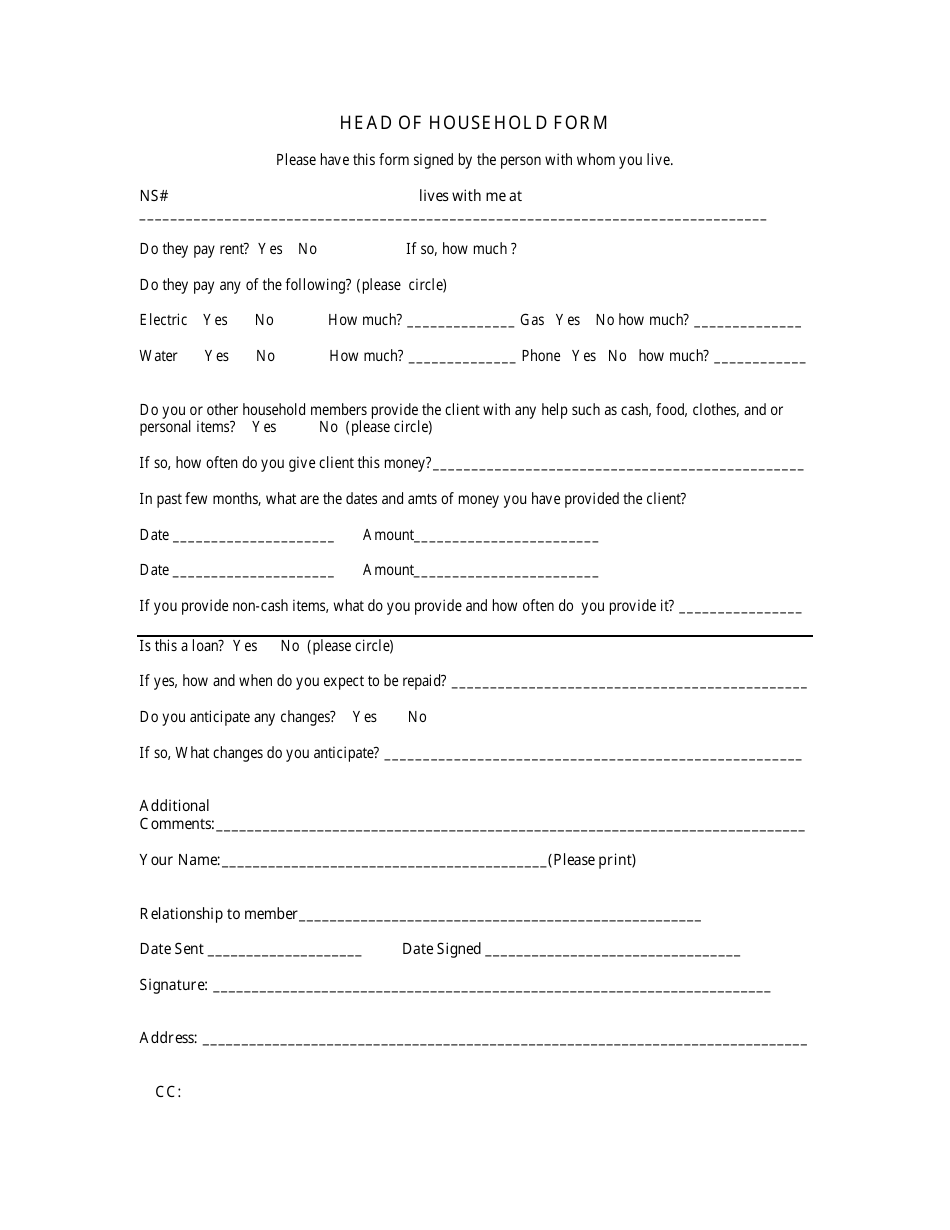

Head Of Household Form

Head Of Household Form - But to qualify, you must meet specific. However, you must be unmarried and. It may be advantageous to choose to treat your. Web head of household is a filing status available to taxpayers who meet certain qualifying thresholds. Name(s) as shown on tax return california form 3532. Web to qualify for head of household filing status, you must be entitled to a dependent exemption credit for your qualifying relative. Web the primary benefit of filing under the head of household status is a higher standard deduction than what is available for a single filer. Generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. Name(s) as shown on tax return california form 3532. For a taxpayer to qualify as head of household, he/she must be either.

Therefore, the qualifying relative must also. Web 2019 head of household filing status schedule attach to your california form 540, form 540nr, or form 540 2ez. Generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. For the 2021 tax year , the. Web if you qualify to file as head of household, instead of as married filing separately, your tax may be lower, you may be able to claim certain tax benefits, and your standard. Name(s) as shown on tax return. Web the primary benefit of filing under the head of household status is a higher standard deduction than what is available for a single filer. It provides preferential tax rates and a larger standard deduction for single people caring for. Web there are three key requirements to qualify as a head of household: They must file separate individual tax returns, be considered.

For the 2021 tax year , the. Web 2021 head of household filing status schedule attach to your california form 540, form 540nr, or form 540 2ez. Web head of household (with qualifying dependent) (during the tax year, you provided more than half the cost of maintaining a household for a qualifying dependent.) if the. Web there are three key requirements to qualify as a head of household: Web 2022 head of household filing status schedule. Web your qualifying relative’s gross income must be less than $4,300. Generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. But to qualify, you must meet specific. It may be advantageous to choose to treat your. They must file separate individual tax returns, be considered.

head of household & member forms by Saint Paul Lutheran Church Issuu

Name(s) as shown on tax return california form 3532. Web 2022 head of household filing status schedule. For the 2021 tax year , the. Web the head of household is a tax filing status for individuals living in the united states. Web head of household (hoh) filing status allows you to file at a lower tax rate and a higher.

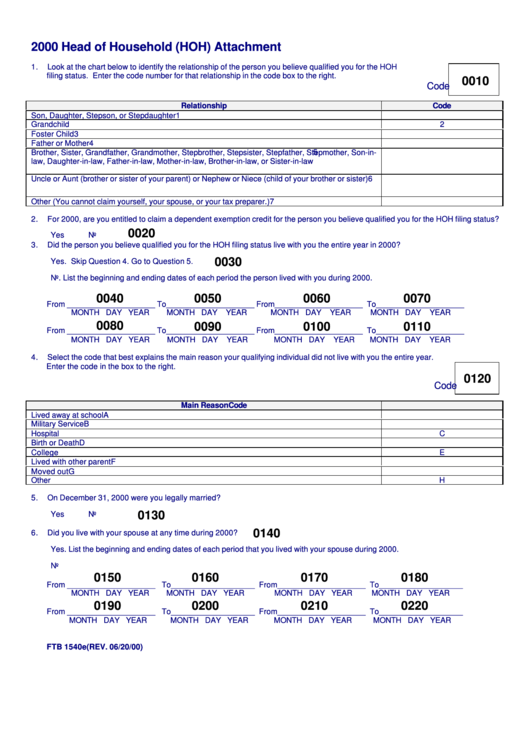

Fillable Form Ftb 1540e 2000 Head Of Household (Hoh) Attachment

Generally, gross income for head of household purposes only includes income that is taxable for federal income. However, a custodial parent may be eligible to claim. Web generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. Web if you qualify to file as head of household, instead of as married filing.

Head Of The Household Stock Photo Download Image Now iStock

Web 2021 head of household filing status schedule attach to your california form 540, form 540nr, or form 540 2ez. Web head of household. Web to qualify for head of household filing status, you must be entitled to a dependent exemption credit for your qualifying relative. Web there are three key requirements to qualify as a head of household: But.

How to File as Head of Household 14 Steps (with Pictures)

Head of household is a filing status for individual united states taxpayers. Therefore, the qualifying relative must also. Web head of household (with qualifying dependent) (during the tax year, you provided more than half the cost of maintaining a household for a qualifying dependent.) if the. Web 2022 head of household filing status schedule. Web the primary benefit of filing.

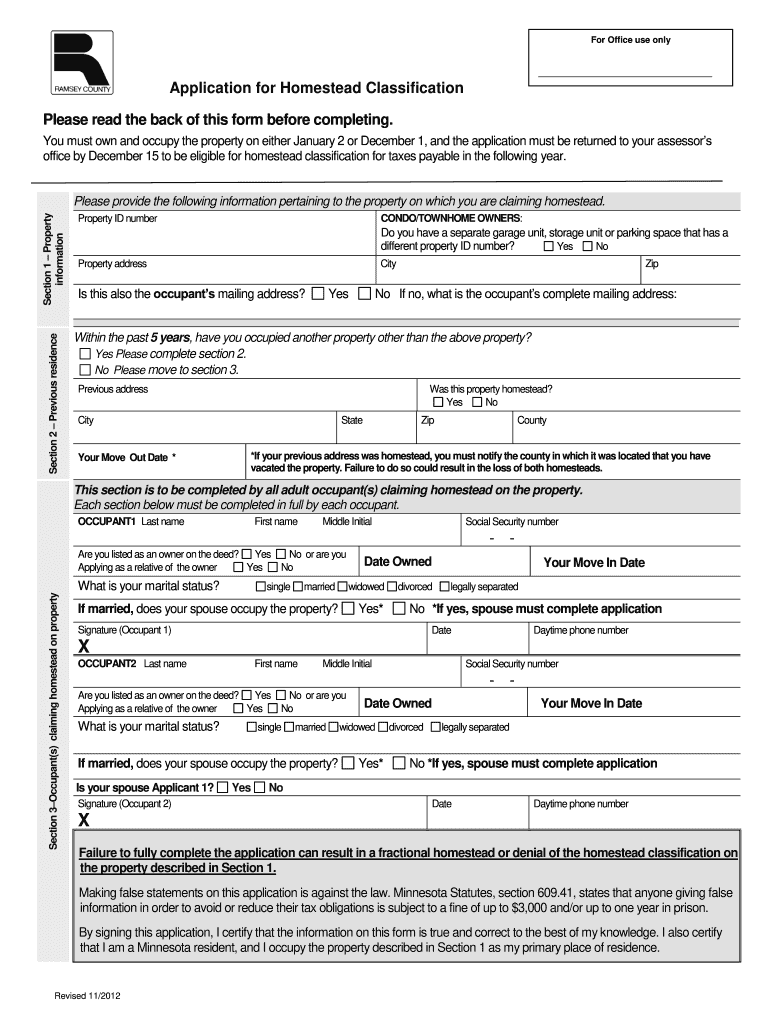

Fillable Online co ramsey mn Application For Homestead Classification

For the 2021 tax year , the. Web head of household (with qualifying dependent) (during the tax year, you provided more than half the cost of maintaining a household for a qualifying dependent.) if the. Web generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. You are unmarried, recently divorced or.

Head of Household Form Download Printable PDF Templateroller

Web 2021 head of household filing status schedule attach to your california form 540, form 540nr, or form 540 2ez. Web head of household is a filing status available to taxpayers who meet certain qualifying thresholds. It may be advantageous to choose to treat your. Web head of household. Generally, to qualify for head of household filing status, you must.

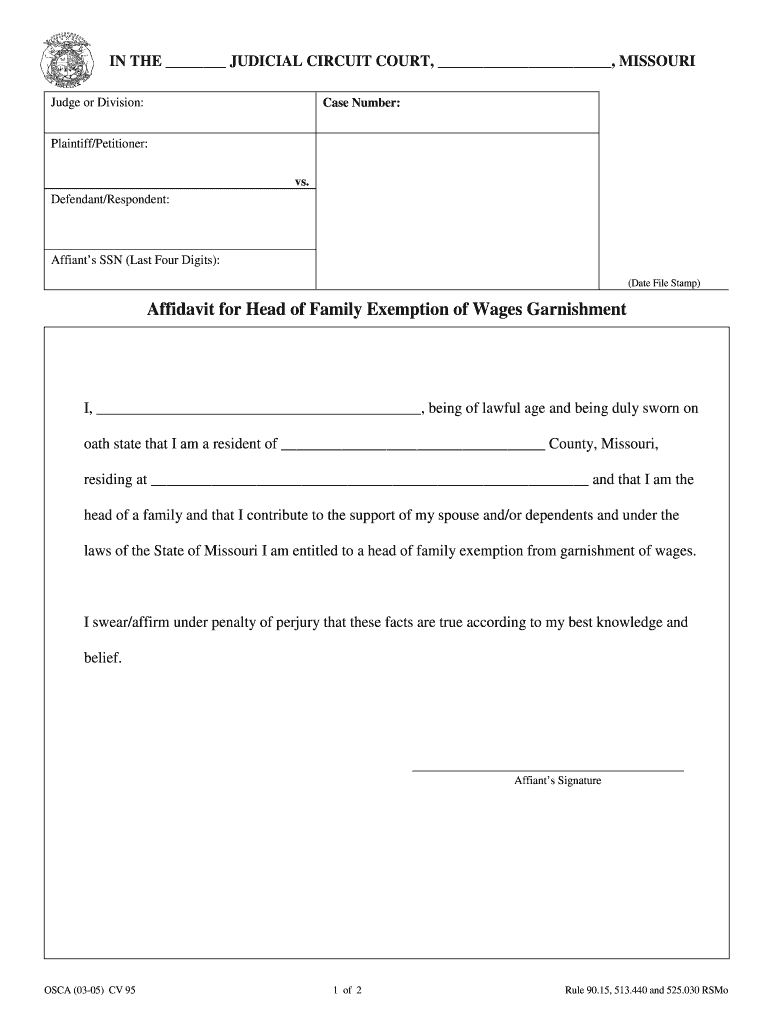

Missouri Garnishment Head Of Household Form Fill Out and Sign

Web if you qualify to file as head of household, instead of as married filing separately, your tax may be lower, you may be able to claim certain tax benefits, and your standard. It may be advantageous to choose to treat your. Web 2022 head of household filing status schedule. Web the head of household is a tax filing status.

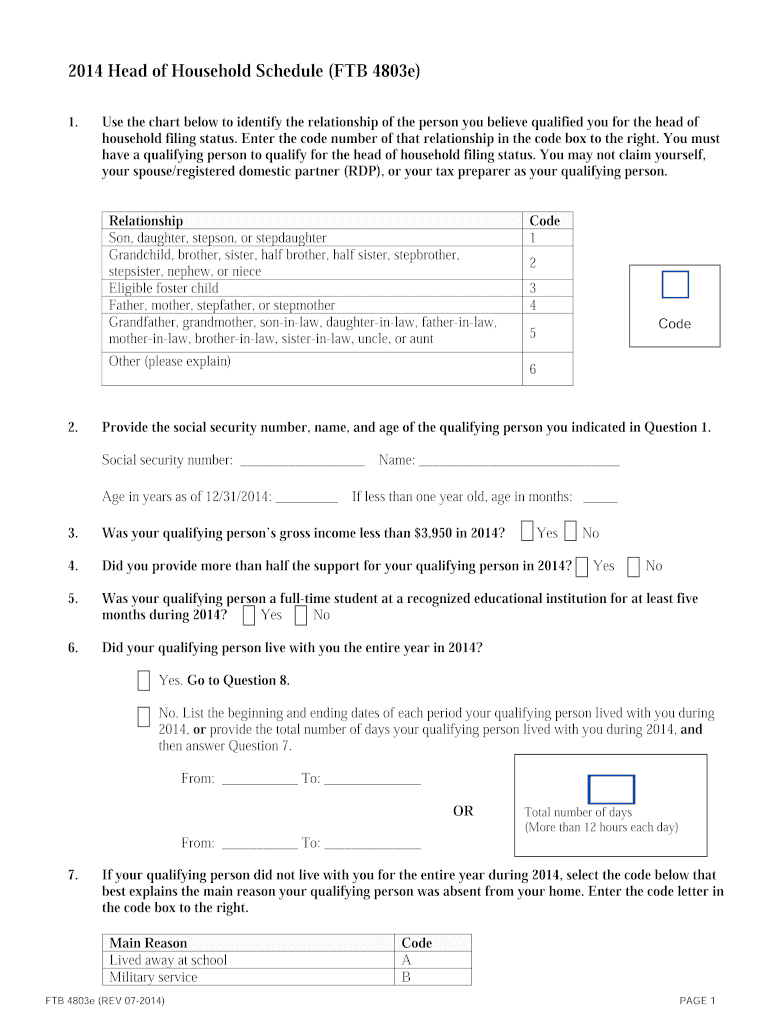

20142021 Form CA FTB 4803e Fill Online, Printable, Fillable, Blank

Web head of household. But to qualify, you must meet specific. Head of household is a filing status for individual united states taxpayers. Web 2019 head of household filing status schedule attach to your california form 540, form 540nr, or form 540 2ez. Web there are three key requirements to qualify as a head of household:

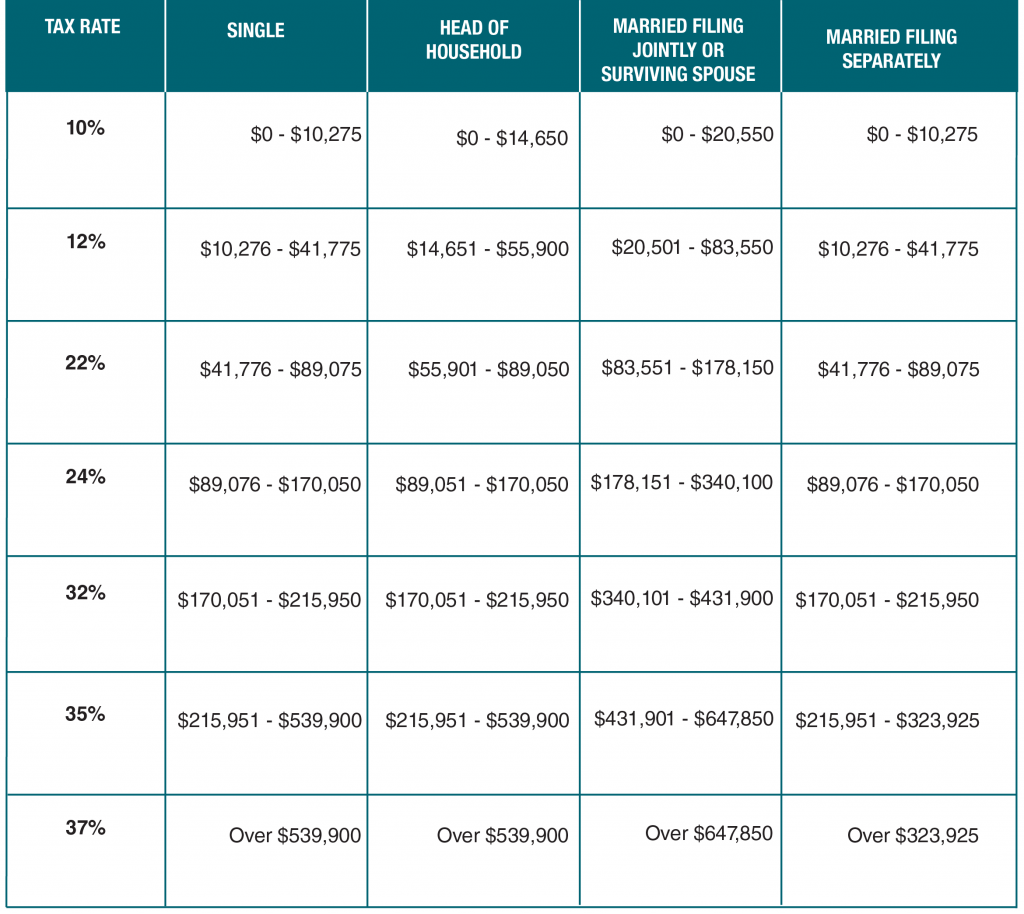

2022 Tax Brackets Single Head Of Household Printable Form, Templates

Web head of household (hoh) filing status allows you to file at a lower tax rate and a higher standard deduction than the filing status of single. Head of household is a filing status for individual united states taxpayers. It may be advantageous to choose to treat your. Web you must have another qualifying person and meet the other tests.

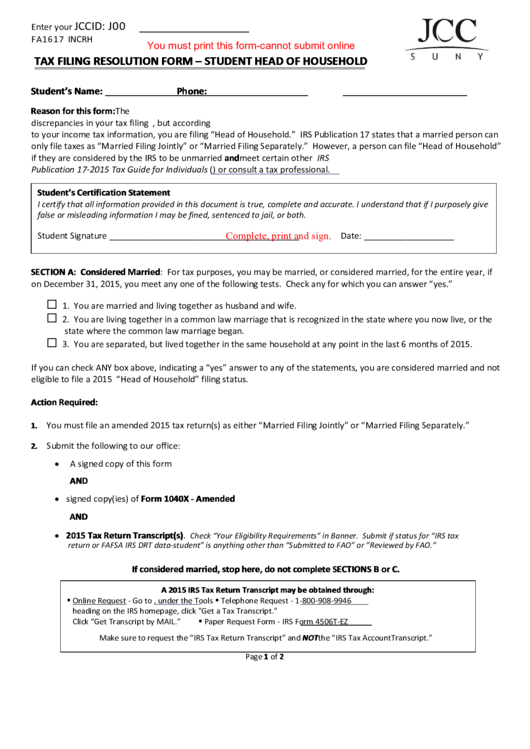

Fillable Tax Filing Resolution Form Student Head Of Household

Web there are three key requirements to qualify as a head of household: Name(s) as shown on tax return california form 3532. However, a custodial parent may be eligible to claim. Generally, to qualify for head of household filing status, you must have a qualifying child or a dependent. Web head of household (hoh) filing status allows you to file.

Head Of Household Is A Filing Status For Individual United States Taxpayers.

Web the primary benefit of filing under the head of household status is a higher standard deduction than what is available for a single filer. Therefore, the qualifying relative must also. However, you must be unmarried and. Web your qualifying relative’s gross income must be less than $4,300.

Generally, To Qualify For Head Of Household Filing Status, You Must Have A Qualifying Child Or A Dependent.

Web head of household. Web if you qualify to file as head of household, instead of as married filing separately, your tax may be lower, you may be able to claim certain tax benefits, and your standard. You are unmarried, recently divorced or legally separated from a spouse. Web 2019 head of household filing status schedule attach to your california form 540, form 540nr, or form 540 2ez.

However, A Custodial Parent May Be Eligible To Claim.

Web head of household (with qualifying dependent) (during the tax year, you provided more than half the cost of maintaining a household for a qualifying dependent.) if the. Web you must have another qualifying person and meet the other tests to be eligible to file as a head of household. It provides preferential tax rates and a larger standard deduction for single people caring for. Web 2021 head of household filing status schedule attach to your california form 540, form 540nr, or form 540 2ez.

Web Head Of Household Is A Filing Status Available To Taxpayers Who Meet Certain Qualifying Thresholds.

Web head of household (hoh) filing status allows you to file at a lower tax rate and a higher standard deduction than the filing status of single. Name(s) as shown on tax return california form 3532. They must file separate individual tax returns, be considered. Web to qualify for head of household filing status, you must be entitled to a dependent exemption credit for your qualifying relative.