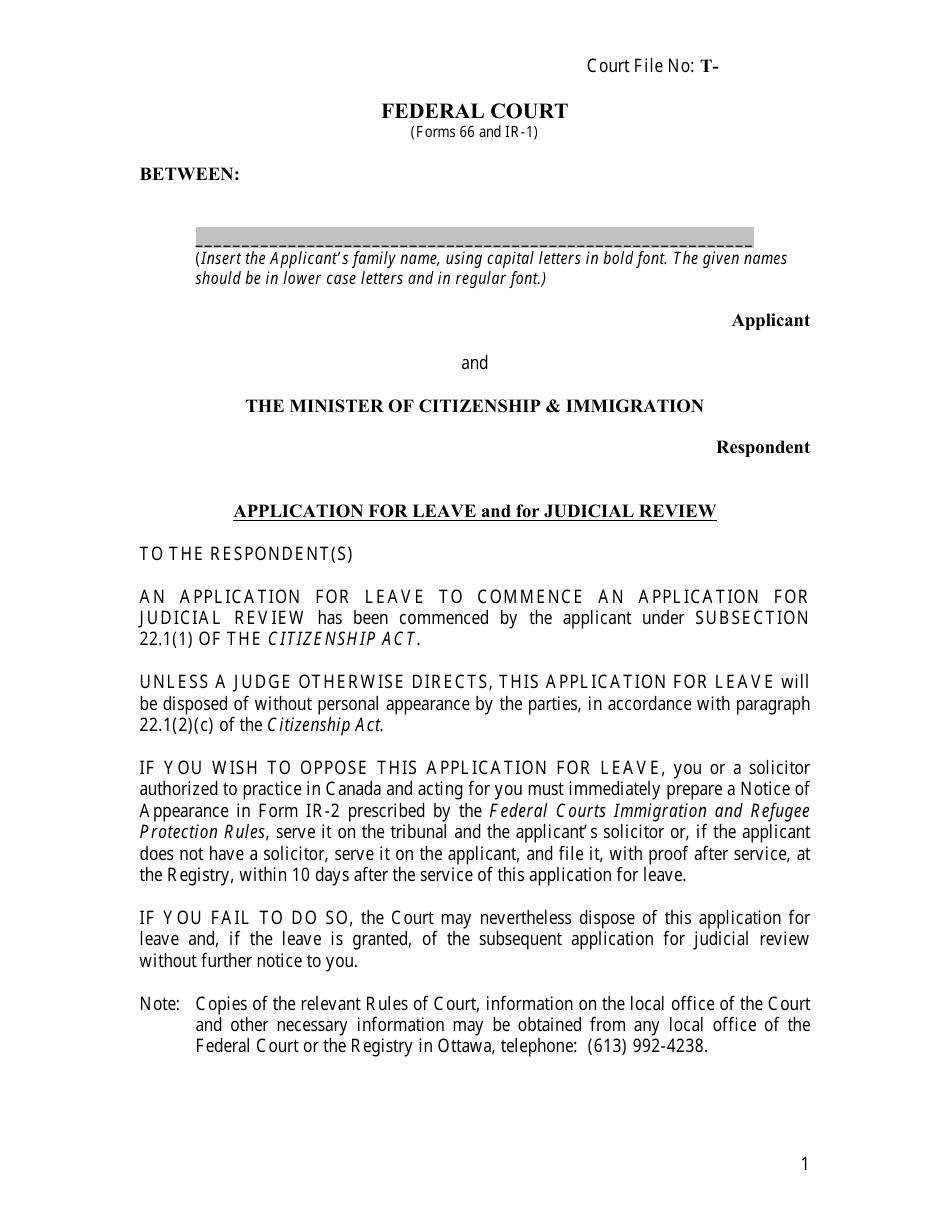

Ir 25 Form

Ir 25 Form - Web july 25, 2023. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. If you are claiming a refund or credit as the result of incorrect. The ir25 form is required for individuals who have received capital gains from property in new zealand. Web prepare and file your federal income taxes online for free. Tips on how to fill out the ir 25 form 2016. Faq's having problems with uploading your return? Web what you need to do. Here are the steps to fill out the. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments.

The ir25 form is required for individuals who have received capital gains from property in new zealand. You can also download it, export it or print it out. 25.1.2 recognizing and developing fraud. Web up to $40 cash back how to fill out ir25 form. Web july 25, 2023. If you are claiming a refund or credit as the result of incorrect. Federal form 2106 which has. Web prepare and file your federal income taxes online for free. Tips on how to fill out the ir 25 form 2016. Web to be considered for the § 48c(e) program, a taxpayer’s § 48c(e) application must be submitted no later than 45 days after doe begins the acceptance process for the.

The ohio department of taxation provides a searchable repository of individual tax. Web what you need to do. If you are claiming a refund or credit as the result of incorrect. Access the forms you need to file taxes or do business in ohio. Tips on how to fill out the ir 25 form 2016. Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. Federal form 2106 which has. Faq's having problems with uploading your return? Read your notice carefully — it will explain the changes we made to your return. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com.

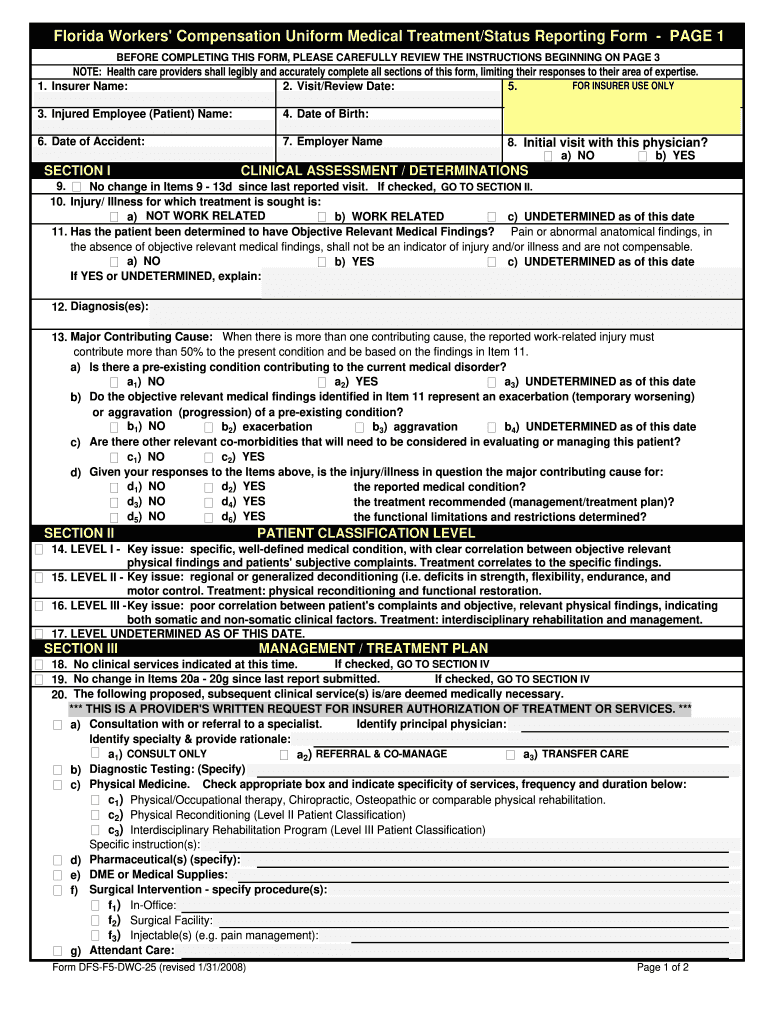

20082022 Form FL DFSF5DWC25 Fill Online, Printable, Fillable, Blank

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web what you need to do. Web to be considered for the § 48c(e) program, a taxpayer’s § 48c(e) application must be submitted no later than 45 days after doe begins the acceptance process for.

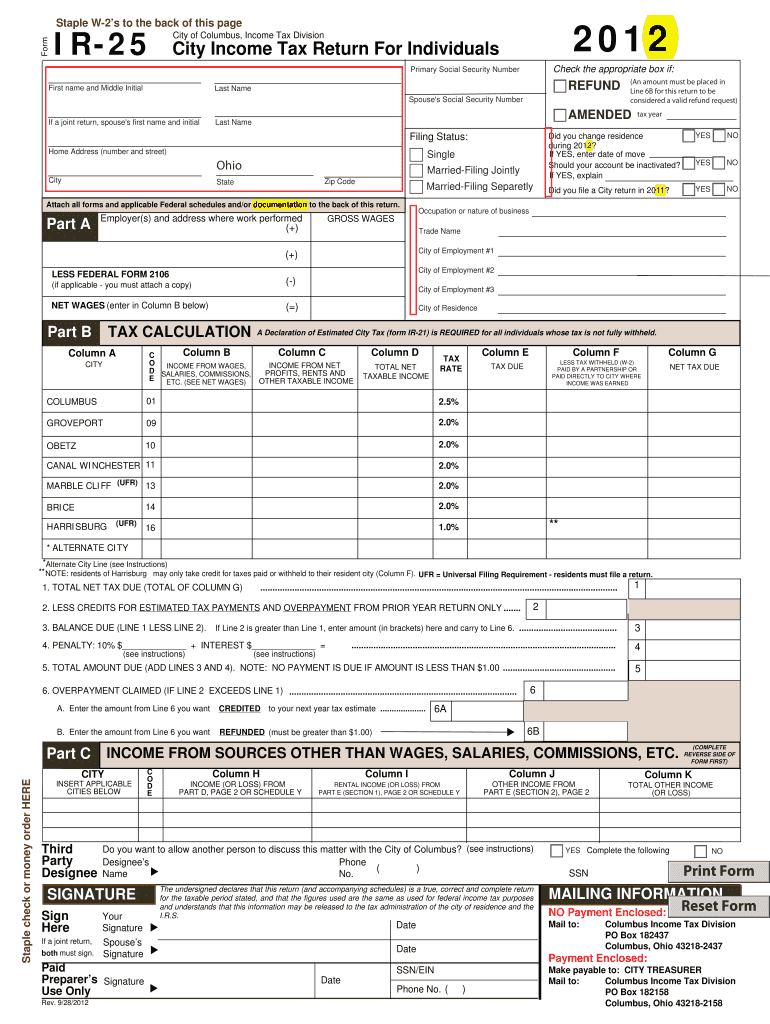

Ir25 Fill Online, Printable, Fillable, Blank pdfFiller

You can also download it, export it or print it out. The ohio department of taxation provides a searchable repository of individual tax. Federal form 2106 which has. 25.1.2 recognizing and developing fraud. Web send ir 25 form via email, link, or fax.

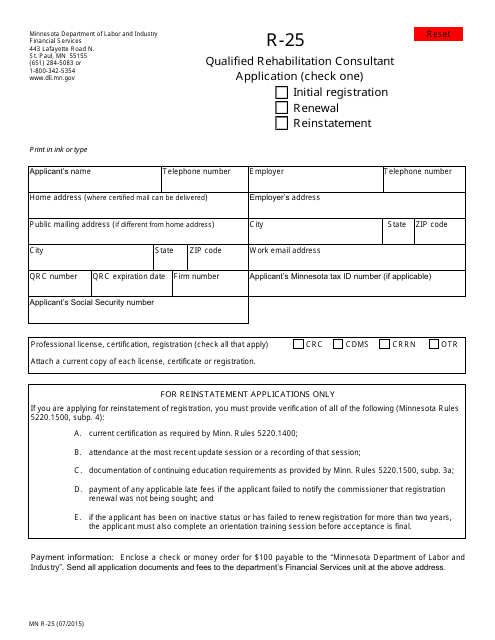

Form R25 Download Fillable PDF or Fill Online Qualified Rehabilitation

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Web the internal revenue bulletin is the authoritative instrument of the commissioner of internal revenue for announcing official rulings and procedures of the. If you are claiming a refund or credit as the result of incorrect..

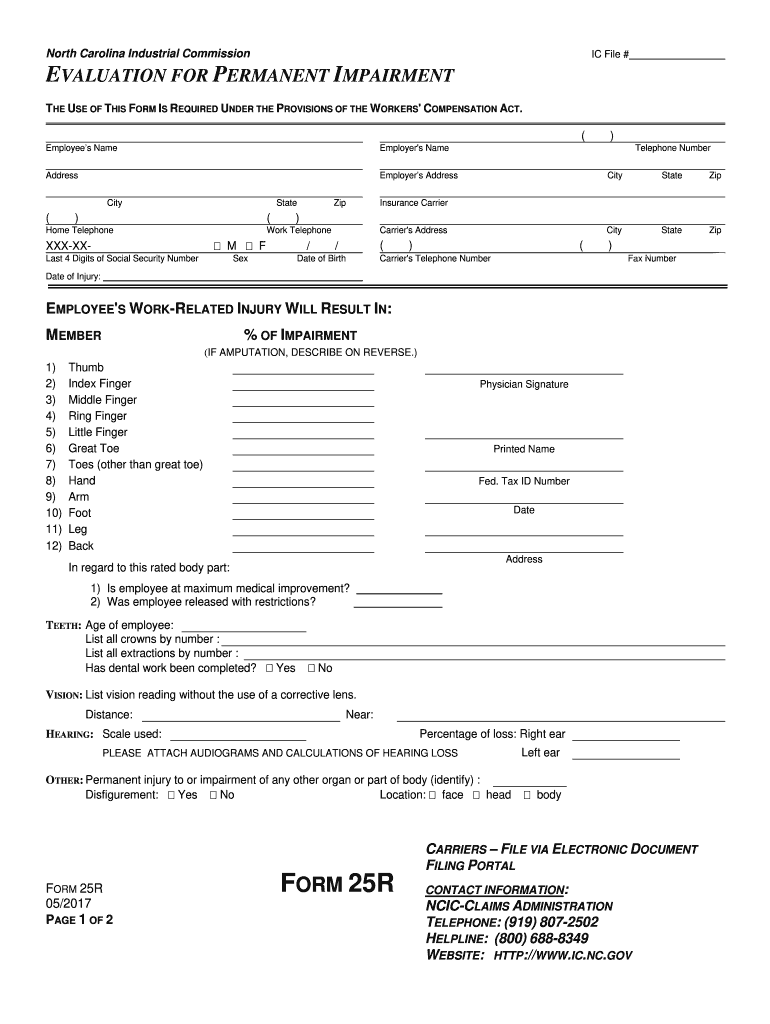

Usar Form 25 R Fill Out and Sign Printable PDF Template signNow

The ir25 form is required for individuals who have received capital gains from property in new zealand. Web to be considered for the § 48c(e) program, a taxpayer’s § 48c(e) application must be submitted no later than 45 days after doe begins the acceptance process for the. Web prepare and file your federal income taxes online for free. Here are.

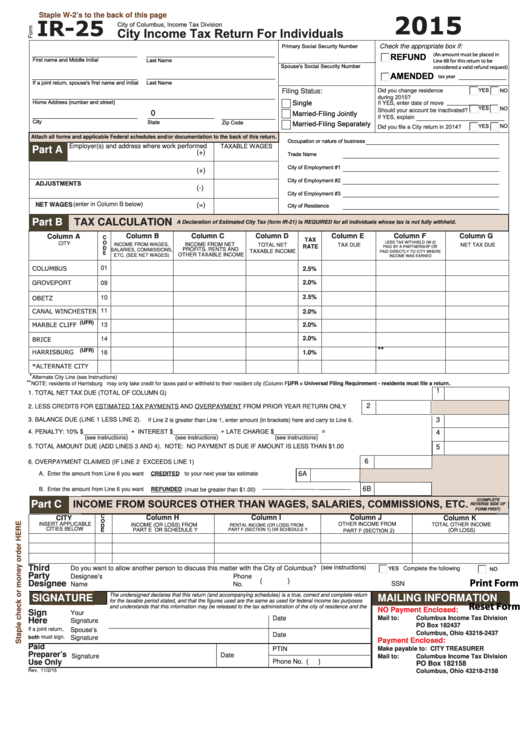

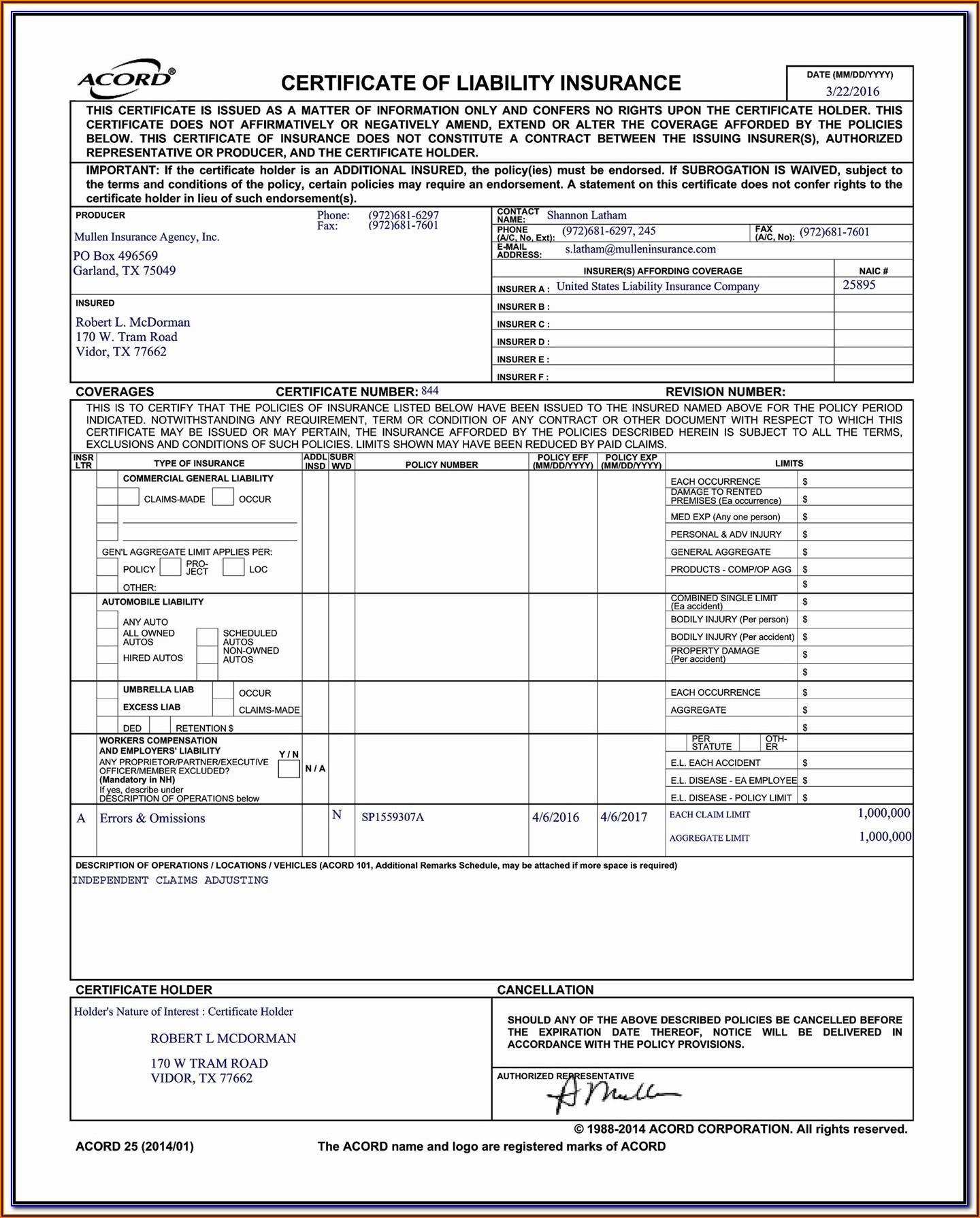

Form 66 (IR1) Download Printable PDF or Fill Online Application for

Here are the steps to fill out the. Web up to $40 cash back how to fill out ir25 form. Edit your how to fill ir 25e online type text, add images, blackout confidential details, add. Federal form 2106 which has. Check the list of payments we applied to your account to see if.

Fillable Form Ir25 City Tax Return For Individuals 2015

Web to be considered for the § 48c(e) program, a taxpayer’s § 48c(e) application must be submitted no later than 45 days after doe begins the acceptance process for the. Access the forms you need to file taxes or do business in ohio. Federal form 2106 which has. Web july 25, 2023. Web as of july 19, the average credit.

Fill Free fillable IRS PDF forms

Try irs free file your online account view your tax records, adjusted gross income and estimated tax payments. Residents who are a partner in an association must report their share of the taxable. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Web july 25,.

Acord Form 26 Form Resume Examples l6YN7wq4V3

Web send ir 25 form via email, link, or fax. If you are claiming a refund or credit as the result of incorrect. Read your notice carefully — it will explain the changes we made to your return. Web the internal revenue bulletin is the authoritative instrument of the commissioner of internal revenue for announcing official rulings and procedures of.

ir 25 YouTube

The ir25 form is required for individuals who have received capital gains from property in new zealand. You can also download it, export it or print it out. Faq's having problems with uploading your return? Web send ir 25 form via email, link, or fax. Read your notice carefully — it will explain the changes we made to your return.

HNP112IR/25X Hunt Electronic CCTV Solutions

Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Tips on how to fill out the ir 25 form 2016. Federal form 2106 which has. The ir25 form is required for individuals who have received capital gains from property in new zealand. Web as of.

Residents Who Are A Partner In An Association Must Report Their Share Of The Taxable.

Web up to $40 cash back how to fill out ir25 form. Check the list of payments we applied to your account to see if. Web to be considered for the § 48c(e) program, a taxpayer’s § 48c(e) application must be submitted no later than 45 days after doe begins the acceptance process for the. Web prepare and file your federal income taxes online for free.

Web What You Need To Do.

The ohio department of taxation provides a searchable repository of individual tax. The ir25 form is required for individuals who have received capital gains from property in new zealand. If you are claiming a refund or credit as the result of incorrect. Faq's having problems with uploading your return?

Here Are The Steps To Fill Out The.

Web the internal revenue bulletin is the authoritative instrument of the commissioner of internal revenue for announcing official rulings and procedures of the. Web send ir 25 form via email, link, or fax. Web partnerships and s corporations use form 8825 to report income and deductible expenses from rental real estate activities, including net income (loss) from. Edit your how to fill ir 25e online type text, add images, blackout confidential details, add.

Try Irs Free File Your Online Account View Your Tax Records, Adjusted Gross Income And Estimated Tax Payments.

Tips on how to fill out the ir 25 form 2016. You can also download it, export it or print it out. Web july 25, 2023. Read your notice carefully — it will explain the changes we made to your return.