Instructions For Form 8958

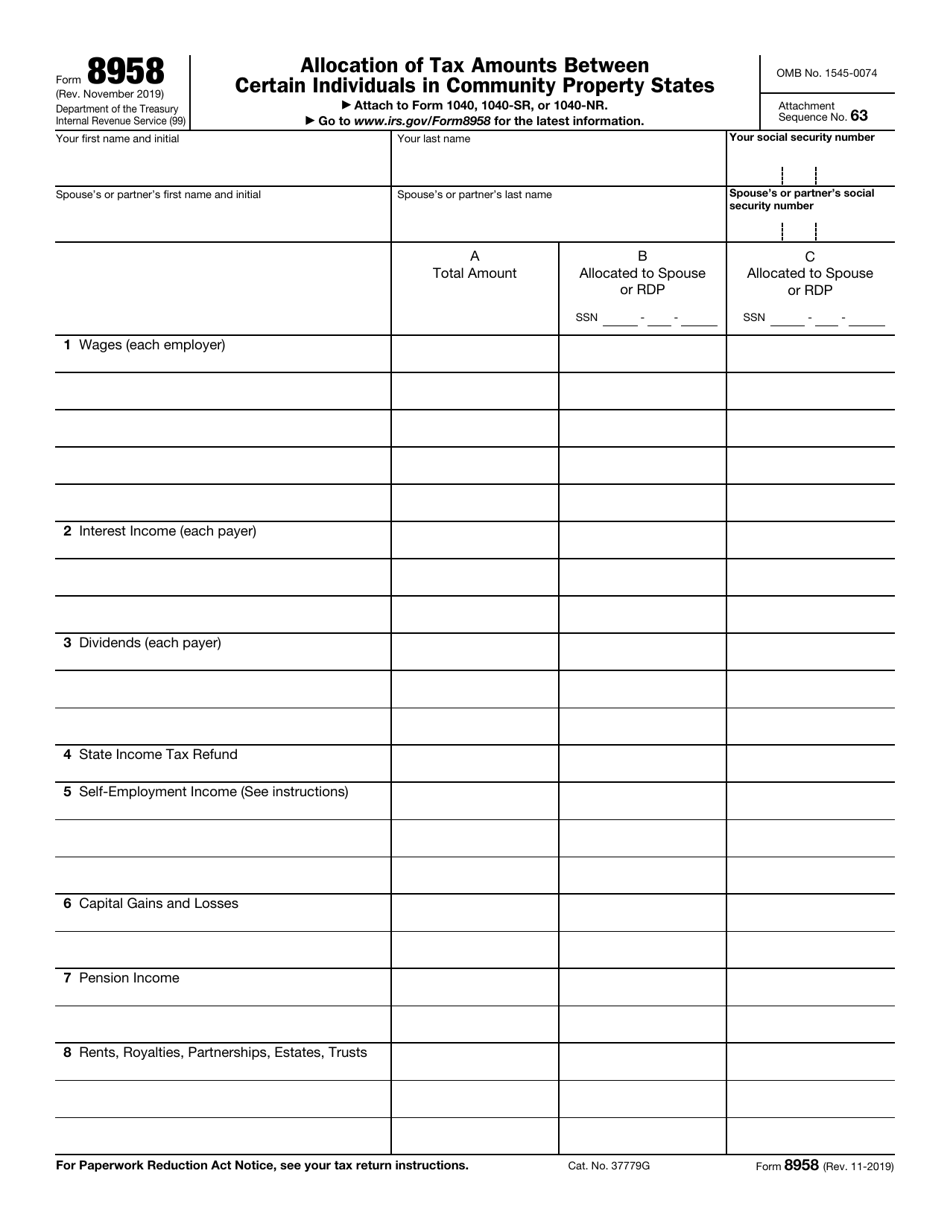

Instructions For Form 8958 - Web form 8958 only explains how you allocated income. Web married filing separately in community property states. For adjustments to items that pass through to the partner's owners or beneficiaries,. Web dec 15, 2022 items that are taxable to the entity partner, the entity partner should use form 8978; Must be removed before printing. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Web the form 8958 is only used when filing as married filing separate (mfs). Persons that operate an fb (foreign branch) or own an fde (foreign disregarded entity) directly.

States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Web dec 15, 2022 items that are taxable to the entity partner, the entity partner should use form 8978; Must be removed before printing. Web mfs without form 8958 = mfs with form 8958 = joint tax return. Persons that operate an fb (foreign branch) or own an fde (foreign disregarded entity) directly. Web general instructions purpose of form form 8858 is used by certain u.s. Web the form 8958 is only used when filing as married filing separate (mfs). Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web form 8958 only explains how you allocated income. For instructions on how to complete form 8958, please check the link:

For instructions on how to complete form 8958, please check the link: Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web wisconsin each state's community property laws determine how both income and property should be allocated for federal purposes, whether community or separate. Must be removed before printing. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Web married filing separately in community property states. Web dec 15, 2022 items that are taxable to the entity partner, the entity partner should use form 8978; For adjustments to items that pass through to the partner's owners or beneficiaries,.

LEGO Granite Grinder Instructions 8958, Power Miners

Web mfs without form 8958 = mfs with form 8958 = joint tax return. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Web use our detailed instructions to fill out and esign your documents online. Web the form 8958 is only.

LEGO Granite Grinder Instructions 8958, Power Miners

Web complete the entire form 8858, including the separate schedule m (form 8858). Web general instructions purpose of form form 8858 is used by certain u.s. For instructions on how to complete form 8958, please check the link: Web show sources > form 8958 is a federal corporate income tax form. Web form 8958 allocation of tax amounts between certain.

p555 by Paul Thompson Issuu

Web use our detailed instructions to fill out and esign your documents online. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. If the split returns need to be changed to allocate income correctly, you must make those.

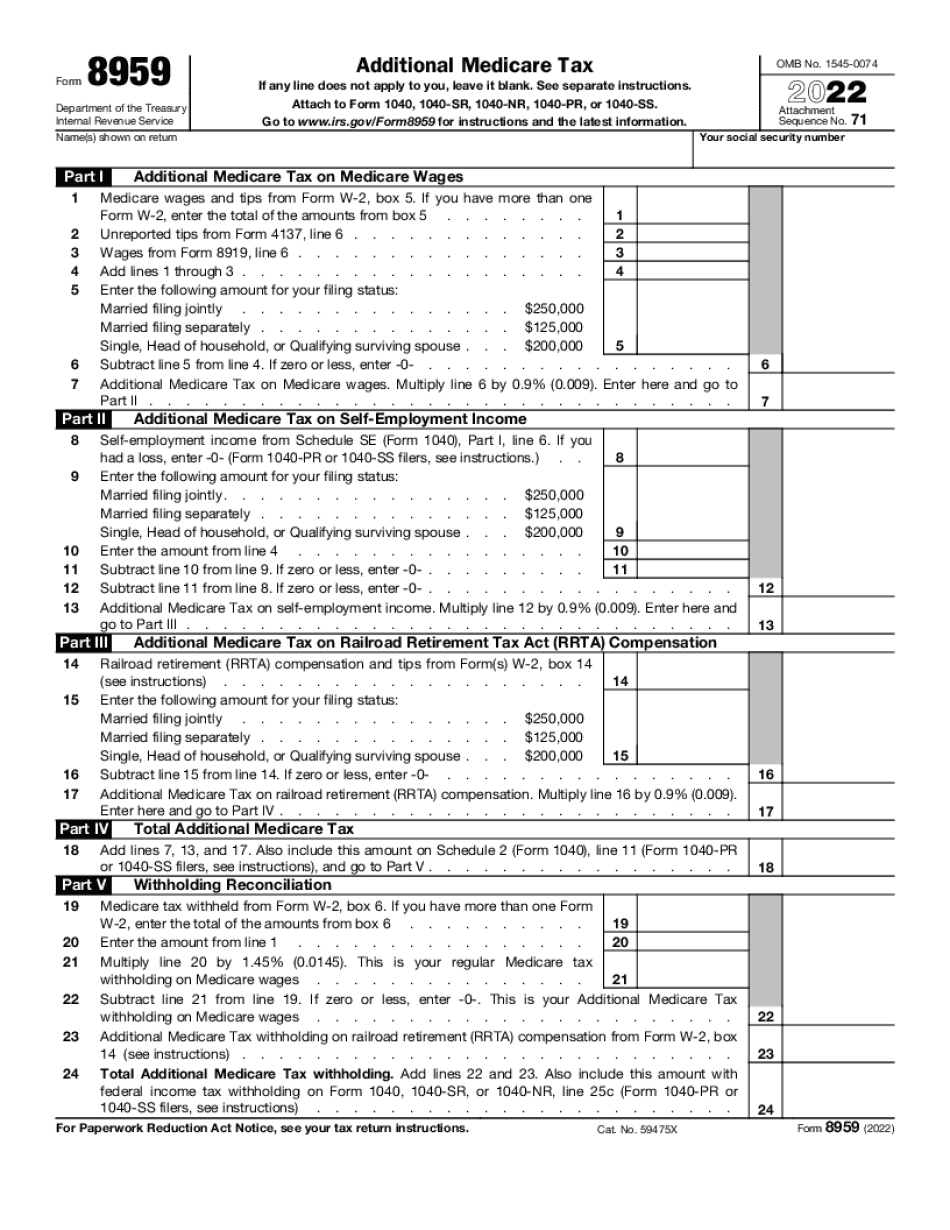

Form 8958 Fill Out and Sign Printable PDF Template signNow

If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web dec 15, 2022 items that are taxable to the entity partner, the entity partner should use form 8978; Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return..

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

Web married filing separately in community property states. Persons that operate an fb (foreign branch) or own an fde (foreign disregarded entity) directly. Web general instructions purpose of form form 8858 is used by certain u.s. Web mfs without form 8958 = mfs with form 8958 = joint tax return. Web show sources > form 8958 is a federal corporate.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Persons that operate an fb (foreign branch) or own an fde (foreign disregarded entity) directly. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. The form 8958 essentially reconciles the difference between what employers (and other. For instructions on how to complete form 8958, please check the link: Web married filing separately.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

For instructions on how to complete form 8958, please check the link: Web general instructions purpose of form form 8858 is used by certain u.s. Must be removed before printing. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. If there's a situation where using an.

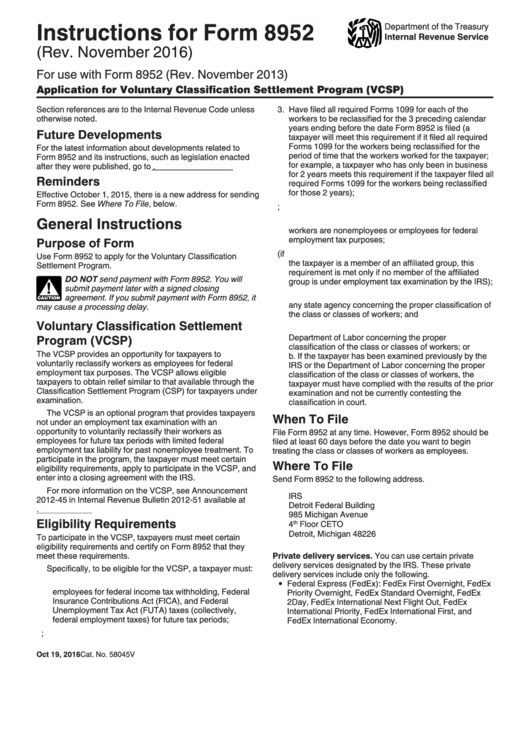

Instructions For Form 8952 Department Of The Treasury 2016

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. Web the form 8958 is only used when filing as married filing separate (mfs). Web show sources > form 8958 is a federal corporate income tax form. Web mfs.

Alcoholics Anonymous 12 Step Worksheets Universal Network

If there's a situation where using an 8958 form would provide the irs more revenue, i could see them complain,. Web use form 8958 to determine the allocation of tax amounts between married filing separate spouses. Web show sources > form 8958 is a federal corporate income tax form. Web general instructions purpose of form form 8858 is used by.

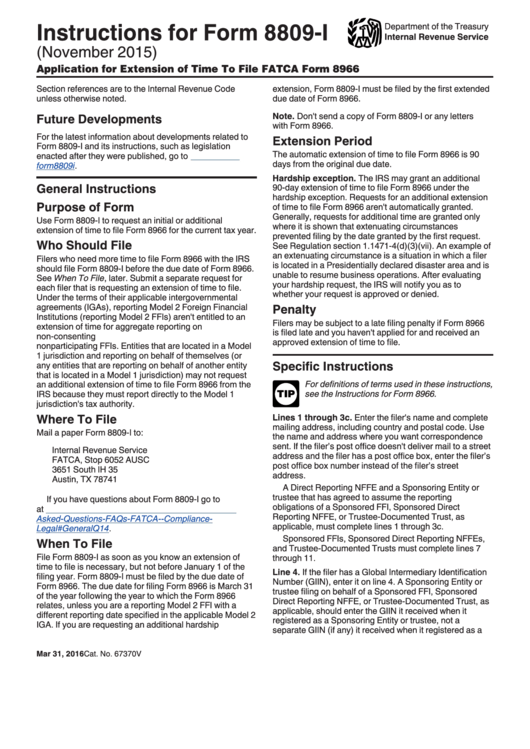

Instructions For Form 8809I Department Of The Treasury printable pdf

Web mfs without form 8958 = mfs with form 8958 = joint tax return. Web use our detailed instructions to fill out and esign your documents online. Web dec 15, 2022 items that are taxable to the entity partner, the entity partner should use form 8978; If there's a situation where using an 8958 form would provide the irs more.

Web If Your Resident State Is A Community Property State, And You File A Federal Tax Return Separately From Your Spouse Or Registered Domestic Partner, Use Form 8958 To Report Half.

States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web income allocation information is required when electronically filing a return with a married filing separately or registered domestic partner status in the individual module of intuit. Must be removed before printing.

Web Mfs Without Form 8958 = Mfs With Form 8958 = Joint Tax Return.

Web wisconsin each state's community property laws determine how both income and property should be allocated for federal purposes, whether community or separate. Web information about form 8958, allocation of tax amounts between certain individuals in community property states, including recent updates, related forms and. For adjustments to items that pass through to the partner's owners or beneficiaries,. Persons that operate an fb (foreign branch) or own an fde (foreign disregarded entity) directly.

Web Complete The Entire Form 8858, Including The Separate Schedule M (Form 8858).

Web general instructions purpose of form form 8858 is used by certain u.s. Web the form 8958 is only used when filing as married filing separate (mfs). If there's a situation where using an 8958 form would provide the irs more revenue, i could see them complain,. Web form 8958 only explains how you allocated income.

Web Show Sources > Form 8958 Is A Federal Corporate Income Tax Form.

Web married filing separately in community property states. If the split returns need to be changed to allocate income correctly, you must make those changes manually. Web certain domestic corporations, partnerships, and trusts that are considered formed or availed of for the purpose of holding, directly or indirectly, specified foreign financial. Web use our detailed instructions to fill out and esign your documents online.