Form W8Imy Instructions

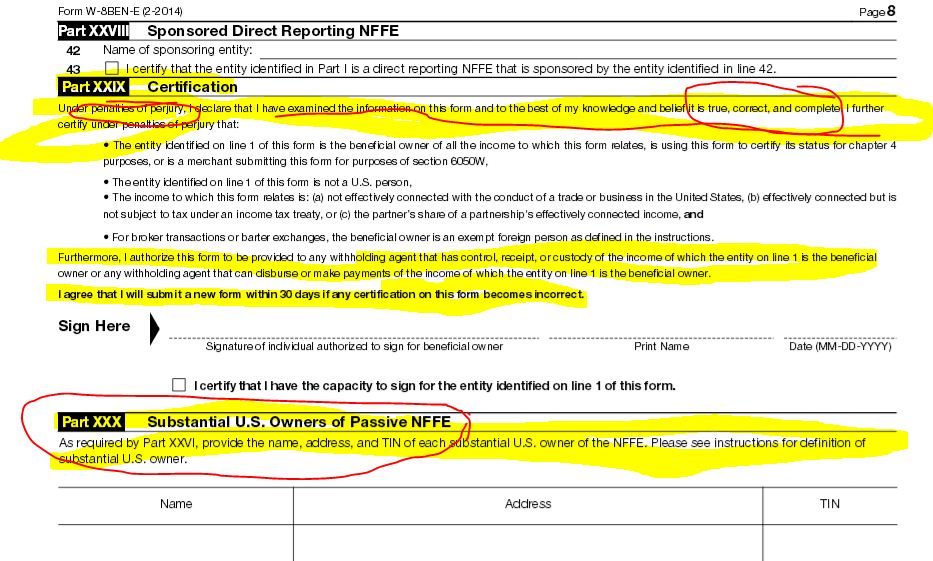

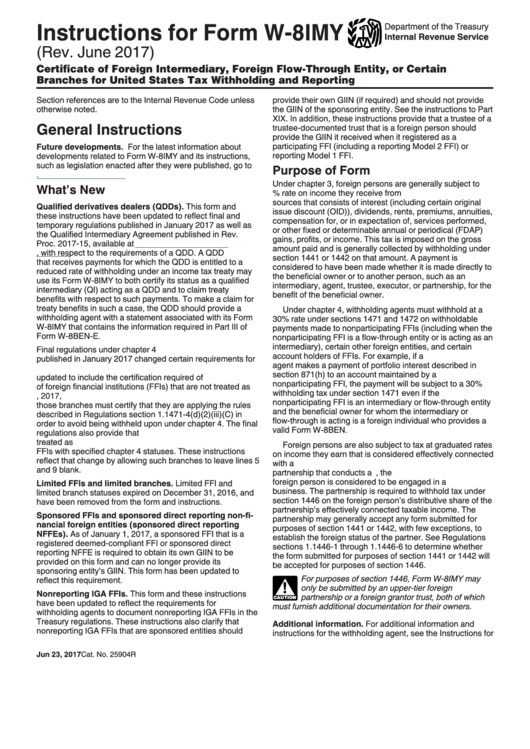

Form W8Imy Instructions - Represent that a foreign person is a qualified intermediary or nonqualified. Section references are to the internal revenue code. List the full legal name on your income tax return; October 2021) department of the treasury internal revenue service. Branches for united states tax withholding and reporting. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as. The updates were necessary, in part, due to the 2017 tax law (pub. Branches for united states tax withholding and reporting and its associated instructions. This form may serve to establish foreign status for purposes of. Branches for united states tax withholding and reporting.

Section references are to the internal revenue code. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as. Qi/wp or wt ein must match the number on line 8 of the form. Branches for united states tax withholding and reporting. This form may serve to establish foreign status for purposes of. For a sole proprietorship, list the business owner’s name line 2: Represent that a foreign person is a qualified intermediary or nonqualified. List the full legal name on your income tax return; October 2021) department of the treasury internal revenue service. List the full name of the entity that is the beneficial owner

The updates were necessary, in part, due to the 2017 tax law (pub. Branches for united states tax withholding and reporting and its associated instructions. Section references are to the internal revenue code. List the full name of the entity that is the beneficial owner Qi/wp or wt ein must match the number on line 8 of the form. For a sole proprietorship, list the business owner’s name line 2: October 2021) department of the treasury internal revenue service. This form may serve to establish foreign status for purposes of. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as. Branches for united states tax withholding and reporting.

Form W8IMY Edit, Fill, Sign Online Handypdf

Qi/wp or wt ein must match the number on line 8 of the form. This form may serve to establish foreign status for purposes of. The updates were necessary, in part, due to the 2017 tax law (pub. Branches for united states tax withholding and reporting. List the full legal name on your income tax return;

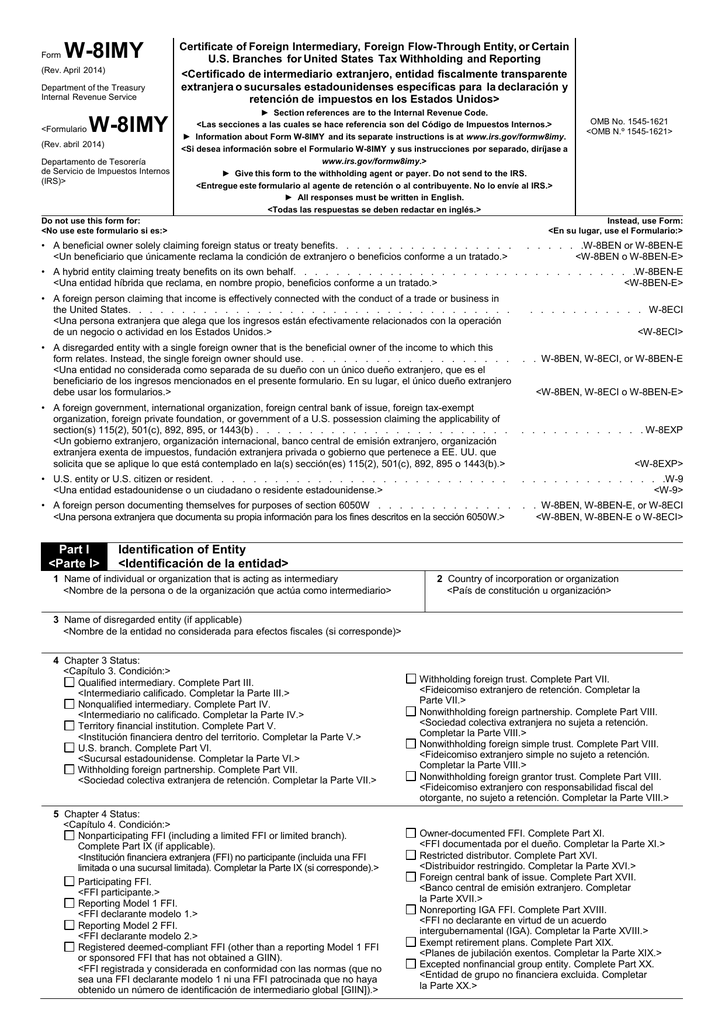

W 8imy Instructions 2016

For a sole proprietorship, list the business owner’s name line 2: Section references are to the internal revenue code. Branches for united states tax withholding and reporting. The updates were necessary, in part, due to the 2017 tax law (pub. List the full legal name on your income tax return;

Form W8IMY Certificate of Foreign Intermediary, Foreign Flowthrough

Branches for united states tax withholding and reporting. This form may serve to establish foreign status for purposes of. For a sole proprietorship, list the business owner’s name line 2: October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that.

W8 imy instructions tikloodd

List the full legal name on your income tax return; Represent that a foreign person is a qualified intermediary or nonqualified. Branches for united states tax withholding and reporting. Branches for united states tax withholding and reporting and its associated instructions. Qi/wp or wt ein must match the number on line 8 of the form.

Instructions For Completing W8ben & W8imy Forms printable pdf download

List the full name of the entity that is the beneficial owner Section references are to the internal revenue code. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for.

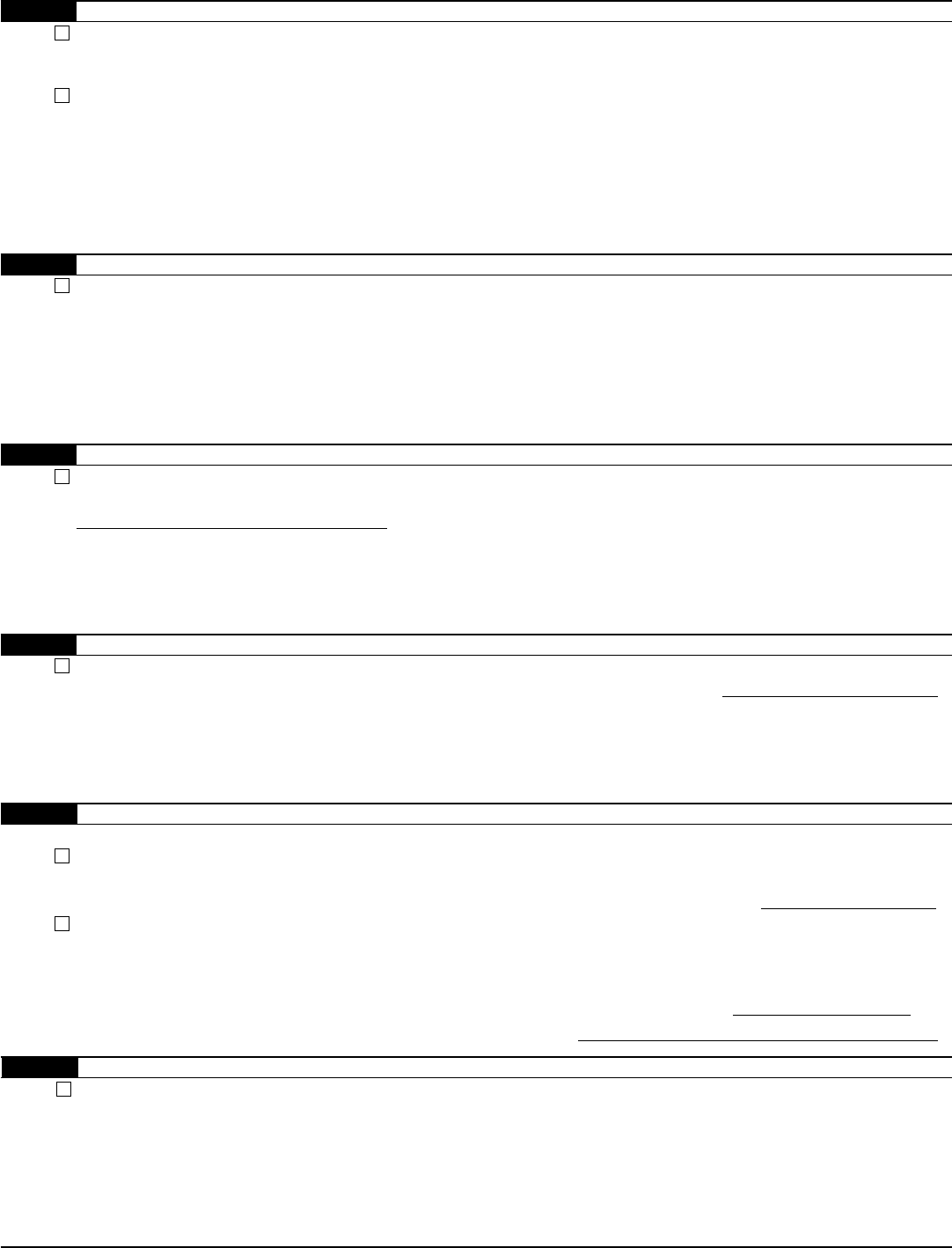

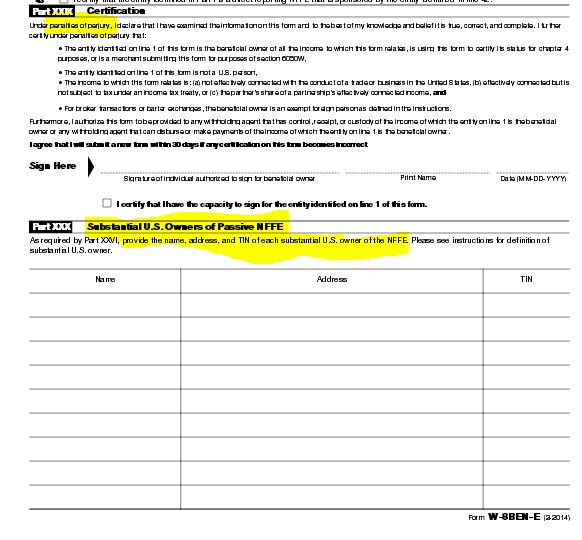

W 8ben E Instructions

List the full legal name on your income tax return; For a sole proprietorship, list the business owner’s name line 2: Branches for united states tax withholding and reporting. The updates were necessary, in part, due to the 2017 tax law (pub. Qi/wp or wt ein must match the number on line 8 of the form.

Form W8IMY Edit, Fill, Sign Online Handypdf

Section references are to the internal revenue code. List the full name of the entity that is the beneficial owner Represent that a foreign person is a qualified intermediary or nonqualified. This form may serve to establish foreign status for purposes of. Branches for united states tax withholding and reporting.

Form W8IMY Certificate of Foreign Intermediary, Foreign FlowThrough

Represent that a foreign person is a qualified intermediary or nonqualified. List the full legal name on your income tax return; For a sole proprietorship, list the business owner’s name line 2: October 2021) department of the treasury internal revenue service. Branches for united states tax withholding and reporting.

Form W 8imy Instructions

October 2021) department of the treasury internal revenue service. Section references are to the internal revenue code. The updates were necessary, in part, due to the 2017 tax law (pub. This form may serve to establish foreign status for purposes of. For a sole proprietorship, list the business owner’s name line 2:

What Is Form W8imy Charles Leal's Template

The updates were necessary, in part, due to the 2017 tax law (pub. List the full name of the entity that is the beneficial owner For a sole proprietorship, list the business owner’s name line 2: Branches for united states tax withholding and reporting. List the full legal name on your income tax return;

October 2021) Department Of The Treasury Internal Revenue Service.

Branches for united states tax withholding and reporting. This form may serve to establish foreign status for purposes of. Branches for united states tax withholding and reporting and its associated instructions. List the full name of the entity that is the beneficial owner

List The Full Legal Name On Your Income Tax Return;

October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be verified for consistency as. Represent that a foreign person is a qualified intermediary or nonqualified. Qi/wp or wt ein must match the number on line 8 of the form. Branches for united states tax withholding and reporting.

The Updates Were Necessary, In Part, Due To The 2017 Tax Law (Pub.

Section references are to the internal revenue code. For a sole proprietorship, list the business owner’s name line 2: