G 7 Form

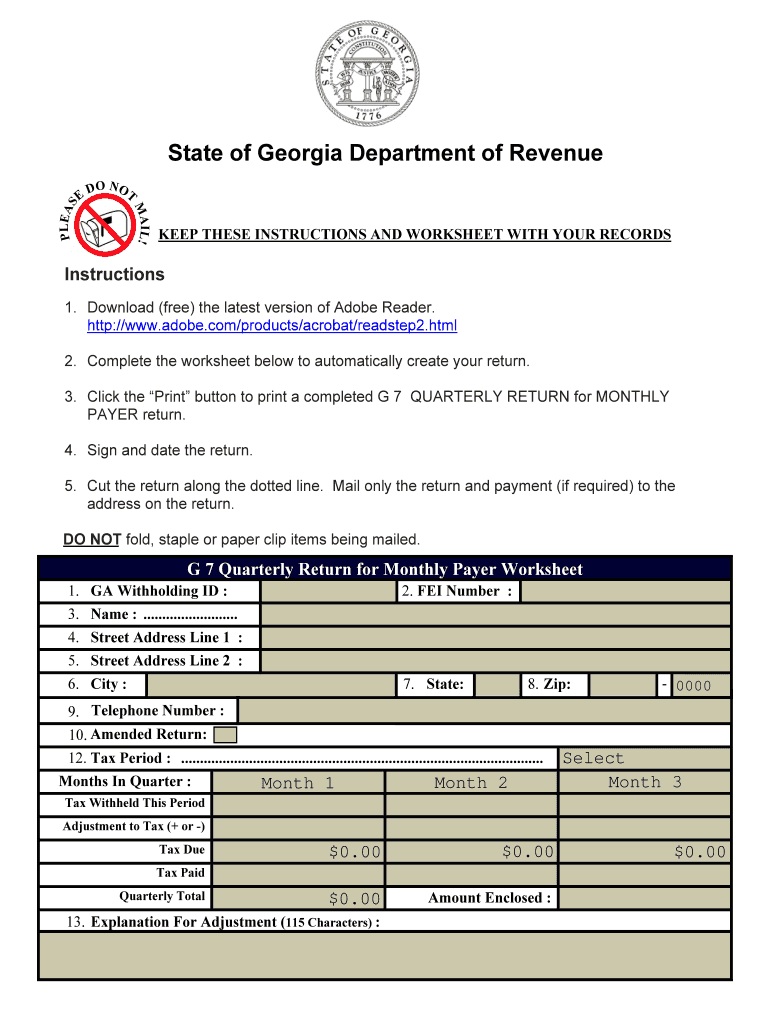

G 7 Form - The form is used to calculate and report your state income. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Printing and scanning is no longer the best way to manage documents. Nonresident withholding id fei number period ending due date vendor code. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. Web handy tips for filling out g 7 form online. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web log into gtc, click on the withholding payroll number, select the return period and import the template. The form is used to calculate and report your state income. Use get form or simply click on the template preview to open it in the editor.

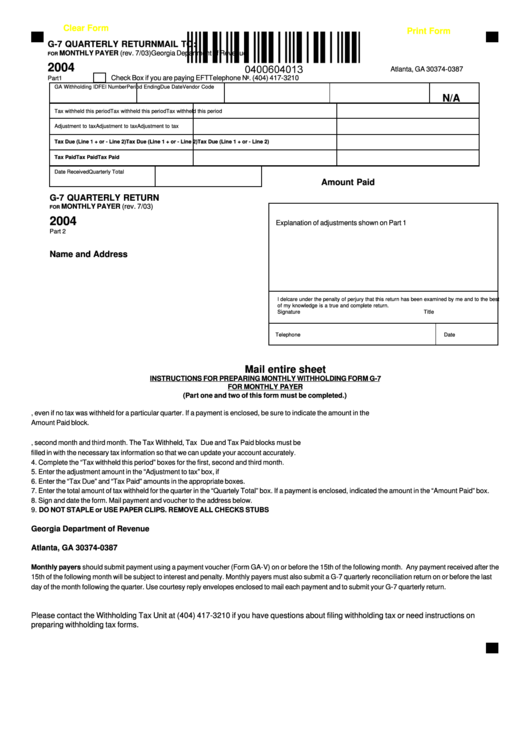

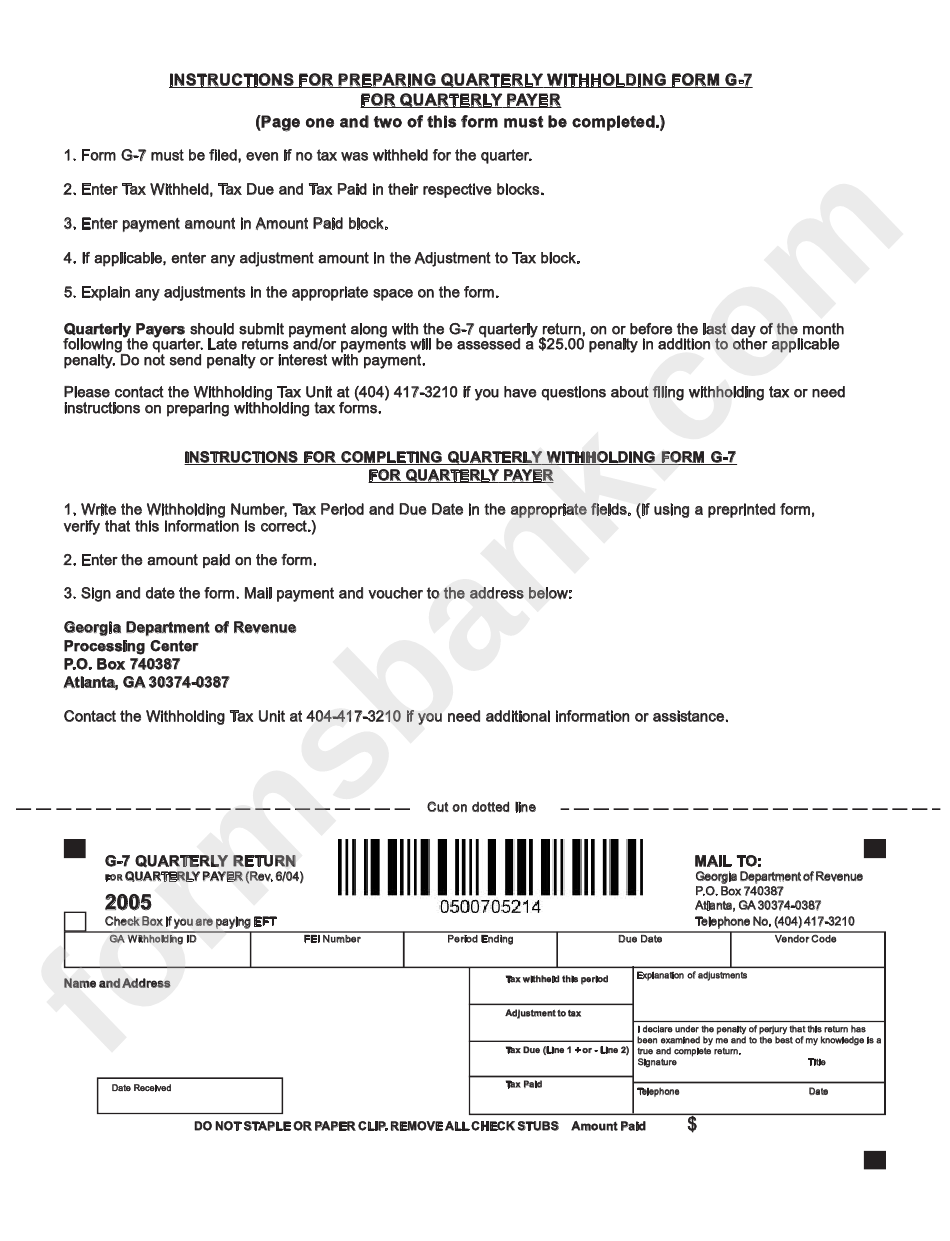

Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. For additional information about this return, please visit the department of. E n te r th e ta x. The form is used to calculate and report your state income. Web log into gtc, click on the withholding payroll number, select the return period and import the template. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. If a payment is enclosed, be sure to indicate the amount in the amount paid block. Use get form or simply click on the template preview to open it in the editor. If the due date falls on. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability.

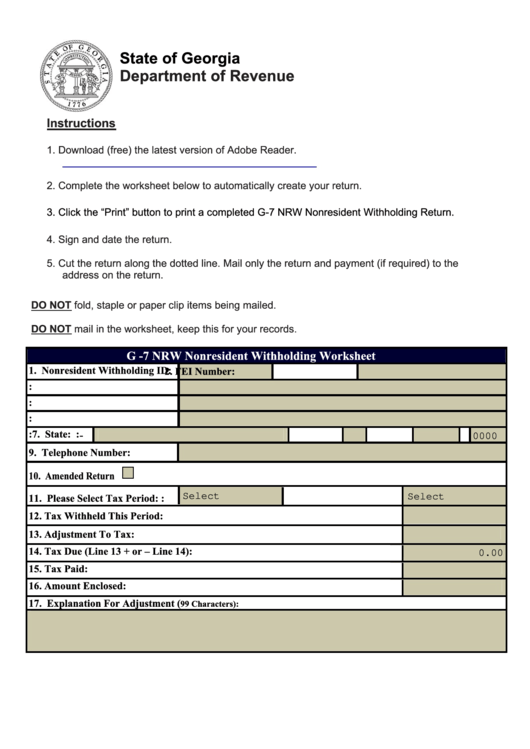

How to file a g7 monthly return.pdf (746.19 kb) The form is used to calculate and report your state income. If the due date falls on. E n te r th e ta x. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. For additional information about this return, please visit the department of. Nonresident withholding id fei number period ending due date vendor code. The form is used to calculate and report your state income. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Go digital and save time with signnow, the best solution for.

2015 Form GA DoR G7 Fill Online, Printable, Fillable, Blank pdfFiller

Web log into gtc, click on the withholding payroll number, select the return period and import the template. The form is used to calculate and report your state income. How to file a g7 monthly return.pdf (746.19 kb) Web handy tips for filling out g 7 form online. Go digital and save time with signnow, the best solution for.

Fillable Form G7 Quarterly Return 2004 printable pdf download

The form is used to calculate and report your state income. E n te r th e ta x. Go digital and save time with signnow, the best solution for. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web handy tips for filling.

Fillable Form G7 Nrw Nonresident Withholding Return

Web handy tips for filling out g 7 form online. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. For additional information about this return, please visit the department of. The form is used to calculate and report your state income. How to file a g7 monthly return.pdf.

Form G7 Quarterly Withholding For Quarterly Payer 2004 printable

If the due date falls on. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. How to file a.

G 7

The form is used to calculate and report your state income. Web log into gtc, click on the withholding payroll number, select the return period and import the template. Use get form or simply click on the template preview to open it in the editor. How to file a g7 monthly return.pdf (746.19 kb) The form is used to calculate.

P&G (7) AM Photography

Web log into gtc, click on the withholding payroll number, select the return period and import the template. The form is used to calculate and report your state income. For additional information about this return, please visit the department of. This instructional document explains how to file a g7 monthly return. E n te r th e ta x.

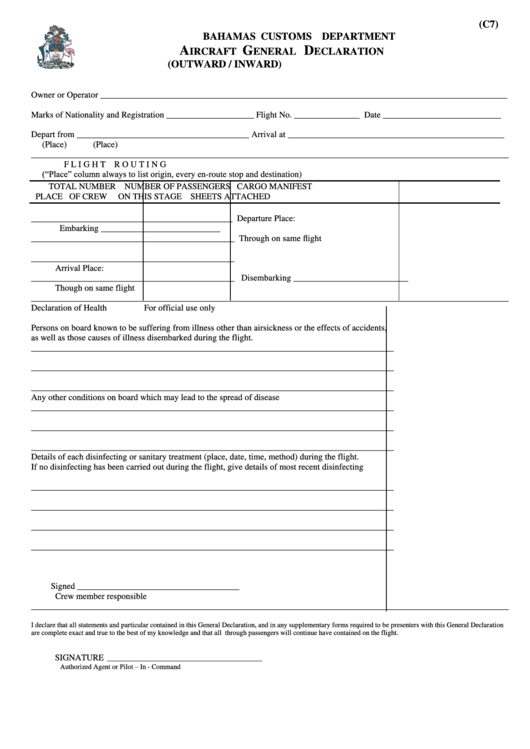

Form C7 Bahamas printable pdf download

This instructional document explains how to file a g7 monthly return. If the due date falls on. E n te r th e ta x. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. How to file a g7 monthly return.pdf (746.19 kb)

mseb app download howtogrownailsfasterinadaytips

E n te r th e ta x. If the due date falls on. If a payment is enclosed, be sure to indicate the amount in the amount paid block. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. How to file a g7.

GForm Elite Short Liner Reviews

The form is used to calculate and report your state income. E n te r th e ta x. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Nonresident withholding id fei number period ending due date vendor code. Use get form or simply.

What's the G7, what countries are members, what does the group do and

Printing and scanning is no longer the best way to manage documents. How to file a g7 monthly return.pdf (746.19 kb) The form is used to calculate and report your state income. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability. Web log into gtc, click on the.

Nonresident Withholding Id Fei Number Period Ending Due Date Vendor Code.

This instructional document explains how to file a g7 monthly return. Web the georgia form g 7 is a state tax form that must be filed by all georgia residents who earn income during the year. Web handy tips for filling out g 7 form online. Web the georgia g7 withholding return, uses employee data from all states and calculates the georgia department of revenue tax liability.

If A Payment Is Enclosed, Be Sure To Indicate The Amount In The Amount Paid Block.

The form is used to calculate and report your state income. Go digital and save time with signnow, the best solution for. E n te r th e ta x. Printing and scanning is no longer the best way to manage documents.

Web The Georgia Form G 7 Is A State Tax Form That Must Be Filed By All Georgia Residents Who Earn Income During The Year.

Web log into gtc, click on the withholding payroll number, select the return period and import the template. How to file a g7 monthly return.pdf (746.19 kb) Use get form or simply click on the template preview to open it in the editor. The form is used to calculate and report your state income.

If The Due Date Falls On.

For additional information about this return, please visit the department of.