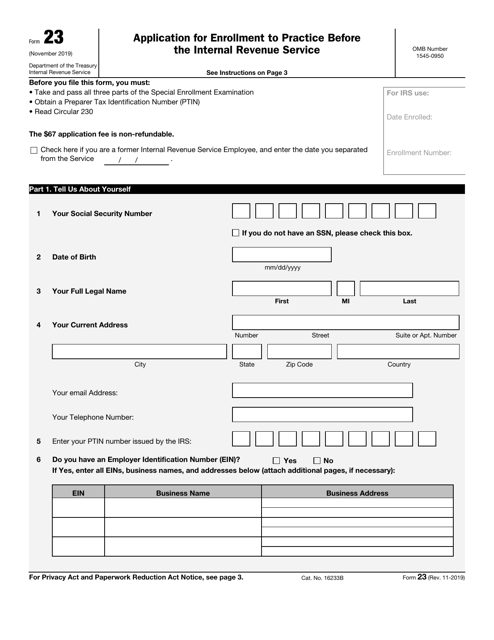

Irs Form 23

Irs Form 23 - Every individual whose gross total income exceeds inr 2. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. In case of any doubt, please refer to relevant provisions Web complete the pay.gov form 23 enrolled agent application and pay $140. California also has the highest annual fee at $820. Itr 1 is for residents with income from salaries and other sources, itr 2 is for those without business. Confused about which itr form to use for filing taxes? • take and pass all three parts of the special enrollment examination See form 23 pdf for additional details. Application for enrollment to practice before the internal revenue service.

Application for enrollment to practice before the internal revenue service. Before you file this form, you must: • take and pass all three parts of the special enrollment examination Instructions for form 941 pdf Republicans, though, have seized on the unverified material as part of their. California also has the highest annual fee at $820. Every individual whose gross total income exceeds inr 2. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. See instructions on page 3. Web complete the pay.gov form 23 enrolled agent application and pay $140.

Web employer's quarterly federal tax return. Web complete the pay.gov form 23 enrolled agent application and pay $140. • take and pass all three parts of the special enrollment examination Instructions for form 941 pdf Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Republicans, though, have seized on the unverified material as part of their. Application for enrollment to practice before the internal revenue service. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Web form 23 (november 2022) department of the treasury internal revenue service. See form 23 pdf for additional details.

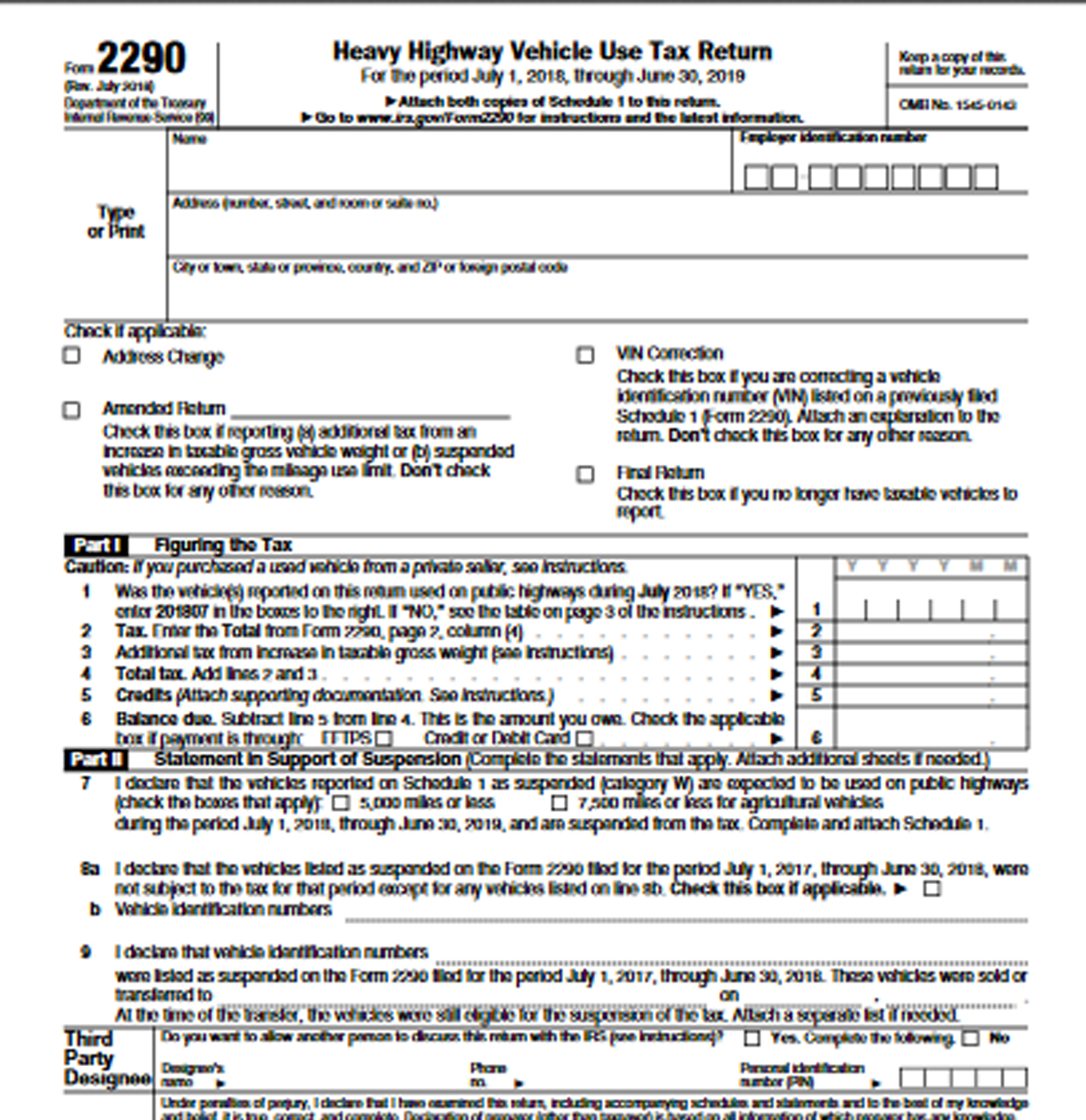

File IRS 2290 Form Online for 20222023 Tax Period

• take and pass all three parts of the special enrollment examination Web form 23 (november 2022) department of the treasury internal revenue service. Confused about which itr form to use for filing taxes? Before you file this form, you must: Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are.

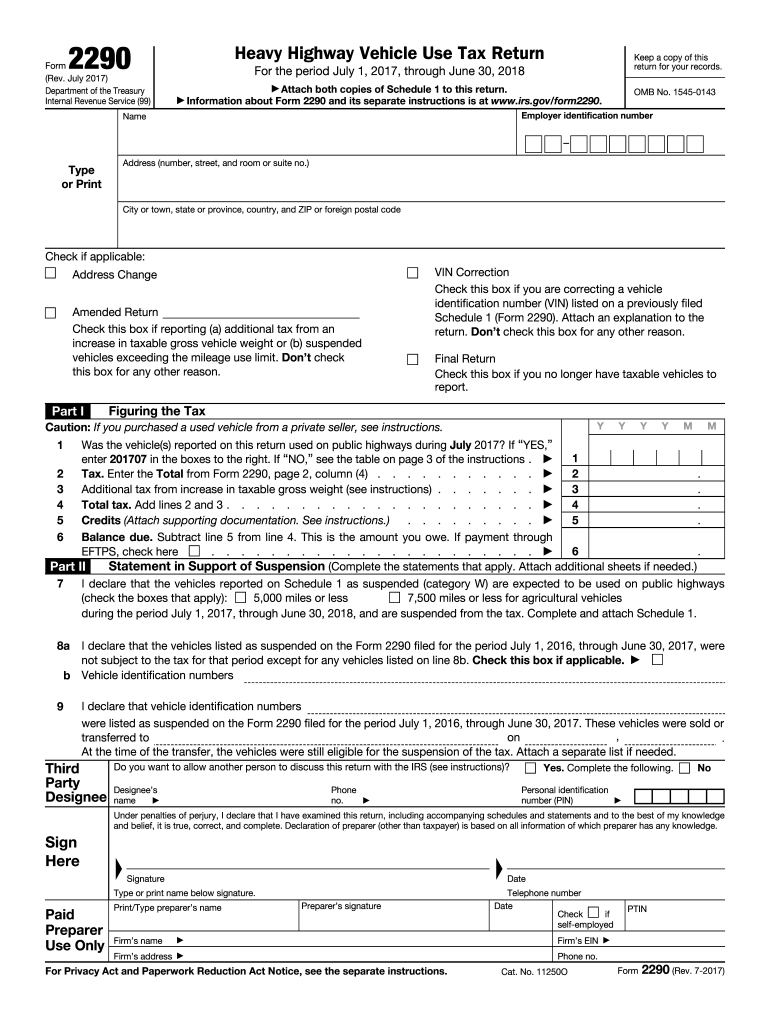

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

See form 23 pdf for additional details. In case of any doubt, please refer to relevant provisions Application for enrollment to practice before the internal revenue service. Web employer's quarterly federal tax return. Republicans, though, have seized on the unverified material as part of their.

Form 23 Application for Enrollment to Practice before the IRS (2014

California also has the highest annual fee at $820. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application. Instructions for form 941.

√99以上 2290 form irs.gov 6319142290 form irs.gov

In case of any doubt, please refer to relevant provisions See instructions on page 3. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Itr 1 is for residents with income from salaries and other sources, itr 2 is for those without business. Web complete the pay.gov form 23.

IRS FORM 147C PDF

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web employer's quarterly federal tax return. Web form 23 (november 2022) department of the treasury internal revenue service. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof.

Irs Form 1040x 2018 All Are Here

Republicans, though, have seized on the unverified material as part of their. Every individual whose gross total income exceeds inr 2. Confused about which itr form to use for filing taxes? California also has the highest annual fee at $820. Before you file this form, you must:

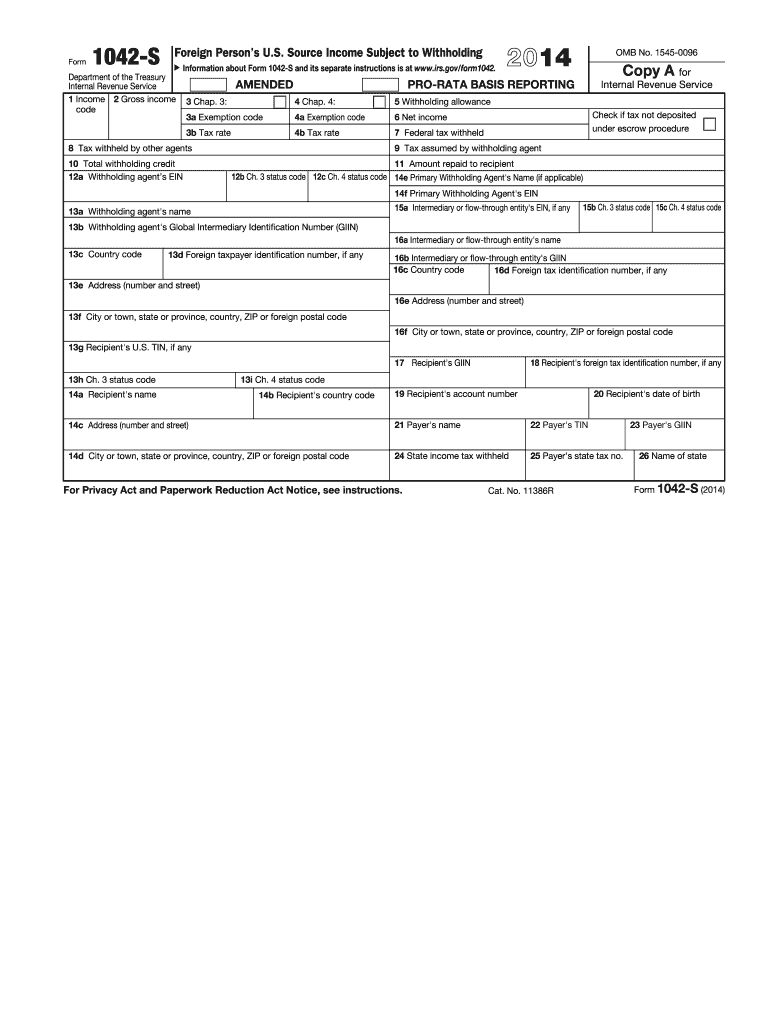

2014 Form IRS 1042S Fill Online, Printable, Fillable, Blank pdfFiller

Application for enrollment to practice before the internal revenue service. Itr 1 is for residents with income from salaries and other sources, itr 2 is for those without business. See form 23 pdf for additional details. See instructions on page 3. In case of any doubt, please refer to relevant provisions

IRS FORM 12333 PDF

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Confused about which itr form to use for filing taxes? Instructions for form 941 pdf Web form 23 (november 2022) department of the treasury internal revenue service. • take and pass all three.

IRS Form 23 Download Fillable PDF or Fill Online Application for

In case of any doubt, please refer to relevant provisions For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application. Before you file this form, you must: Instructions for form 941 pdf See instructions on page 3.

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Republicans, though, have seized on the unverified material as part of their. • take and pass all three parts of the special enrollment examination Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. In case of any doubt, please refer to relevant provisions For successful examination candidates, our goal.

Application For Enrollment To Practice Before The Internal Revenue Service.

Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. • take and pass all three parts of the special enrollment examination Every individual whose gross total income exceeds inr 2. Web complete the pay.gov form 23 enrolled agent application and pay $140.

California Also Has The Highest Annual Fee At $820.

See instructions on page 3. Confused about which itr form to use for filing taxes? In case of any doubt, please refer to relevant provisions Before you file this form, you must:

Republicans, Though, Have Seized On The Unverified Material As Part Of Their.

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Web form 23 (november 2022) department of the treasury internal revenue service. Instructions for form 941 pdf Itr 1 is for residents with income from salaries and other sources, itr 2 is for those without business.

Web Employer's Quarterly Federal Tax Return.

See form 23 pdf for additional details. For successful examination candidates, our goal is to have this process completed within 90 days of receipt of your application.