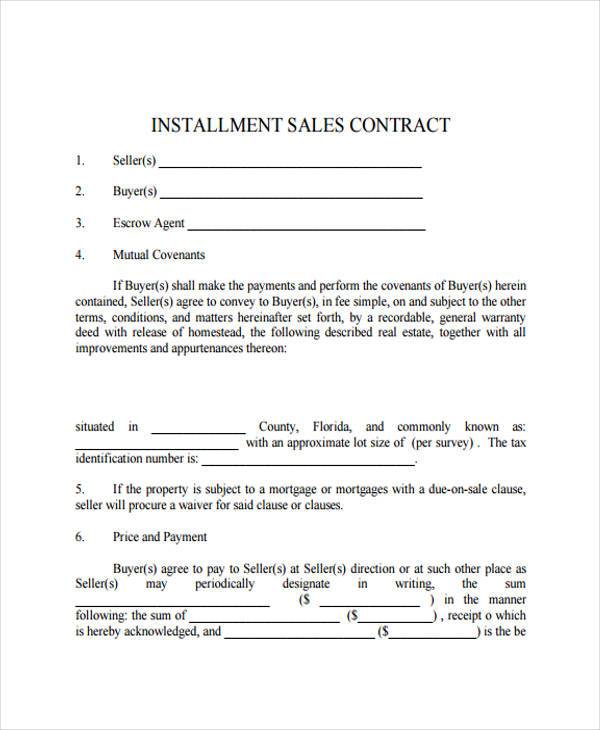

Installment Sale Form

Installment Sale Form - Web there are two requirements for an installment sale. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. *permanent residents of guam or the virgin islands cannot use form 9465. California form 3805e use a separate form for each sale or other disposition of property on the. Web 2021 installment sale income attach to your california tax return. You fill in information like a description of the property, when you acquired it, when you sold it, the. 1) create installment sale agreement 2) print & download, 100% free! Web form 6252 is used to report income from the sale of real or personal property coming from an installment sale. California form 3805e use a separate form for each sale or other disposition of property on the. Web 2022 installment sale income attach to your california tax return.

You will also have to report the installment sale. Ad 1) create installment sale agreement 2) print & download, 100% free. A separate form should be filed for each asset you sell using this method. Web there are two requirements for an installment sale. Web if you were on summary tab and did not see sale number box click on detail tab to drill down. Web 2021 installment sale income attach to your california tax return. An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. Web form 6252 is used to report income from an installment sale. Buyer shall pay a charge of 5% of the monthly installment for each payment not received by note holder within 10 calendar days after its due dare, 4. Web an installment sale is a form of revenue recognition where revenue and expenses are recognized at the time of cash exchange.

Web 2021 installment sale income attach to your california tax return. Form 13844 (february 2023) application for reduced user fee for installment agreements department of. Web 2022 installment sale income attach to your california tax return. A separate form should be filed for each asset you sell using this method. This form is filed by anyone who has realized a gain on the. Free to personalize and print to fit your needs. On federal tab, select the income/deductions category. 1) create installment sale agreement 2) print & download, 100% free! Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year.

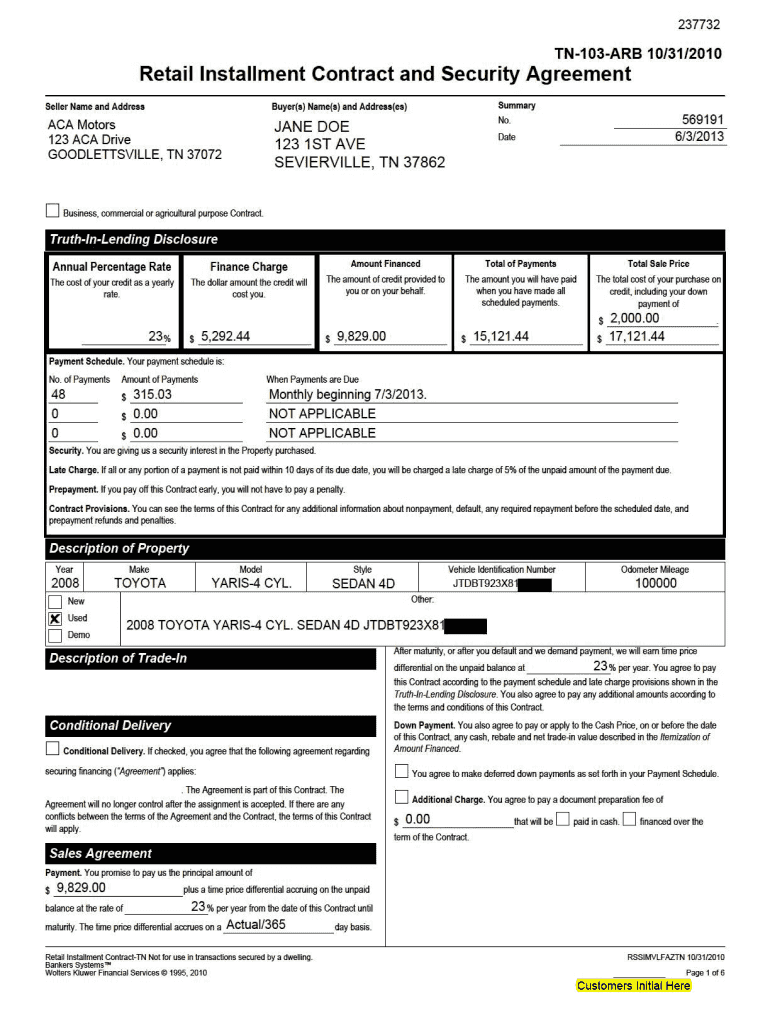

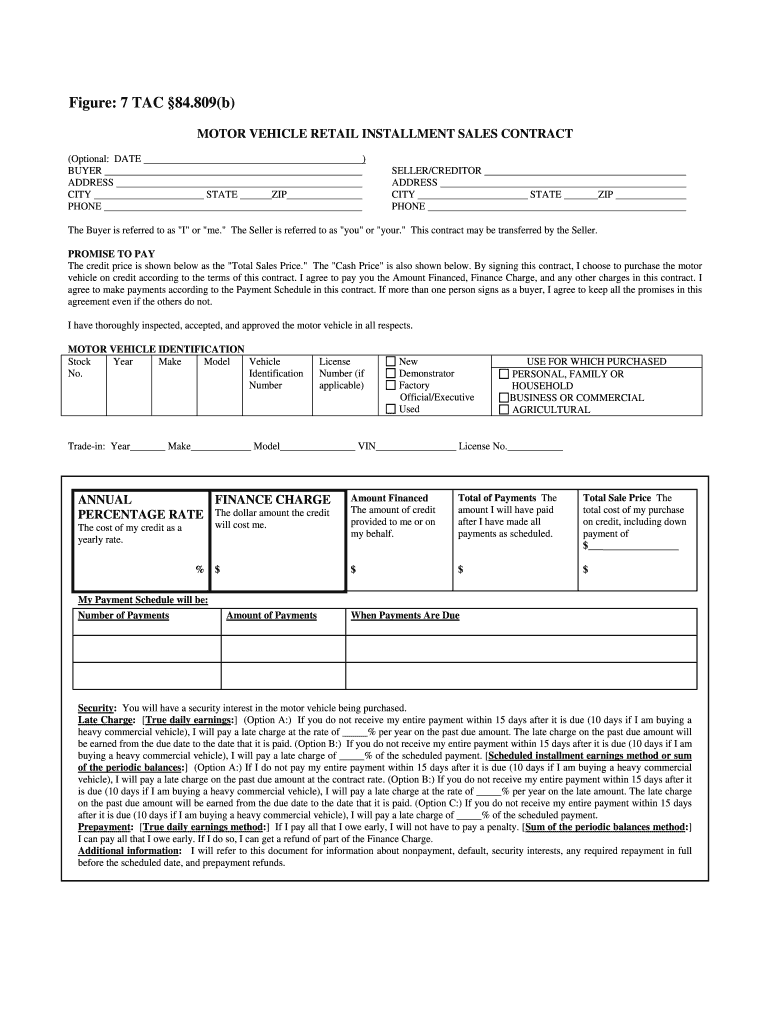

Motor Vehicle Retail Installment Sales Contract PDF Form Fill Out and

Web an installment sale is a form of revenue recognition where revenue and expenses are recognized at the time of cash exchange. Create your installment sale agreement in minutes. Web 2022 installment sale income attach to your california tax return. This form is filed by anyone who has realized a gain on the. Web form 6252 is used to report.

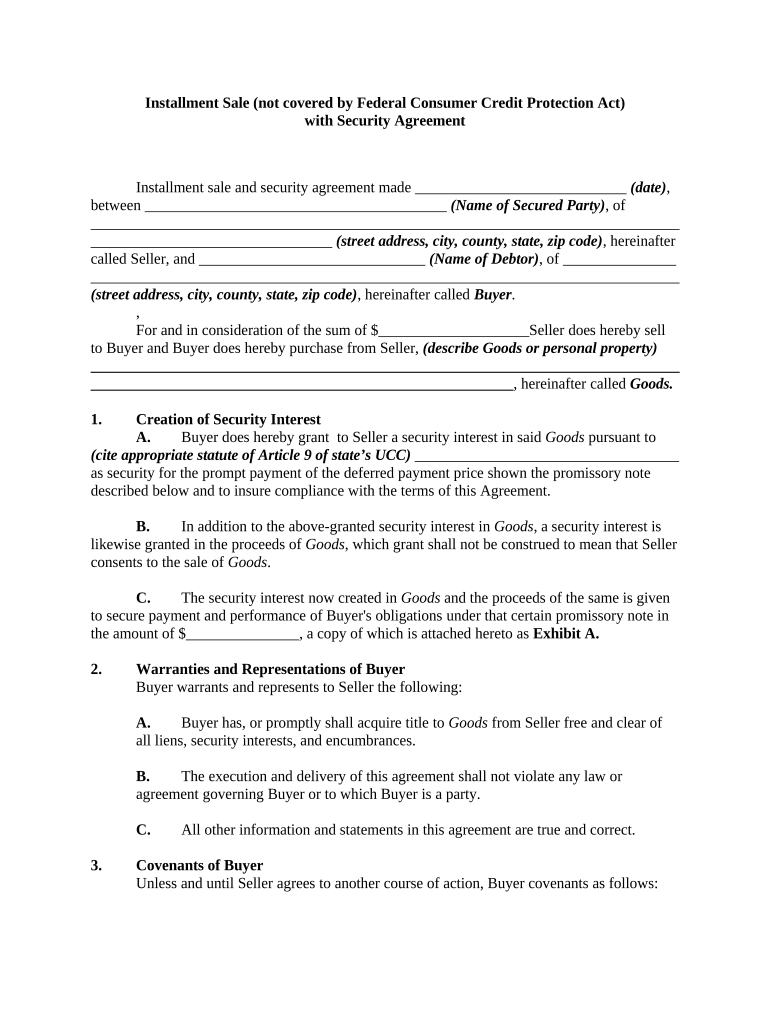

Installment Sale Form Fill Out and Sign Printable PDF Template signNow

The first is that if an asset is sold and payments will be made over time that at least one payment be received. Web 2022 installment sale income attach to your california tax return. Ad 1) create installment sale agreement 2) print & download, 100% free. Web form 6252 is used to report income from an installment sale. *permanent residents.

Form 6252 Installment Sale (2015) Free Download

Web form 6252 is used to report income from the sale of real or personal property coming from an installment sale. Web by turbotax294updated april 14, 2023. Buyer shall pay a charge of 5% of the monthly installment for each payment not received by note holder within 10 calendar days after its due dare, 4. This form is filed by.

FREE 8+ Installment Agreement Form Samples in PDF MS Word

Ad 1) create installment sale agreement 2) print & download, 100% free. A separate form should be filed for each asset you sell using this method. *permanent residents of guam or the virgin islands cannot use form 9465. 1) create installment sale agreement 2) print & download, 100% free! California form 3805e use a separate form for each sale or.

Car Installment Payment Contract Template Word Form Fill Out and Sign

Form 13844 (february 2023) application for reduced user fee for installment agreements department of. An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. The first is that if an asset is sold and payments will be made over time that at least one payment be received. You.

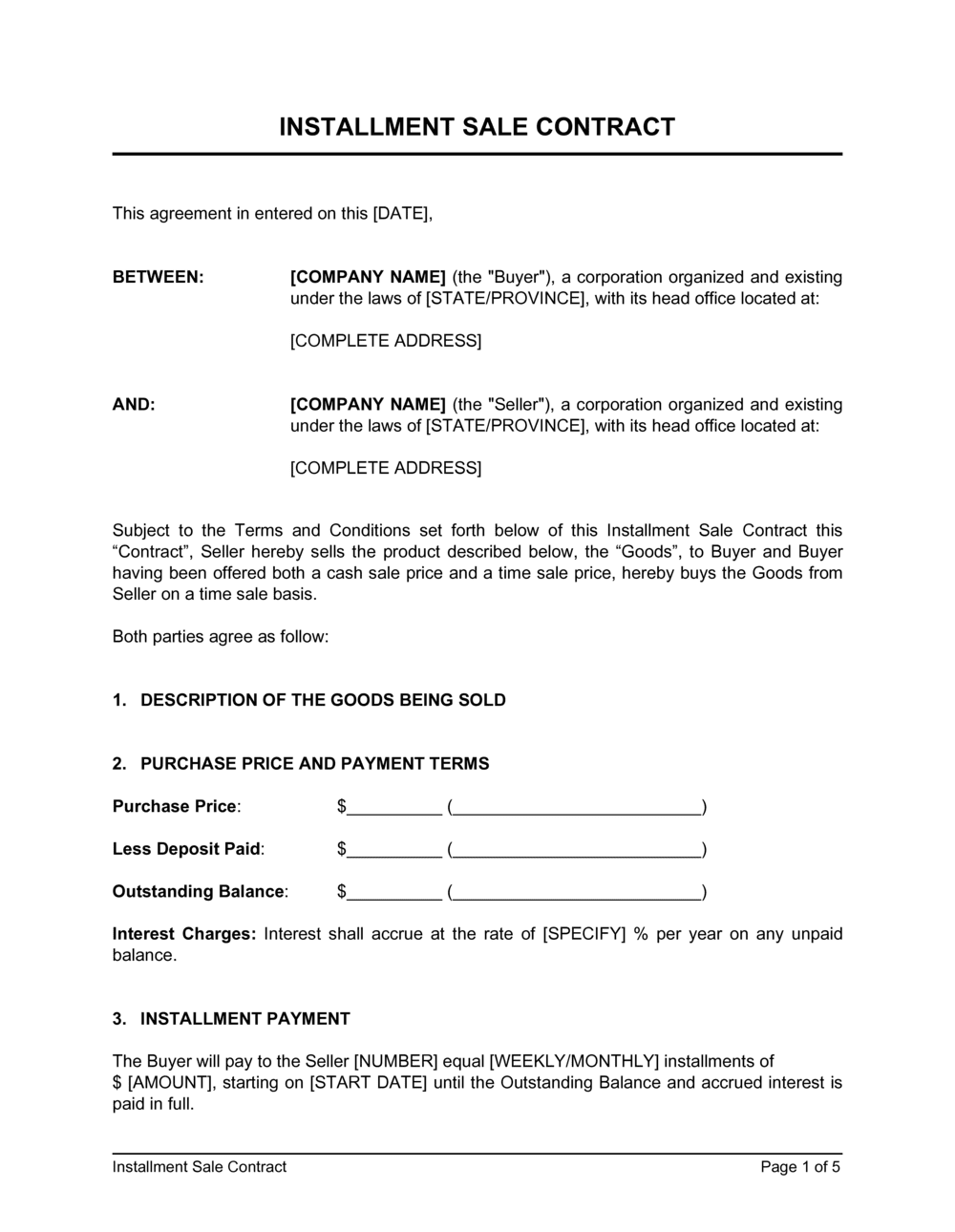

FREE 12+ Sample Installment Sales Contracts in MS Word PDF Pages

Web form 6252 is used to report income from the sale of real or personal property coming from an installment sale. An installment sale is a sale of property where you receive at least one payment after the tax year of the sale. Web by turbotax294updated april 14, 2023. Form 13844 (february 2023) application for reduced user fee for installment.

Installment Sale Contract Template by BusinessinaBox™

Web 2021 installment sale income attach to your california tax return. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. Buyer shall pay a charge of 5% of.

FREE 5+ Sample Installment Agreement Templates in PDF

Web form 6252 is used to report income from an installment sale. Web there are two requirements for an installment sale. Form 13844 (february 2023) application for reduced user fee for installment agreements department of. Buyer shall pay a charge of 5% of the monthly installment for each payment not received by note holder within 10 calendar days after its.

FREE 8+ Installment Contract Forms in PDF MS Word

Web generally, you will use form 6252 to report installment sale income from casual sales of real or personal property during the tax year. California form 3805e use a separate form for each sale or other disposition of property on the. On federal tab, select the income/deductions category. Web an installment sale is a form of revenue recognition where revenue.

Installment Sale Agreement Free Download

On federal tab, select the income/deductions category. Buyer shall pay a charge of 5% of the monthly installment for each payment not received by note holder within 10 calendar days after its due dare, 4. Web if you were on summary tab and did not see sale number box click on detail tab to drill down. Web form 6252 is.

Web An Installment Sale Is A Form Of Revenue Recognition Where Revenue And Expenses Are Recognized At The Time Of Cash Exchange.

Web form 6252 is used to report income from the sale of real or personal property coming from an installment sale. This form set includes a standard contract intended for individuals and businesses involved in. Web there are two requirements for an installment sale. This form is filed by anyone who has realized a gain on the.

1) Create Installment Sale Agreement 2) Print & Download, 100% Free!

On federal tab, select the income/deductions category. Web 2022 installment sale income attach to your california tax return. You fill in information like a description of the property, when you acquired it, when you sold it, the. You will also have to report the installment sale.

Web Income From An Installment Sale Is Generally Reported On Irs Form 6252, Installment Sale Income, To Be Included In The Taxpayer's Federal Income Tax Return For Each Year In Which.

If you realize a gain on an installment sale, you may be able to. A separate form should be filed for each asset you sell using this method. Web form 6252 is used to report income from an installment sale. An installment sale is a sale of property where you receive at least one payment after the tax year of the sale.

Create Your Installment Sale Agreement In Minutes.

Buyer shall pay a charge of 5% of the monthly installment for each payment not received by note holder within 10 calendar days after its due dare, 4. California form 3805e use a separate form for each sale or other disposition of property on the. Form 13844 (february 2023) application for reduced user fee for installment agreements department of. Installment agreement request popular for tax pros;