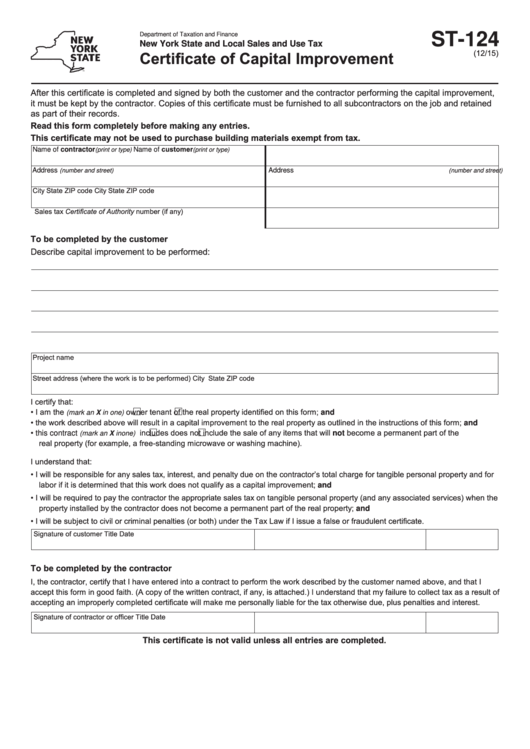

Form St 124

Form St 124 - Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. Nonprofit organizations that sell, or make it known. Web dor sales and use tax forms. The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. This certificate is only for use by a purchaser who: A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, This term also includes items such as doors, windows, sinks, and furnaces used in construction. You must give the contractor a properly completed form within 90 days after the service is rendered. Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the

A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. Web dor sales and use tax forms. This certificate is only for use by a purchaser who: This term also includes items such as doors, windows, sinks, and furnaces used in construction. That they sell, a product or related service. Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. You must give the contractor a properly completed form within 90 days after the service is rendered.

Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, You must give the contractor a properly completed form within 90 days after the service is rendered. (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. This term also includes items such as doors, windows, sinks, and furnaces used in construction. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the Nonprofit organizations that sell, or make it known. That they sell, a product or related service. The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project.

St12 form 2007 Fill out & sign online DocHub

Web dor sales and use tax forms. This certificate is only for use by a purchaser who: (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. Purchase orders showing an exemption from the sales or use tax based on.

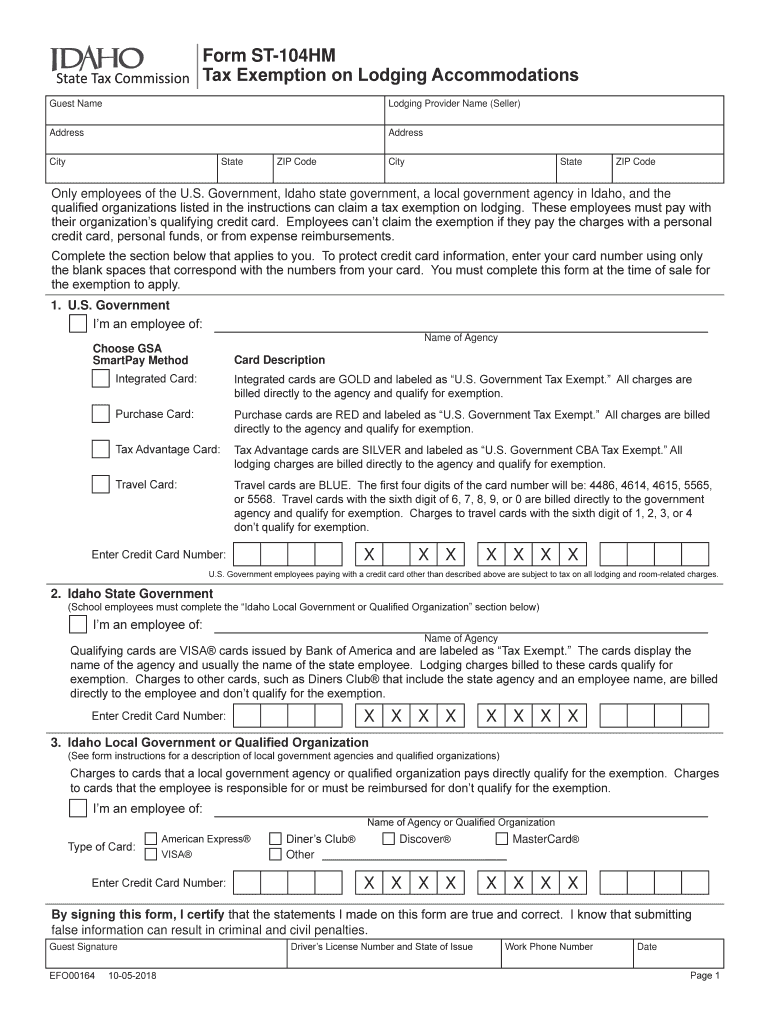

Idaho form st104 Fill out & sign online DocHub

Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, Web dor.

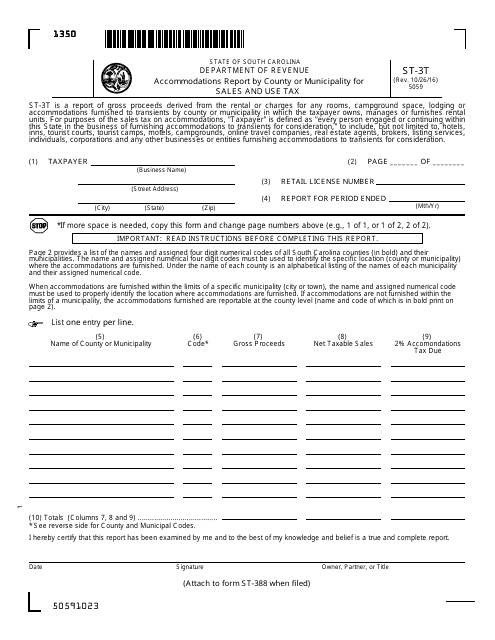

Form ST3t Download Printable PDF or Fill Online Report

That they sell, a product or related service. This certificate is only for use by a purchaser who: Nonprofit organizations that sell, or make it known. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, Web for collecting sales tax on retail sales.) retailers can be businesses,.

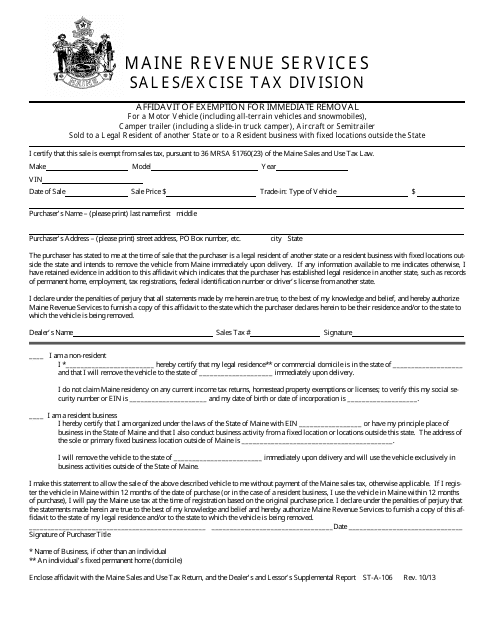

Form STA106 Download Printable PDF or Fill Online Affidavit of

(see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. You must give the contractor a properly completed form within 90 days after the service is rendered. The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for.

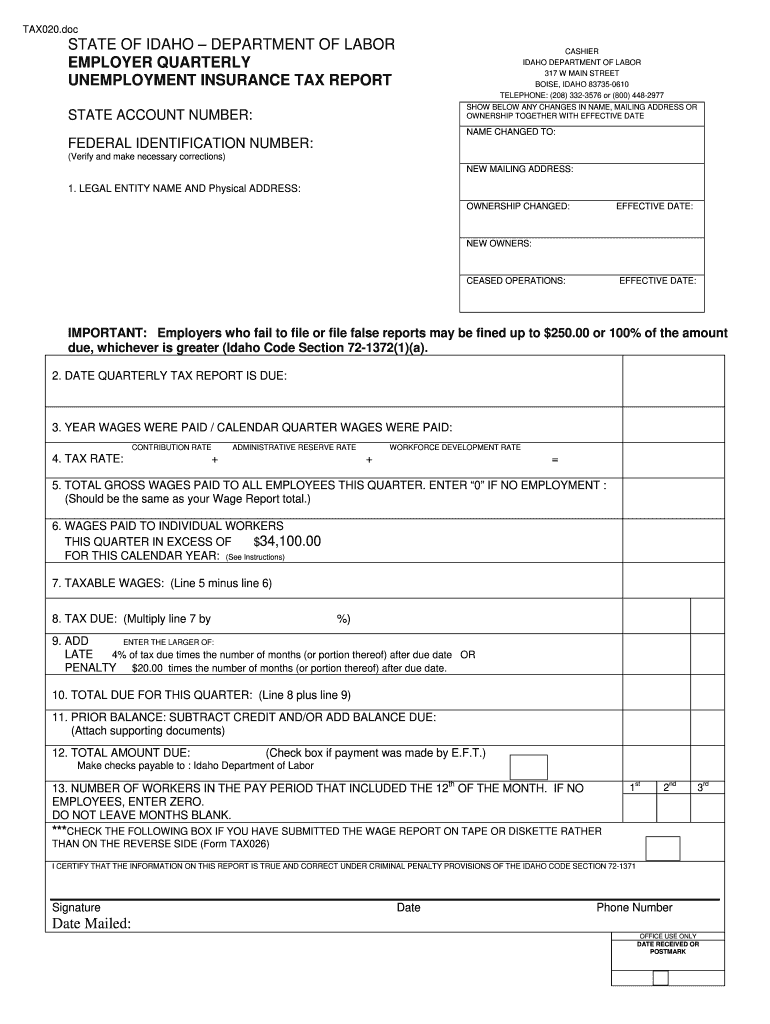

Tax020 form Fill out & sign online DocHub

Nonprofit organizations that sell, or make it known. Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, You must give the contractor a properly completed form.

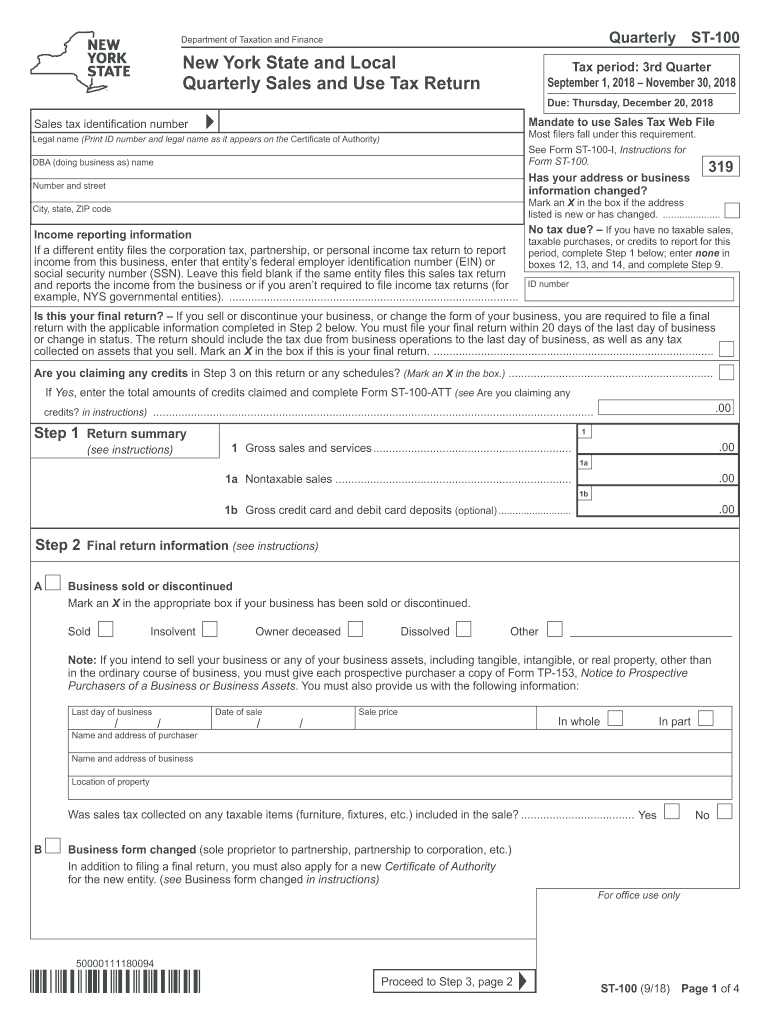

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller

Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor). You must give the contractor a properly completed form within 90 days after the service is rendered. (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or.

Getting A Home Improvement Loan Home Improvement Pennsylvania

Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. Nonprofit organizations that sell, or make it known. You must give the contractor a properly completed form within 90 days after the service is rendered. The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. (see publication 862 for additional.

How To Fill Out St 120 Form

Web dor sales and use tax forms. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, This certificate is only for use by a purchaser who: Here you will find an alphabetical listing of sales and use tax forms administered by the massachusetts department of revenue (dor)..

Form ST 124 Tax Ny Gov New York State Fill Out and Sign Printable PDF

(see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel. That they sell, a product or related service. Nonprofit organizations that sell, or make it known. Web dor sales and use tax forms. This term also includes items such as.

Fillable Form St124 Certificate Of Capital Improvement printable pdf

Nonprofit organizations that sell, or make it known. Web for collecting sales tax on retail sales.) retailers can be businesses, individuals, or even. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, Here you will find an alphabetical listing of sales and use tax forms administered by.

This Term Also Includes Items Such As Doors, Windows, Sinks, And Furnaces Used In Construction.

This certificate is only for use by a purchaser who: Web dor sales and use tax forms. A certificate is accepted in good faith when a contractor has no knowledge that the certificate is false or is fraudulently given, (see publication 862 for additional information.) the term materials is defined as items that become a physical component part of real or personal property, such as lumber, bricks, or steel.

Web For Collecting Sales Tax On Retail Sales.) Retailers Can Be Businesses, Individuals, Or Even.

Nonprofit organizations that sell, or make it known. The contractor must use a separate form st‑120.1, contractor exempt purchase certificate, for each project. That they sell, a product or related service. You must give the contractor a properly completed form within 90 days after the service is rendered.

Here You Will Find An Alphabetical Listing Of Sales And Use Tax Forms Administered By The Massachusetts Department Of Revenue (Dor).

Purchase orders showing an exemption from the sales or use tax based on this certificate must contain the address of the