Georgia Form 501 Instructions

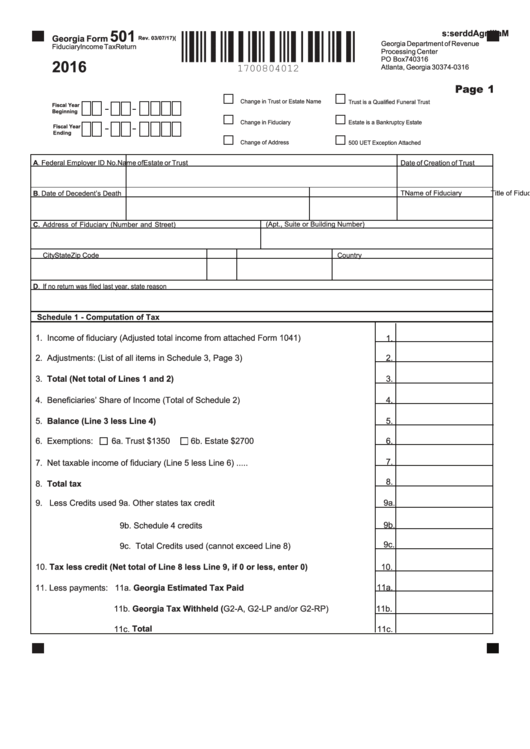

Georgia Form 501 Instructions - Returns are required to be filed by the 15th day of the 4th month Web print blank form > georgia department of revenue save form. Web up to $40 cash back print prepare and mail form 500 or 500ez to the georgia department of revenue. (list of all items in schedule 2, page. Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 501, fully updated for tax year 2022. Web it appears you don't have a pdf plugin for this browser. Web print blank form > georgia department of revenue zoom in; Web file a georgia income tax return on form 501. Web 501 fiduciary income tax return what's new?

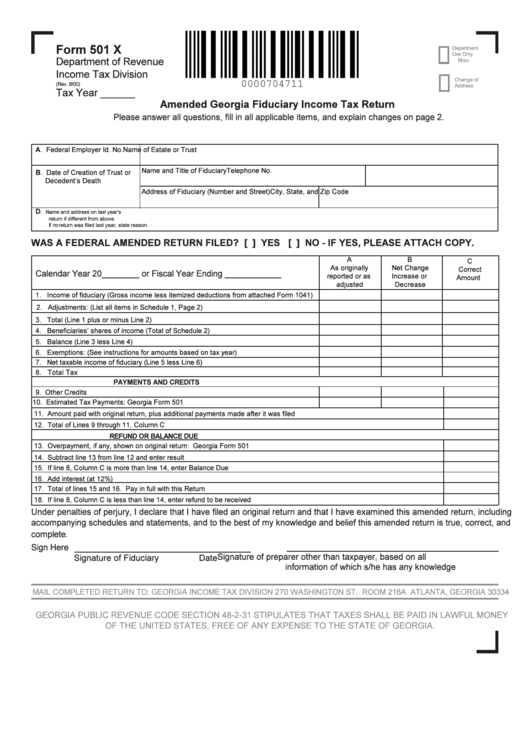

You can download or print. Web income tax return on form 501 (see our website for information regarding the u.s. Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a. Web georgia form 500 (rev. Web up to $40 cash back print prepare and mail form 500 or 500ez to the georgia department of revenue. Web print blank form > georgia department of revenue zoom in; Web for example, an organization which pursues tax exemption under internal revenue code (irc) section 501 (c) (3) must limit itself in its organizing documents to the exempt. 501x amended fiduciary income tax return what's new?. Web 501 fiduciary income tax return what's new? Returns are required to be filed by the 15th day of the 4th month

Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a. (list of all items in schedule 2, page. Returns are required to be filed by the 15th day of the 4th month Income of fiduciary (adjusted total income from attached form 1041). Web income tax return on form 501 (see our website for information regarding the u.s. 501x amended fiduciary income tax return what's new?. Web it appears you don't have a pdf plugin for this browser. Web for example, an organization which pursues tax exemption under internal revenue code (irc) section 501 (c) (3) must limit itself in its organizing documents to the exempt. Returns are required to be filed by the 15th day of the 4th month Returns are required to be filed by the 15th day of the 4th month following the close of the taxable year.the due date for a.

Fillable Form 501 Fiduciary Tax Return 2016

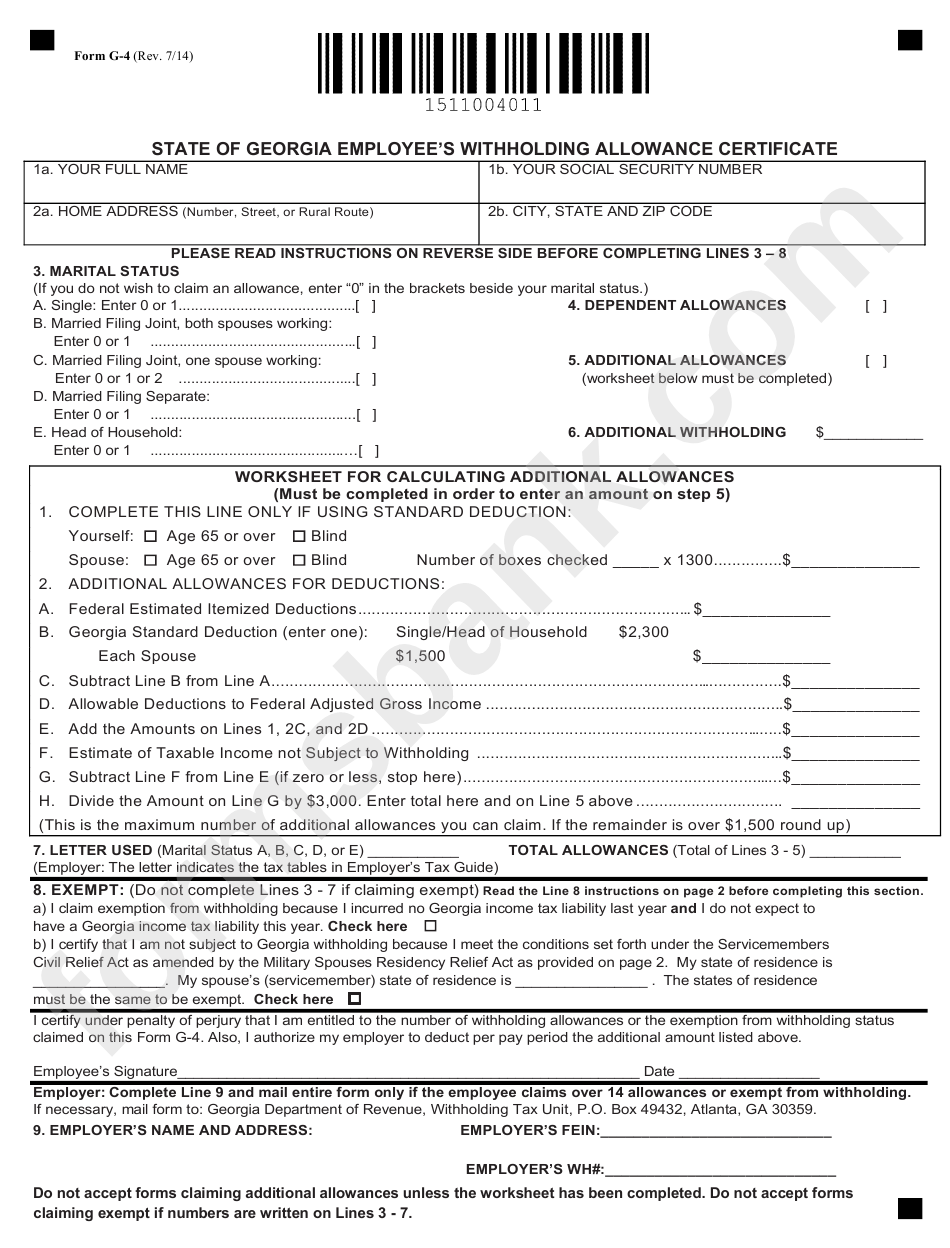

Print blank form > georgia department of revenue. Web return on form 501 (see our website for information regarding the u.s. Web 501 fiduciary income tax return what's new? Web georgia tax forms the publications listed below are located on the georgia department of revenue website and require adobe acrobat reader to view. Physical location of business, farm or household.

Form 501 X Amended Fiduciary Tax Return printable pdf

Web georgia form 500 (rev. Web for example, an organization which pursues tax exemption under internal revenue code (irc) section 501 (c) (3) must limit itself in its organizing documents to the exempt. Web income tax return on form 501 (see our website for information regarding the u.s. Visit the adobe web site. Print blank form > georgia department of.

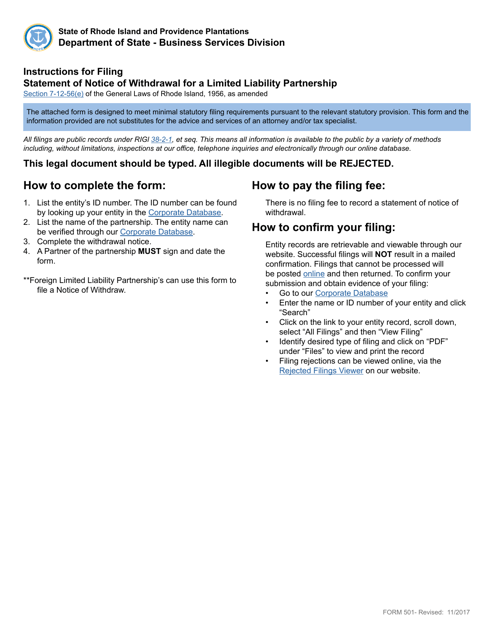

Form 501 Download Fillable PDF or Fill Online Statement of Notice of

Web georgia tax forms the publications listed below are located on the georgia department of revenue website and require adobe acrobat reader to view. Web print blank form > georgia department of revenue save form. Georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Physical location of business, farm or household. Returns.

Form G4 State Of Employee'S Withholding Allowance

Returns are required to be filed by the 15th day of the 4th month following the close of the taxable year.the due date for a. Web income tax return on form 501 (see our website for information regarding the u.s. Georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Returns are required.

Temporary Guardianship Form Form Resume Examples

501x amended fiduciary income tax return what's new?. Web for example, an organization which pursues tax exemption under internal revenue code (irc) section 501 (c) (3) must limit itself in its organizing documents to the exempt. Income of fiduciary (adjusted total income from attached form 1041). Returns are required to be filed by the 15th day of the 4th month.

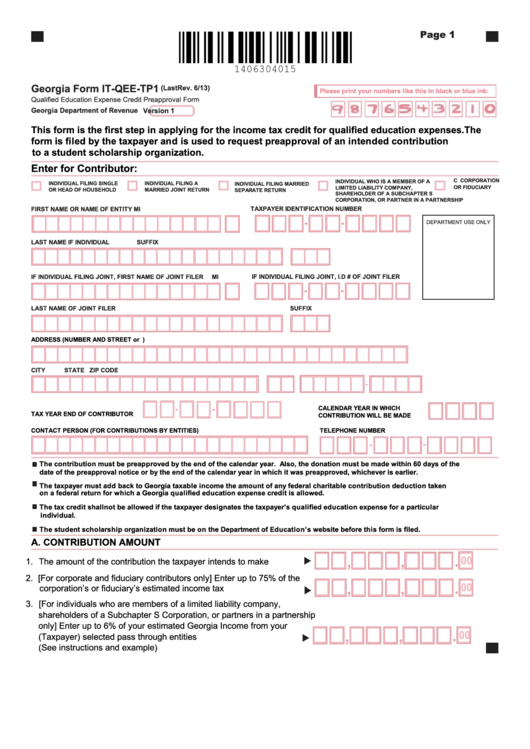

Fillable Form ItQeeTp1 Qualified Education Expense Credit

Print blank form > georgia department of revenue. Returns are required to be filed by the 15th day of the 4th month Web file a georgia income tax return on form 501. Web for example, an organization which pursues tax exemption under internal revenue code (irc) section 501 (c) (3) must limit itself in its organizing documents to the exempt..

2019 Form GA DoR 500NOL Fill Online, Printable, Fillable, Blank

501x amended fiduciary income tax return what's new?. Web print blank form > georgia department of revenue zoom in; Visit the adobe web site. Income of fiduciary (adjusted total income from attached form 1041). You can download or print.

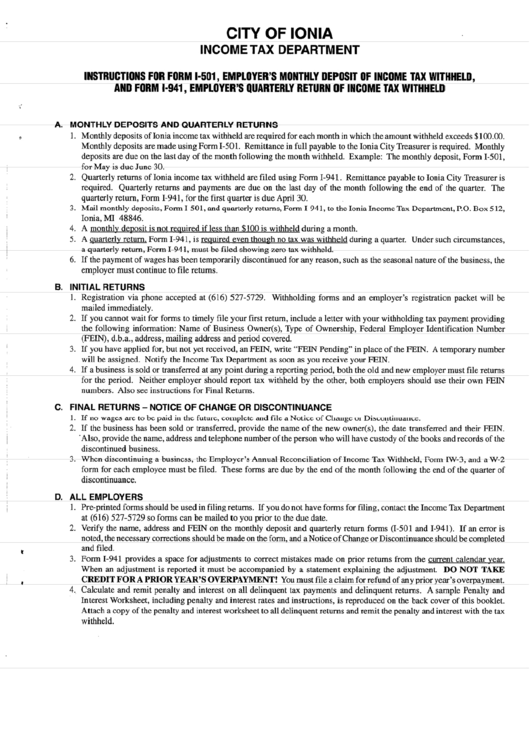

Instructions For Form I501, Employer'S Monthly Deposit Of Tax

Print blank form > georgia department of revenue. Web print blank form > georgia department of revenue zoom in; Returns are required to be filed by the 15th day of the 4th month Trade name by which business is known if different than 1. Web we last updated the fiduciary income tax return in january 2023, so this is the.

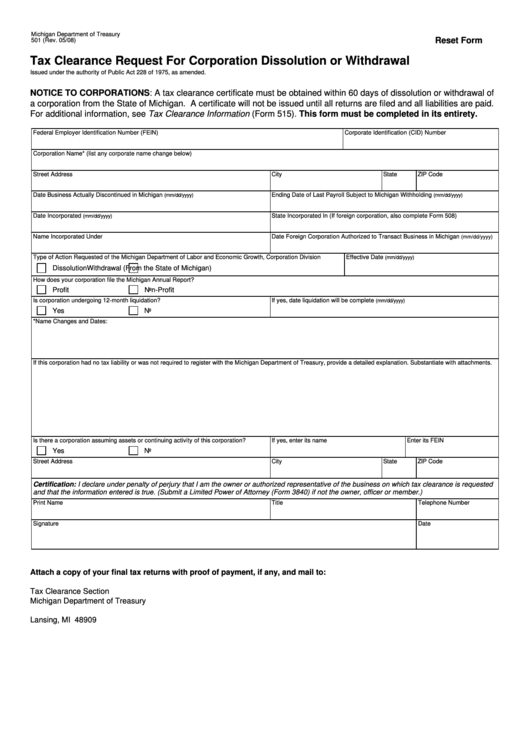

Fillable Form 501 Tax Clearance Request For Corporation Dissolution

Web up to $40 cash back print prepare and mail form 500 or 500ez to the georgia department of revenue. (list of all items in schedule 2, page. Georgia individual income tax returns must be received or postmarked by the april 18, 2023 due date. Web it appears you don't have a pdf plugin for this browser. Returns are required.

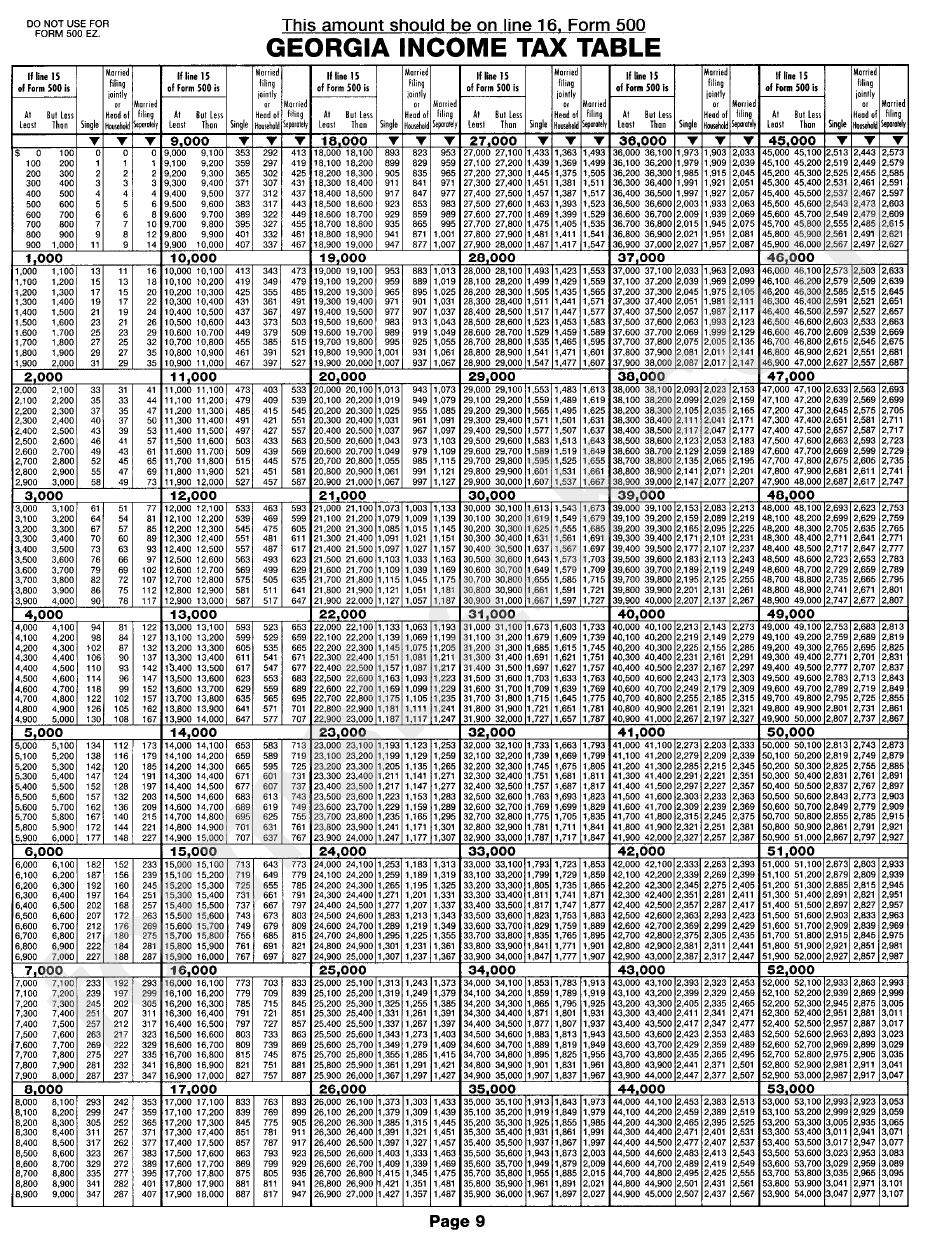

Form 500 Tax Table printable pdf download

Returns are required to be filed by the 15th day of the 4th month following the close of the taxable year.the due date for a. Complete, save and print the form online using your browser. Physical location of business, farm or household. Trade name by which business is known if different than 1. Returns are required to be filed by.

Web Up To $40 Cash Back Print Prepare And Mail Form 500 Or 500Ez To The Georgia Department Of Revenue.

Web print blank form > georgia department of revenue save form. Web income tax under section 501(c)(3) of internal revenue code. Income of fiduciary (adjusted total income from attached form 1041). Web return on form 501 (see our website for information regarding the u.s.

(List Of All Items In Schedule 2, Page.

Visit the adobe web site. (list of all items in schedule 2, page. Web georgia form 500 (rev. Web every resident and nonresident fiduciary having income from sources within georgia or managing funds or property for the benefit of a resident of this state is required to file a.

Returns Are Required To Be Filed By The 15Th Day Of The 4Th Month Following The Close Of The Taxable Year.the Due Date For A.

Web file a georgia income tax return on form 501. Web we last updated the fiduciary income tax return in january 2023, so this is the latest version of form 501, fully updated for tax year 2022. 501x amended fiduciary income tax return what's new?. Web it appears you don't have a pdf plugin for this browser.

Georgia Individual Income Tax Returns Must Be Received Or Postmarked By The April 18, 2023 Due Date.

Web 501 fiduciary income tax return what's new? Income of fiduciary (adjusted total income from attached form 1041). Web for example, an organization which pursues tax exemption under internal revenue code (irc) section 501 (c) (3) must limit itself in its organizing documents to the exempt. You can download or print.