How To Print Form 941 From Quickbooks Online

How To Print Form 941 From Quickbooks Online - On the left panel, choose the taxes menu to select payroll tax. The process to pay and file quickbooks form 941 manually how to print form 941 from. Under forms, click the category of forms you want to view. Only the original signed form should be submitted to the irs. Let me walk you through the process of. Turbotax does not prepare form 941. Web click on the employees menu. Click on the employees from the top menu bar. Move your cursor to the taxes tab. But how do you file.

Hover your screen below and click archived forms and filings under the filing resources. Let me walk you through the process of. Now in your file form section select the. Web employers must file a quarterly form 941 to report wages paid, tips your employees have received, federal income tax withheld, and both the employer's and employee's share of. After quickbooks submits the data, a confirmation. Web click the links to view the instructions. In the forms section, tap the view and print archived forms link under quarterly. Web click on the employees menu. Web to print form 941 or 944. Once the system finished repairing your pdf reader, consider.

Web click the links to view the instructions. The 941 employer's quarterly tax return will show. Do not submit a photocopy. In the navigation bar, click taxes > payroll tax. Go to taxes from the left menu and t select payroll tax. Web click on the employees menu. Web to print form 941 or 944. Click taxes on the left navigation menu and choose payroll tax. Once the system finished repairing your pdf reader, consider. Select either form 941 or 944 in the tax reports section of print reports.

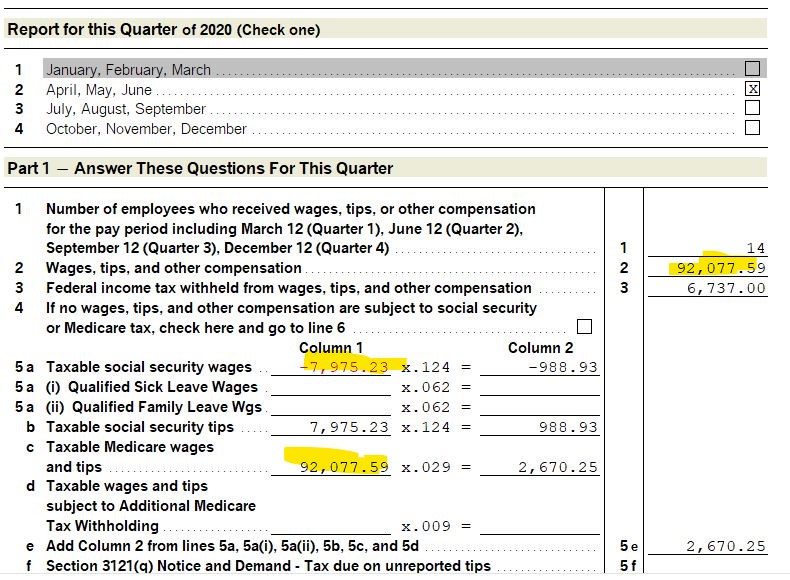

Form 941

Web it must be filed at least quarterly and sometimes more often, depending on the size of your payroll. Under forms, click the category of forms you want to view. Do not submit a photocopy. Once the system finished repairing your pdf reader, consider. Web best answers alexv quickbooks team november 17, 2020 07:40 pm thanks for joining us here,.

How to Print Form 941 ezAccounting Payroll

Web click on the employees menu. Web let me walk you through the steps on how you can view your previously filed quarterly 941 forms from last year. Under forms, click the category of forms you want to view. Web it must be filed at least quarterly and sometimes more often, depending on the size of your payroll. The process.

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

From the forms category page (for example,. The 941 employer's quarterly tax return will show. Under forms, click the category of forms you want to view. Choose quarterly tax forms and 941 as your filter. Click on the employees from the top menu bar.

How to Download or Print Form 941 YouTube

Go to taxes from the left menu and t select payroll tax. Let me walk you through the process of. Web here are the simple steps to follow: Only the original signed form should be submitted to the irs. Click on the employees from the top menu bar.

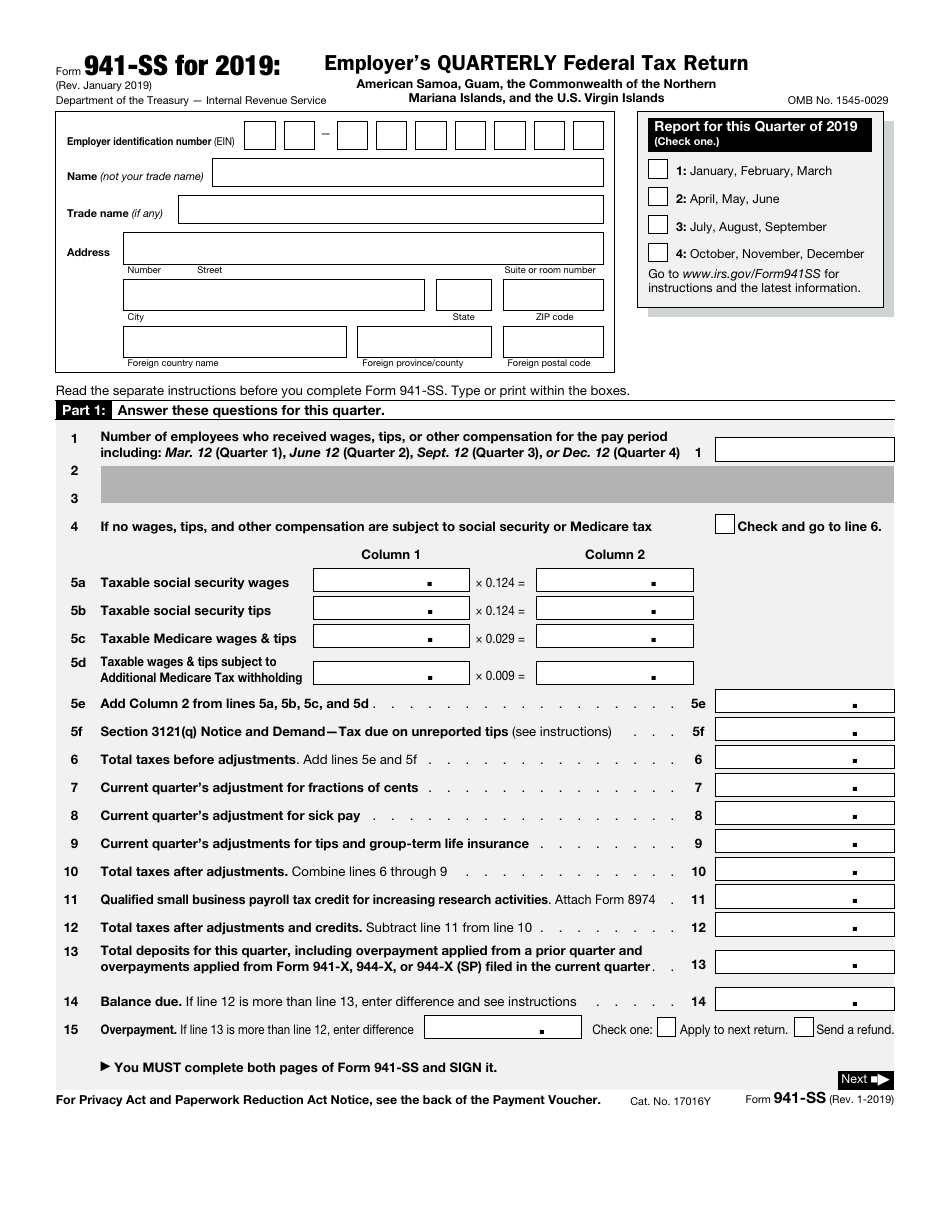

IRS Form 941SS 2019 Fill Out, Sign Online and Download Fillable

In the forms section, tap the view and print archived forms link under quarterly. On the left panel, choose the taxes menu to select payroll tax. Web to view an archived form: Web employers must file a quarterly form 941 to report wages paid, tips your employees have received, federal income tax withheld, and both the employer's and employee's share.

1995 Form IRS 941PR Fill Online, Printable, Fillable, Blank pdfFiller

Move your cursor to the taxes tab. Choose quarterly tax forms and 941 as your filter. Web here are the simple steps to follow: Web to view an archived form: Under forms, click the category of forms you want to view.

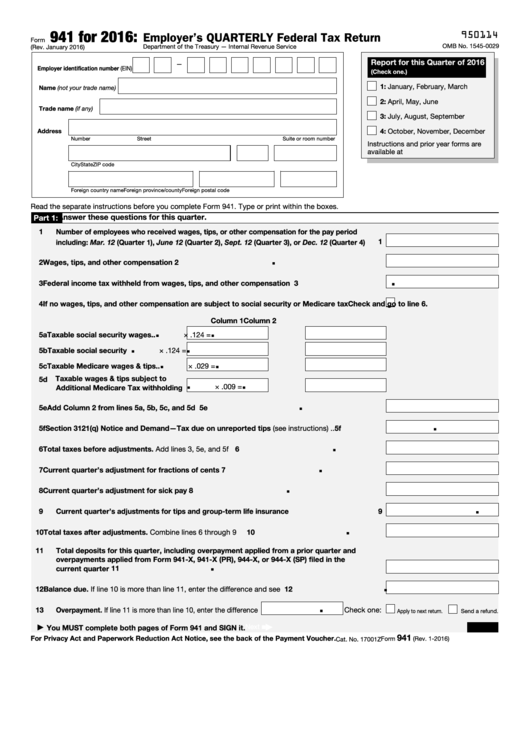

Print Irs Form 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web click on the employees menu. Web quickbooks sends the payment and form data to intuit, who processes information and submits the return to the agency. Web to print form 941 or 944. The 941 employer's quarterly tax return will show. In the navigation bar, click taxes > payroll tax.

QuickBooks 941 Feature Creates Tax Form 941 Fast Video YouTube

Web click the links to view the instructions. Web quickbooks sends the payment and form data to intuit, who processes information and submits the return to the agency. Web click acrobat or adobe reader. Click on the employees from the top menu bar. From the forms category page (for example,.

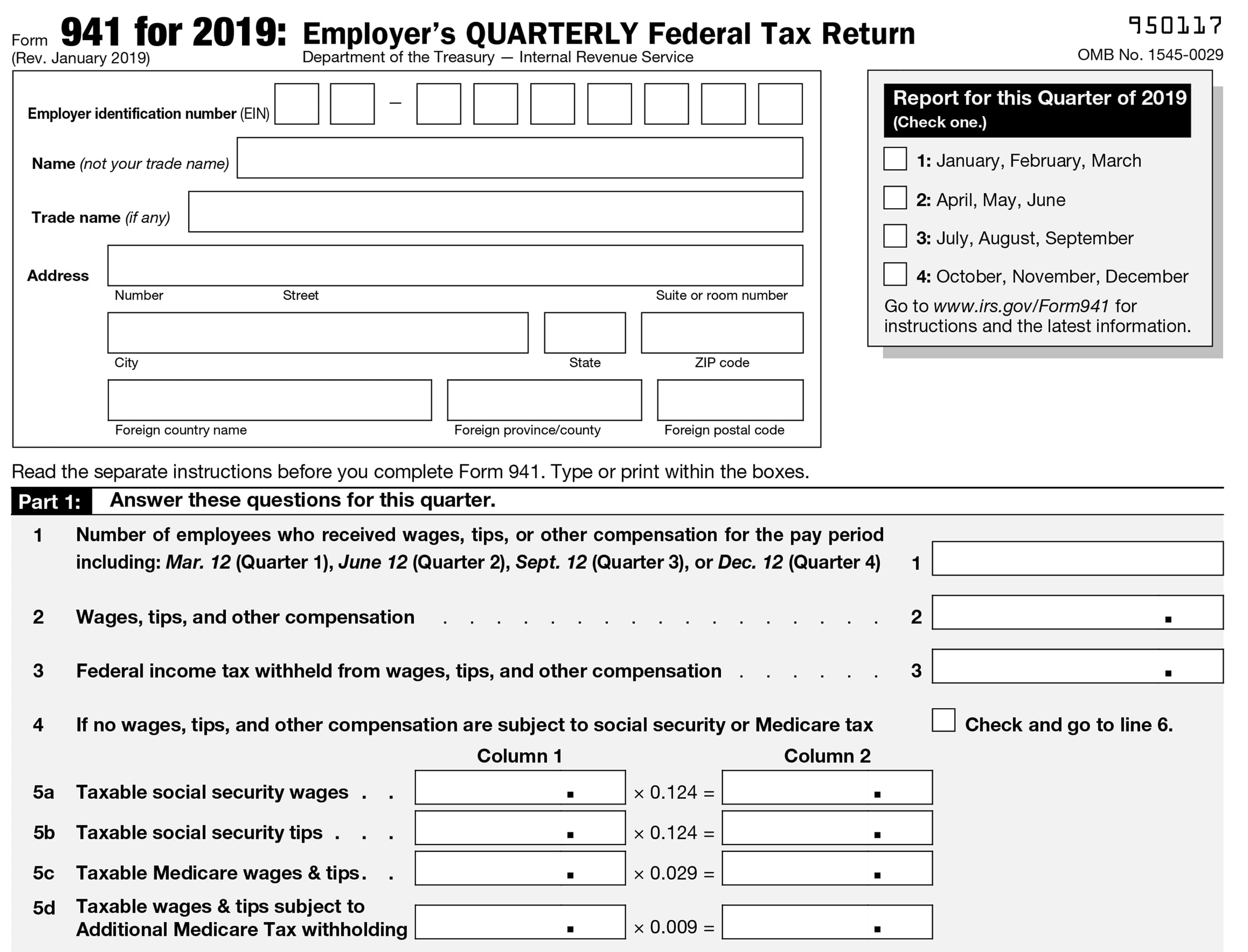

EFile 941 at 3.99 Fillable Form 941 2019 Create 941 for Free

Indicate the appropriate tax quarter and year in the quarter and year fields. Web click on the employees menu. In the navigation bar, click taxes > payroll tax. Web it must be filed at least quarterly and sometimes more often, depending on the size of your payroll. Web quickbooks sends the payment and form data to intuit, who processes information.

From The Forms Category Page (For Example,.

After quickbooks submits the data, a confirmation. Web employers must file a quarterly form 941 to report wages paid, tips your employees have received, federal income tax withheld, and both the employer's and employee's share of. Click taxes on the left navigation menu and choose payroll tax. Web best answers alexv quickbooks team november 17, 2020 07:40 pm thanks for joining us here, outsidetheboxvid.

Select Payroll Tax, Then Filings.

Select either form 941 or 944 in the tax reports section of print reports. Click on the employees from the top menu bar. Web click acrobat or adobe reader. Indicate the appropriate tax quarter and year in the quarter and year fields.

But How Do You File.

On the left panel, choose the taxes menu to select payroll tax. The 941 employer's quarterly tax return will show. Web to view an archived form: In the navigation bar, click taxes > payroll tax.

Web It Must Be Filed At Least Quarterly And Sometimes More Often, Depending On The Size Of Your Payroll.

Turbotax does not prepare form 941. Under forms, click the category of forms you want to view. Choose quarterly tax forms and 941 as your filter. Web click the links to view the instructions.