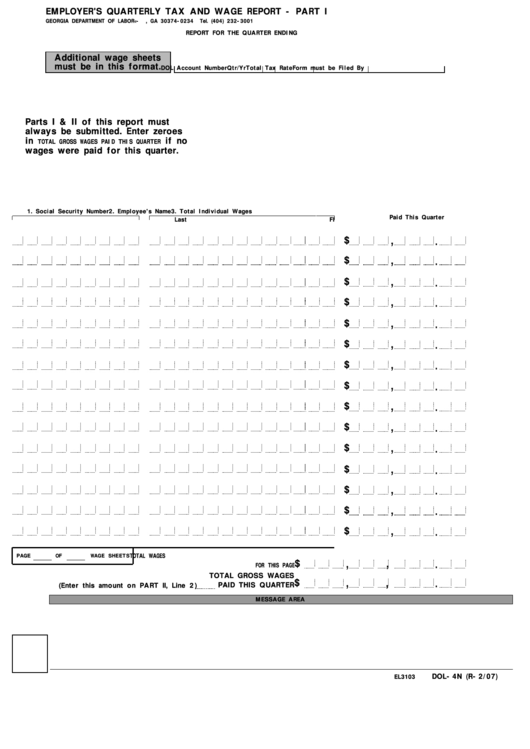

Georgia Employers Quarterly Tax And Wage Report Form

Georgia Employers Quarterly Tax And Wage Report Form - Web all employers can submit tax and wage report information electronically using the online filing of employer’s quarterly tax and wage application by accessing the gdol. Web georgia department of revenue save form. Pay your team and access hr and benefits with the #1 online payroll provider. Web to prepare georgia quarterly tax and wage reports: Go to employees or on the fly > state tax & wage forms. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web the georgia department of labor (gdol) offers all employers the ability to file their quarterly tax and wage reports, make payments via the online services, and. Click the link to see the form instructions. Menu changes on the website the forms menu has moved! Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages.

Web georgia department of revenue save form. Best overall payroll software for small businesses by business.com Web it includes applicable withholding tax tables, basic definitions, answers to frequently asked questions, and references to applicable sections of title 48 of the official code of. Web georgia state income tax form 500 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Ad approve payroll when you're ready, access employee services & manage it all in one place. Pay your team and access hr and benefits with the #1 online payroll provider. Web the georgia department of labor (gdol) offers all employers the ability to file their quarterly tax and wage reports, make payments via the online services, and. Menu changes on the website the forms menu has moved! Web all employers can submit tax and wage report information electronically using the online filing of employer’s quarterly tax and wage application by accessing the gdol.

Web it includes applicable withholding tax tables, basic definitions, answers to frequently asked questions, and references to applicable sections of title 48 of the official code of. Web georgia state income tax form 500 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Web to prepare georgia quarterly tax and wage reports: Web this report has been handed to or mailed to the worker. The notice of failure to file. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Printable georgia state tax forms for the 2022 tax. Print blank form > georgia department of revenue. Signature of official, employee of the employeror authorized agent for the employerdate completed and released to. Web the georgia department of labor (gdol) offers all employers the ability to file their quarterly tax and wage reports, make payments via the online services, and.

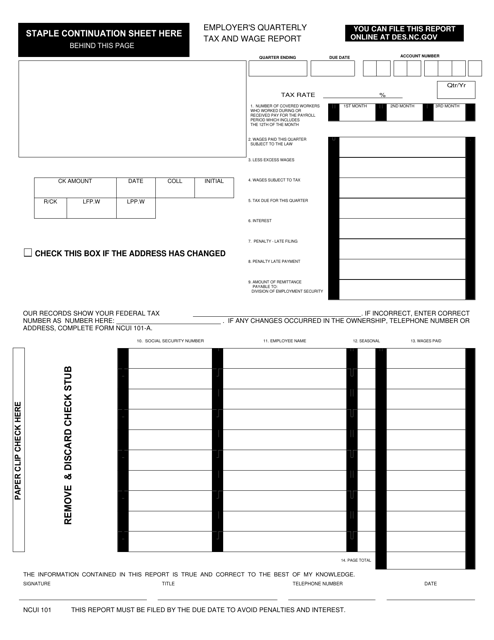

Unemployment Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

Go to employees or on the fly > state tax & wage forms. Read more about the changes employer's tax guide employer's tax guide this guide is used to explain the. Print blank form > georgia department of revenue. Web it includes applicable withholding tax tables, basic definitions, answers to frequently asked questions, and references to applicable sections of title.

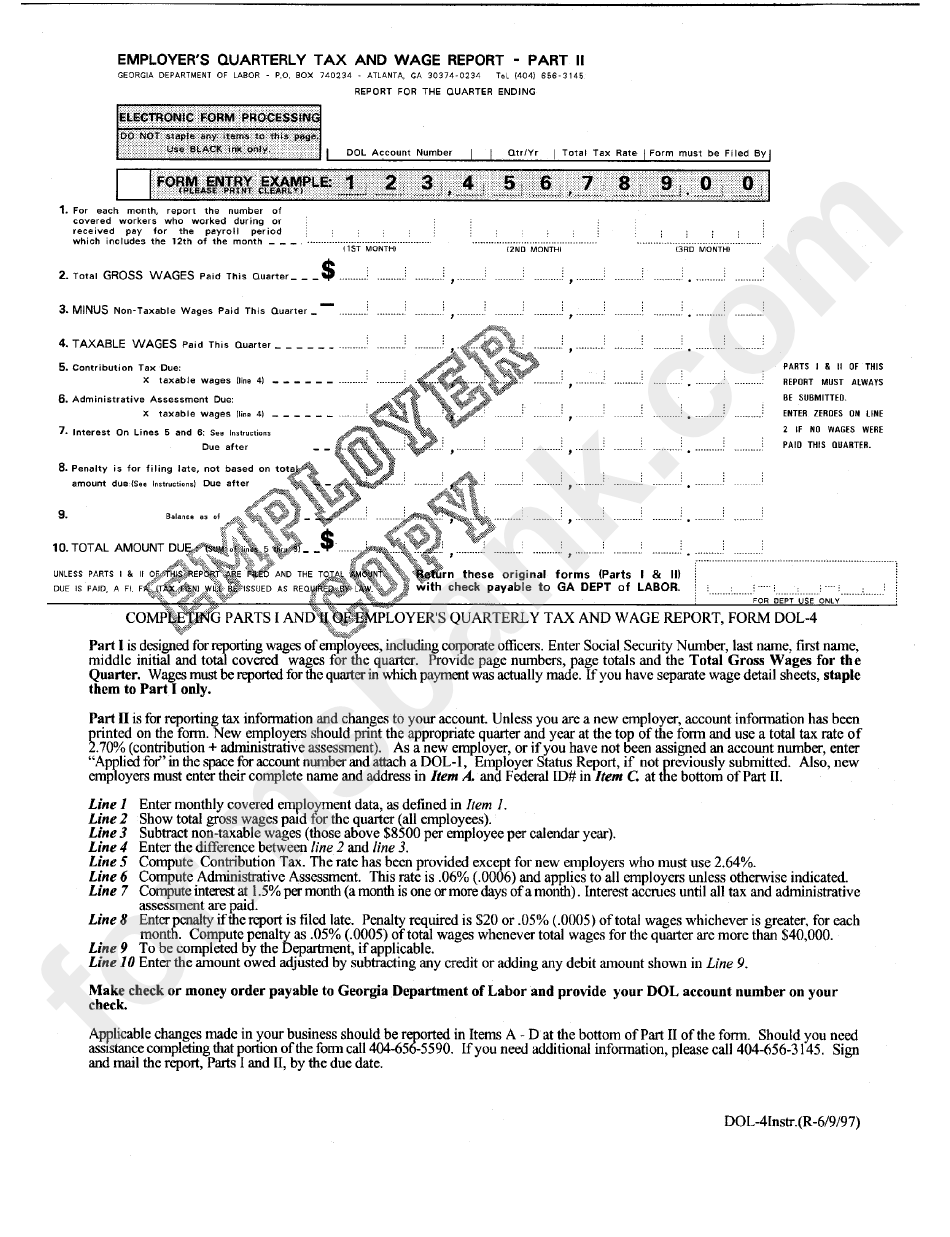

Form Dol4n Employer'S Quarterly Tax And Wage Report State Of

The notice of failure to file. Printable georgia state tax forms for the 2022 tax. Web the georgia department of labor (gdol) offers all employers the ability to file their quarterly tax and wage reports, make payments via the online services, and. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from.

Form NCUI101 Download Fillable PDF or Fill Online Employer's Quarterly

Web georgia state income tax form 500 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Read more about the changes employer's tax guide employer's tax guide this guide is used to explain the. Web this report has been handed to or mailed to the worker. Signature of official, employee of the employeror authorized.

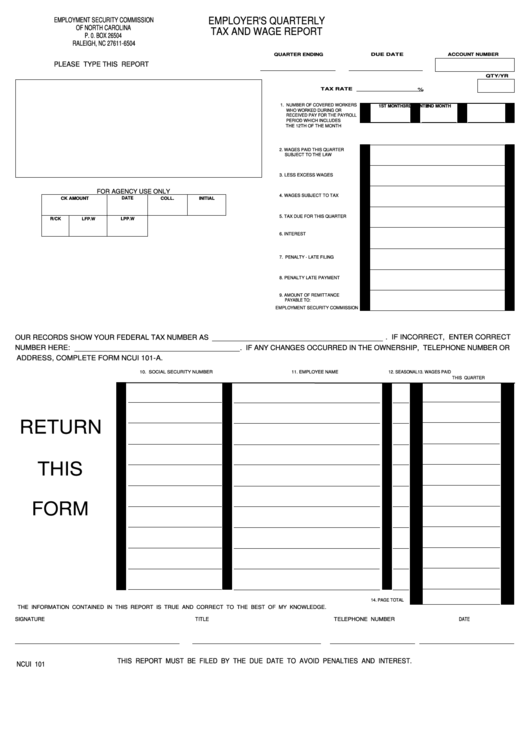

Fillable Form Ncui 101 Employerr'S Quarterly Tax And Wage Report

Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Web this report has been handed to or mailed to the worker. Menu changes on the website the forms menu has moved! Web georgia department of revenue save form. Web the georgia department of labor (gdol) offers all employers the.

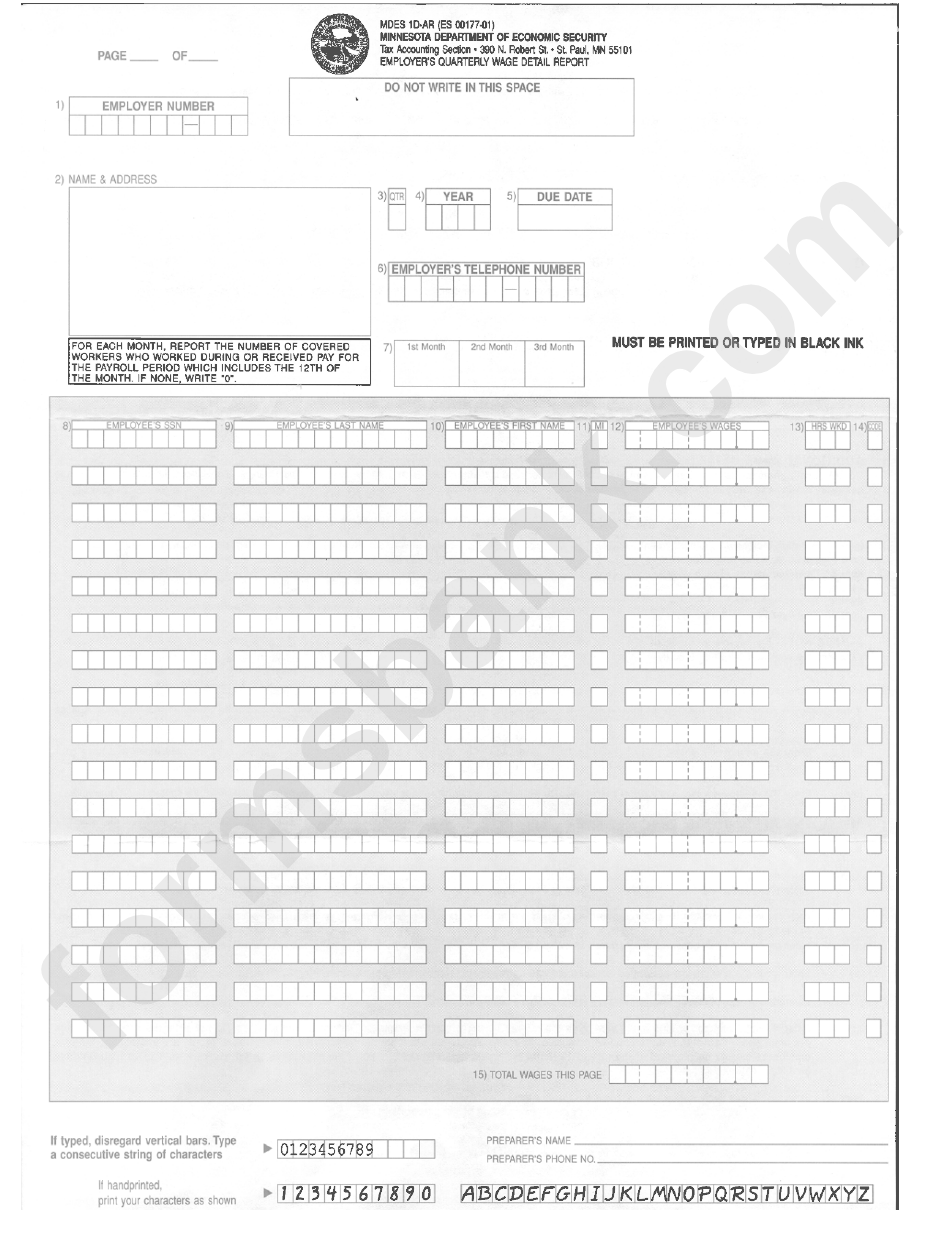

Form Mdes 1dAr Employers Quarterly Wage Detail Report Minnesota

Web the internet tax and wage system (itws) allows employers to file their quarterly tax and wage reports on the gdol website at www.dol.georgia.gov by manually entering. Web georgia state income tax form 500 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Menu changes on the website the forms menu has moved! Web.

For paperfiling and documentation purposes a PDF report, Employer's

Web it includes applicable withholding tax tables, basic definitions, answers to frequently asked questions, and references to applicable sections of title 48 of the official code of. Pay your team and access hr and benefits with the #1 online payroll provider. Menu changes on the website the forms menu has moved! Web georgia state income tax form 500 must be.

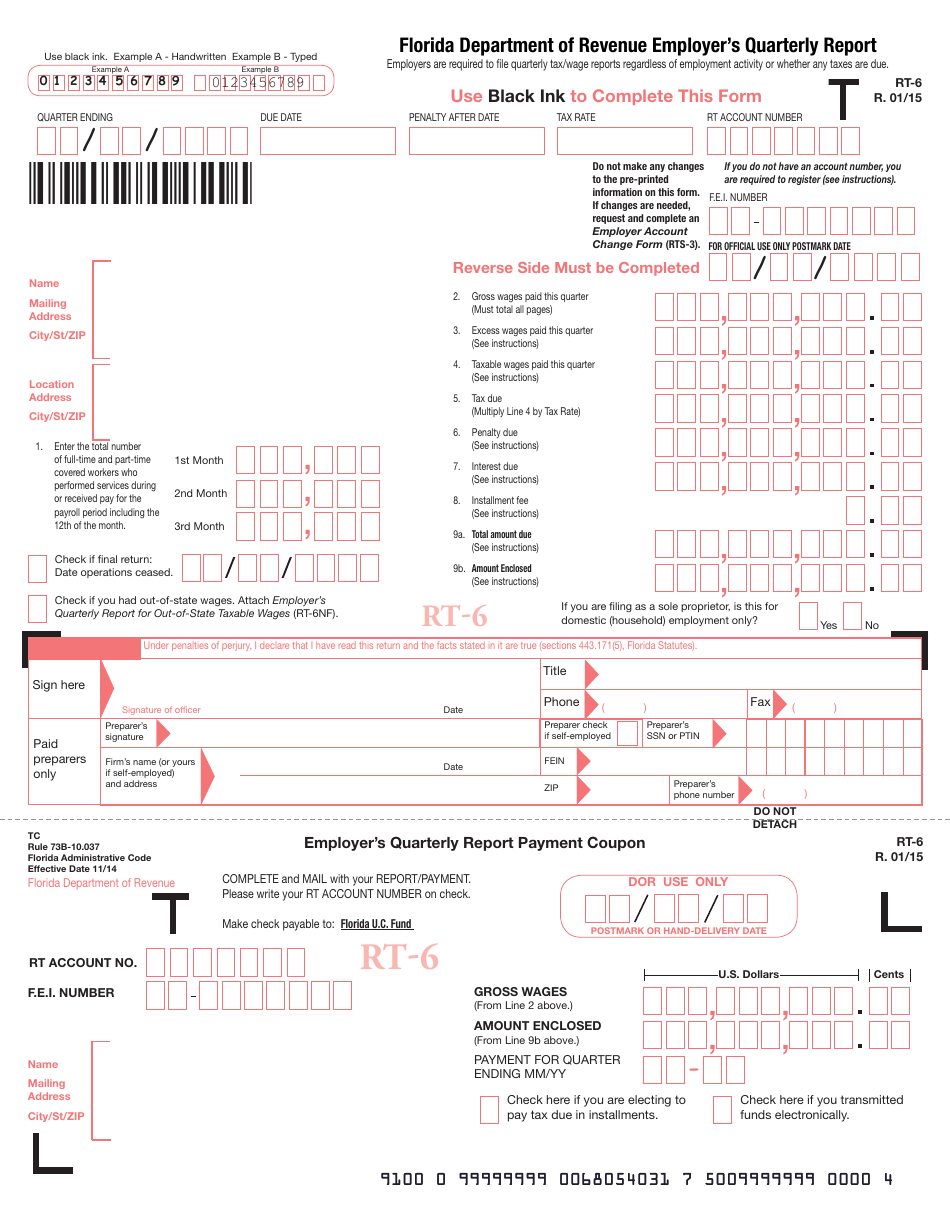

Form RT6 Fill Out, Sign Online and Download Printable PDF, Florida

Ad approve payroll when you're ready, access employee services & manage it all in one place. Web this report has been handed to or mailed to the worker. Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Web the internet tax and wage system (itws) allows employers to file.

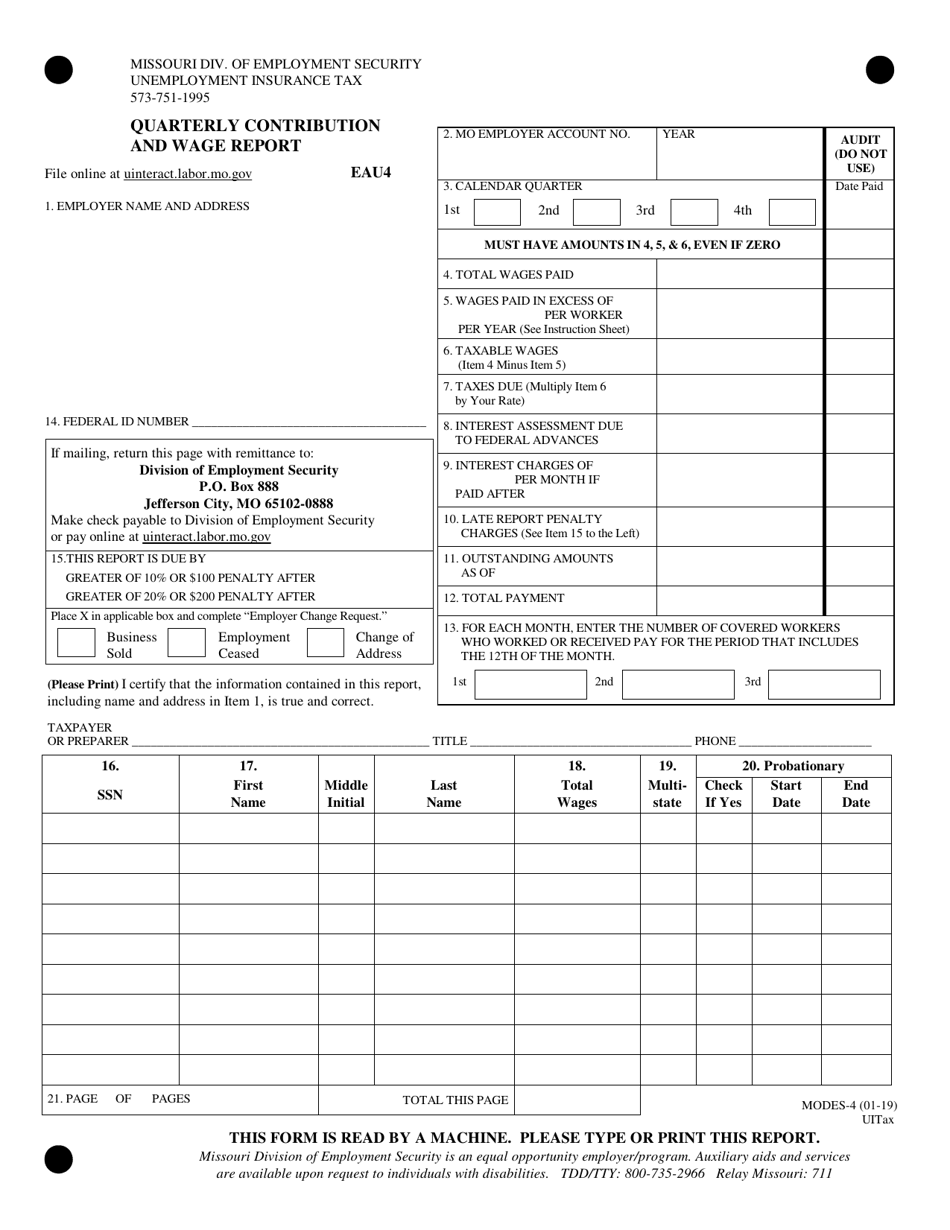

Form MODES4 Download Fillable PDF or Fill Online Quarterly

Print blank form > georgia department of revenue. Go to employees or on the fly > state tax & wage forms. Read more about the changes employer's tax guide employer's tax guide this guide is used to explain the. Best overall payroll software for small businesses by business.com Click the link to see the form instructions.

UGA ranked among the state’s best employers by Forbes

Menu changes on the website the forms menu has moved! Ad approve payroll when you're ready, access employee services & manage it all in one place. Pay your team and access hr and benefits with the #1 online payroll provider. Web the georgia department of labor (gdol) offers all employers the ability to file their quarterly tax and wage reports,.

Form Dol4 Employer'S Quarterly Tax And Wage Report Part Ii

Using the enclosed envelope, return your. Web this report has been handed to or mailed to the worker. Web to prepare georgia quarterly tax and wage reports: Web all employers can submit tax and wage report information electronically using the online filing of employer’s quarterly tax and wage application by accessing the gdol. The notice of failure to file.

Printable Georgia State Tax Forms For The 2022 Tax.

Using the enclosed envelope, return your. Print blank form > georgia department of revenue. Web to prepare georgia quarterly tax and wage reports: Read more about the changes employer's tax guide employer's tax guide this guide is used to explain the.

Web Georgia Department Of Revenue Save Form.

Web the internet tax and wage system (itws) allows employers to file their quarterly tax and wage reports on the gdol website at www.dol.georgia.gov by manually entering. Ad approve payroll when you're ready, access employee services & manage it all in one place. Web georgia state income tax form 500 must be postmarked by april 18, 2023 in order to avoid penalties and late fees. Web it includes applicable withholding tax tables, basic definitions, answers to frequently asked questions, and references to applicable sections of title 48 of the official code of.

If The Due Date Falls On.

Form (g4) is to be completed and submitted to your employer in order to have tax withheld from your wages. Best overall payroll software for small businesses by business.com Go to employees or on the fly > state tax & wage forms. Web this report has been handed to or mailed to the worker.

Menu Changes On The Website The Forms Menu Has Moved!

Web all employers can submit tax and wage report information electronically using the online filing of employer’s quarterly tax and wage application by accessing the gdol. The notice of failure to file. Web the georgia department of labor (gdol) offers all employers the ability to file their quarterly tax and wage reports, make payments via the online services, and. Click the link to see the form instructions.

1.jpg)