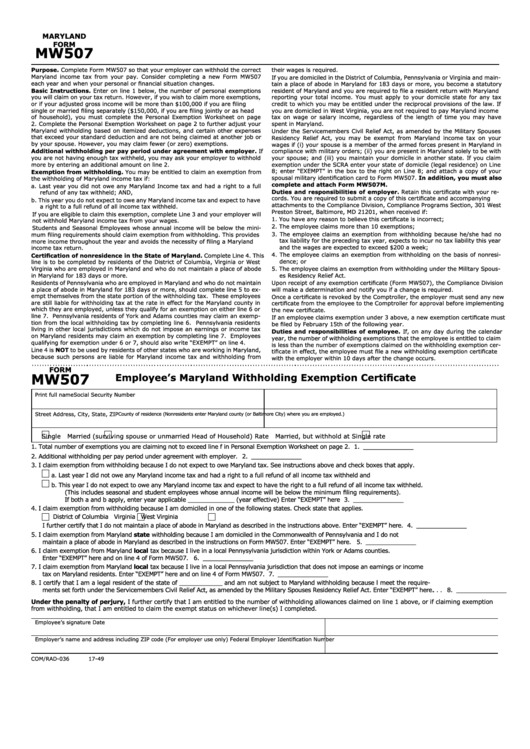

How To Fill Out Mw507 Form

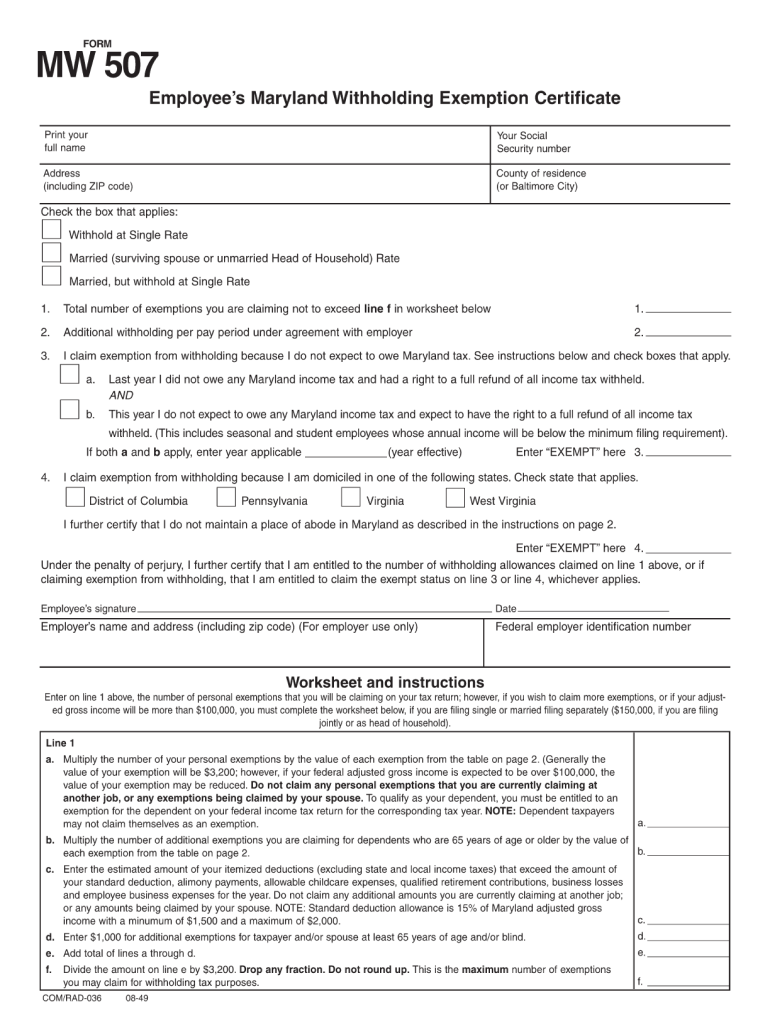

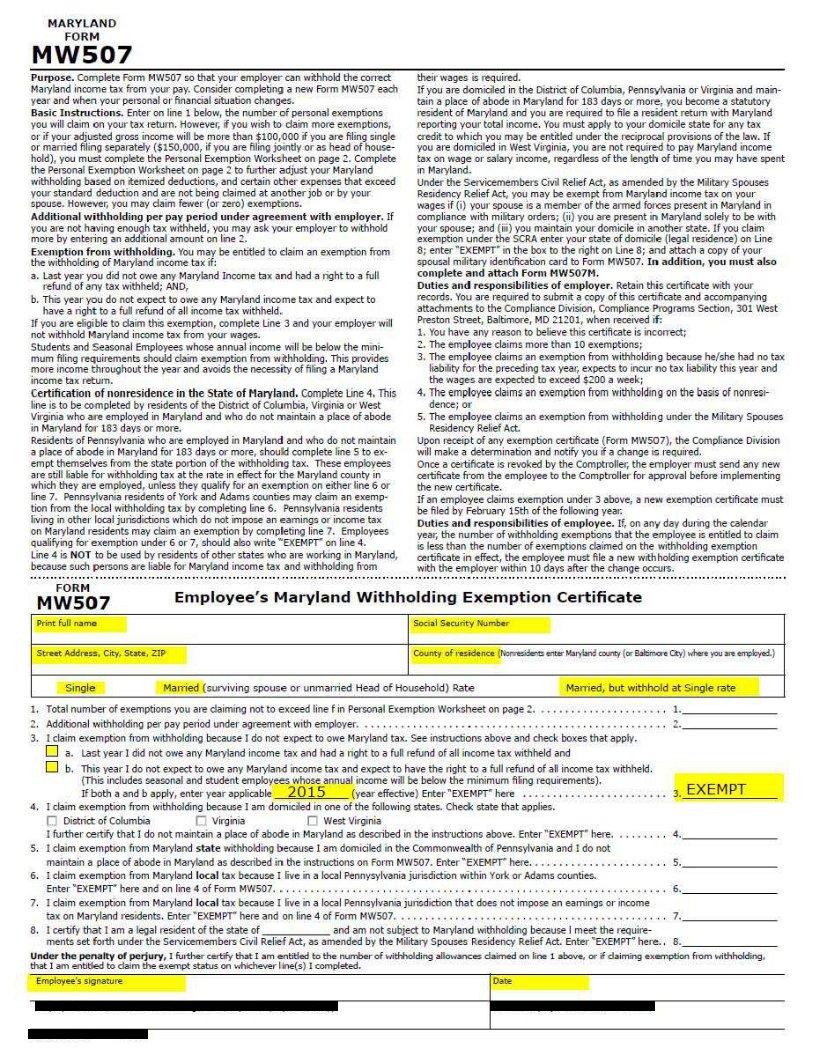

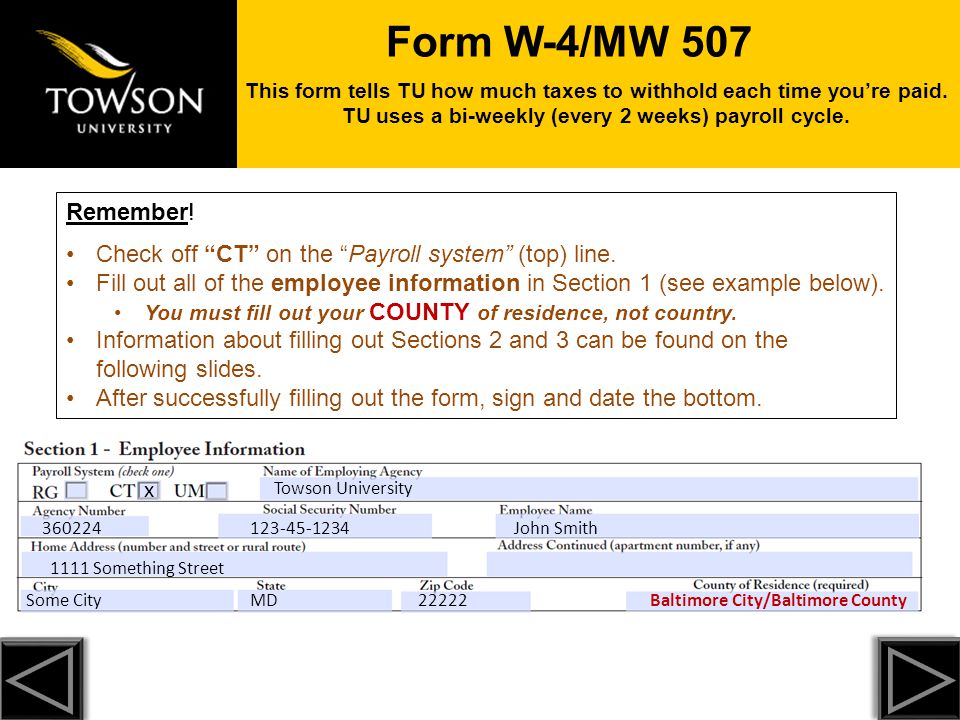

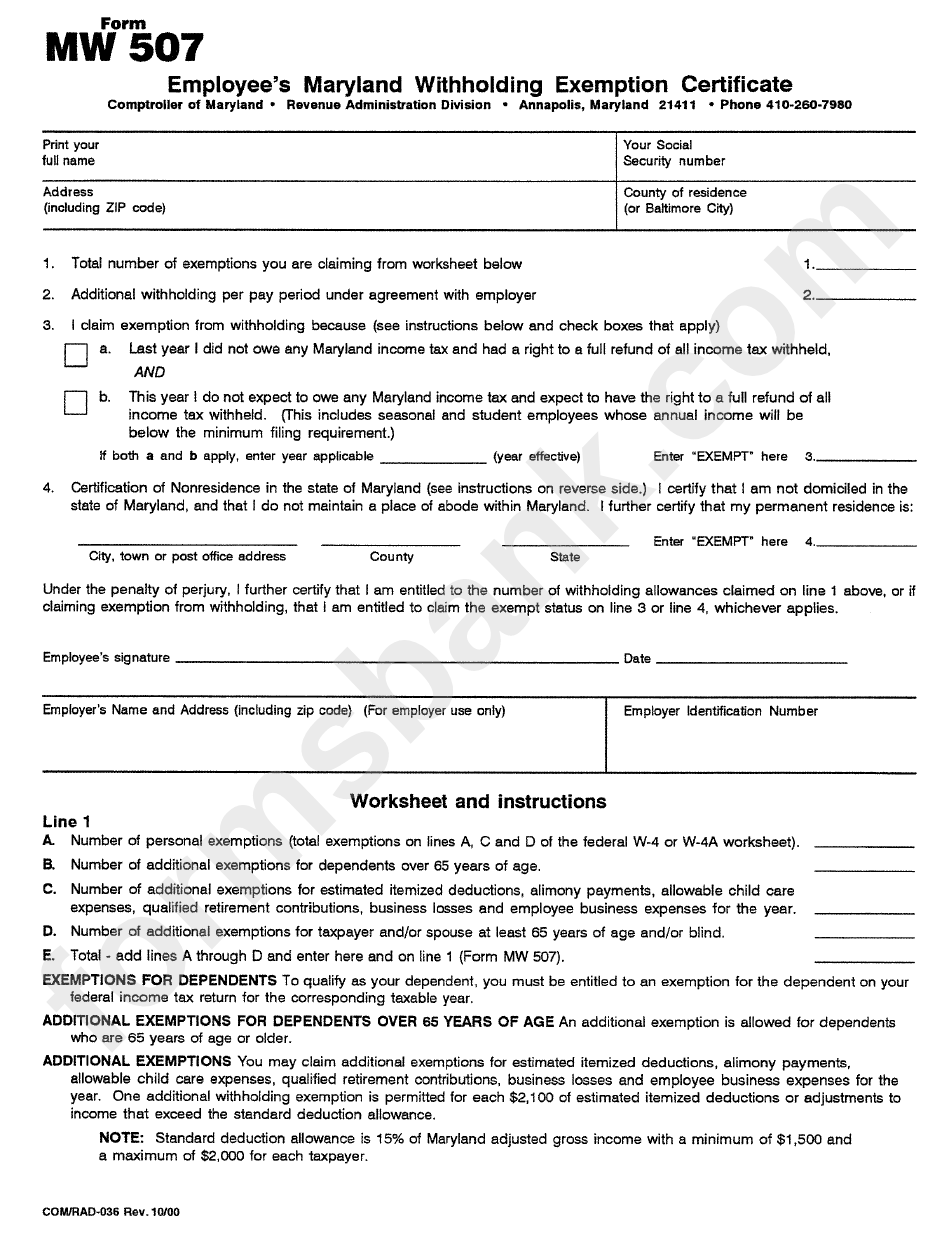

How To Fill Out Mw507 Form - Learn how to properly fill out to form to avoid any tax liabilities by the end of this year. From withholding, fill out lines 1 through 3 of part 1. Web irs form mw507 is the state of maryland’s withholding exemption certificate. Web download or print the 2022 maryland mw507 (employee's maryland withholding exemption certificate) for free from the maryland comptroller of maryland. However, if you wish to claim moreexemptions, or if your adjusted gross. Web make any changes needed: Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Calculate employee’s withholding exemptions you can learn quite a bit about the state’s withholding form requirements and still not stumble upon one of the. Web enter on line 1 above, the number of personal exemptions that you will be claiming on your tax return; Web complete the employee’s withholding allowance certificate as follows:

Sign it in a few clicks draw your signature, type. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Consider completing a new form mw507 each year and. For maryland state government employees only. Web make any changes needed: Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Insert text and photos to your form mw507, highlight information that matters, remove parts of content and replace them with new ones, and. Web irs form mw507 is the state of maryland’s withholding exemption certificate. Enter in item b of page 1, the whole dollar amount that you wish. Edit your mw507 example online type text, add images, blackout confidential details, add comments, highlights and more.

A copy of your dependent. Web completing form mw507m if you meet all of the eligibility requirements for the exemption. Web form used by individuals to direct their employer to withhold maryland income tax from their pay. This includes your full name,. Use get form or simply click on the template preview to open it in the editor. For maryland state government employees only. From withholding, fill out lines 1 through 3 of part 1. Learn how to properly fill out to form to avoid any tax liabilities by the end of this year. Web maryland control form mw507 is required for filing us income tax. Consider completing a new form mw507 each year and.

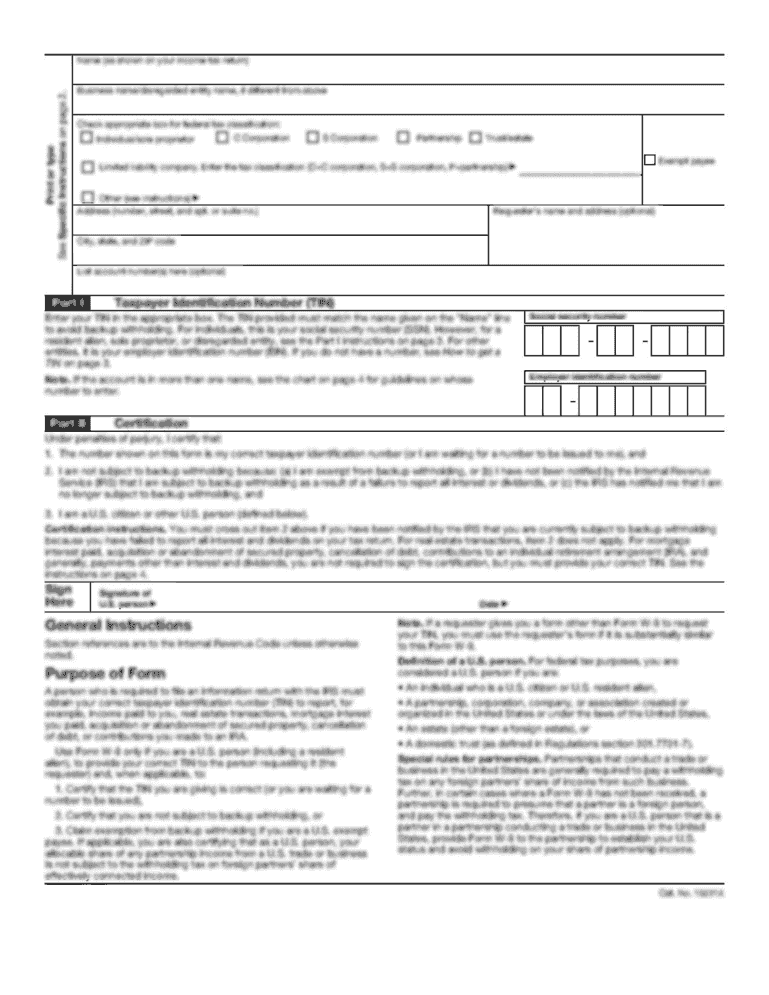

How to Fill Out The Personal Allowances Worksheet (W4 Worksheet) for

Exemption from maryland withholding tax for a qualified civilian. Learn how to properly fill out to form to avoid any tax liabilities by the end of this year. Consider completing a new form mw507 each year and. Web download or print the 2022 maryland mw507 (employee's maryland withholding exemption certificate) for free from the maryland comptroller of maryland. Web maryland.

Mw507 Personal Exemptions Worksheets

Use get form or simply click on the template preview to open it in the editor. Web irs form mw507 is the state of maryland’s withholding exemption certificate. Web maryland control form mw507 is required for filing us income tax. From withholding, fill out lines 1 through 3 of part 1. All maryland residents or employees must complete form mw507.

Fillable Form Mw507 Employee'S Maryland Withholding Exemption

Insert text and photos to your form mw507, highlight information that matters, remove parts of content and replace them with new ones, and. Web maryland tax form mw507 is essential for filing state income taxes. For maryland state government employees only. Web maryland control form mw507 is required for filing us income tax. Calculate employee’s withholding exemptions you can learn.

Mw507 Form 2022 How To Fill Out Fill Online, Printable, Fillable

All maryland residents or employees must complete form mw507 to ensure their employer. Web maryland tax form mw507 is essential for filing state income taxes. Sign it in a few clicks draw your signature, type. Learned how to orderly fill out the form to avoid any tax liabilities at which end are the year. For maryland state government employees only.

Form Mw507 ≡ Fill Out Printable PDF Forms Online

Web enter on line 1 above, the number of personal exemptions that you will be claiming on your tax return; Insert text and photos to your form mw507, highlight information that matters, remove parts of content and replace them with new ones, and. Use get form or simply click on the template preview to open it in the editor. All.

Mw507 Tutorial Fill Out and Sign Printable PDF Template signNow

Web download or print the 2022 maryland mw507 (employee's maryland withholding exemption certificate) for free from the maryland comptroller of maryland. Web form used by individuals to direct their employer to withhold maryland income tax from their pay. Learned how to orderly fill out the form to avoid any tax liabilities at which end are the year. From withholding, fill.

Form Mw 507 Example ≡ Fill Out Printable PDF Forms Online

Start by entering your personal information in the first section of the form. From withholding, fill out lines 1 through 3 of part 1. Calculate employee’s withholding exemptions you can learn quite a bit about the state’s withholding form requirements and still not stumble upon one of the. A copy of your dependent. Learned how to orderly fill out the.

MW507 How to fill out MW507 Form Examples for Single and Married

Web quick steps to complete and design form mw507 online: Enter in item b of page 1, the whole dollar amount that you wish. Consider completing a new form mw507 each year and. Learned how to orderly fill out the form to avoid any tax liabilities at which end are the year. Exemption from maryland withholding tax for a qualified.

Form Mw 507 Employee'S Maryland Withholding Exemption Certificate

However, if you wish to claim moreexemptions, or if your adjusted gross. For maryland state government employees only. Web irs form mw507 is the state of maryland’s withholding exemption certificate. This includes your full name,. Consider completing a new form mw507 each year and.

Fill Free fillable forms Comptroller of Maryland

Web make any changes needed: Web irs form mw507 is the state of maryland’s withholding exemption certificate. Web quick steps to complete and design form mw507 online: Use get form or simply click on the template preview to open it in the editor. All maryland residents or employees must complete form mw507 to ensure their employer.

Web Maryland Tax Form Mw507 Is Essential For Filing State Income Taxes.

Use get form or simply click on the template preview to open it in the editor. Start by entering your personal information in the first section of the form. Consider completing a new form mw507 each year and. For maryland state government employees only.

Web Form Used By Individuals To Direct Their Employer To Withhold Maryland Income Tax From Their Pay.

Learn how to properly fill out to form to avoid any tax liabilities by the end of this year. However, if you wish to claim moreexemptions, or if your adjusted gross. Exemption from maryland withholding tax for a qualified civilian. Web download or print the 2022 maryland mw507 (employee's maryland withholding exemption certificate) for free from the maryland comptroller of maryland.

A Copy Of Your Dependent.

From withholding, fill out lines 1 through 3 of part 1. Learned how to orderly fill out the form to avoid any tax liabilities at which end are the year. Web completing form mw507m if you meet all of the eligibility requirements for the exemption. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay.

Sign It In A Few Clicks Draw Your Signature, Type.

All maryland residents or employees must complete form mw507 to ensure their employer. Enter in item b of page 1, the whole dollar amount that you wish. Web enter on line 1 above, the number of personal exemptions that you will be claiming on your tax return; Calculate employee’s withholding exemptions you can learn quite a bit about the state’s withholding form requirements and still not stumble upon one of the.