Idaho Form 42

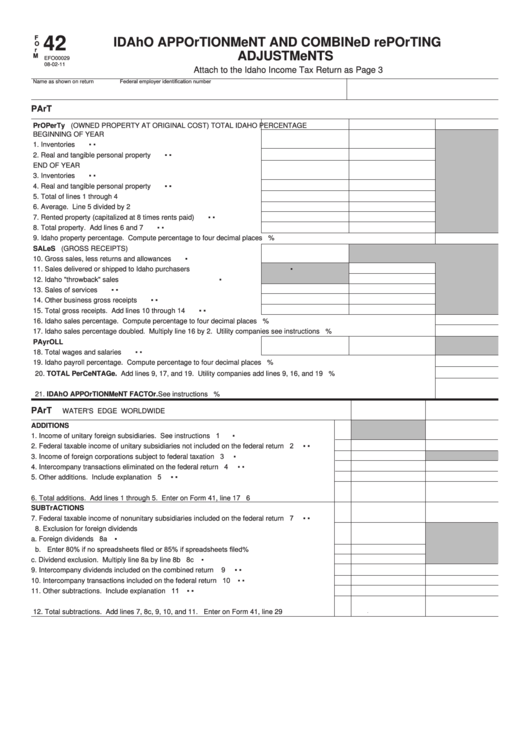

Idaho Form 42 - Line 10 on form 42a is for everywhere. If the taxpayer is a partner in. Enter all state income tax refunds included on federal schedule 1, line 1. Factor from form 42, part i, line 21. Affidavit of service with orders rtf pdf. Contempt this rule governs all contempt proceedings brought in connection with a criminal proceeding. Web form 42—idaho supplemental schedule for multistate and multinational businesses form 44—idaho business income tax credits and credit recapture form 49—idaho. Web instructions for form no. Complete the claim form please complete all applicable items on the claim form. Web idaho apportionment factor and is used by taxpayers who have income from business activity that’s taxable in idaho and another state or country.

Complete the claim form please complete all applicable items on the claim form. File this statement with the idaho state tax. If the taxpayer is a partner in. If not, enter the idaho apportionment. Certificate of service rtf pdf. Idaho form 42 “idaho apportionment and combined reporting adjustments” 12 h0355, section 2. Factor from form 42, part i, line 21. Acknowledgment of service by defendant rtf pdf. In re the general adjudication of rights to the. Web form 42 is used to show the total for the unitary group.

Web of this form provides the computation of the idaho apportionment factor and is used by taxpayers who have income from business activity that’s taxable in idaho and another. Web form 42 is used to show the total for the unitary group. Web idaho column on form 42. File this statement with the idaho state tax. If not, enter the idaho apportionment. In re the general adjudication of rights to the. A schedule must be attached detailing the idaho apportionment factor computation for each corporation in the group. Web idaho has a state income tax that ranges between 1.125% and 6.925%. Factor from form 42, part i, line 21. Certificate of service rtf pdf.

USS Idaho BB42 Kit 4253

Factor from form 42, part i, line 21. 7/21 state of idaho department of water resources notice of change in water right ownership list the numbers. Web instructions for form no. Web complete and include form 42; Web form 42 is used to show the total for the unitary group.

Fill Free fillable forms State of Idaho

Web of this form provides the computation of the idaho apportionment factor and is used by taxpayers who have income from business activity that’s taxable in idaho and another. Web complete and include form 42; Affidavit verifying income rtf pdf. Web idaho column on form 42. State of idaho, in and for the county of twin falls.

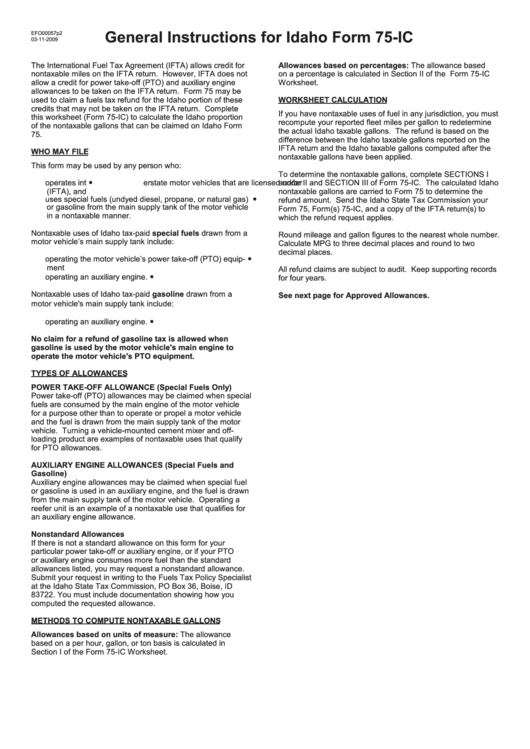

General Instructions For Idaho Form 75Ic printable pdf download

Web file a claim on form no. Enter all state income tax refunds included on federal schedule 1, line 1. If the taxpayer is a partner in. A schedule must be attached detailing the idaho apportionment factor computation for each corporation in the group. Web idaho column on form 42.

1+ Idaho Do Not Resuscitate Form Free Download

Complete the claim form please complete all applicable items on the claim form. Contempt this rule governs all contempt proceedings brought in connection with a criminal proceeding. Affidavit of service with orders rtf pdf. Web form 42—idaho supplemental schedule for multistate and multinational businesses form 44—idaho business income tax credits and credit recapture form 49—idaho. Enter all state income tax.

Fillable Form 42 Idaho Apportionment And Combined Reporting

Affidavit of service with orders rtf pdf. 7/21 state of idaho department of water resources notice of change in water right ownership list the numbers. If not, enter the idaho apportionment. State of idaho, in and for the county of twin falls. Enter the apportionment factor from form 42, part i, line 21.

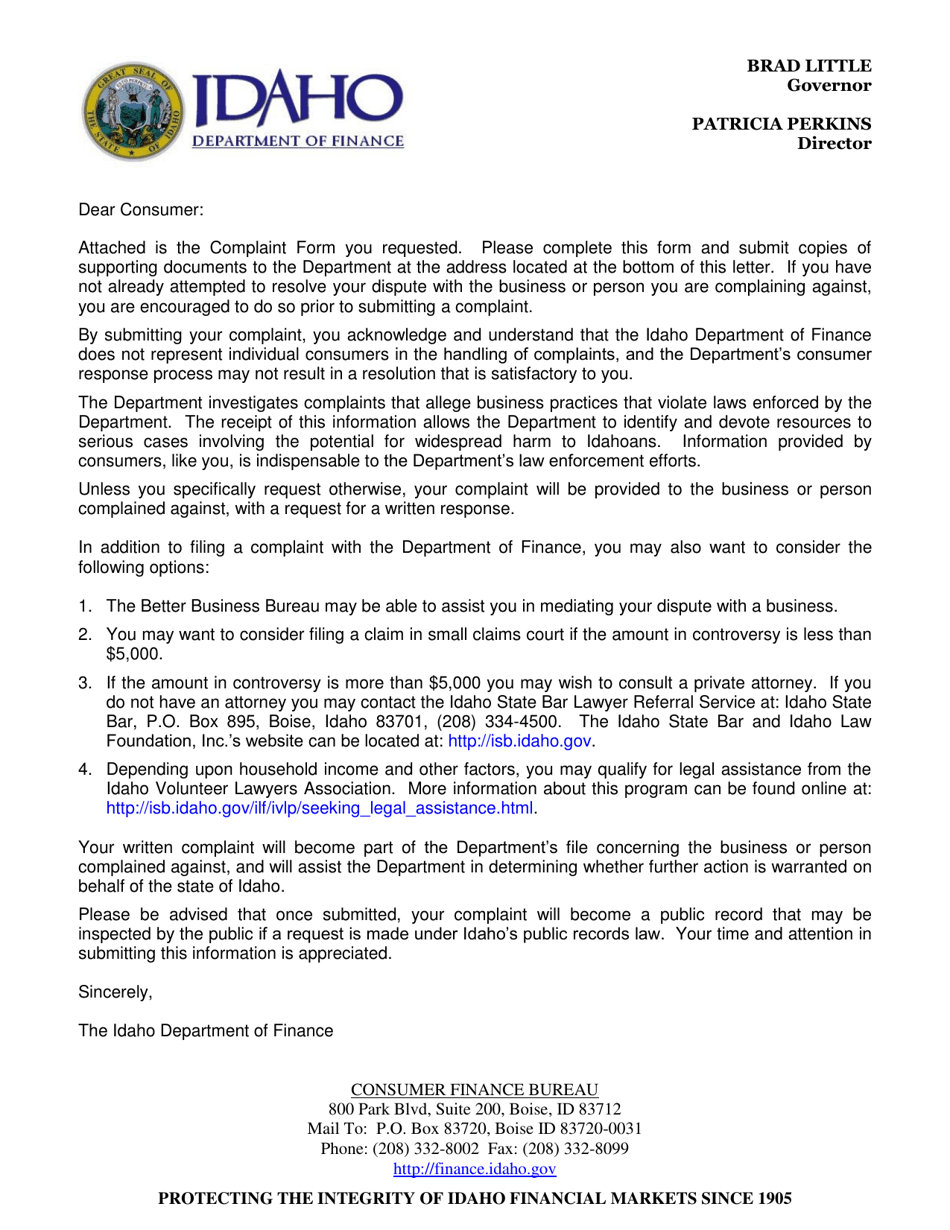

Idaho Complaint Form Download Printable PDF Templateroller

If not, enter the idaho apportionment. Multiply line 32 by the percent. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. 7/21 state of idaho department of water resources notice of change in water right ownership list the numbers. Web idaho apportionment factor and is used.

W9 Idaho Fill Online, Printable, Fillable, Blank pdfFiller

Enter the apportionment factor from form 42, part i, line 21. Web instructions for form no. A claim that is incomplete will not be accepted and. Web idaho column on form 42. Web file a claim on form no.

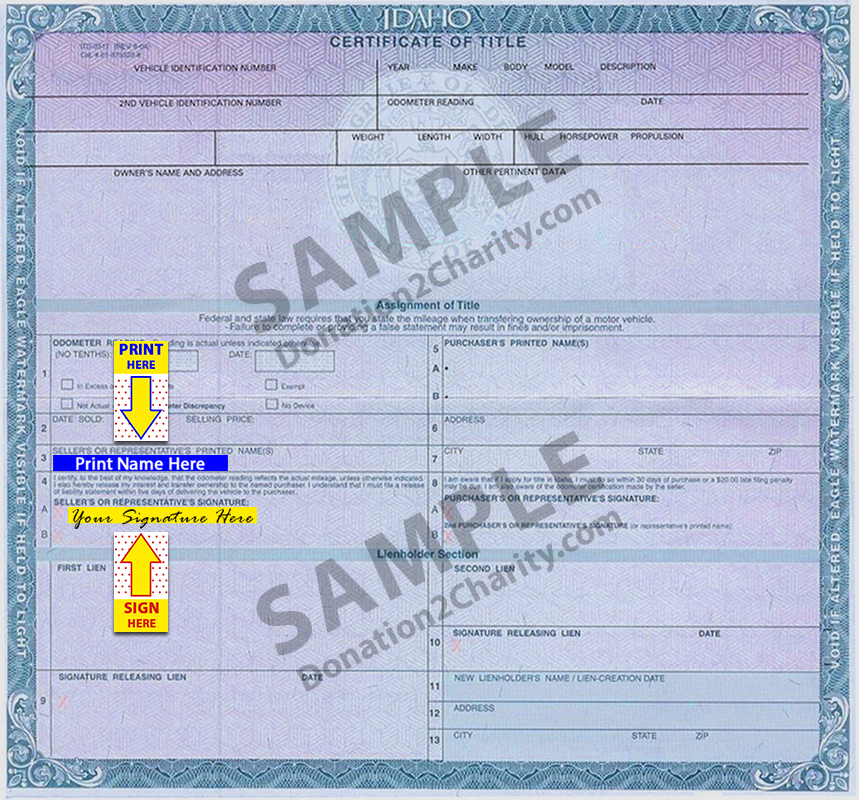

Idaho Donation2Charity

Web of this form provides the computation of the idaho apportionment factor and is used by taxpayers who have income from business activity that’s taxable in idaho and another. Affidavit verifying income rtf pdf. Web complete and include form 42; Net business income apportioned to idaho. Enter all state income tax refunds included on federal schedule 1, line 1.

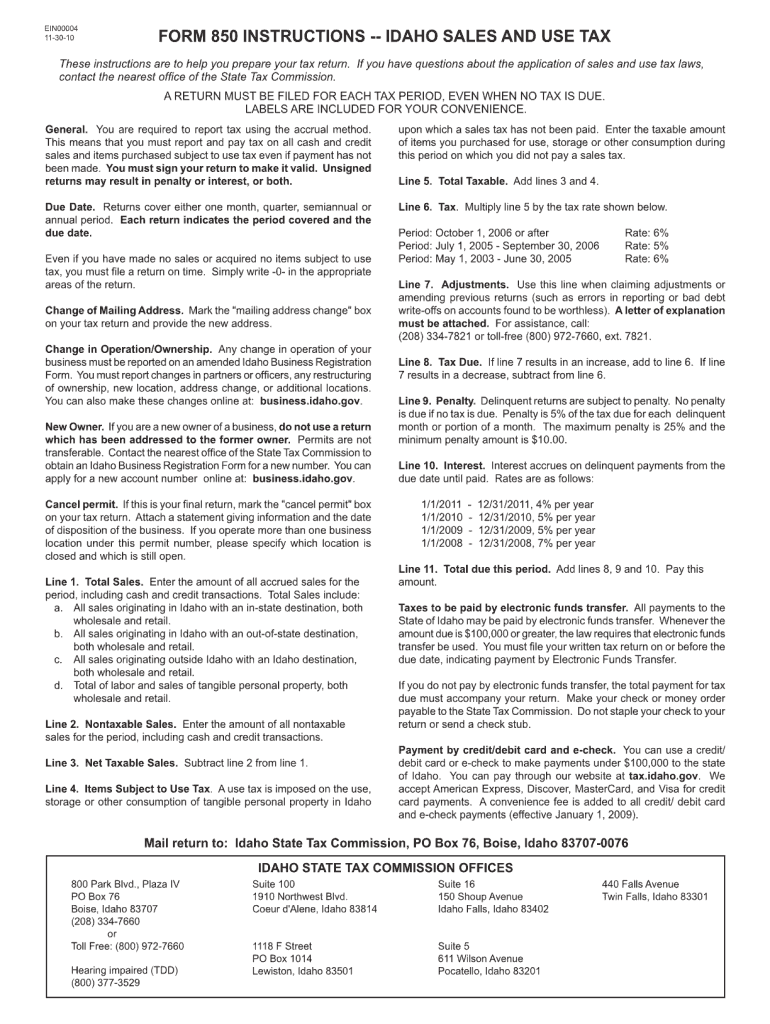

Idaho Form 850 PDF Fill Out and Sign Printable PDF Template signNow

If the taxpayer is a partner in. Web form 42—idaho supplemental schedule for multistate and multinational businesses form 44—idaho business income tax credits and credit recapture form 49—idaho. Web idaho has a state income tax that ranges between 1.125% and 6.925%. File this statement with the idaho state tax. Web idaho criminal rule 42.

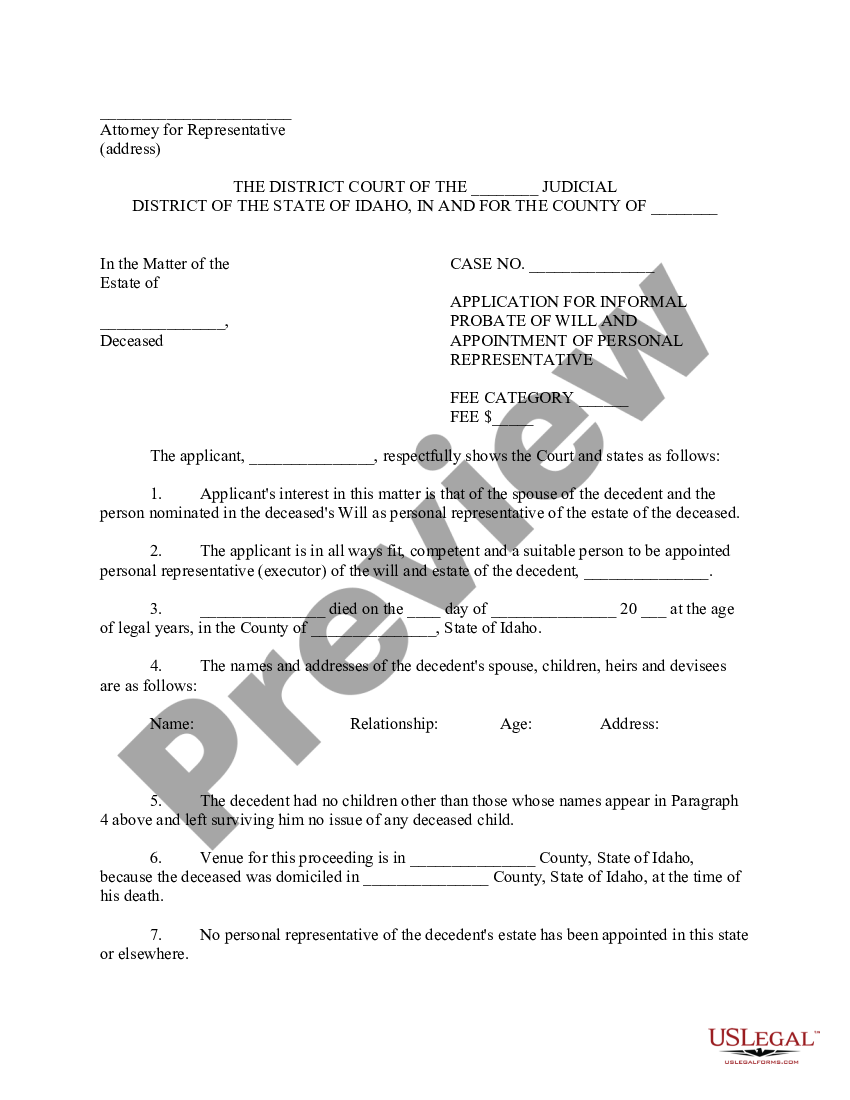

Idaho Application for Informal Probate of Will and Appointment of

Web idaho has a state income tax that ranges between 1.125% and 6.925%. Affidavit verifying income rtf pdf. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. It does not apply to contempt charged under. Contempt this rule governs all contempt proceedings brought in connection with.

Web Complete And Include Form 42;

Web form 42—idaho supplemental schedule for multistate and multinational businesses form 44—idaho business income tax credits and credit recapture form 49—idaho. Complete the claim form please complete all applicable items on the claim form. Web idaho criminal rule 42. Idaho form 42 “idaho apportionment and combined reporting adjustments” 12 h0355, section 2.

Web Idaho Has A State Income Tax That Ranges Between 1.125% And 6.925%.

Certificate of service rtf pdf. A claim that is incomplete will not be accepted and. Multiply line 32 by the percent. A schedule must be attached detailing the idaho apportionment factor computation for each corporation in the group.

Web Instructions For Form No.

It does not apply to contempt charged under. In re the general adjudication of rights to the. 7/21 state of idaho department of water resources notice of change in water right ownership list the numbers. If not, enter the idaho apportionment.

Web File A Claim On Form No.

Web idaho apportionment factor and is used by taxpayers who have income from business activity that’s taxable in idaho and another state or country. Web form 42 is used to show the total for the unitary group. Net business income apportioned to idaho. Enter the apportionment factor from form 42, part i, line 21.