Insurance Expense On Balance Sheet

Insurance Expense On Balance Sheet - Insurance payable exists on a company’s balance sheet only if there is an insurance expense. Insurance companies calculate insurance expense. Your balance sheet is a summary of how much your business owns and how much it owes. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. The costs that have expired should be reported in income. Web when the insurance premiums are paid in advance, they are referred to as prepaid. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Balance sheet vs income statement. Web insurance expense and insurance payable are interrelated; It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events.

Web insurance expense is also known as the insurance premium. Balance sheet vs income statement. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web when the insurance premiums are paid in advance, they are referred to as prepaid. Your balance sheet is a summary of how much your business owns and how much it owes. Web insurance expense and insurance payable are interrelated; The costs that have expired should be reported in income. Insurance companies calculate insurance expense. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance.

Web does insurance expense go on the balance sheet? Web when the insurance premiums are paid in advance, they are referred to as prepaid. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web insurance expense is also known as the insurance premium. It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. Insurance companies calculate insurance expense. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. The costs that have expired should be reported in income. Your balance sheet is a summary of how much your business owns and how much it owes.

Insurance expense insurance

Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web insurance expense and insurance payable are interrelated; Insurance payable exists on a company’s balance sheet only if there is an insurance expense. Insurance companies calculate insurance expense. Your balance sheet is a summary.

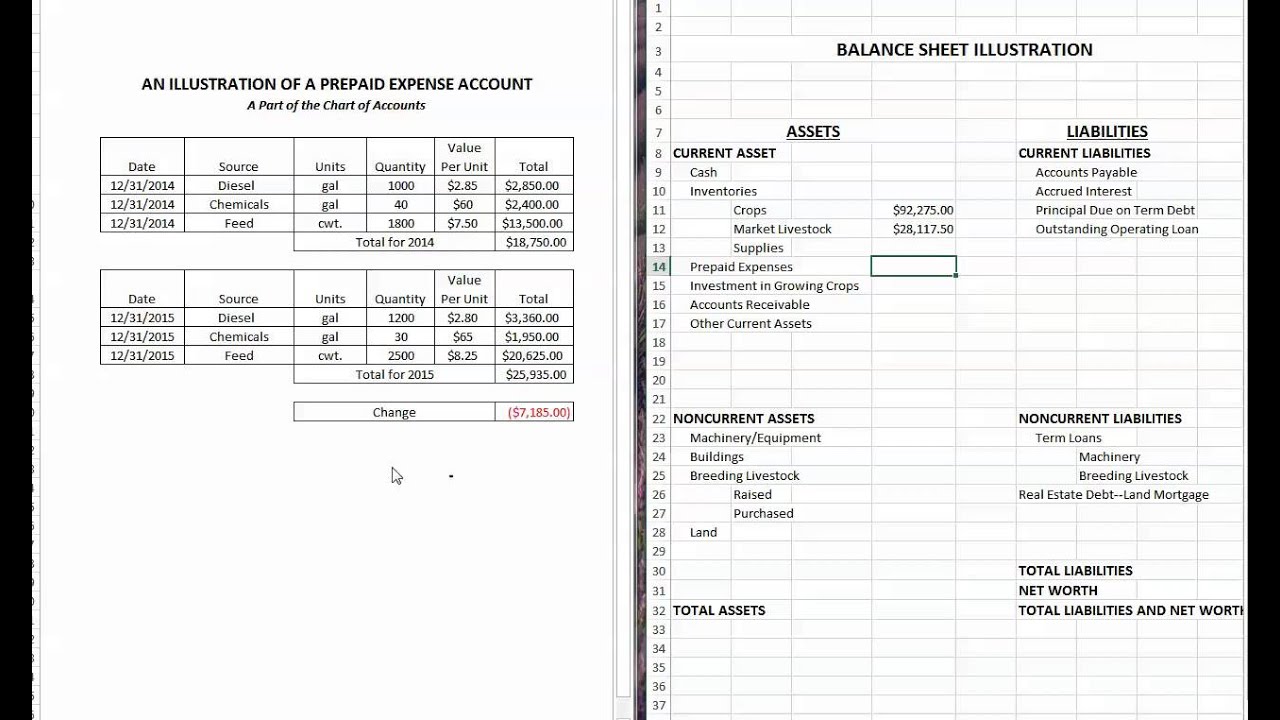

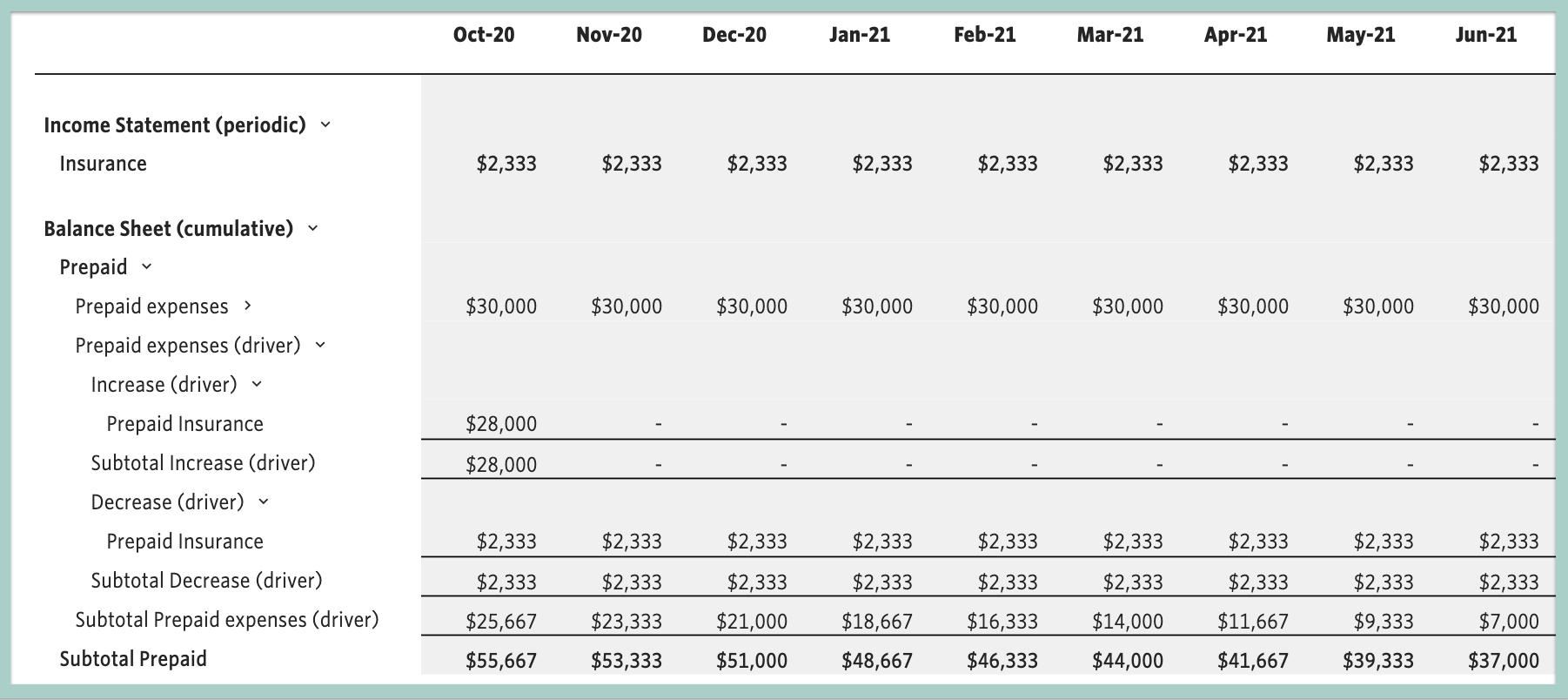

Prepaid Expenses and Balance Sheet YouTube

Web does insurance expense go on the balance sheet? Your balance sheet is a summary of how much your business owns and how much it owes. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Balance sheet vs income statement. Web when the.

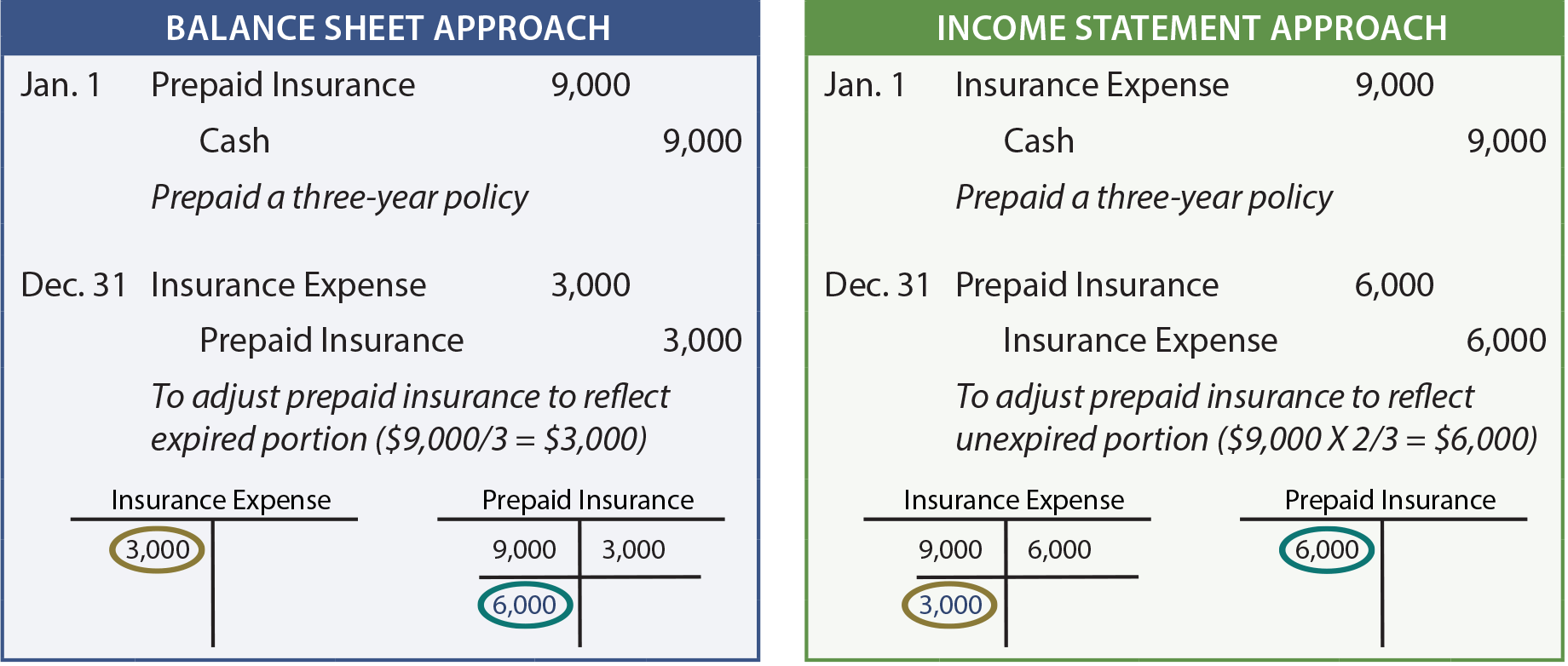

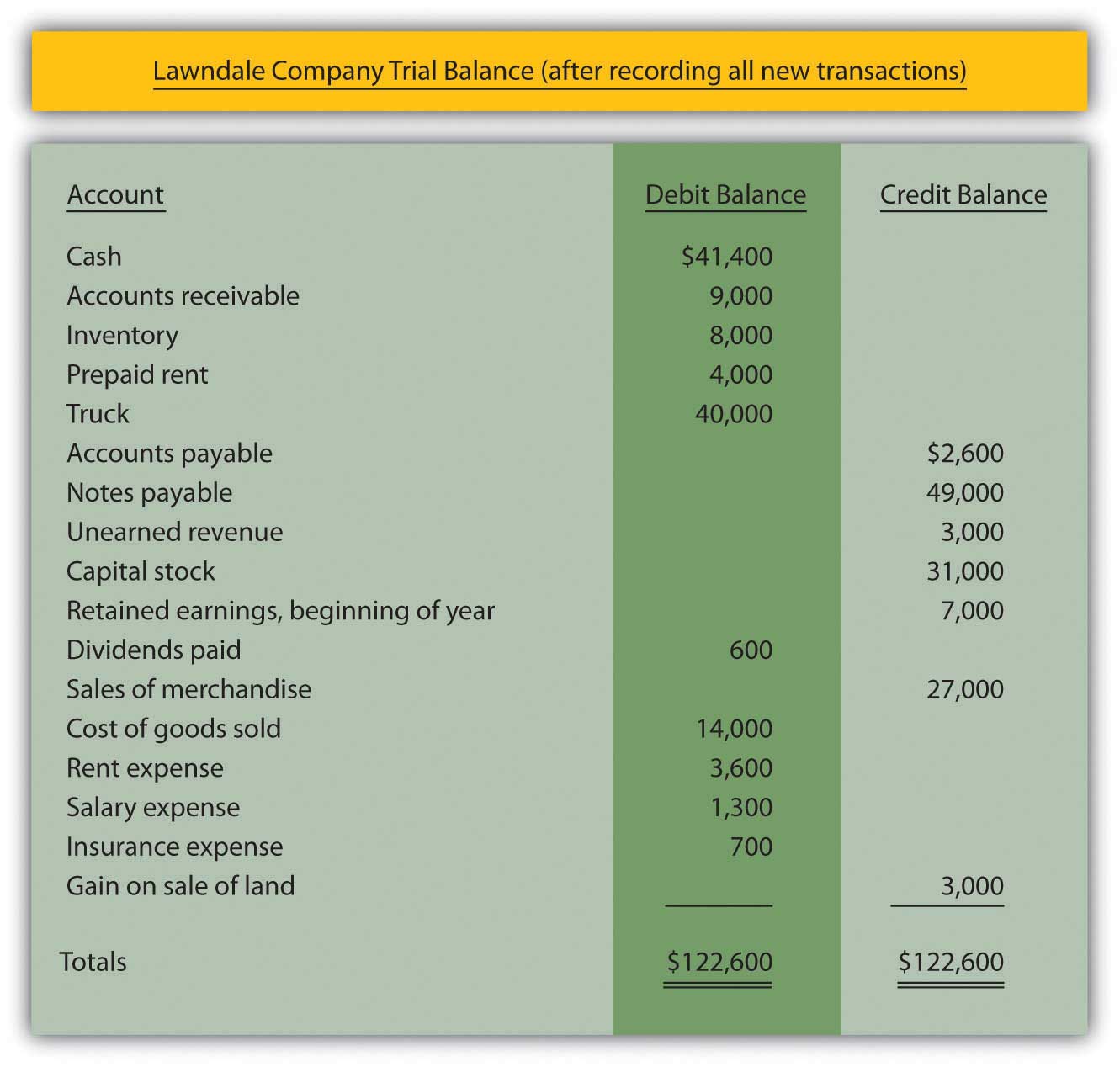

The Adjusting Process And Related Entries

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Insurance companies calculate insurance expense. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. Web insurance expense is also known as the insurance premium. Web does insurance expense go on the balance.

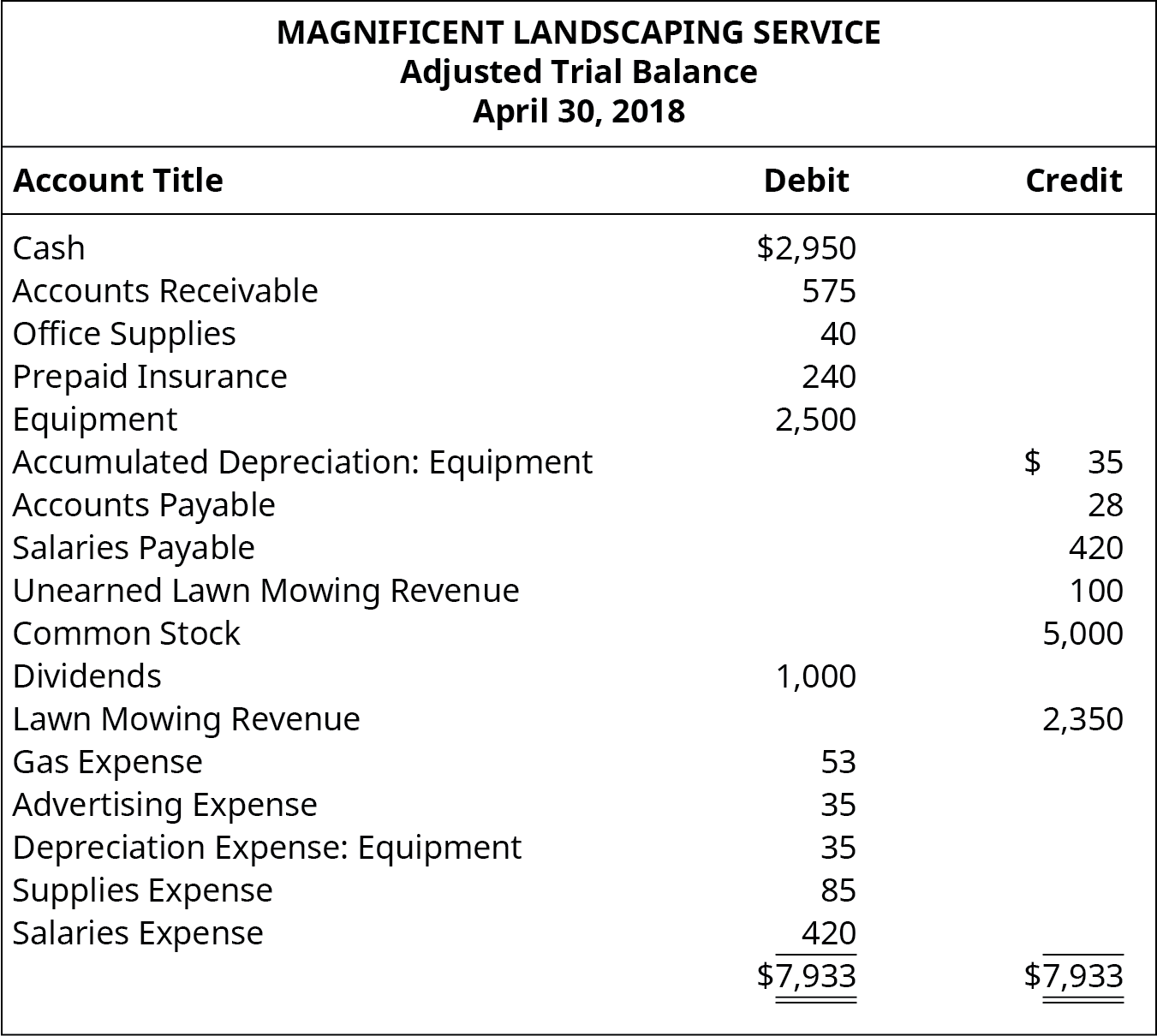

Prepare Financial Statements Using the Adjusted Trial Balance SPSCC

Balance sheet vs income statement. Web insurance expense is also known as the insurance premium. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. The costs that have expired should be reported in income. It is the amount paid to insurance companies to cover the uncertain risks.

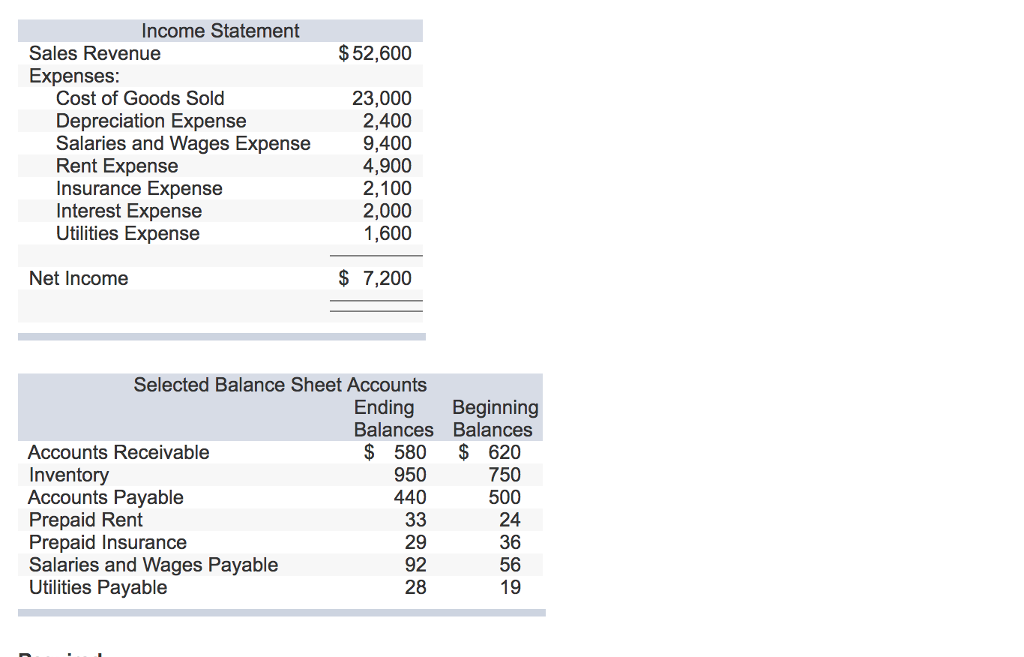

Solved The statement and selected balance sheet

It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Web when the insurance premiums are paid in advance, they are referred to as prepaid. Web insurance expense is also known as the insurance premium. Web does insurance expense go on the balance sheet? Insurance companies calculate insurance expense.

Prepare Financial Statements From Adjusted Trial Balance Worksheet

The costs that have expired should be reported in income. Insurance companies calculate insurance expense. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web when the insurance premiums are paid in advance, they are referred to as prepaid. Insurance payable exists on.

And Bills Spreadsheet in Expenses Sheet Template Pics Expense

It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. Balance sheet vs income statement. Web does insurance expense go on the balance sheet? The costs that have expired should be reported in income. Web when the insurance premiums are paid in advance, they are referred to as prepaid.

Overview Plan for Prepaid Insurance

Balance sheet vs income statement. Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web when the insurance premiums are paid in advance, they are referred to as prepaid. Web insurance expense and insurance payable are interrelated; Insurance companies calculate insurance expense.

Understanding Insurance Expense on Balance Sheet Insure Scope 360

Balance sheet vs income statement. At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current. Web insurance expense and insurance payable are interrelated; The costs that have expired should be reported in income. Insurance payable exists on a company’s balance sheet only if there is an insurance expense.

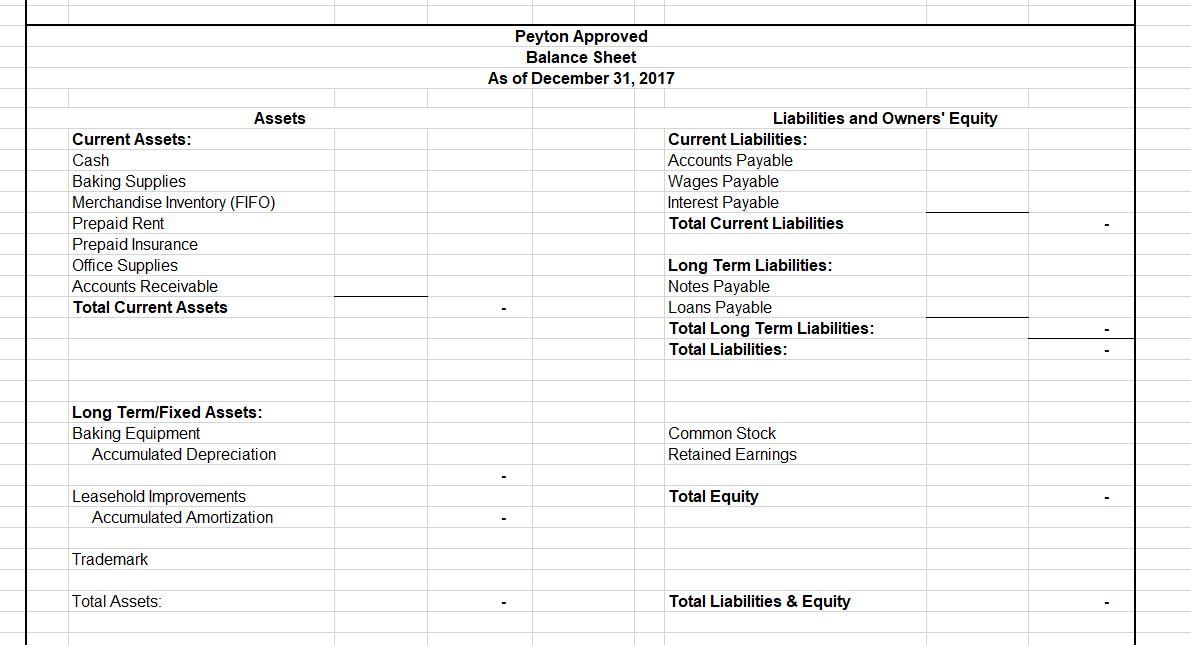

Solved Please help with these tables below. In your final

It is the amount paid to insurance companies to cover the uncertain risks from unexpected life events. The costs that have expired should be reported in income. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. Web any insurance premium costs that have not expired as of the balance sheet date should be reported.

Web Insurance Expense Is Also Known As The Insurance Premium.

Balance sheet vs income statement. Insurance payable exists on a company’s balance sheet only if there is an insurance expense. The costs that have expired should be reported in income. Insurance companies calculate insurance expense.

It Is The Amount Paid To Insurance Companies To Cover The Uncertain Risks From Unexpected Life Events.

Web any insurance premium costs that have not expired as of the balance sheet date should be reported as a current asset such as prepaid insurance. Web does insurance expense go on the balance sheet? Web insurance expense and insurance payable are interrelated; Web when the insurance premiums are paid in advance, they are referred to as prepaid.

Your Balance Sheet Is A Summary Of How Much Your Business Owns And How Much It Owes.

At the end of any accounting period, the amount of the insurance premiums that remain prepaid should be reported in the current.