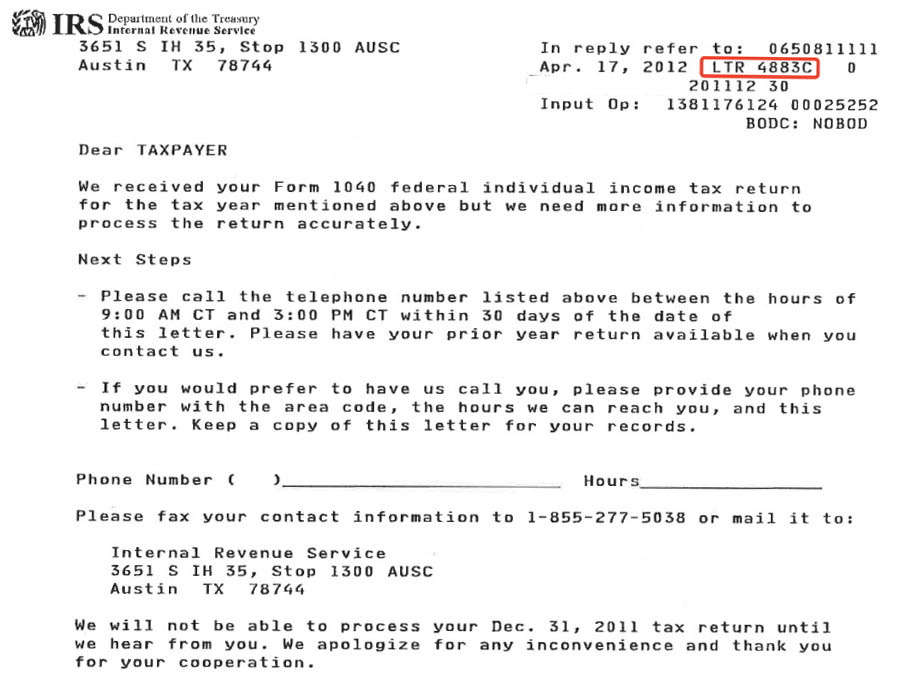

Irs Form 4883C

Irs Form 4883C - The irs doesn’t communicate online or via email. Get personalized help join the community Web the irs sends letter 4883c when they have received your return but they need more information to process it. Web while the irs 4883c letter is from the irs, it’s nothing to be afraid of. What happens during the call? Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used. It’s basically a letter of request for you to contact the irs. Web what is irs letter 4883c? Does the irs verify identity online? The information they seek is for you to verify your identity by personally appearing in their office.

What can a taxpayer do if they get irs letter 4883c? You received a 5447c letter and can verify your identity online. What is the difference between letter 4883c and 5071c? Web what is irs letter 4883c? Try early in the day and put the phone on speaker so you can do something else while you wait. The information they seek is for you to verify your identity by personally appearing in their office. Or get an appointment at your local irs office. Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used. The irs doesn’t communicate online or via email. It’s basically a letter of request for you to contact the irs.

The irs sends this notice to request that you provide documentation to prove your identity. Web who must use the identity and tax return verification service. An irs representative directed you to use it. Try early in the day and put the phone on speaker so you can do something else while you wait. How many calls should a taxpayer make? Web the 4883c or 6330c letter; The irs doesn’t communicate online or via email. They use letter 5071c to ask you to go online or call to verify your identity. Web while the irs 4883c letter is from the irs, it’s nothing to be afraid of. Web why you received irs letter 4883c.

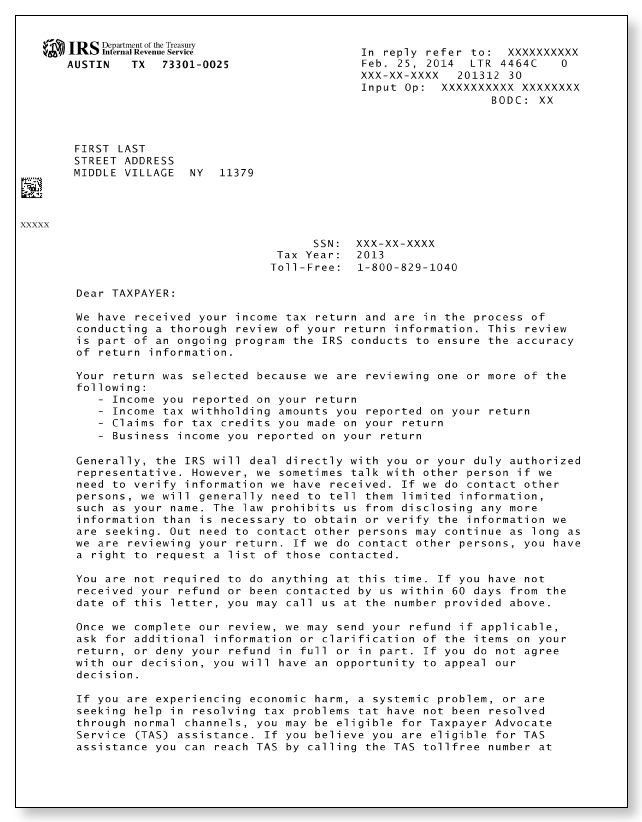

Letter From Irs 2021 ULETRE

The information they seek is for you to verify your identity by personally appearing in their office. What happens during the call? The irs fraud detection system flagged your tax return as a potential identity theft case. Open turbotax sign in why sign in to support? If you received a 4883c letter or a 6330c letter, follow the instructions on.

IRS Identity Fraud Filters Working Overtime Center for Agricultural

Try early in the day and put the phone on speaker so you can do something else while you wait. An irs representative directed you to use it. Web why you received irs letter 4883c. The irs sends this notice to request that you provide documentation to prove your identity. Web is a must you have to have the letter.

¿Qué es la carta 4883C del IRS y qué debes hacer si la recibes?

Web what is irs letter 4883c? They use letter 5071c to ask you to go online or call to verify your identity. Try early in the day and put the phone on speaker so you can do something else while you wait. They are concerned about your identity and want to confirm it before they process your return. An irs.

On Your Side Alert This IRS form is not a scam

They are concerned about your identity and want to confirm it before they process your return. What is the difference between letter 4883c and 5071c? Get personalized help join the community How many calls should a taxpayer make? Web the irs sends letter 4883c when they have received your return but they need more information to process it.

IRS Letter 4883C How To Use The IRS ID Verification Service

How many calls should a taxpayer make? After they obtain your control # they asked me for my social security number and full birth name or. If you received a 4883c letter or a 6330c letter, follow the instructions on the letter. Before your return can complete processing, you must prove that you are the legitimate owner of the social.

How To Write A Letter To Irs Sample Cover Letters Samples

Web is a must you have to have the letter 4883c they sent to you via mail before calling the irs because they will ask for a control number that is on your letter. Keep in mind, you will only receive this communication via mail. What can a taxpayer do if they get irs letter 4883c? They use letter 5071c.

Real Internal Revenue Service Letters & Notices

The irs sends this notice to request that you provide documentation to prove your identity. What are some tips to remember? Web what is irs letter 4883c? Web the 4883c or 6330c letter; Or get an appointment at your local irs office.

What to Do if You Receive the 4883c Letter from the IRS The Handy Tax Guy

Web why you received irs letter 4883c. The irs doesn’t communicate online or via email. Web the 4883c or 6330c letter; They use letter 5071c to ask you to go online or call to verify your identity. Keep in mind, you will only receive this communication via mail.

IRSLetter4464CSample1a Central Tax Services

After they obtain your control # they asked me for my social security number and full birth name or. The irs fraud detection system flagged your tax return as a potential identity theft case. The irs doesn’t communicate online or via email. Open turbotax sign in why sign in to support? Is the website www.idverify.irs.gov fake?

IRS LTR 4883C, Potential Identify Theft

Web who must use the identity and tax return verification service. Keep in mind, you will only receive this communication via mail. Web what is irs letter 4883c? What is the difference between letter 4883c and 5071c? The irs doesn’t communicate online or via email.

How Many Calls Should A Taxpayer Make?

Does the irs verify identity online? Web what is irs letter 4883c? Is the website www.idverify.irs.gov fake? Get personalized help join the community

It’s Basically A Letter Of Request For You To Contact The Irs.

Web the irs sends letter 4883c when they have received your return but they need more information to process it. Open turbotax sign in why sign in to support? They are concerned about your identity and want to confirm it before they process your return. Web while the irs 4883c letter is from the irs, it’s nothing to be afraid of.

Keep In Mind, You Will Only Receive This Communication Via Mail.

Try early in the day and put the phone on speaker so you can do something else while you wait. Before your return can complete processing, you must prove that you are the legitimate owner of the social security number used. The information they seek is for you to verify your identity by personally appearing in their office. You received a 5447c letter and can verify your identity online.

They Use Letter 5071C To Ask You To Go Online Or Call To Verify Your Identity.

What is the difference between letter 4883c and 5071c? Or get an appointment at your local irs office. If you received a 4883c letter or a 6330c letter, follow the instructions on the letter. The irs fraud detection system flagged your tax return as a potential identity theft case.