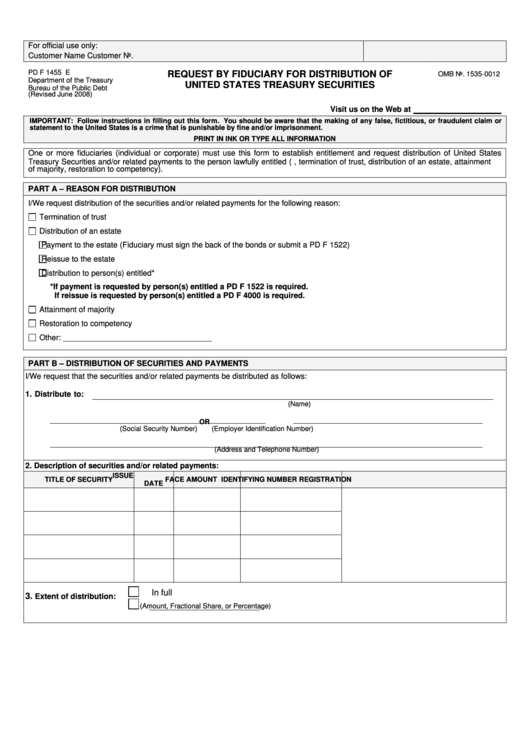

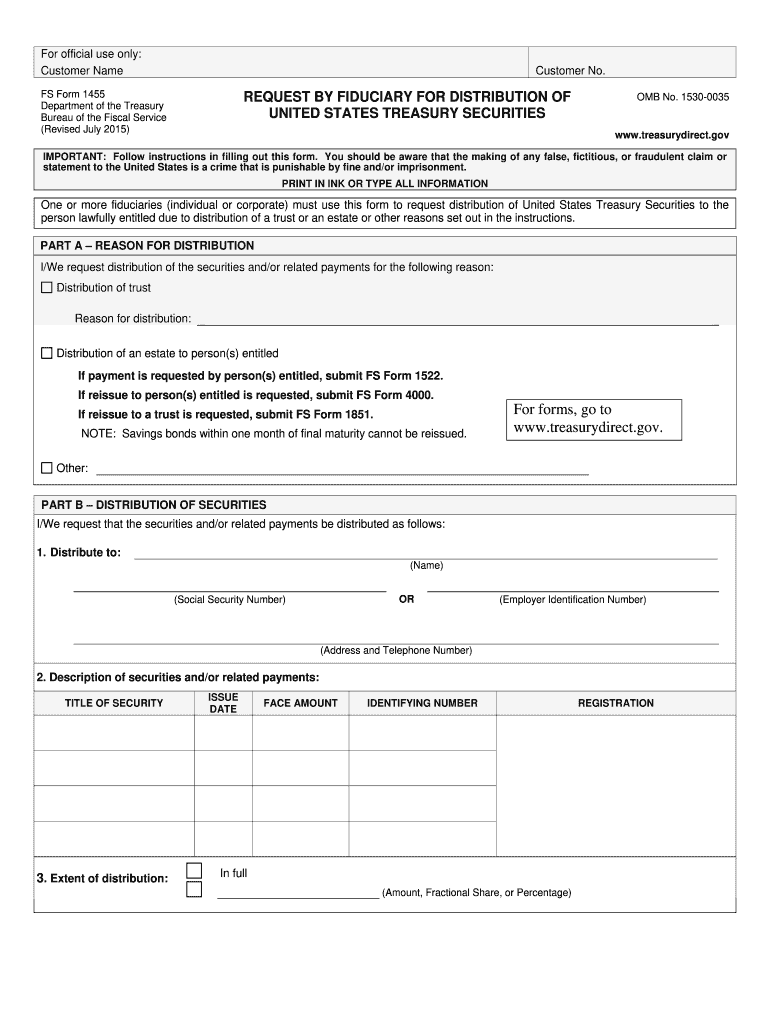

Irs Form 1455

Irs Form 1455 - Savings bonds and treasury securities forms. The internal revenue service (irs) will send a notice or a letter for any number of reasons. Web 60 rows fs form 1455 request by fiduciary for distribution of united states treasury. Read and review your notice carefully. Treasury international capital (tic) forms and instructions. It will explain why we were unable to apply. Web internal revenue code section 1445 refers to a specific set of guidelines centered on withholding taxes and refunds when a foreign person sells property within the united. Open it up with online editor and start editing. Edit, sign and save pd f 1455 e form. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a.

Search for your notice or letter to learn what it means and what you should do advance child tax credit letters get. Web get the irs form 1055 you require. Treasury international capital (tic) forms and instructions. Web i got a notice from the irs. Web did you receive an irs notice or letter? Any interest that is or becomes due on securities belonging to the estate of a decedent will be paid to. Read and review your notice carefully. It will explain why we were unable to apply. Web 60 rows fs form 1455 request by fiduciary for distribution of united states treasury. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a.

Show details how it works browse for the form 1455 customize and esign fs form 1455 send. Web i got a notice from the irs. Savings bonds and treasury securities forms. Web irs forms and instructions. It may be about a specific issue on your. Extensions of statute of limitations. Web 60 rows fs form 1455 request by fiduciary for distribution of united states treasury. Web find and fill out the correct fs form 1455 request by fiduciary for treasurydirect. Web send your document before we email you how we send documents documents we accept we accept these documents: The internal revenue service (irs) will send a notice or a letter for any number of reasons.

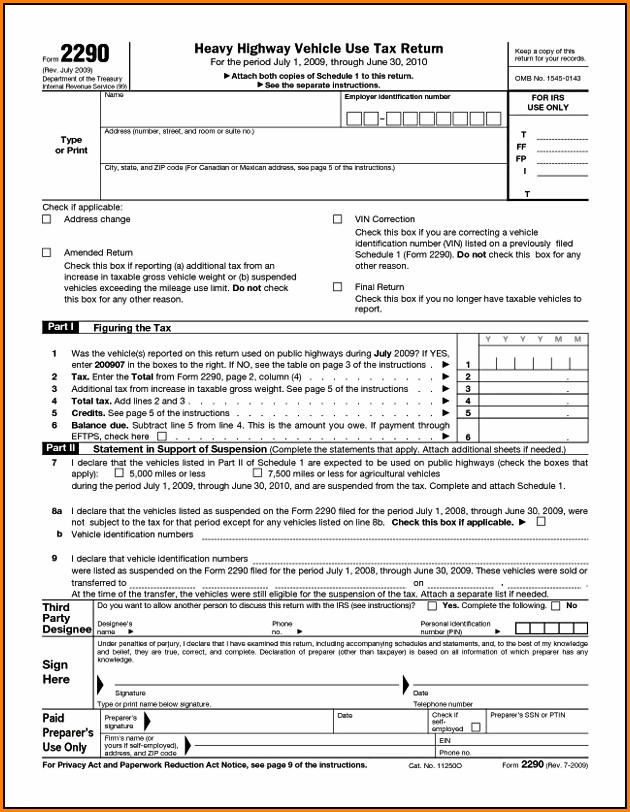

File IRS 2290 Form Online for 20222023 Tax Period

The 1099s are issued in the year following the redemption, please. Web irs forms and instructions. Sign it in a few clicks draw your signature, type it,. Web use a irs form 1455 template to make your document workflow more streamlined. Web 60 rows fs form 1455 request by fiduciary for distribution of united states treasury.

Irs Form Ssa 1099 Form Resume Examples wdP9l16YRD

Web did you receive an irs notice or letter? Edit, sign and save pd f 1455 e form. Any interest that is or becomes due on securities belonging to the estate of a decedent will be paid to. Web internal revenue code section 1445 refers to a specific set of guidelines centered on withholding taxes and refunds when a foreign.

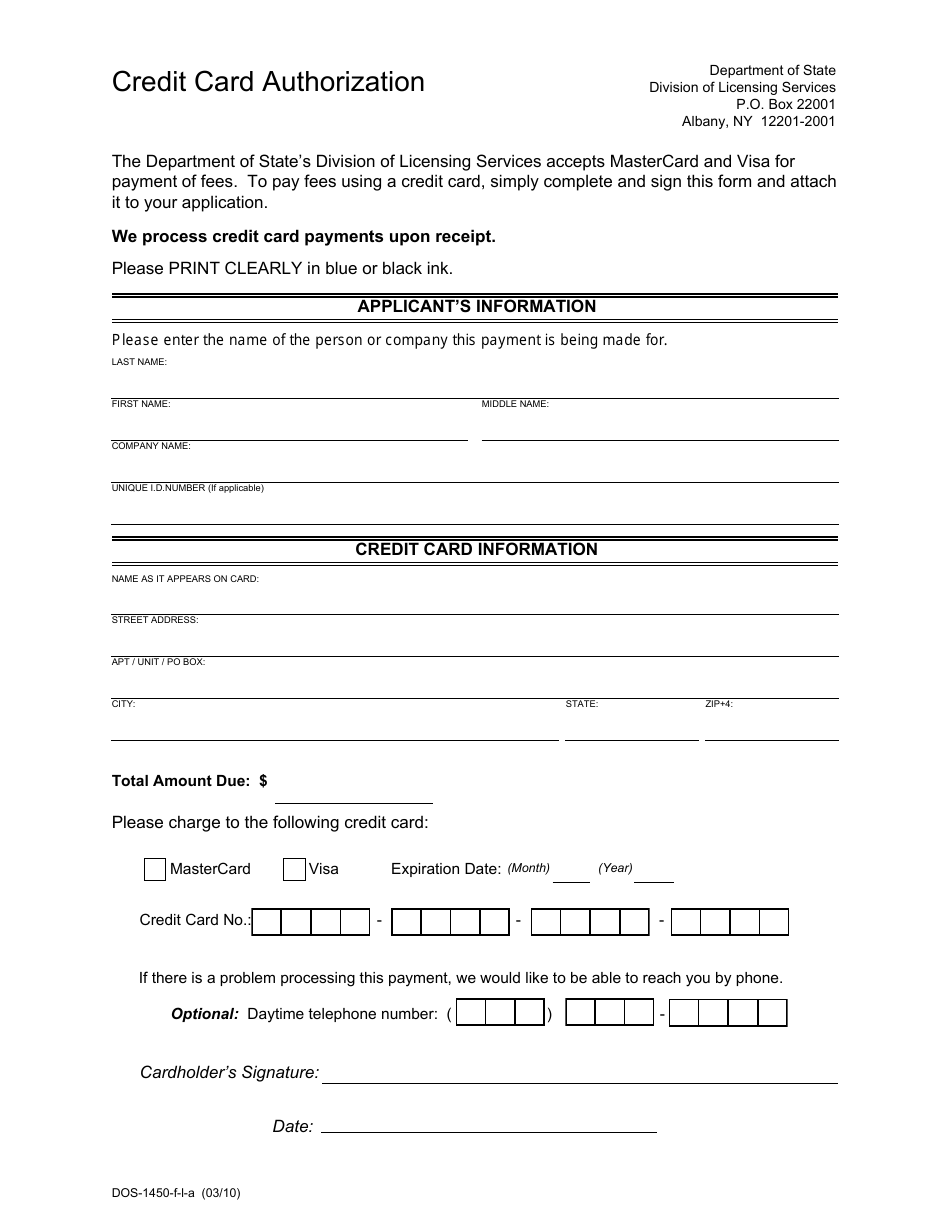

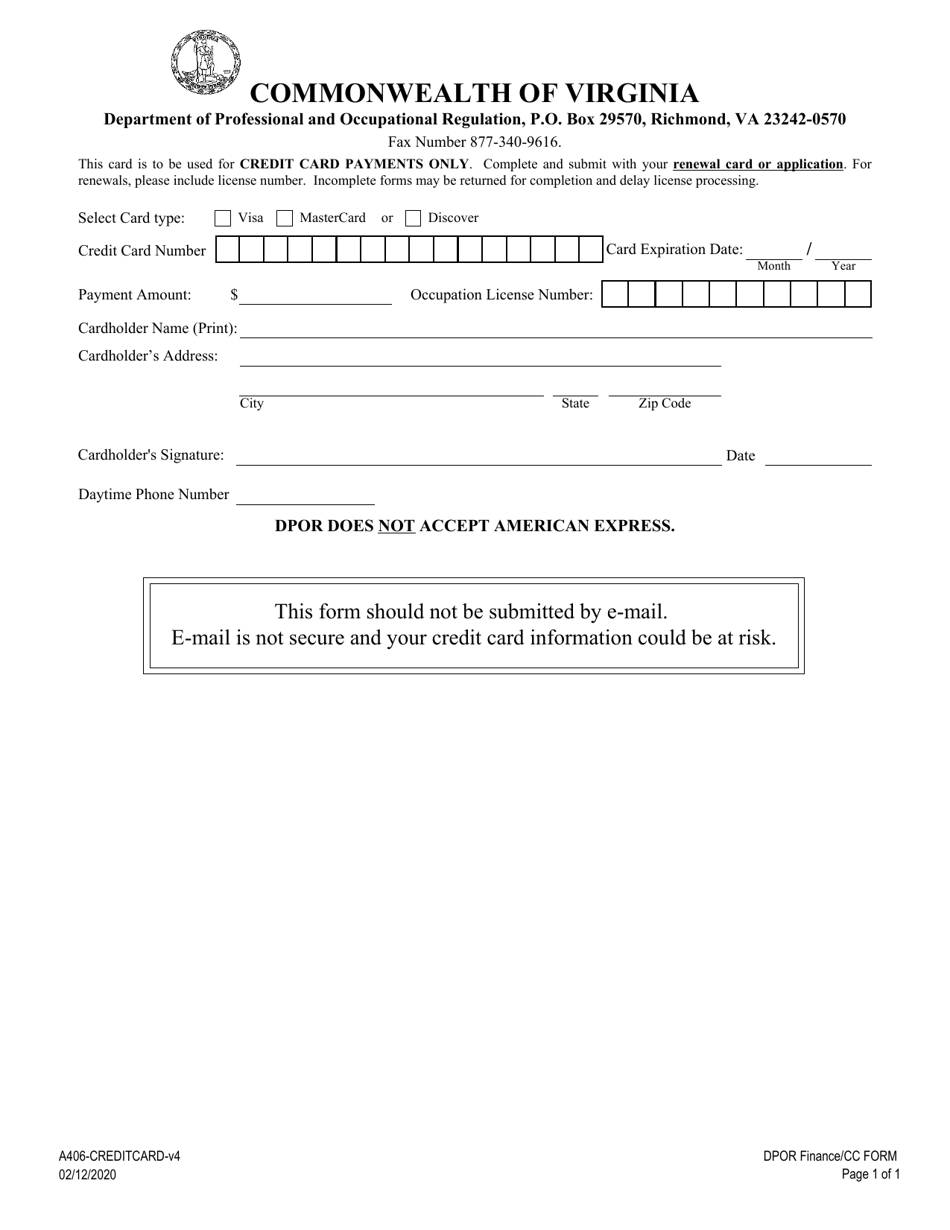

Form DOS1450FLA Download Fillable PDF or Fill Online Credit Card

Treasury international capital (tic) forms and instructions. Show details how it works browse for the form 1455 customize and esign fs form 1455 send. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a. Edit your 1455 form online.

IRS FORM 1455 United States Treasury Security Securities (Finance)

The 1099s are issued in the year following the redemption, please. Treasury international capital (tic) forms and instructions. Edit your 1455 form online type text, add images, blackout confidential details, add comments, highlights and more. Web send your document before we email you how we send documents documents we accept we accept these documents: Choose the correct version of.

Fillable Form Pd F 1455 Request By Fiduciary For Distribution Of

Edit your 1455 form online type text, add images, blackout confidential details, add comments, highlights and more. Web internal revenue code section 1445 refers to a specific set of guidelines centered on withholding taxes and refunds when a foreign person sells property within the united. Web get the irs form 1055 you require. It may be about a specific issue.

Form 1455 Fill Out and Sign Printable PDF Template signNow

Web what you need to do you don't need to do anything if you agree with the notice. Edit your 1455 form online type text, add images, blackout confidential details, add comments, highlights and more. Web did you receive an irs notice or letter? Web when the irs needs to ask a question about a taxpayer's tax return, notify them.

Form A406CREDITCARD Download Fillable PDF or Fill Online Credit Card

Web send your document before we email you how we send documents documents we accept we accept these documents: Edit, sign and save pd f 1455 e form. Web did you receive an irs notice or letter? Web get the irs form 1055 you require. Web 60 rows fs form 1455 request by fiduciary for distribution of united states treasury.

Irs Form 2290 Printable Form Resume Examples

Open it up with online editor and start editing. Web did you receive an irs notice or letter? Web on the reverse of the security. Web i got a notice from the irs. Web use a irs form 1455 template to make your document workflow more streamlined.

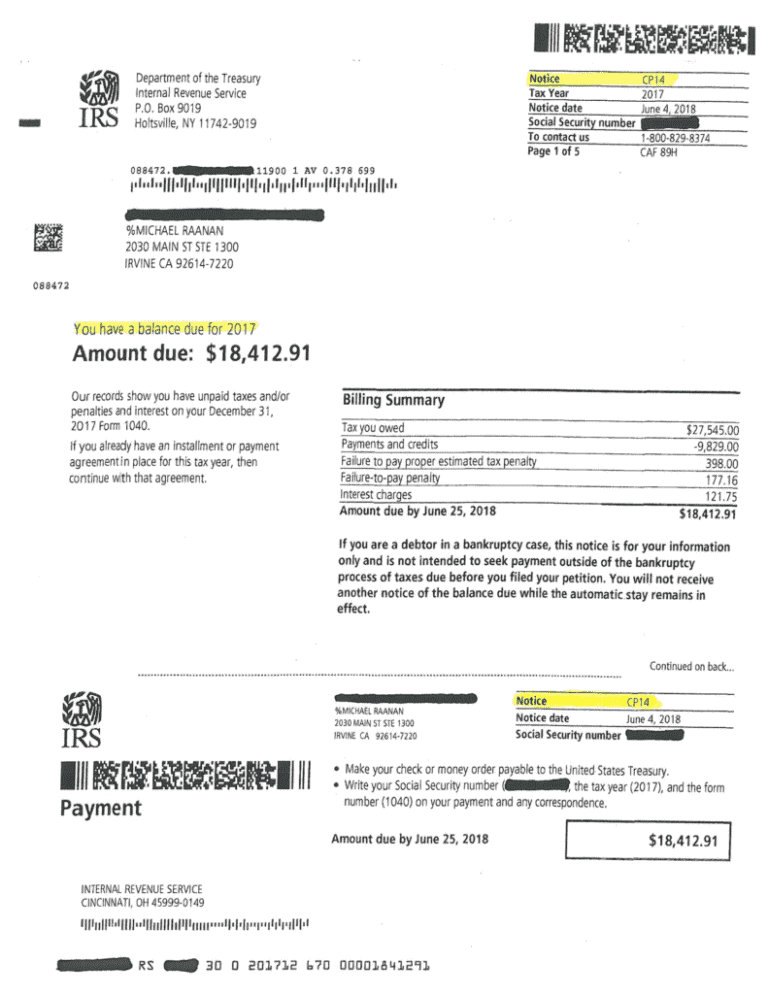

IRS CP14 Tax Notice Letter What is it? Landmark Tax Group

Web i got a notice from the irs. Web find and fill out the correct fs form 1455 request by fiduciary for treasurydirect. Edit your 1455 form online type text, add images, blackout confidential details, add comments, highlights and more. Sometimes this is to randomly. Open it up with online editor and start editing.

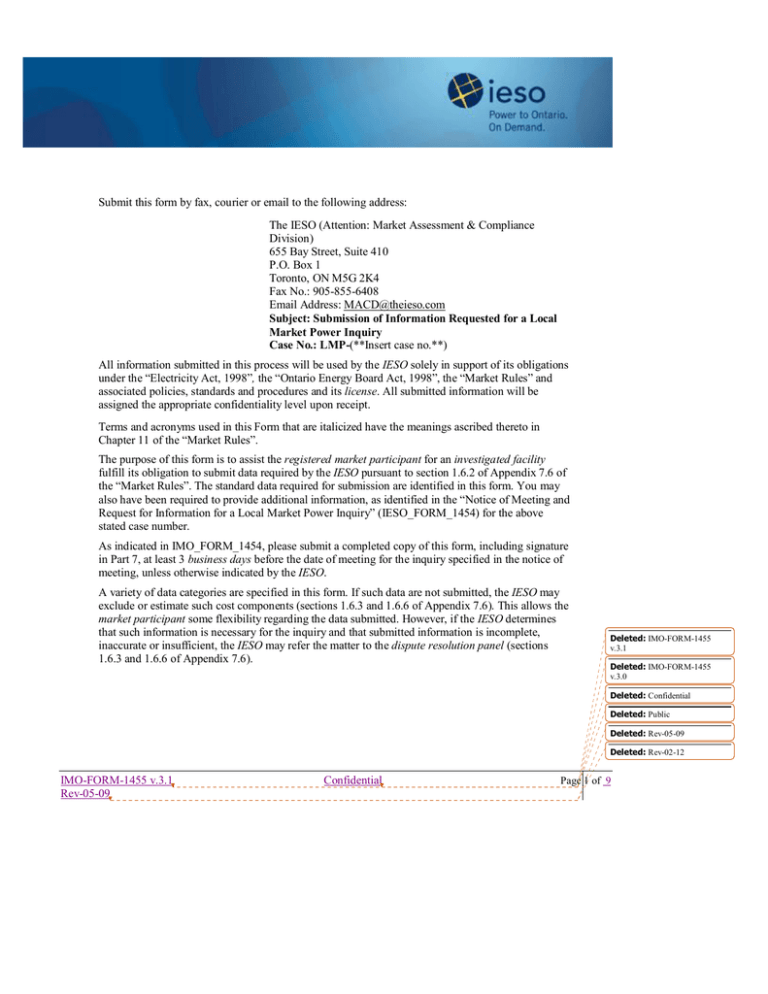

IMOFORM1455 v.3.1 Confidential Rev0509 Submit this

Web did you receive an irs notice or letter? Web use a irs form 1455 template to make your document workflow more streamlined. Edit, sign and save pd f 1455 e form. Download or email pd f 1455 e & more fillable forms, register and subscribe now! Web 60 rows fs form 1455 request by fiduciary for distribution of united.

Web 60 Rows Fs Form 1455 Request By Fiduciary For Distribution Of United States Treasury.

Choose the correct version of. Web irs forms and instructions. Web send your document before we email you how we send documents documents we accept we accept these documents: Web get the irs form 1055 you require.

It May Be About A Specific Issue On Your.

Treasury international capital (tic) forms and instructions. Extensions of statute of limitations. Web did you receive an irs notice or letter? The internal revenue service (irs) will send a notice or a letter for any number of reasons.

Sometimes This Is To Randomly.

Search for your notice or letter to learn what it means and what you should do advance child tax credit letters get. Web i got a notice from the irs. The 1099s are issued in the year following the redemption, please. Show details how it works browse for the form 1455 customize and esign fs form 1455 send.

Web When The Irs Needs To Ask A Question About A Taxpayer's Tax Return, Notify Them About A Change To Their Account, Or Request A Payment, The Agency Often Mails A.

Open it up with online editor and start editing. It will explain why we were unable to apply. Involved parties names, addresses and phone numbers etc. Edit, sign and save pd f 1455 e form.