complete, edit or print tax forms instantly. Ad access irs tax forms.

Web Per Irs Instructions, The 2019 Form 8752 (Required Payment Or Refund Under Section 7519) Must Be Mailed And The Required Payment Made By May 15, 2020.

Web file form 8752 at the applicable irs address listed below. A partnership or s corporation must file form 8752 if it made a. Click the button get form to open it and start modifying. In general, the term “applicable payments” means any amount deductible in the base year.