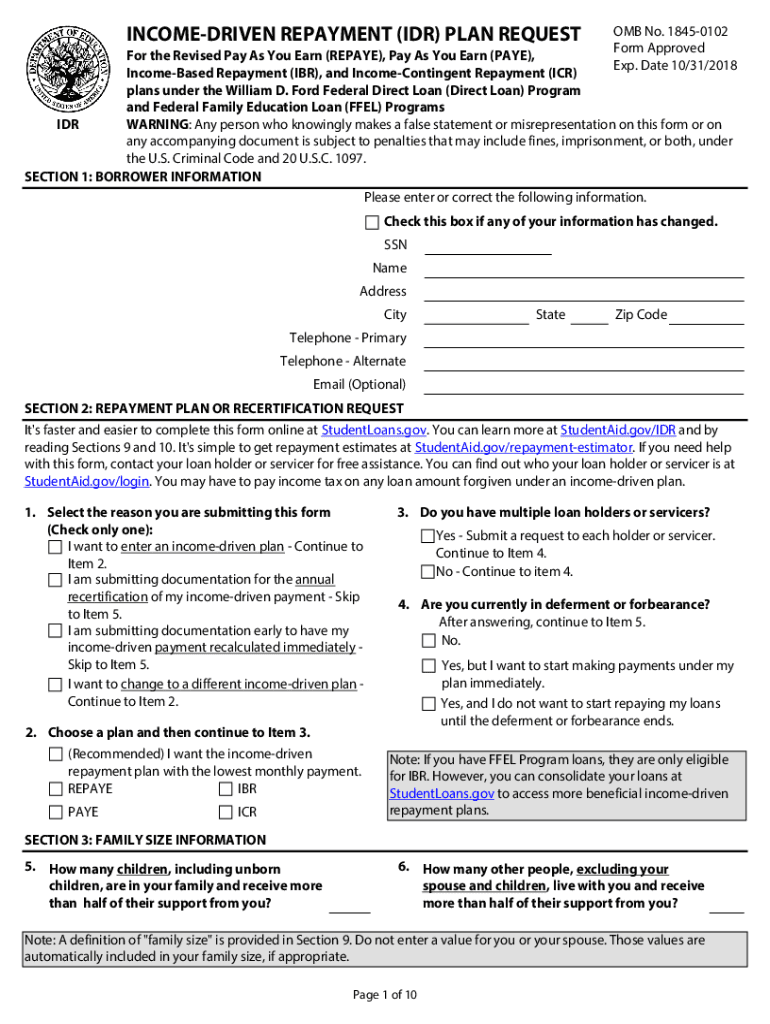

Income Driven Repayment Plan Form

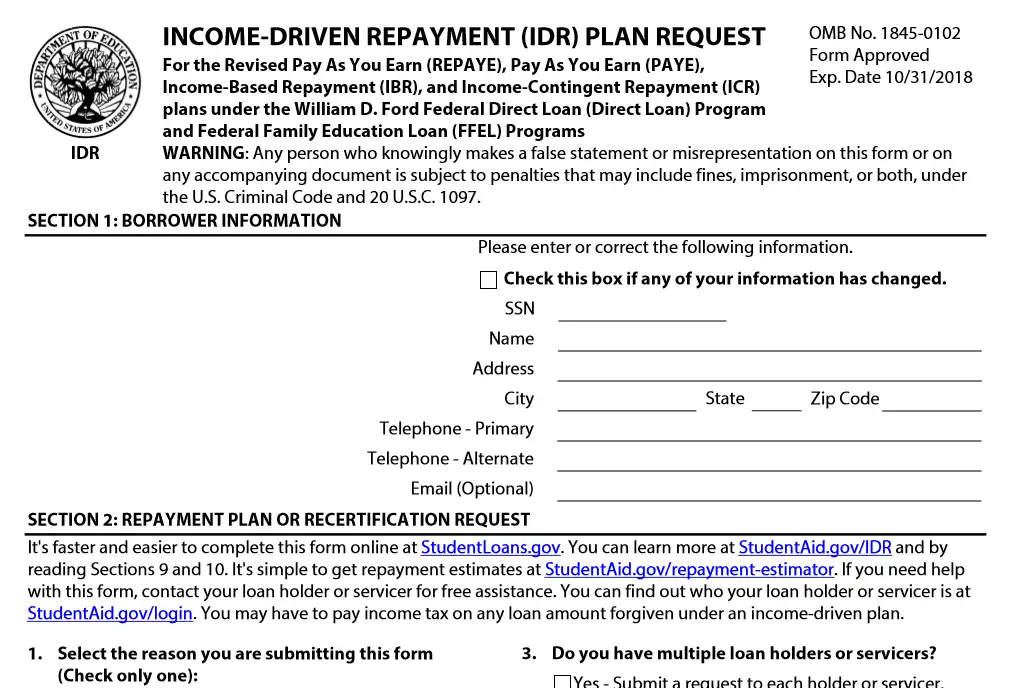

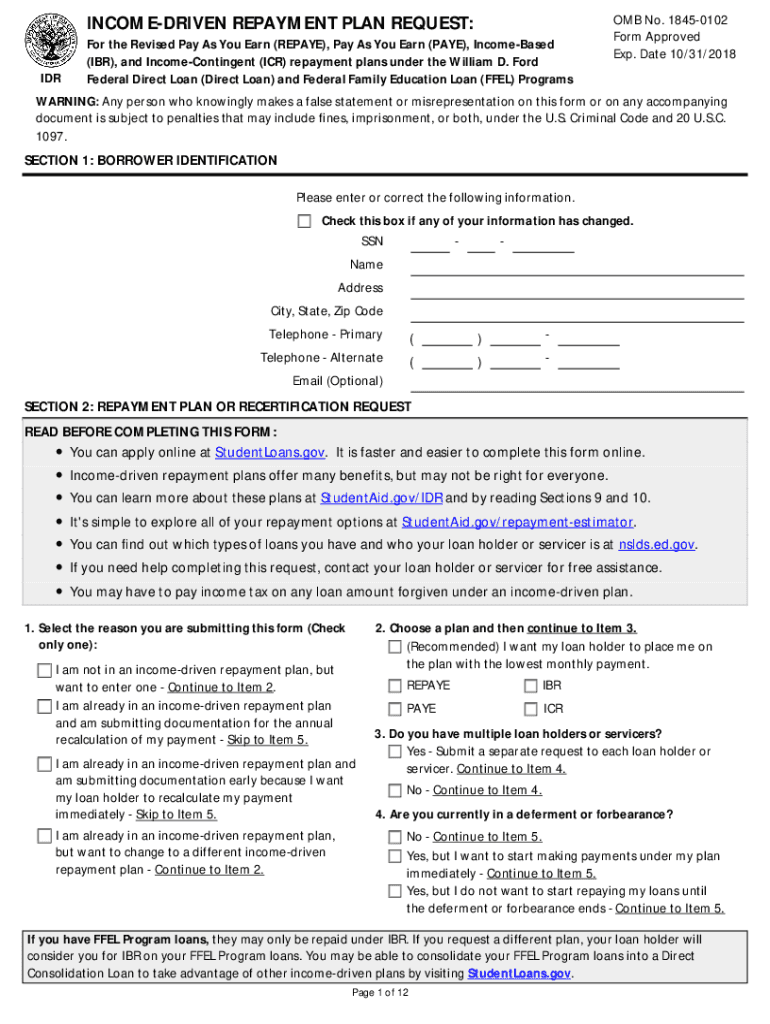

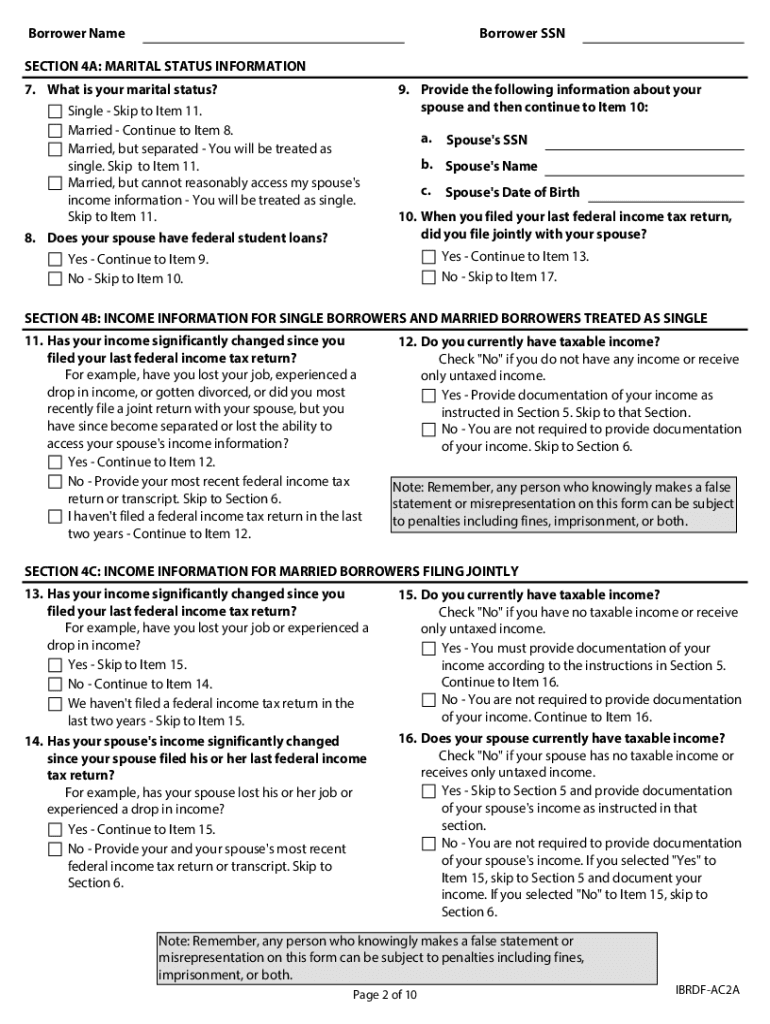

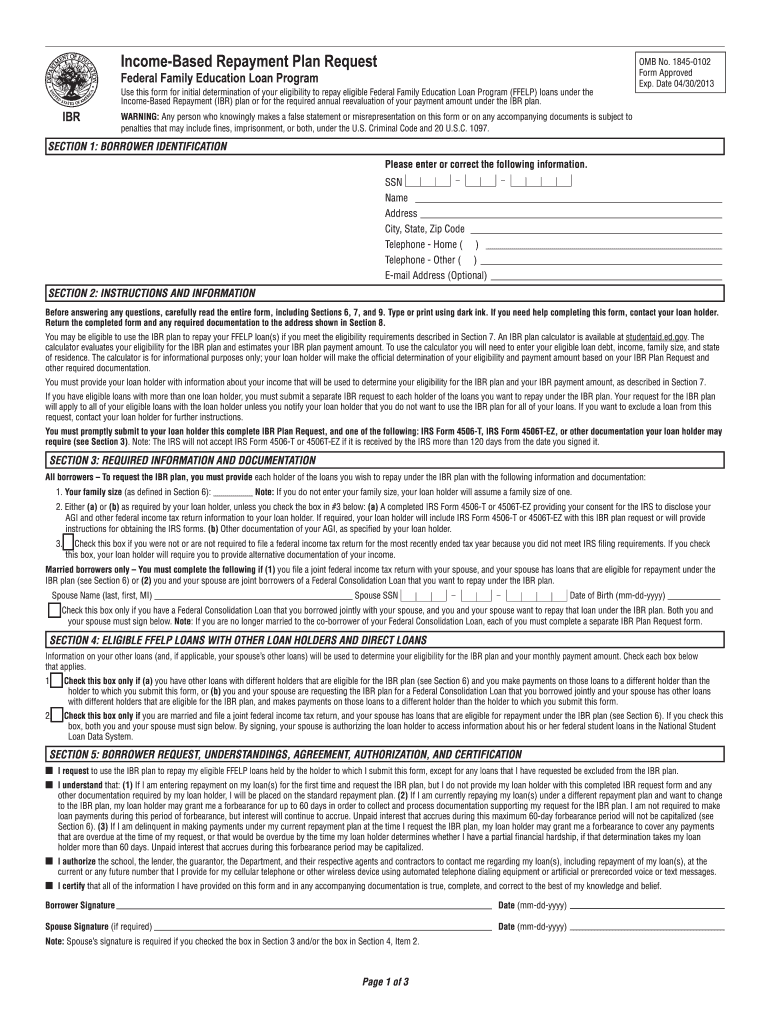

Income Driven Repayment Plan Form - Web 2 days agopay as you earn repayment plan (paye plan): If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Web 1 day agoyou can apply for save directly on the education department website. Web this is just the tip of the iceberg. You still have more time left until the end of your repayment period. Web your loans must be federal direct loans. Web depending on the status of your loan repayment, this change will result in one of the following for eligible borrowers: An idr plan bases your monthly payment on your income and family size. You can make smaller monthly payments by extending the. The forms are for use by borrowers who are seeking the revised pay as you earn (repaye), pay as you earn.

More than 4.4 million borrowers have been repaying their loans for at least 20 years, and 2.3 million of these borrowers have never defaulted or been. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Web depending on the status of your loan repayment, this change will result in one of the following for eligible borrowers: There are four idr plans available, all of which come with different features based on your needs. Use this income driven repayment plan request form template online to allow students to manage their load debt. The revised versions have an expiration date of august 31, 2021. Place the template on your website to allow them to fill it out anywhere. Find your repayment plan options. Every student succeeds act (essa) ferpa. Plans under the william d.

You can make smaller monthly payments by extending the. The amount is recalculated each year to take into account any. Find your repayment plan options. The revised versions have an expiration date of august 31, 2021. You will be closer to the end of your repayment period and closer to forgiveness. Web your loans must be federal direct loans. The forms are for use by borrowers who are seeking the revised pay as you earn (repaye), pay as you earn. Plans under the william d. There are four idr plans available, all of which come with different features based on your needs. You still have more time left until the end of your repayment period.

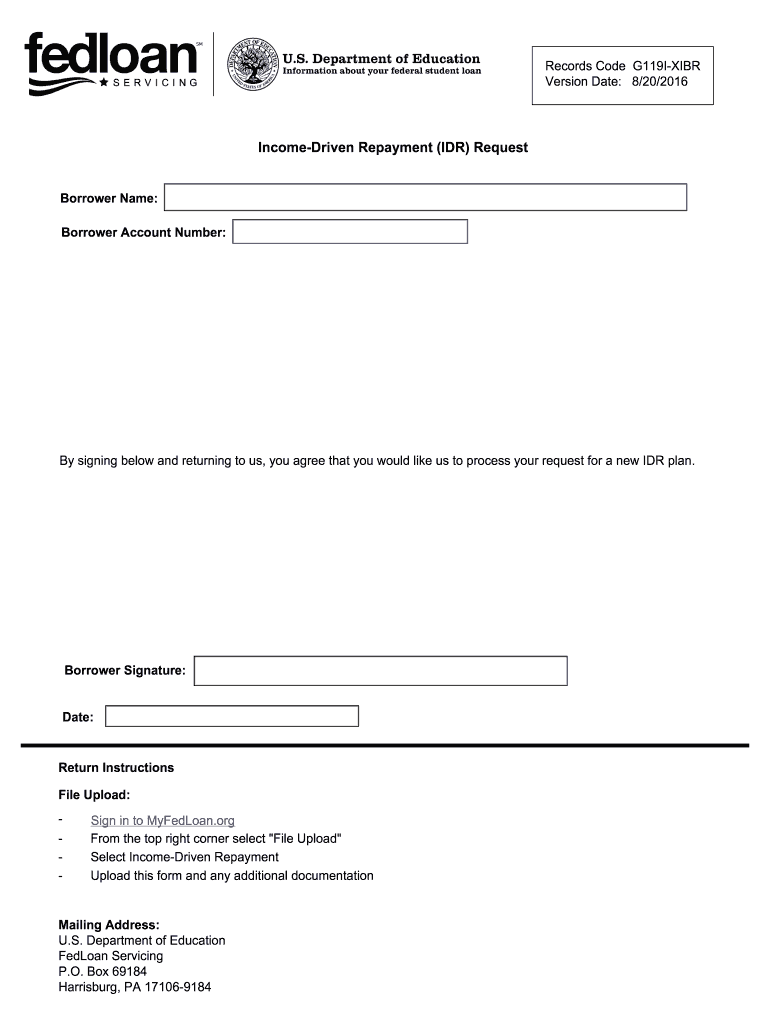

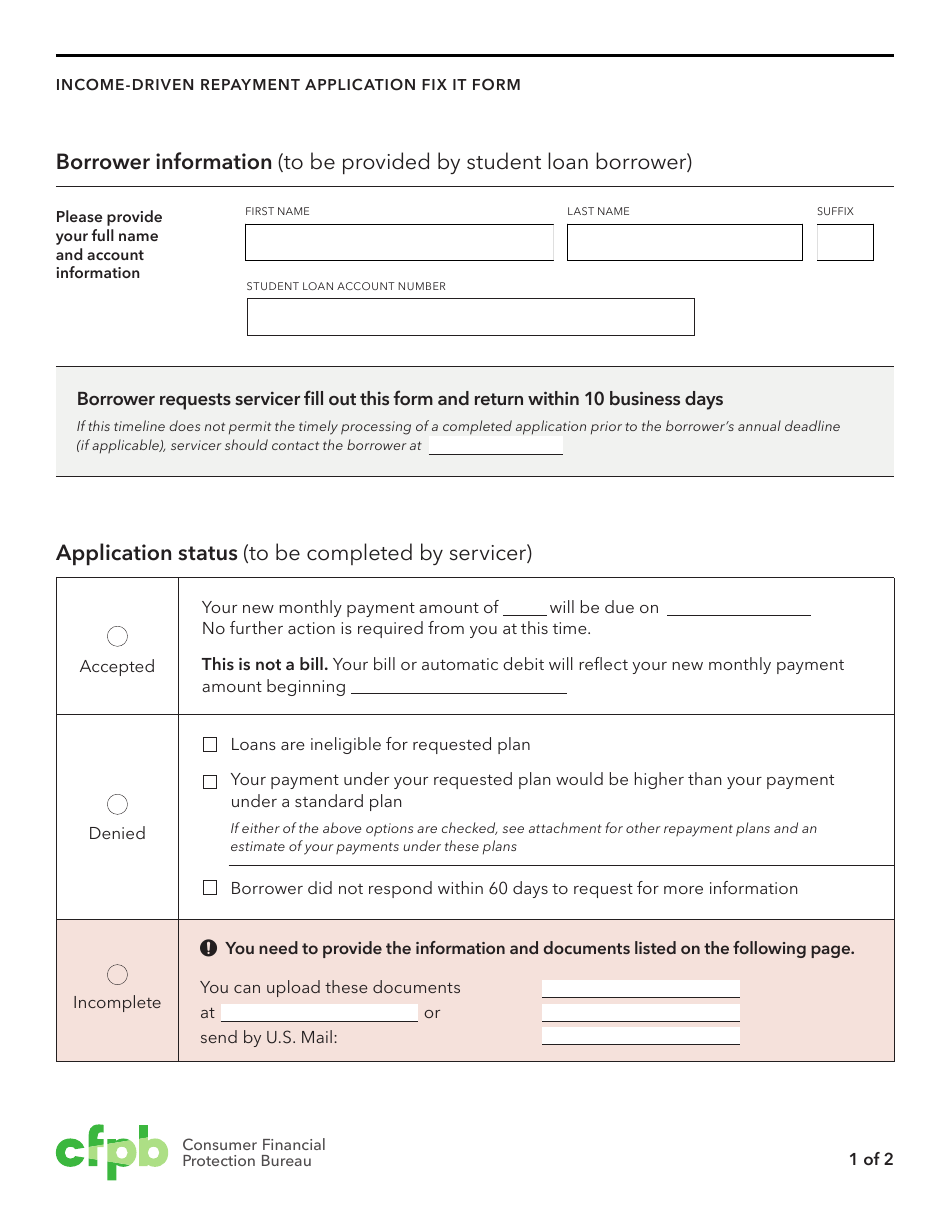

Fillable Online myfedloan Repayment Plan Request

Web 1 day agoapplication for new repayment plan out. You still have more time left until the end of your repayment period. Web an estimated 43.5 million americans owe money in student loan form. Ford federal direct loan (direct loan) program 8/31/2021 These plans can make payments more manageable, help you make progress on your loan, and provide flexibility as.

Which Repayment Plan is Right for You? Student loan

The revised versions have an expiration date of august 31, 2021. The amount is recalculated each year to take into account any. Web depending on the status of your loan repayment, this change will result in one of the following for eligible borrowers: Use this income driven repayment plan request form template online to allow students to manage their load.

How To Apply For Based Student Loan Repayment

The revised versions have an expiration date of august 31, 2021. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Web this is just the tip of the iceberg. Use this income driven repayment plan request form template online to allow students to manage their load debt. Plans under the william.

Repayment Plan Form Fill Online, Printable, Fillable, Blank pdfFiller

There are four idr plans available, all of which come with different features based on your needs. Learn more information from ed. Every student succeeds act (essa) ferpa. Web depending on the status of your loan repayment, this change will result in one of the following for eligible borrowers: The forms are for use by borrowers who are seeking the.

Driven Repayment Plan Form What is a Financial Plan

The forms are for use by borrowers who are seeking the revised pay as you earn (repaye), pay as you earn. Ford federal direct loan (direct loan) program 8/31/2021 Learn more information from ed. Web 1 day agoapplication for new repayment plan out. An idr plan bases your monthly payment on your income and family size.

Driven Repayment Plan Form Pdf PASIVINCO

These plans can make payments more manageable, help you make progress on your loan, and provide flexibility as your income changes. You will be closer to the end of your repayment period and closer to forgiveness. There are four idr plans available, all of which come with different features based on your needs. Plus, payments you make on an idr.

Idr Driven Repayment Plan Fill Out and Sign Printable PDF

Ford federal direct loan (direct loan) program 8/31/2021 Web on april 19, 2022, the u.s. Plans under the william d. Web this is just the tip of the iceberg. The amount is recalculated each year to take into account any.

Fill Free fillable Tcm51871

Web 1 day agoapplication for new repayment plan out. Web 2 days agopay as you earn repayment plan (paye plan): You can make smaller monthly payments by extending the. Web 1 day agoyou can apply for save directly on the education department website. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if.

Repayment Application Fix It Form Download Printable PDF

And the average monthly payment among borrowers is $337. Place the template on your website to allow them to fill it out anywhere. Web 1 day agoyou can apply for save directly on the education department website. Web this is just the tip of the iceberg. Web an estimated 43.5 million americans owe money in student loan form.

Mohela Form Fill Online, Printable, Fillable, Blank pdfFiller

These plans can make payments more manageable, help you make progress on your loan, and provide flexibility as your income changes. Web how do i find.? Web on april 19, 2022, the u.s. These are repayment options that tie monthly payments to borrowers’ discretionary incomes, as calculated by the federal government. Every student succeeds act (essa) ferpa.

Web 1 Day Agoapplication For New Repayment Plan Out.

If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. You can make smaller monthly payments by extending the. Web how do i find.? The forms are for use by borrowers who are seeking the revised pay as you earn (repaye), pay as you earn.

Web Your Loans Must Be Federal Direct Loans.

And the average monthly payment among borrowers is $337. Use this income driven repayment plan request form template online to allow students to manage their load debt. Ford federal direct loan (direct loan) program 8/31/2021 There are four idr plans available, all of which come with different features based on your needs.

These Plans Can Make Payments More Manageable, Help You Make Progress On Your Loan, And Provide Flexibility As Your Income Changes.

Every student succeeds act (essa) ferpa. The amount is recalculated each year to take into account any. An idr plan bases your monthly payment on your income and family size. The revised versions have an expiration date of august 31, 2021.

Place The Template On Your Website To Allow Them To Fill It Out Anywhere.

More than 4.4 million borrowers have been repaying their loans for at least 20 years, and 2.3 million of these borrowers have never defaulted or been. Web on april 19, 2022, the u.s. Web depending on the status of your loan repayment, this change will result in one of the following for eligible borrowers: Web this is just the tip of the iceberg.