Free Form 9465

Free Form 9465 - Web irs free file online: Web where to file your taxes for form 9465. Download form 9465 there are two ways to obtain form 9465. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. December 2011) if you are filing this form with your tax return, attach it to the front of the return. Complete, edit or print tax forms instantly. Web what is form 9465? Don't file if your business is. English form 9465, installment agreement request if you can’t pay your federal income taxes in full, you may be eligible to request an installment. If you select this option, you must manually print.

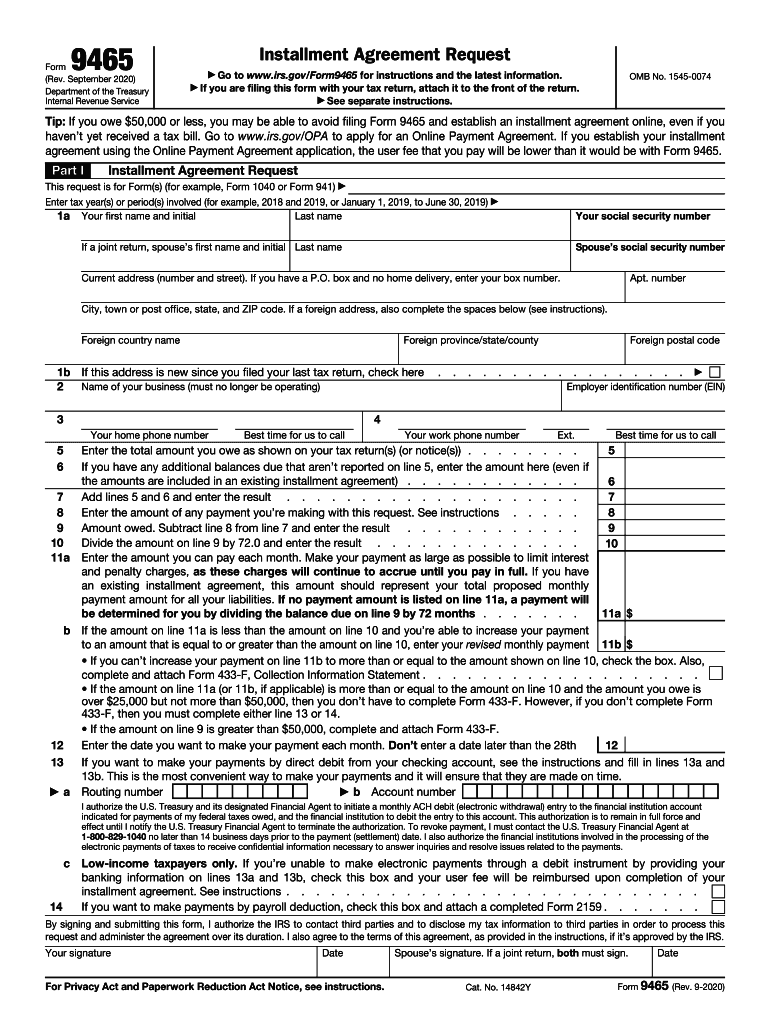

Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Ad access irs tax forms. Don't file if your business is. The following taxpayers can use form 9465 to request a payment plan:. Don't file this form if you can pay your balance in full within 120 days. Web who can use irs form 9465? First is going to the irs website and downloading it yourself. Web for the latest developments related to form 9465 and its instructions, such as legislation enacted after they were published, go to irs.gov/form9465. Answer the following questions to find an irs free file provider. If you are filing form 9465 with your return, attach it to the front of your return when you file.

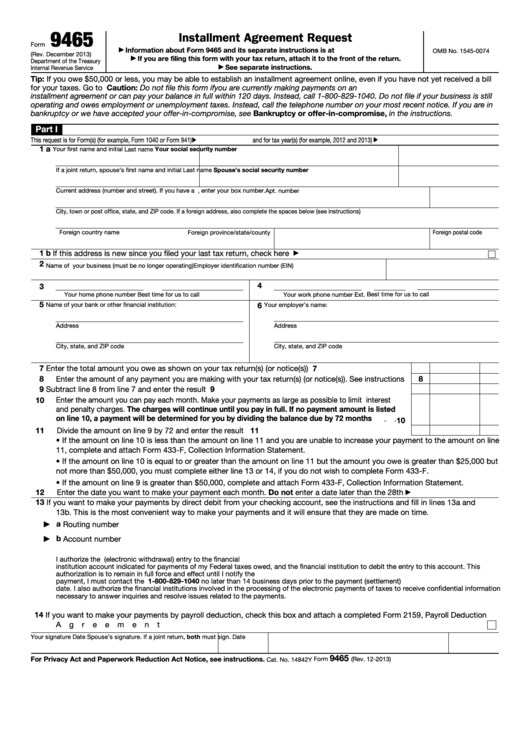

English form 9465, installment agreement request if you can’t pay your federal income taxes in full, you may be eligible to request an installment. Web 9465 installment agreement request form (rev. Businesses can only use this form if they are out of business. If you select this option, you must manually print. It is a good idea to at least pay a portion of our tax debt before asking for. Don't file if your business is. This form is for income earned in tax year 2022, with tax returns due in april. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Web irs form payment plan 9465 is a document you can file to request said payment plan. Download form 9465 there are two ways to obtain form 9465.

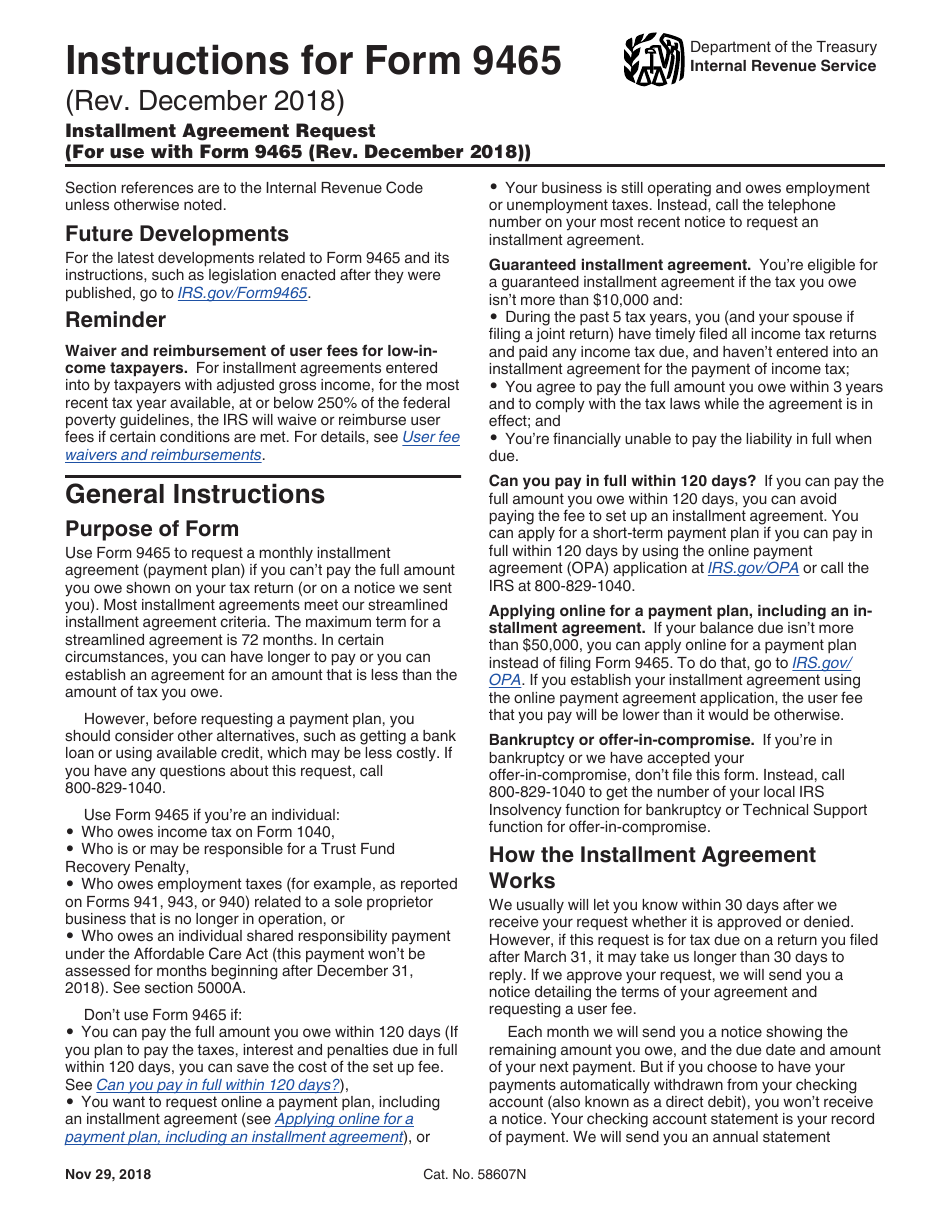

Download Instructions for IRS Form 9465 Installment Agreement Request

If you are filing form 9465 with your return, attach it to the front of your return when you file. If you are filing form 9465. Ad access irs tax forms. First is going to the irs website and downloading it yourself. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full.

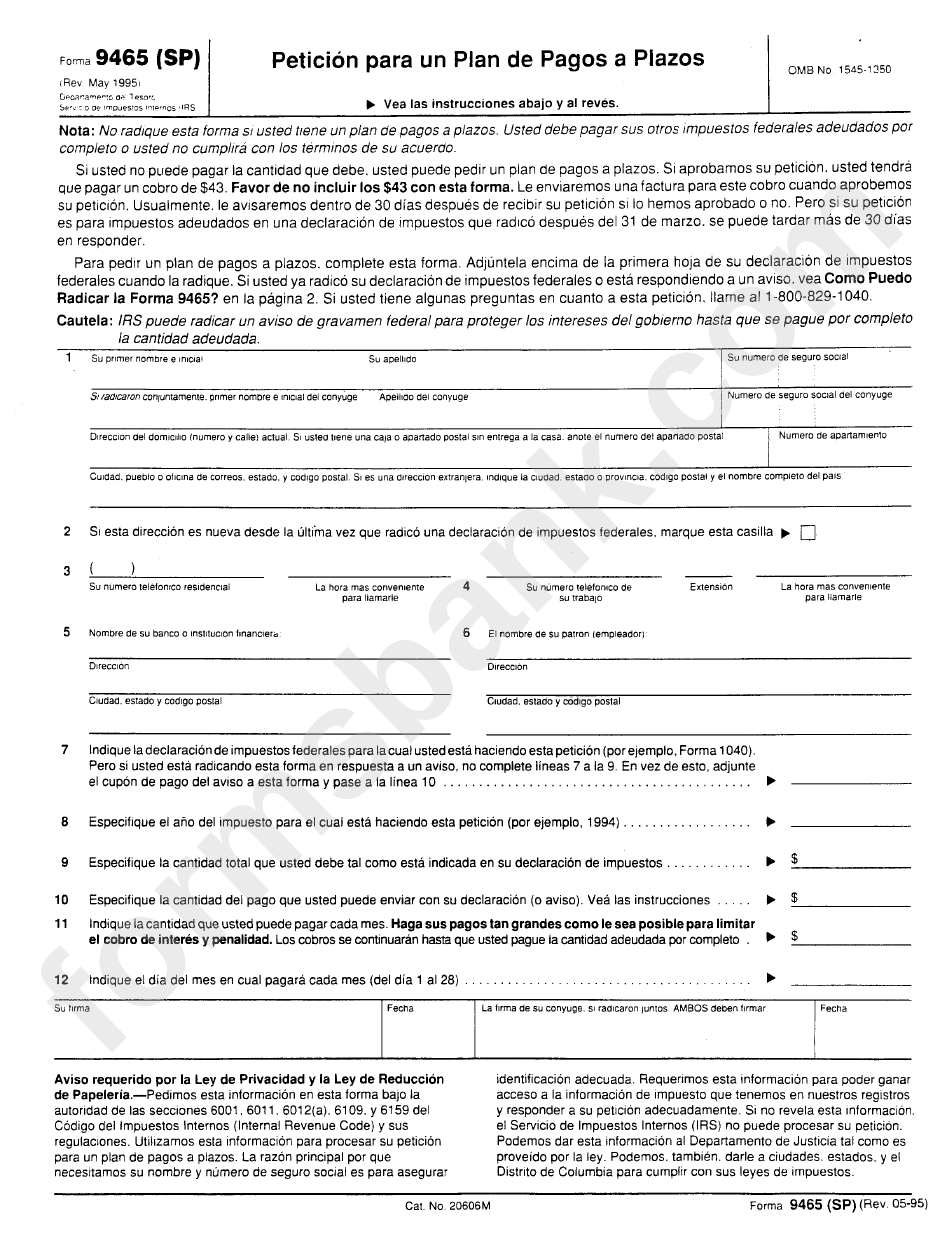

Form 9465 Sp Petitcion Para Un Plan De Pagos A Plazos printable pdf

Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. Web irs form payment plan 9465 is a document you can file to request said payment plan. Web up to $40 cash back irs form 9465 is known as the installment agreement request form 9465 is designed by the internal revenue service for individuals.

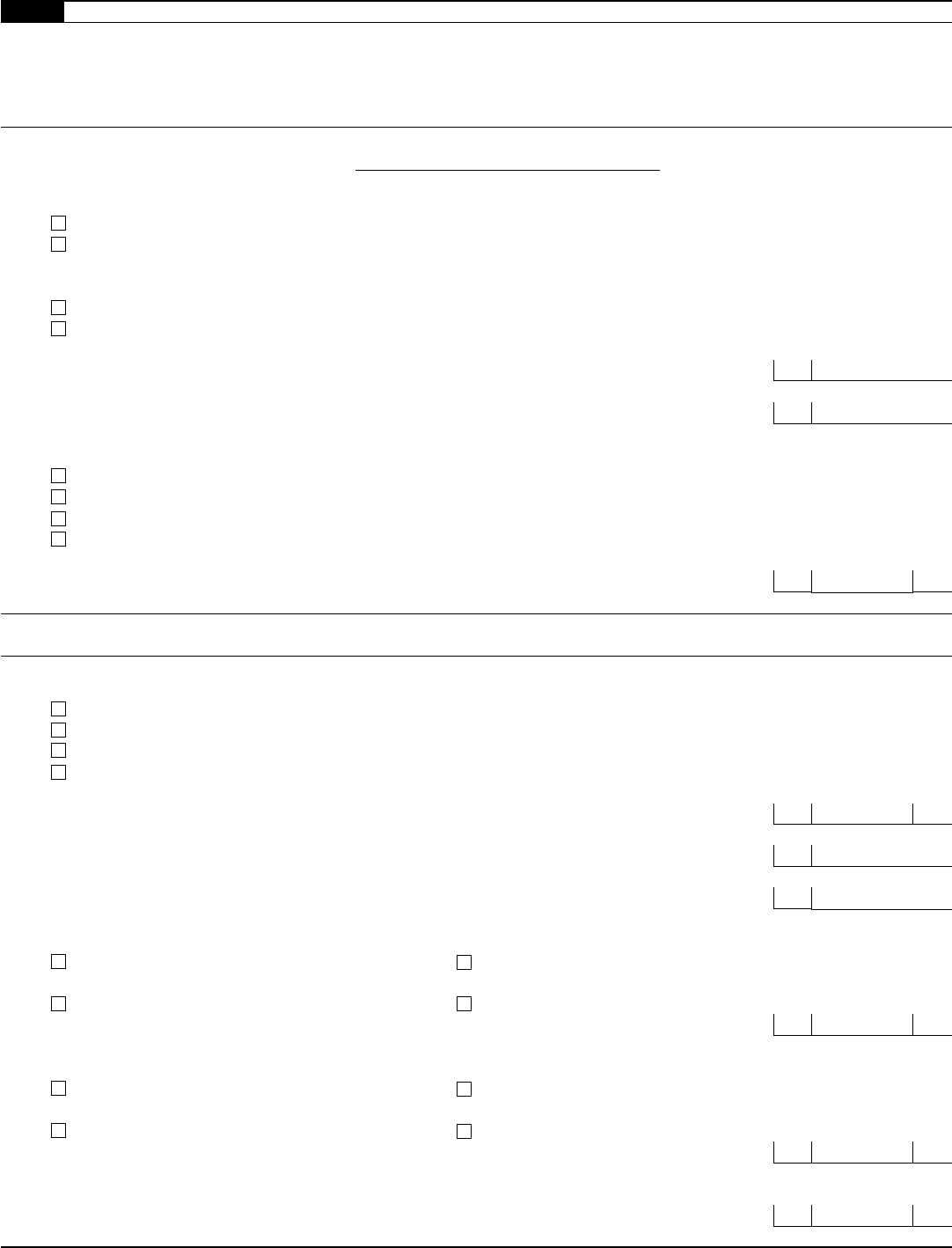

Stay on Top of your Tax Installments by Filing Form 9465

Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. December 2011) if you are filing this form with your tax return, attach it to the front of the return. If you are filing form 9465 with your return, attach.

Form 9465 (Rev. February 2017) Edit, Fill, Sign Online Handypdf

The following taxpayers can use form 9465 to request a payment plan:. Web who can use irs form 9465? First is going to the irs website and downloading it yourself. It is a good idea to at least pay a portion of our tax debt before asking for. If you select this option, you must manually print.

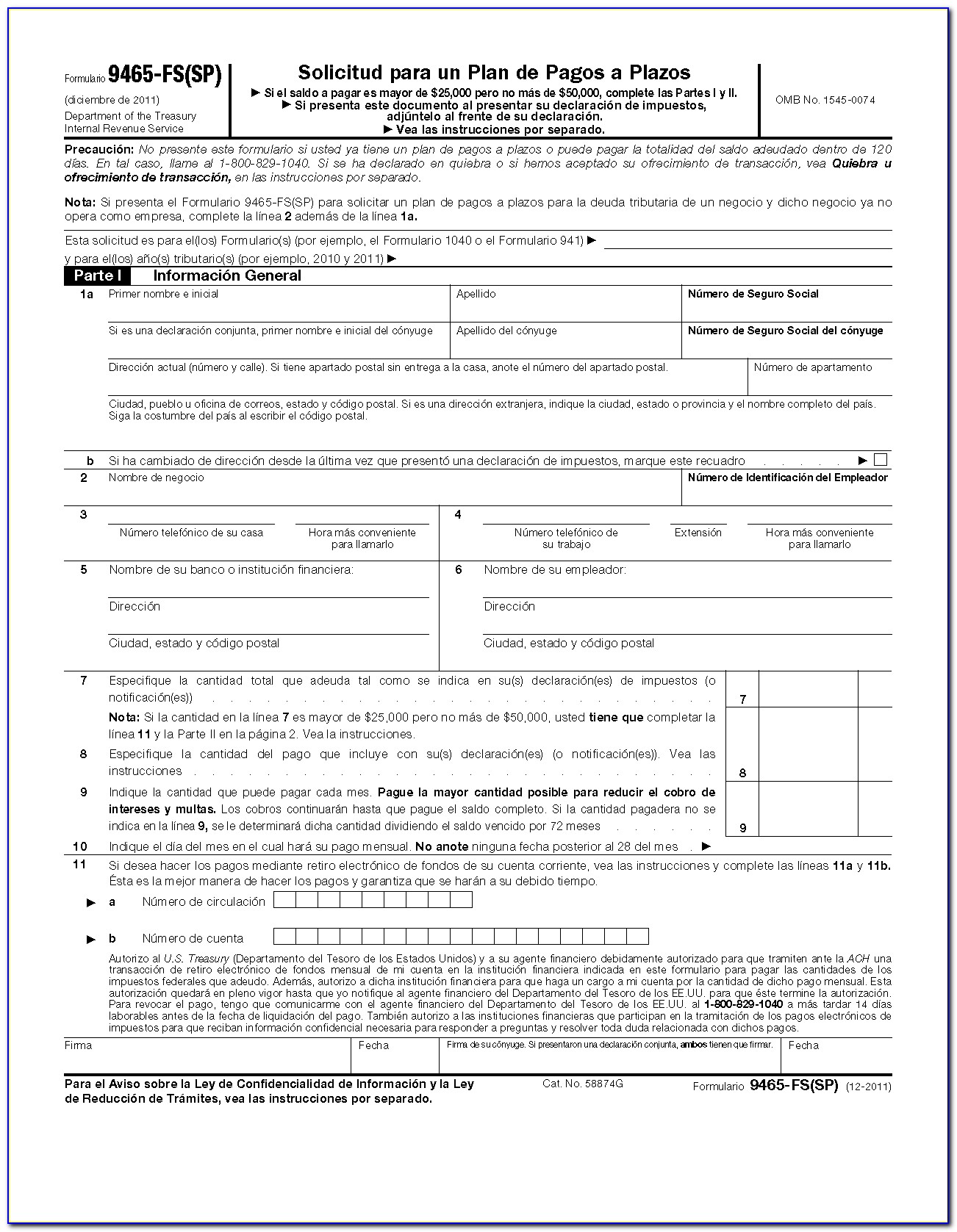

Form 9465FS Installment Agreement Request (2011) Free Download

This form is for income earned in tax year 2022, with tax returns due in april. Businesses can only use this form if they are out of business. Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Web go.

Irs Payment Form 9465 Form Resume Examples EvkBqoxO2d

The following taxpayers can use form 9465 to request a payment plan:. Web 9465 installment agreement request form (rev. Web irs free file online: It is a good idea to at least pay a portion of our tax debt before asking for. Web irs form payment plan 9465 is a document you can file to request said payment plan.

940 Form 2021

Web irs free file online: Ad access irs tax forms. The following taxpayers can use form 9465 to request a payment plan:. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. Web form 9465 is primarily for individuals.

Fillable Form 9465 Installment Agreement Request printable pdf download

Complete, edit or print tax forms instantly. Web where to file your taxes for form 9465. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). Web go to irs.gov to apply to pay online. Web 9465.

28 Irs form 9465 Fillable in 2020 Irs forms, Letter templates free

Web irs free file online: Complete, edit or print tax forms instantly. Don't file if your business is. Web irs form payment plan 9465 is a document you can file to request said payment plan. Web what is form 9465?

20202023 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

English form 9465, installment agreement request if you can’t pay your federal income taxes in full, you may be eligible to request an installment. If you are filing form 9465 with your return, attach it to the front of your return when you file. If you select this option, you must manually print. Web we last updated federal form 9465.

Web Go To Irs.gov To Apply To Pay Online.

Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. Complete, edit or print tax forms instantly. Web where to file your taxes for form 9465. It is a good idea to at least pay a portion of our tax debt before asking for.

Don't File This Form If You Can Pay Your Balance In Full Within 120 Days.

Web irs free file online: Web irs form payment plan 9465 is a document you can file to request said payment plan. If you are filing form 9465. Web what is form 9465?

Don't File If Your Business Is.

Web the irs form 9465 is a document used to request a monthly installment plan if you cannot pay the full amount of taxes you owe by the due date. Web who can use irs form 9465? Download form 9465 there are two ways to obtain form 9465. English form 9465, installment agreement request if you can’t pay your federal income taxes in full, you may be eligible to request an installment.

Web 9465 Installment Agreement Request Form (Rev.

The following taxpayers can use form 9465 to request a payment plan:. If you select this option, you must manually print. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). First is going to the irs website and downloading it yourself.