Iowa Tax Withholding Form

Iowa Tax Withholding Form - Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue. Do not claim more allowances than necessary or you will not. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. Irs withholding calculator iowa legal aid can sometimes help with tax problems or questions. Web print or download 44 iowa income tax forms for free from the iowa department of revenue. Employee's withholding certificate form 941; Learn about sales & use tax; Web all publicly distributed iowa tax forms can be found on the iowa department of revenue's tax form index site. The federal withholding is no longer deducted from the iowa taxable. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years.

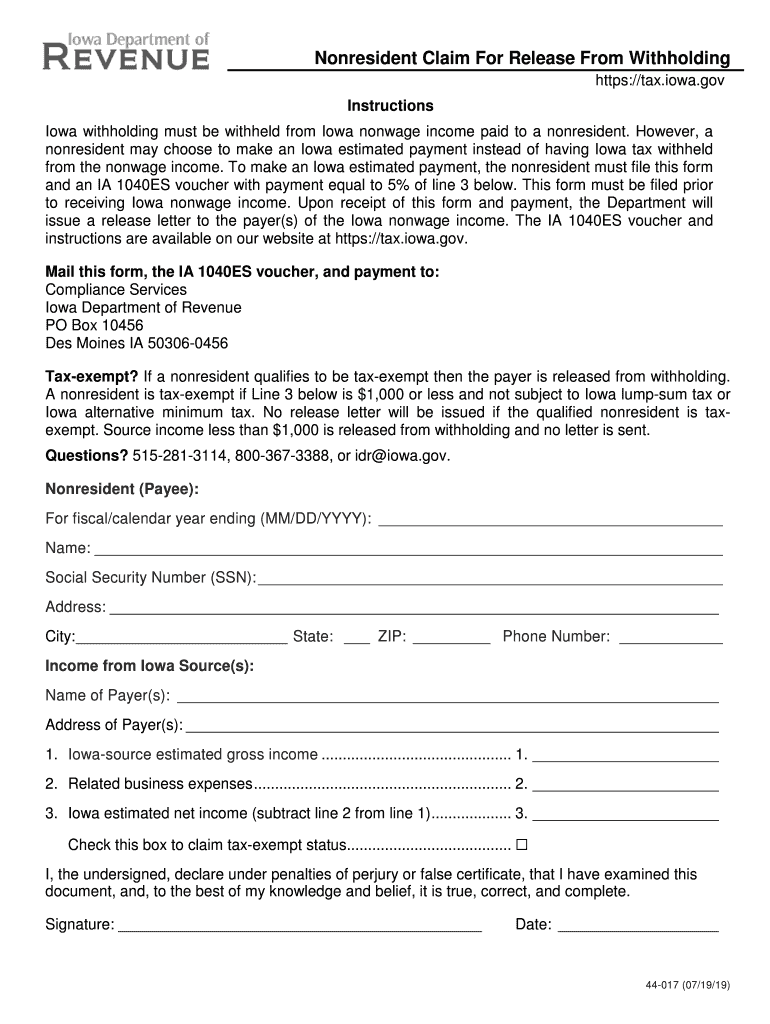

Web enter the total here. 3 $ (a) other income (not from jobs). The federal withholding is no longer deducted from the iowa taxable. Do not claim more allowances. The ia 1040es voucher and instructions are available on. Web receipt of this form and payment, the department will issue a release letter to the payer(s) of the iowa nonwage income. You should claim exemption from withholding if you are a resident of iowa and do not expect to owe any iowa income tax or expect to have a right. Web a withholding calculator is available at: Web the income tax withholding formula for the state of iowa includes the following changes: Employee's withholding certificate form 941;

Web learn about property tax; The federal withholding is no longer deducted from the iowa taxable. Employee's withholding certificate form 941; Web enter the total here. Do not claim more allowances. The hawkeye state has a progressive income tax system where the income taxes are some of the highest in the united states. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. The ia 1040es voucher and instructions are available on. Learn about sales & use tax; Official state of iowa website here is how you know.

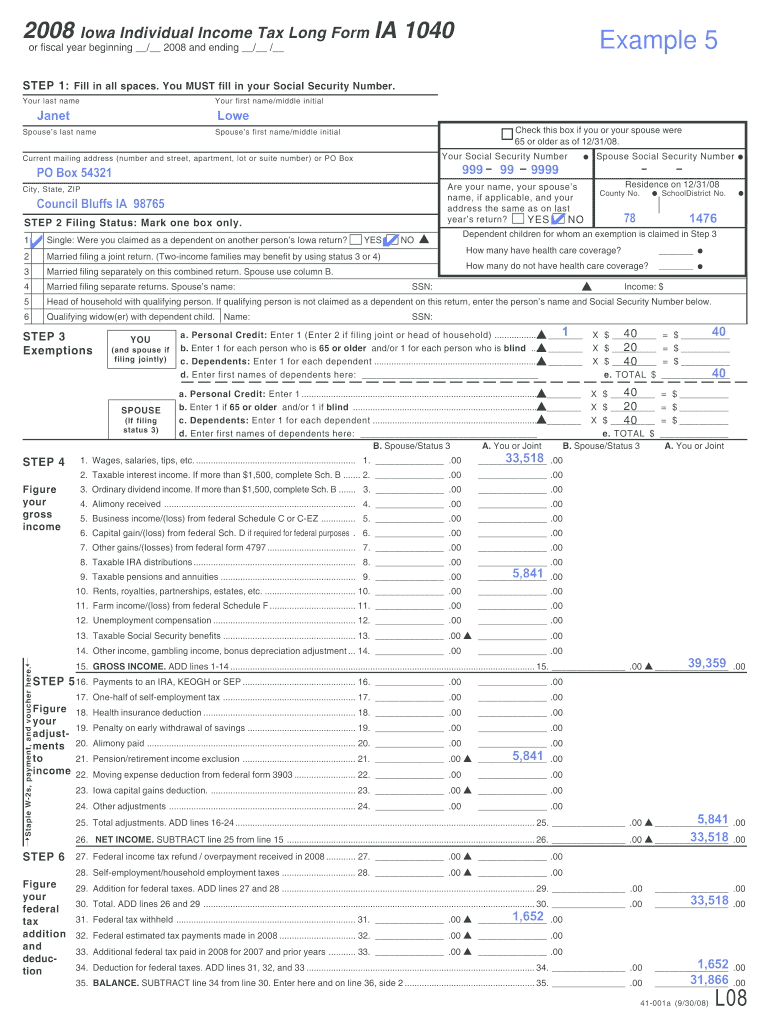

Fillable Online iowa 2008 Iowa Individual Tax Long Form IA 1040

Stay informed, subscribe to receive updates. The ia 1040es voucher and instructions are available on. Web a withholding calculator is available at: If you want tax withheld for other income you expect this year that won’t have withholding, enter the. Web the income tax withholding formula for the state of iowa includes the following changes:

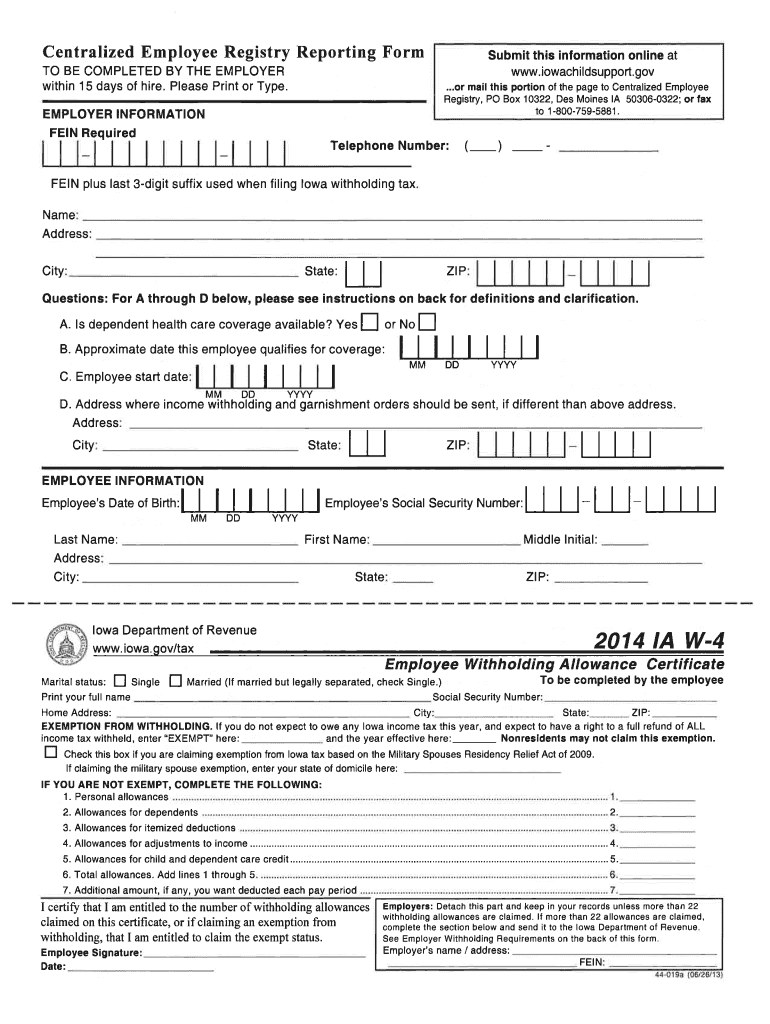

Iowa W4 Form Fill Out and Sign Printable PDF Template signNow

Stay informed, subscribe to receive updates. Web learn about property tax; Irs withholding calculator iowa legal aid can sometimes help with tax problems or questions. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Web if you elect federal withholding, you are an iowa resident, and your benefit is.

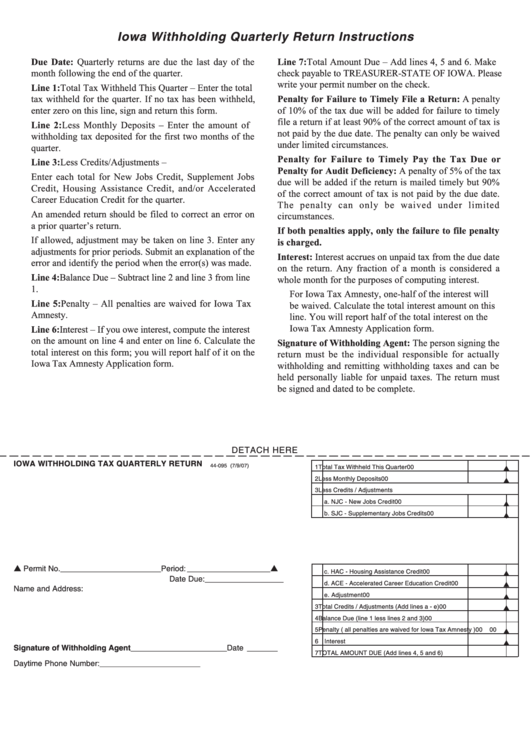

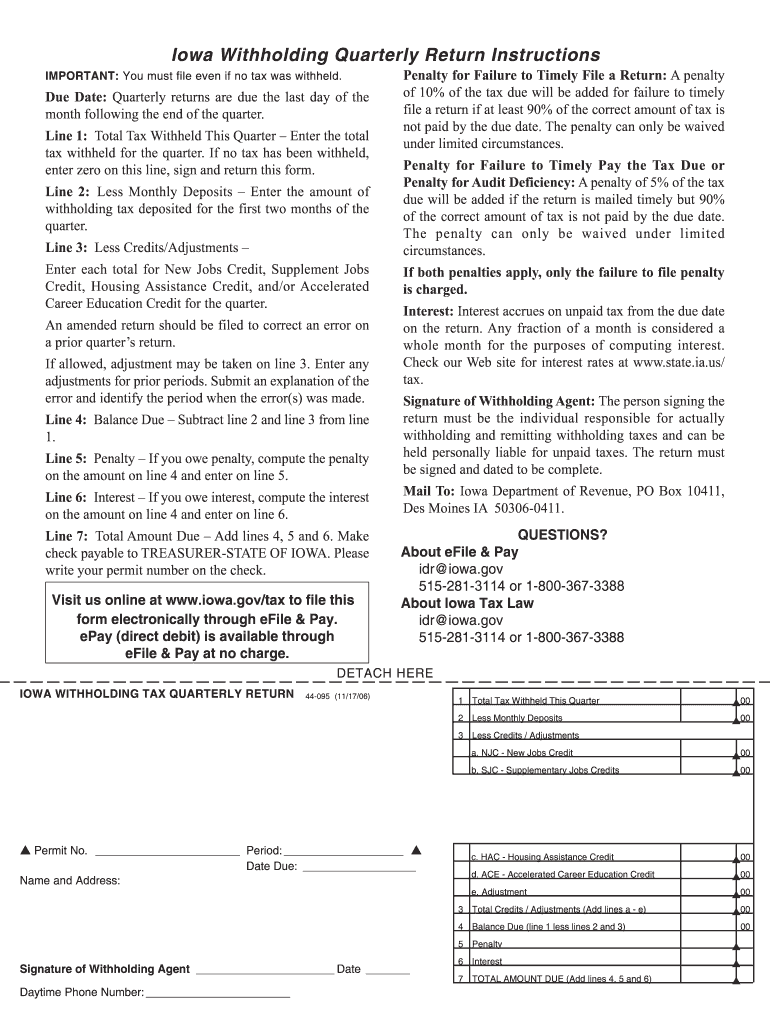

Form 44095 Iowa Withholding Tax Quarterly Return printable pdf download

Employee's withholding certificate form 941; Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required,. 3 $ (a) other income (not from jobs). Official state of iowa website here is how you know. Web learn about property tax;

Why is my Iowa tax refund delayed?

Read more about iowa withholding annual vsp report. Web sunday, january 1, 2023. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Web receipt of this form and payment, the department will issue a release letter to the payer(s) of the iowa nonwage income. Stay informed, subscribe to receive.

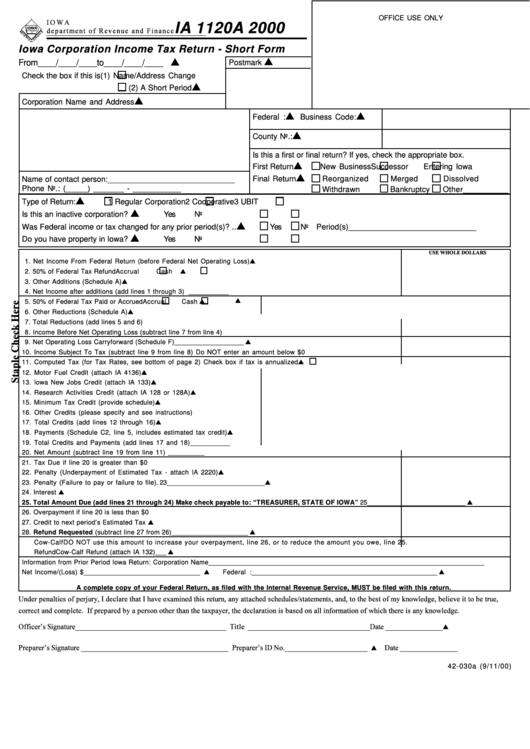

Form Ia 1120a Iowa Corporation Tax Return Short Form 2000

Web enter the total here. 3 $ (a) other income (not from jobs). The hawkeye state has a progressive income tax system where the income taxes are some of the highest in the united states. Taxformfinder provides printable pdf copies of. Web the income tax withholding formula for the state of iowa includes the following changes:

2023 payroll withholding calculator ChayalAizza

Web sunday, january 1, 2023. Employers engaged in a trade or business who pay. Read more about iowa withholding annual vsp report. Official state of iowa website here is how you know. Taxformfinder provides printable pdf copies of.

Iowa W 4 2021 Printable 2022 W4 Form

The federal withholding is no longer deducted from the iowa taxable. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years. Employers engaged in a trade or business who pay. Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa.

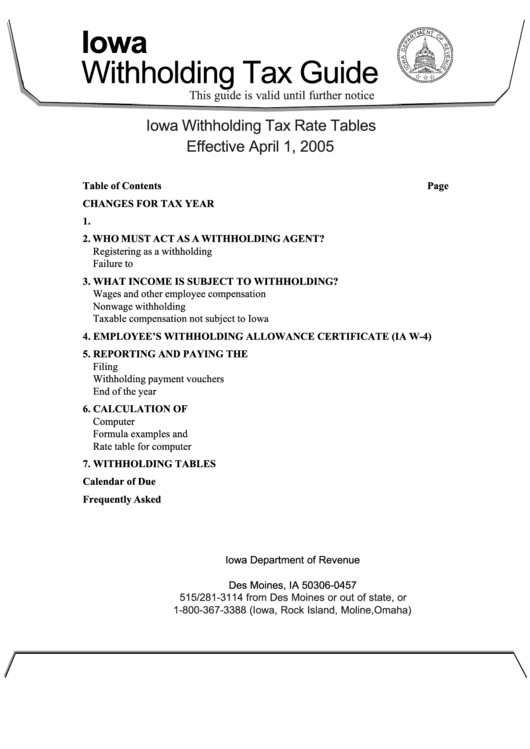

Iowa Withholding Tax Booklet And Tax Tables 2005 printable pdf download

Employee's withholding certificate form 941; You should claim exemption from withholding if you are a resident of iowa and do not expect to owe any iowa income tax or expect to have a right. Irs withholding calculator iowa legal aid can sometimes help with tax problems or questions. Employers engaged in a trade or business who pay. Do not claim.

Iowa Withholding Form Fill Out and Sign Printable PDF Template signNow

The hawkeye state has a progressive income tax system where the income taxes are some of the highest in the united states. 3 $ (a) other income (not from jobs). Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required,..

IA DoR W4 2021 Fill out Tax Template Online US Legal Forms

Irs withholding calculator iowa legal aid can sometimes help with tax problems or questions. Web a withholding calculator is available at: Web learn about property tax; The ia 1040es voucher and instructions are available on. Employers engaged in a trade or business who pay.

Web A Withholding Calculator Is Available At:

Employee's withholding certificate form 941; The federal withholding is no longer deducted from the iowa taxable. Web if you elect federal withholding, you are an iowa resident, and your benefit is more than $6,000 per year ($12,000 if married), withholding for iowa income tax is required,. You may notice a change in your iowa tax withholding on your january 1st paycheck for the next several years.

The Hawkeye State Has A Progressive Income Tax System Where The Income Taxes Are Some Of The Highest In The United States.

You should claim exemption from withholding if you are a resident of iowa and do not expect to owe any iowa income tax or expect to have a right. Learn about sales & use tax; 3 $ (a) other income (not from jobs). Read more about iowa withholding annual vsp report.

The Ia 1040Es Voucher And Instructions Are Available On.

Web learn about property tax; Do not claim more allowances. Employers engaged in a trade or business who pay. Do not claim more allowances than necessary or you will not.

Stay Informed, Subscribe To Receive Updates.

Web print or download 44 iowa income tax forms for free from the iowa department of revenue. Irs withholding calculator iowa legal aid can sometimes help with tax problems or questions. If you want tax withheld for other income you expect this year that won’t have withholding, enter the. Web iowa has a state income tax that ranges between 0.33% and 8.53% , which is administered by the iowa department of revenue.