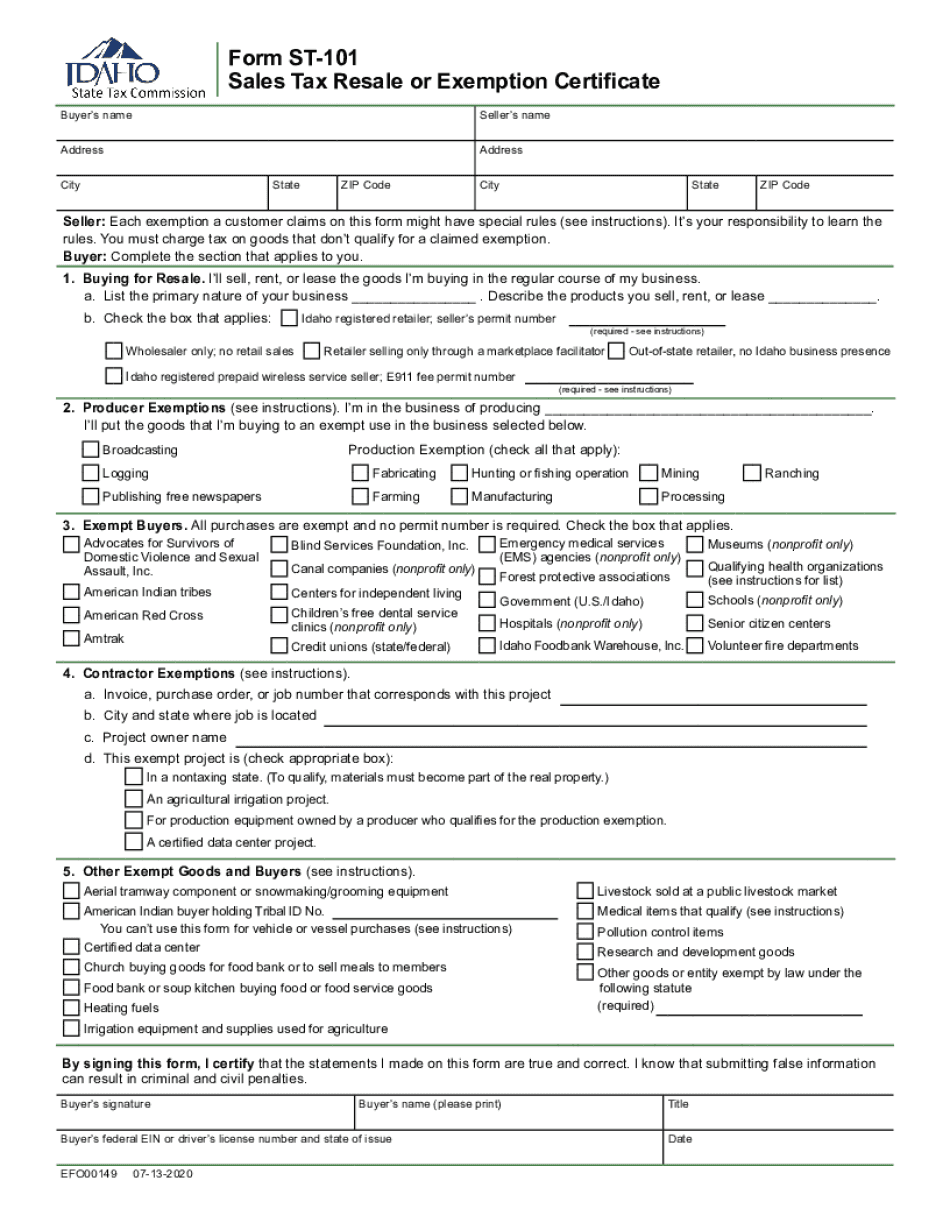

Idaho Sales Tax Exemption Form

Idaho Sales Tax Exemption Form - Other exempt goods and buyers (see instructions). When the purchased goods are resold, sales tax should be collected. Sales tax resale or exemption certificate. Web do not qualify for exemption. Web idaho sales tax exemption form st 133. The exemption doesn’t include licensed motor vehicles or trailers. This exemption applies only to materials that will become part of real property and only if the contractor isn’t subject to a use tax or a similar tax in the other state. In the state of idaho, exclusion. Do i have to pay sales tax on a car i inherited? Idaho local government agency or other qualified organization* * (see the back of this form for qualified organizations.) name of agency or qualified organization:

Web to grow, store, prepare, or serve food exempt from sales tax. Web each exemption a customer may claim on this form has special rules (see instructions). Idaho local government agency or other qualified organization* * (see the back of this form for qualified organizations.) name of agency or qualified organization: Individual income tax forms (current) individual income tax forms (archive) property tax forms. Web in a nontaxing state are exempt from idaho sales tax. Sales tax resale and exemption certificate. While idaho's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. Heating fuels such as wood, coal, petroleum, propane, and natural gas are exempt when purchased to heat an enclosed building or Complete the section that applies to you. This exemption applies only to materials that will become part of real property and only if the contractor isn’t subject to a use tax or a similar tax in the other state.

Each exemption a customer may claim on this form has special rules (see instructions). Idaho exempt buyers can use this form to purchase goods free from sales tax. Online document management has become popular with companies and individuals. Canoes, kayaks, truck campers, and inflatable boats sold without motors don't qualify for this exemption. You must charge tax to any customers and on any goods that don't qualify for a claimed exemption and are taxable by law. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web each exemption a customer may claim on this form has special rules (see instructions). The seller must keep a copy of the completed form on file. Web cigarette taxes forms. Fuels taxes and fees forms.

Idaho Sales Tax Exemption Form Fill Out and Sign Printable PDF

Web to grow, store, prepare, or serve food exempt from sales tax. Web do not qualify for exemption. Sales and use tax forms. Only the family relationships, listed below line 3 in this section, qualify. When the purchased goods are resold, sales tax should be collected.

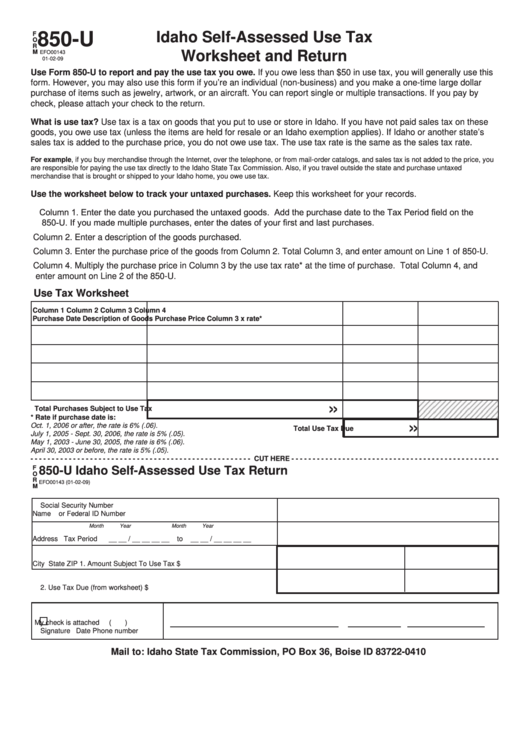

Fillable Form 850U Idaho SelfAssessed Use Tax Worksheet And Return

Web may qualify for an exemption from idaho sales tax. Other exempt goods and buyers (see instructions). Complete the section that applies to you. In the state of idaho, exclusion. Web we have one idaho sales tax exemption forms available for you to print or save as a pdf file.

Idaho Sales Tax Exemption Form St 133 20202021 Fill and Sign

If any of these links are broken, or you can't find the form you need, please let us know. Web each exemption a customer may claim on this form has special rules (see instructions). Idaho exempt buyers can use this form to purchase goods free from sales tax. Please report and pay use tax using your existing account. You must.

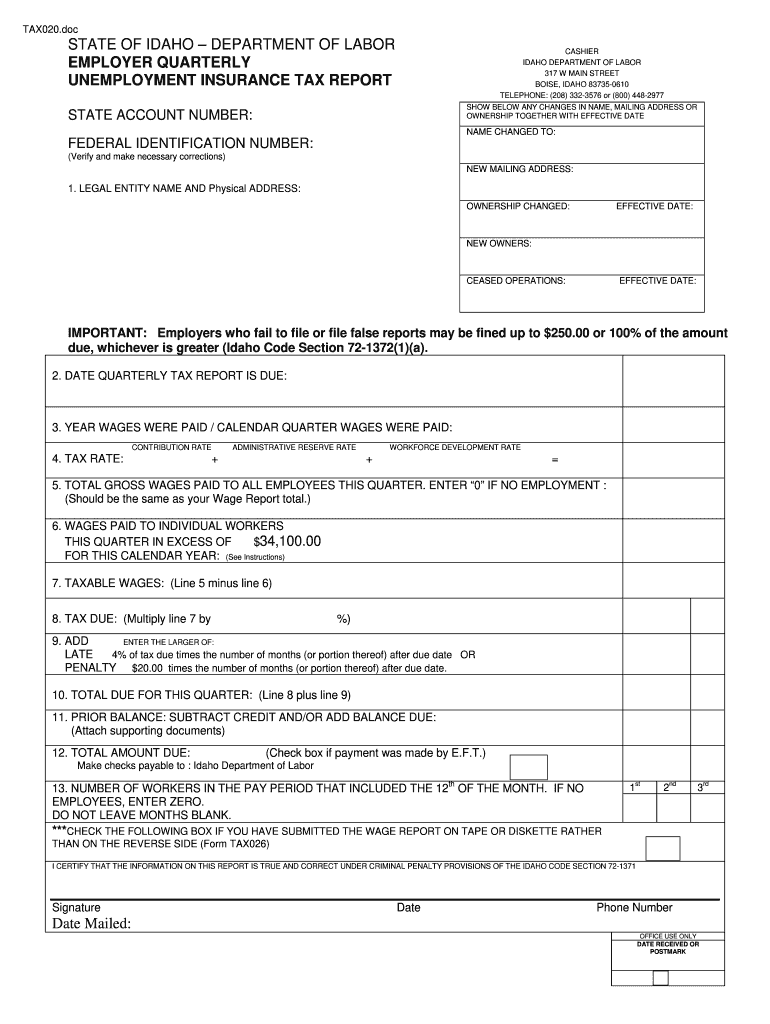

Idaho Quarterly Form the Form in Seconds Fill Out and Sign Printable

This form is valid only if all information has been completed. Web don’t use this form if you already have a sales and use tax account. You must charge tax to any customers and on any goods that don't qualify for a claimed exemption and are taxable by law. Web yard sales (or garage sales) are a popular way to.

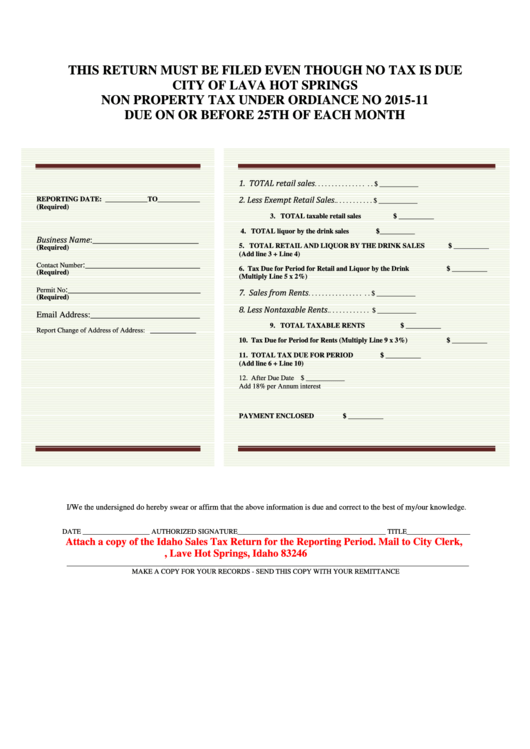

Idaho Sales Tax Return Form printable pdf download

You must charge tax to customers on goods that don’t qualify for a claimed exemption and are taxable by law. Web each exemption a customer may claim on this form has special rules (see instructions). Web sales tax resale or exemption certificate general. For payments of $100,000 or more contact the tax. The seller is responsible for collecting sales tax.

Sales Tax StateImpact Idaho

Don’t staple your check to your return or send a check stub. Get everything done in minutes. The seller must keep a copy of the completed form on file. You must charge tax to any customers and on any goods that don't qualify for a claimed exemption and are taxable by law. Fuels taxes and fees forms.

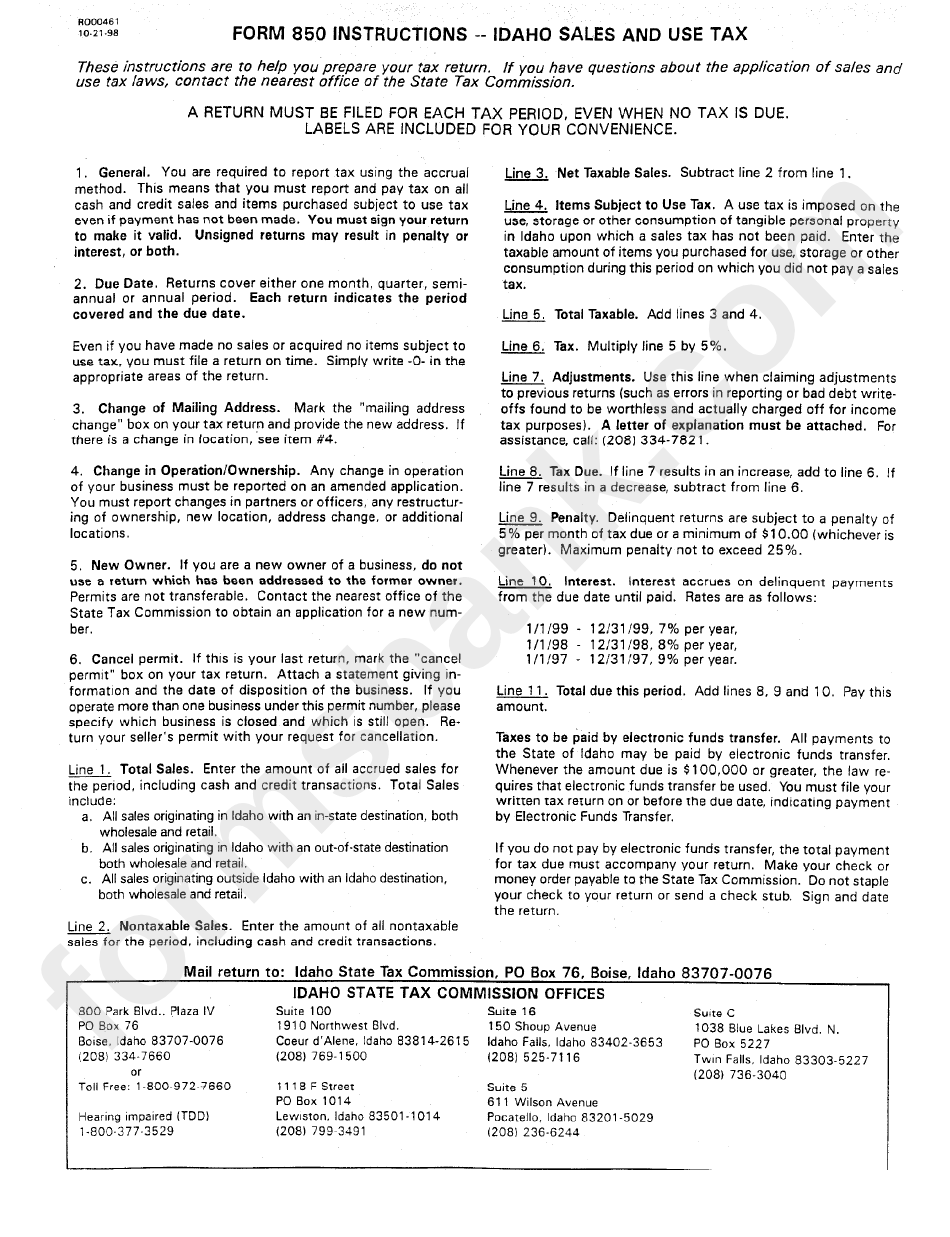

Form 850 Instructions Idaho Sales And Use Tax printable pdf download

Web cigarette taxes forms. Several examples of exemptions are prescription drugs, some groceries, truck campers, office trailers, and transport trailers. Other exempt goods and buyers (see instructions). You must charge tax to customers on goods that don’t qualify for a claimed exemption and are taxable by law. Each exemption a customer may claim on this form has special rules (see.

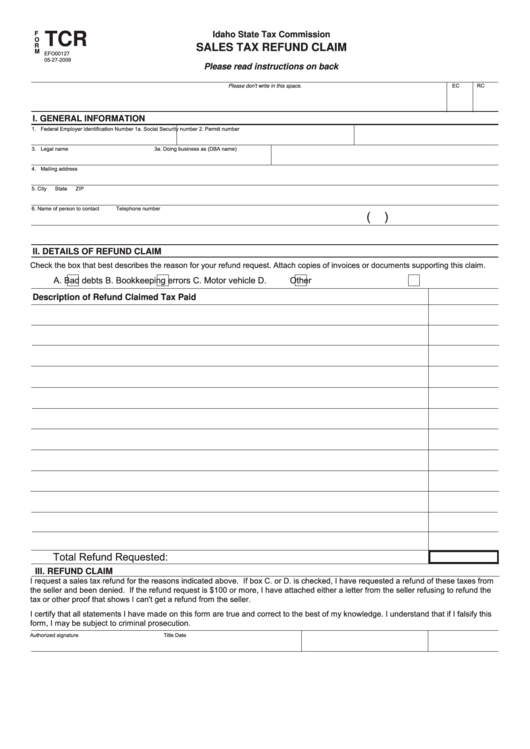

Form Tcr Idaho Sales Tax Refund Claim printable pdf download

Other exempt goods and buyers (see instructions). Web do not qualify for exemption. Online document management has become popular with companies and individuals. Complete the section that applies to you. Idaho local government agency or other qualified organization* * (see the back of this form for qualified organizations.) name of agency or qualified organization:

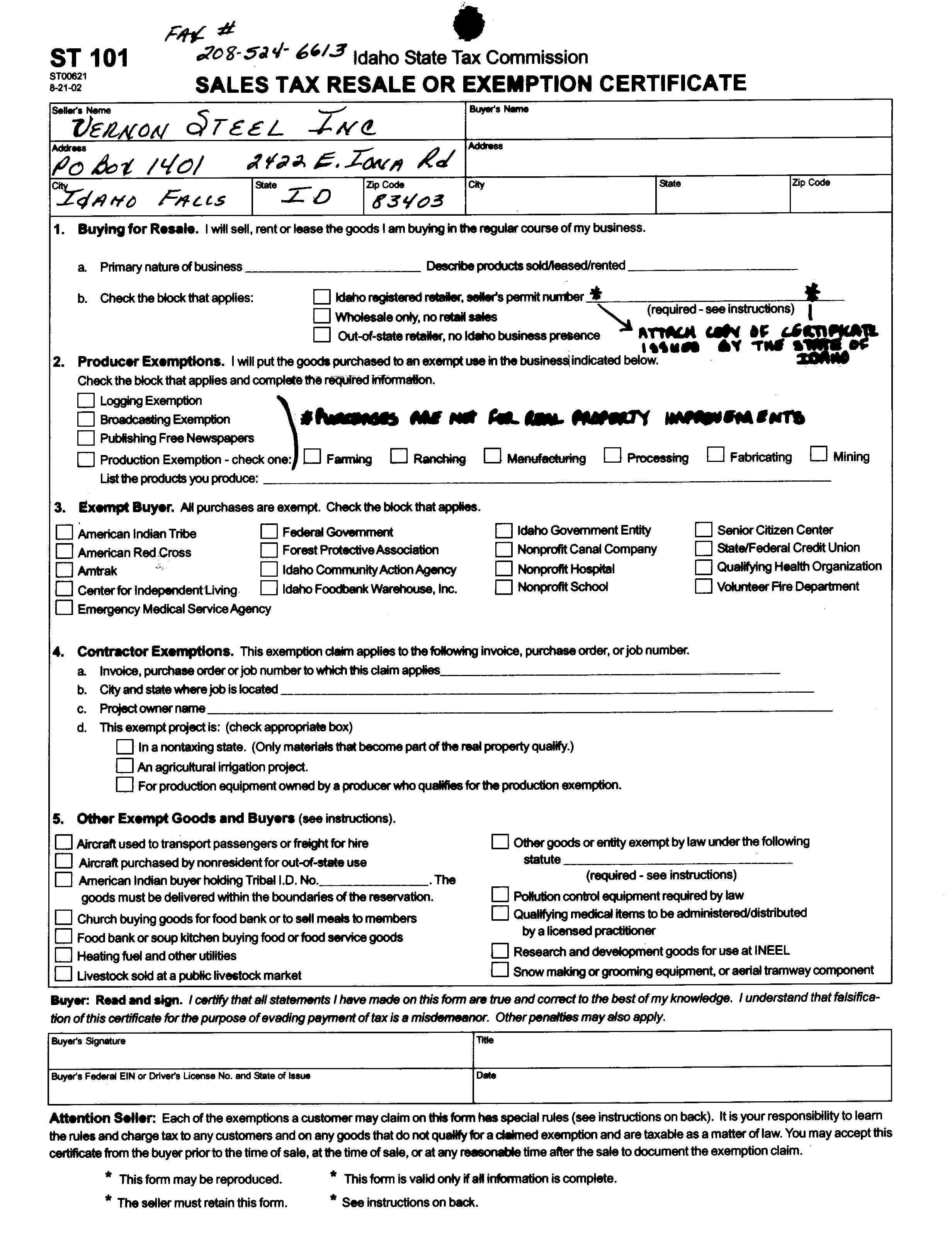

Vernon Steel

The seller must keep a copy of the completed form on file. Web do not qualify for exemption. Don’t staple your check to your return or send a check stub. It’s your responsibility to learn the rules. Complete the section that applies to you.

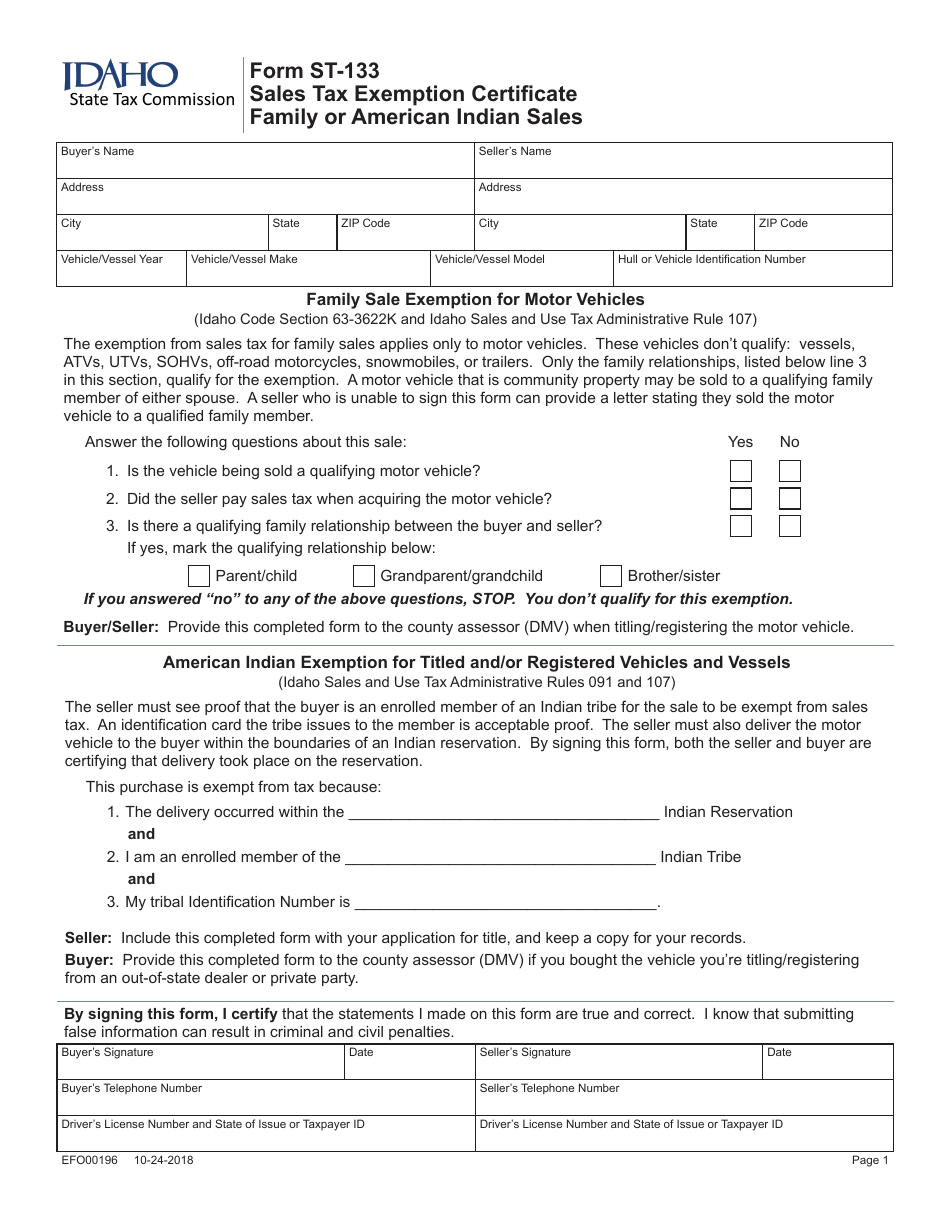

Form ST133 (EFO00196) Download Fillable PDF or Fill Online Sales Tax

It's your responsibility to learn the rules. Sales and use tax return instructions 2022. Online document management has become popular with companies and individuals. Idaho residents may not claim this exemption. Jobs in alaska, oregon, and montana qualify, as do some jobs in washington.

The Seller Is Responsible For Collecting Sales Tax If The Form Isn’t Completed.

It's your responsibility to learn the rules. It's your responsibility to learn the rules. Do i have to pay sales tax on a car i inherited? The exemption doesn’t include licensed motor vehicles or trailers.

Please Report And Pay Use Tax Using Your Existing Account.

Web a buyer can claim an exemption from idaho sales tax on the lease or purchase of a motor vehicle, trailer, or glider kit that will be used to assemble a glider kit vehicle, used in interstate commerce when the following requirements are met and Web do not qualify for exemption. Sales and use tax return instructions 2022. Web sales tax resale or exemption certificate general.

Idaho Residents May Not Claim This Exemption.

Canoes, kayaks, truck campers, and inflatable boats sold without motors don't qualify for this exemption. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web sales tax exemptions in idaho. When the purchased goods are resold, sales tax should be collected.

You Can Find Resale Certificates For Other States Here.

Jobs in alaska, oregon, and montana qualify, as do some jobs in washington. Web to grow, store, prepare, or serve food exempt from sales tax. Web we have one idaho sales tax exemption forms available for you to print or save as a pdf file. For payments of $100,000 or more contact the tax.