How To Form An S Corp In Oklahoma

How To Form An S Corp In Oklahoma - Get started on yours today. In very few states, you will also be required to file a separate. In the guide below, we. Get started on yours today. Before becoming an s corp, you have to first form a c corp. Easily search and see if your proposed business name is currently available. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. Ad form a s corporation to get investors or go public with your business. Web completing and filing of these forms creates a new profit or not for profit corporation or a limited liability company.

File your s corporation today. Ad form your incorporation in any state. Web anthropic, google, microsoft and openai team up to establish best practices but critics argue they want to avoid regulation. Web corporations may be formed for profit or nonprofit purposes. In the guide below, we. 2 who must file all corporations having an election in effect under subchapter s of the internal revenue code (irc) engaged in business or deriving. Before becoming an s corp, you have to first form a c corp. See how easily you can file an s corp with these s corp formation services Web contact the oklahoma attorney general's office. Start your corporation with us.

Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Web completing and filing of these forms creates a new profit or not for profit corporation or a limited liability company. Ad form a s corporation to get investors or go public with your business. Web how to form an ok corporation yourself in 6 steps. As the 2023/2024 school year draws near, parents are looking at a bigger school supplies bill than ever before. Hire a registered agent step 3: Register a business name in oklahoma. Web how to form a s corporation in oklahoma step 1: Get started on yours today. Web we would like to show you a description here but the site won’t allow us.

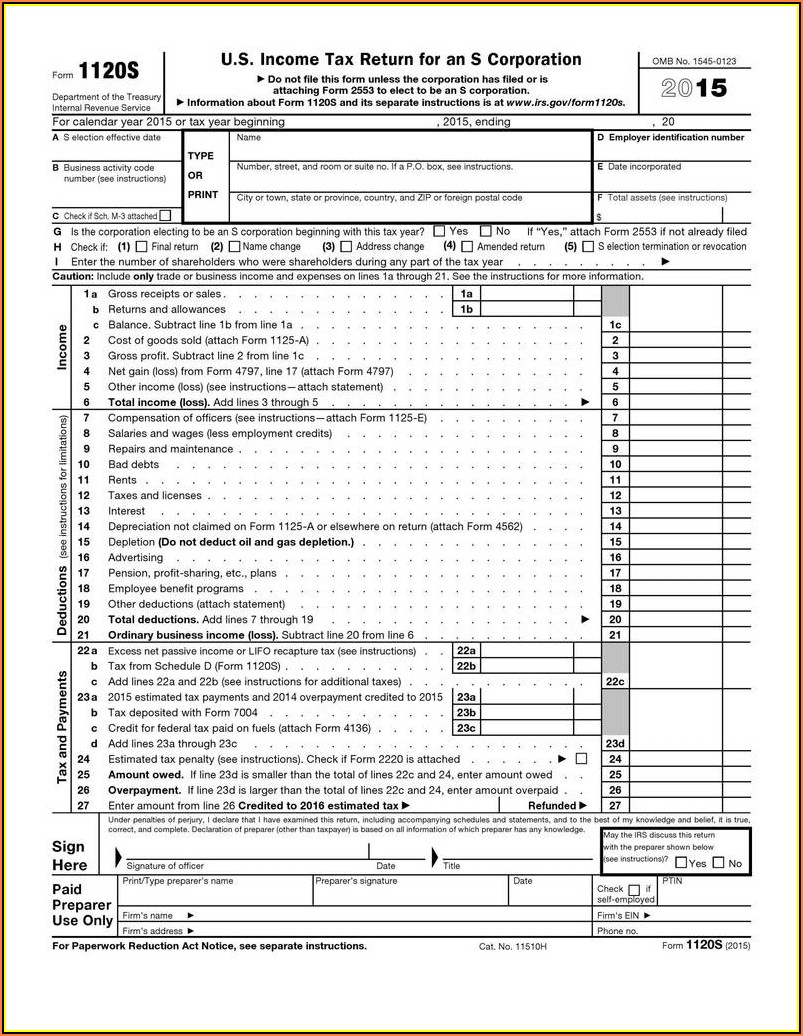

Irs 2553 Form S Corporation Irs Tax Forms

Get started on yours today. Register a business name in oklahoma. Web we would like to show you a description here but the site won’t allow us. Web appoint a registered agent choose directors or managers file formation documents with the oklahoma secretary of state filing form 2553 to apply for s corp status start. Ad form a s corporation.

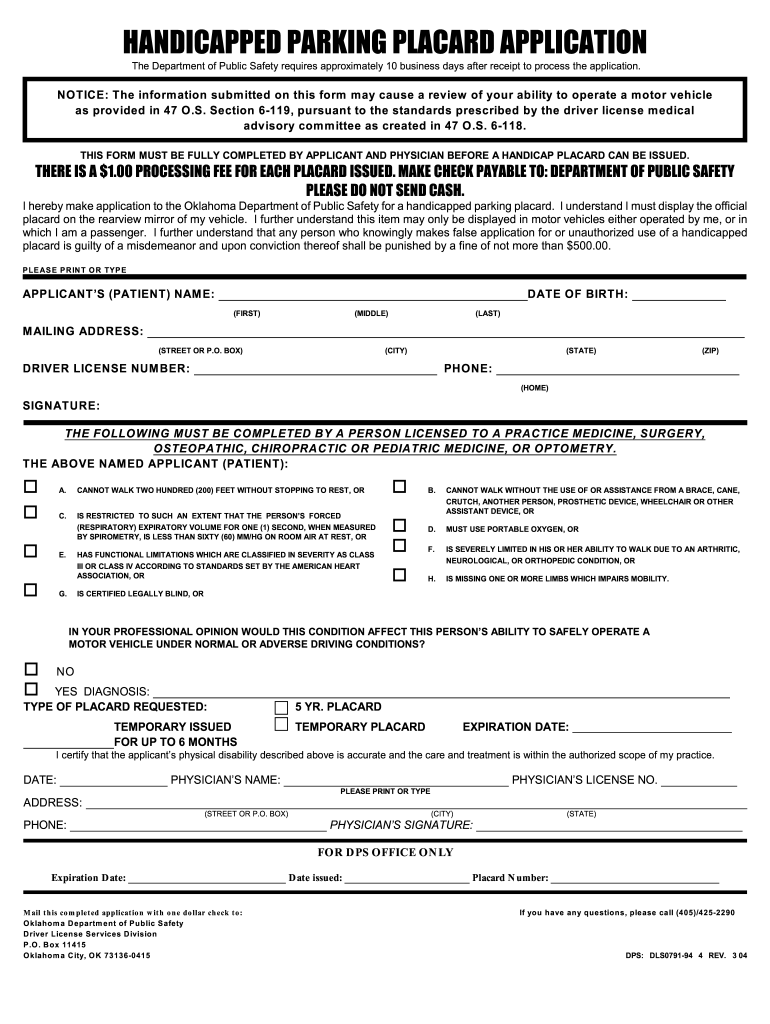

Handicap Parking Permit Application Fill Out and Sign Printable PDF

Register a business name in oklahoma. We're ready when you are. Select a name for your corporation deciding on a business name for your oklahoma corporation is the initial step in the process of forming your oklahoma corporation. Web appoint a registered agent choose directors or managers file formation documents with the oklahoma secretary of state filing form 2553 to.

Forming An S Corp In Texas Form Resume Examples 8lDRo645av

Ad find the right registered agent for your business' needs, we compared the best options. Get exactly what you want at the best price. See how easily you can file an s corp with these s corp formation services The name of the corporation has to be different from. Free registered agent service for the first year.

An SCorp Gift Charitable Solutions, LLC

We're ready when you are. Hire a registered agent step 3: Office of the oklahoma attorney general 313 ne 21st street oklahoma city, ok 73105 oklahoma city: Ad 3m+ customers have trusted us with their business formations. It is important that your oklahoma llc has a name that attracts.

Energy Transfer Partners K 1 2019 Image Transfer and Photos

Free registered agent service for the first year. Ad form a s corporation to get investors or go public with your business. We're ready when you are. Start your corporation with us. The name of the corporation has to be different from.

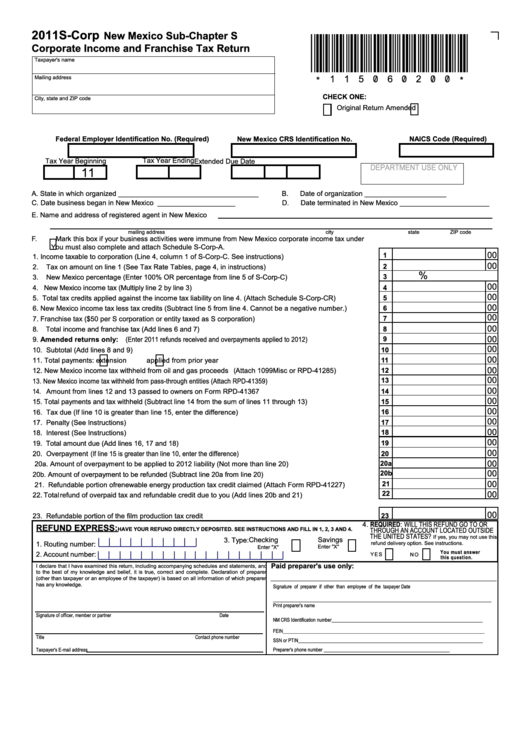

Form SCorp New Mexico SubChapter S Corporate And Franchise

Web completing and filing of these forms creates a new profit or not for profit corporation or a limited liability company. Register a business name in oklahoma. It is important that your oklahoma llc has a name that attracts. Web how to form an ok corporation yourself in 6 steps. Web anthropic, google, microsoft and openai team up to establish.

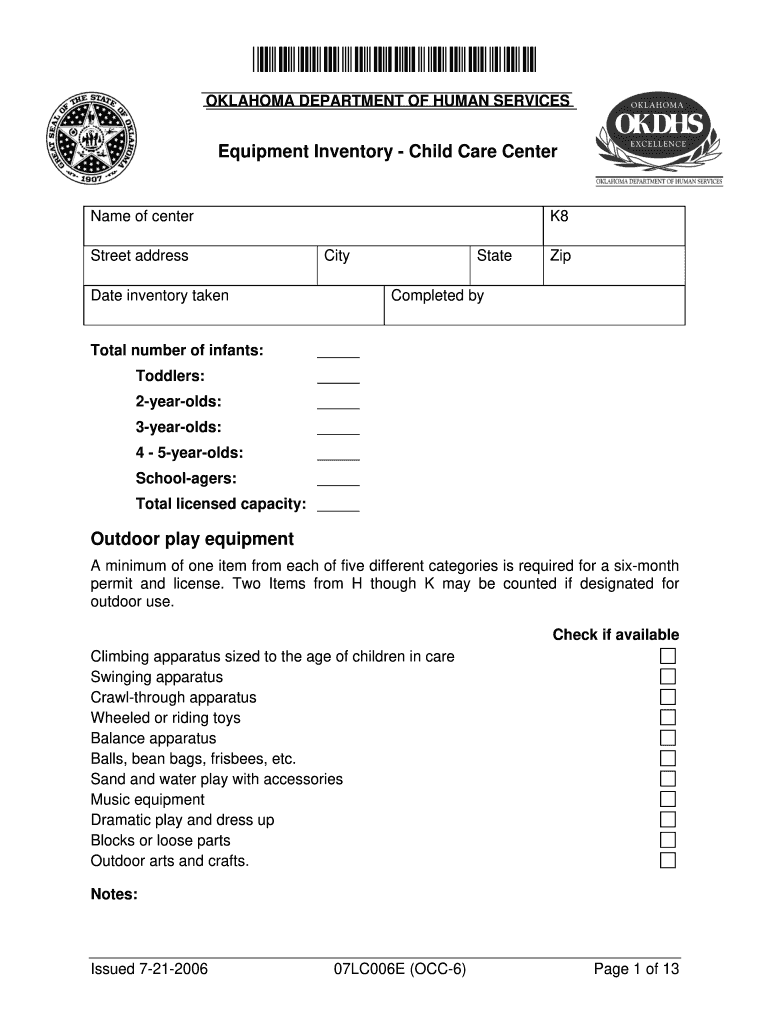

Oklahoma Department Of Human Services Form 07lc006e 20202021 Fill

Hire a registered agent step 3: The first and most significant step in forming an llc in oklahoma is deciding on a. Our business specialists help you incorporate your business. Web how to form an ok corporation yourself in 6 steps. Web how to form a s corporation in oklahoma step 1:

W9 vs. 1099

File your s corporation today. Office of the oklahoma attorney general 313 ne 21st street oklahoma city, ok 73105 oklahoma city: In the guide below, we. Web we would like to show you a description here but the site won’t allow us. Ad 3m+ customers have trusted us with their business formations.

2020 W9 Forms To Print Example Calendar Printable in W9 Form

In very few states, you will also be required to file a separate. Start your corporation with us. Give your llc a name. File your s corporation today. Ad form your incorporation in any state.

Irs Tax Form 1040ez 2020 Form Resume Examples qeYzgN5V8X

Format and forms that the business will use to file annual income taxes (regarding its. We're ready when you are. Web to form a corporation in oklahoma, you must file a certificate of incorporation with the secretary of state and pay a filing fee. Web form 2553 to elect s corp status. We're ready when you are.

2 Who Must File All Corporations Having An Election In Effect Under Subchapter S Of The Internal Revenue Code (Irc) Engaged In Business Or Deriving.

Web to qualify as an s corporation in oklahoma, an irs form 2553 must be filed with the internal revenue service. The first and most significant step in forming an llc in oklahoma is deciding on a. Web anthropic, google, microsoft and openai team up to establish best practices but critics argue they want to avoid regulation. Web form 2553 to elect s corp status.

Web Forming An Llc And Electing Oklahoma S Corp Tax Status Step 1:

Web we would like to show you a description here but the site won’t allow us. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. File your s corporation today. The four companies say they launched.

Our Business Specialists Help You Incorporate Your Business.

Ad protect your business from liabilities. Ad form your incorporation in any state. Easily search and see if your proposed business name is currently available. Register a business name in oklahoma.

In The Guide Below, We.

File your s corporation today. Get exactly what you want at the best price. Ad developed by legal professionals. Web completing and filing of these forms creates a new profit or not for profit corporation or a limited liability company.

/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png)