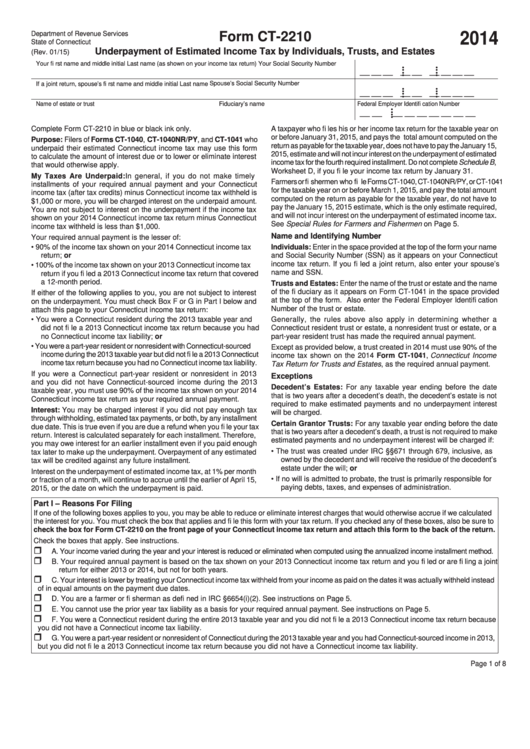

Form Ct 2210

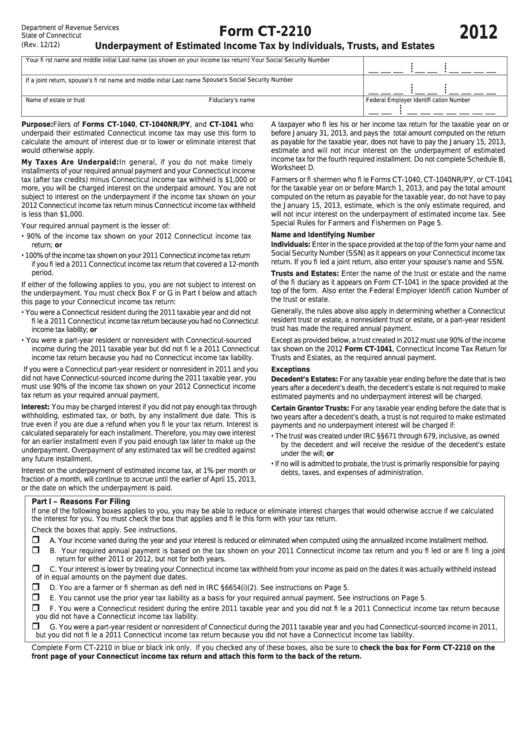

Form Ct 2210 - The irs will generally figure your penalty for you and you should not file form 2210. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Benefits to electronic filing include: Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Web if you are attaching a completed: Simple, secure, and can be completed from the comfort of your home. Web please complete this form and submit this request to:

Benefits to electronic filing include: Web if you are attaching a completed: 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Web file your 2022 connecticut income tax return online! Simple, secure, and can be completed from the comfort of your home. Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy.

Filers of forms ct‑1040connecticut resident income , tax returnct‑1040nr/py, , connecticut. Web please complete this form and submit this request to: Benefits to electronic filing include: Web connecticut individual forms availability. This will begin an appeal process that may result in the dcf’s finding being. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Simple, secure, and can be completed from the comfort of your home. Web if you are attaching a completed:

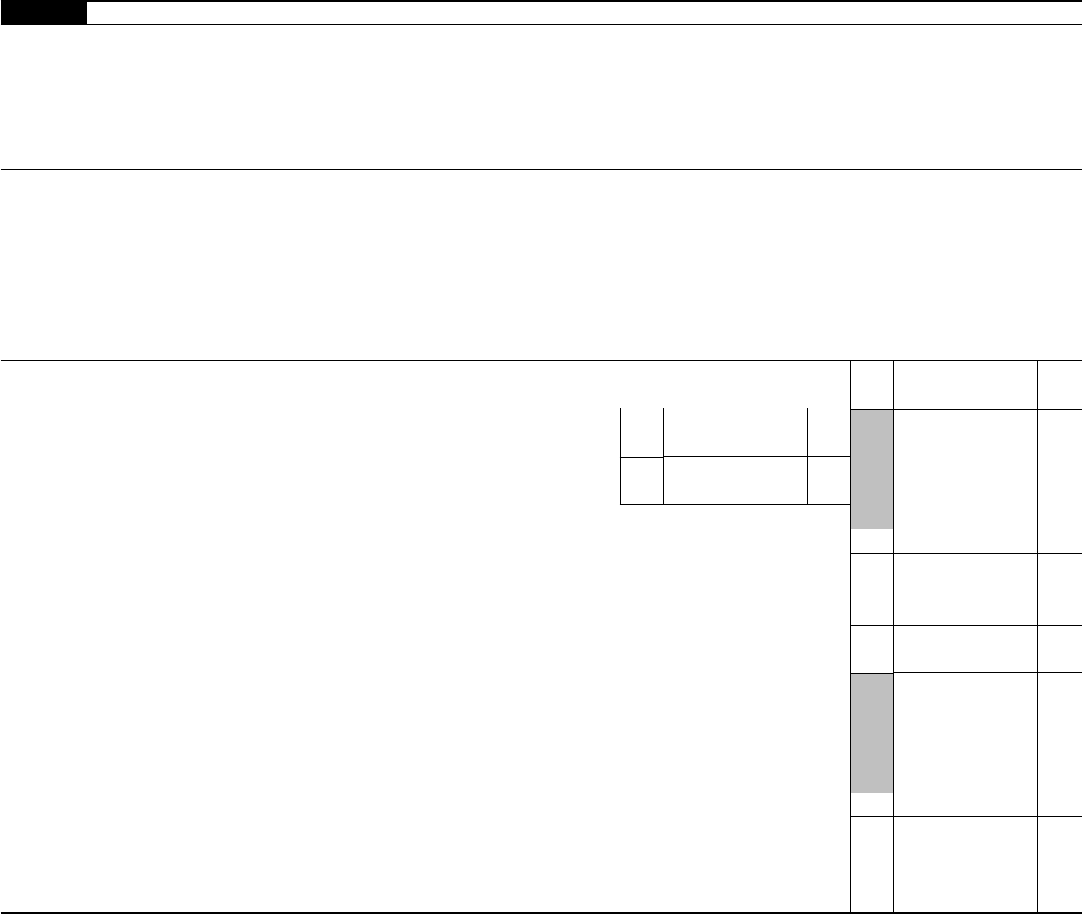

Form Ct2210 Underpayment Of Estimated Tax By Individuals

Web file your 2022 connecticut income tax return online! The irs will generally figure your penalty for you and you should not file form 2210. Benefits to electronic filing include: Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Other (e.g., copy of your federal return, other jurisdiction etc.) do.

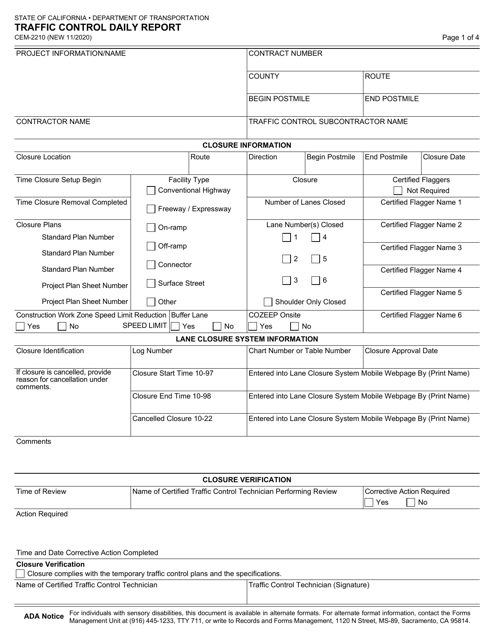

Form CEM2210 Download Fillable PDF or Fill Online Traffic Control

The irs will generally figure your penalty for you and you should not file form 2210. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. Web if you are attaching a completed: Benefits to electronic filing include: Web file your 2022 connecticut income tax.

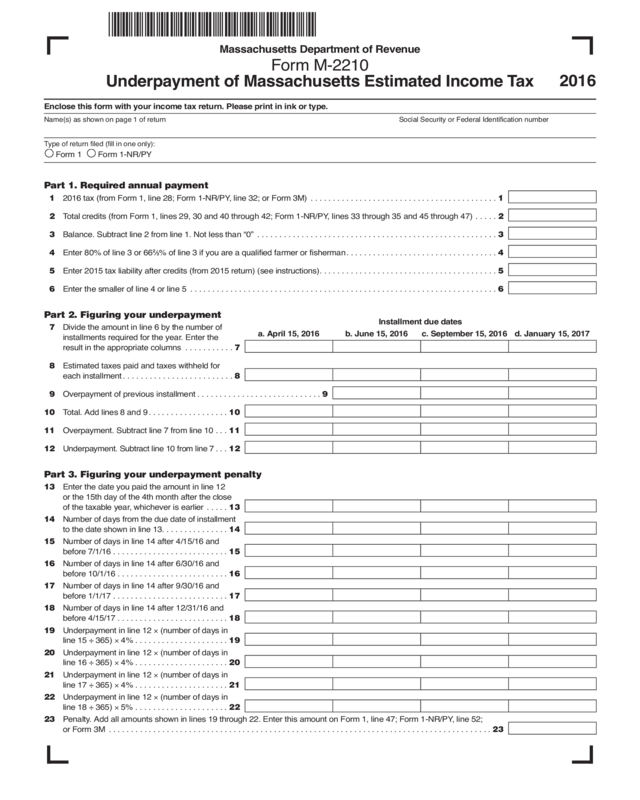

Form M2210 Edit, Fill, Sign Online Handypdf

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Web.

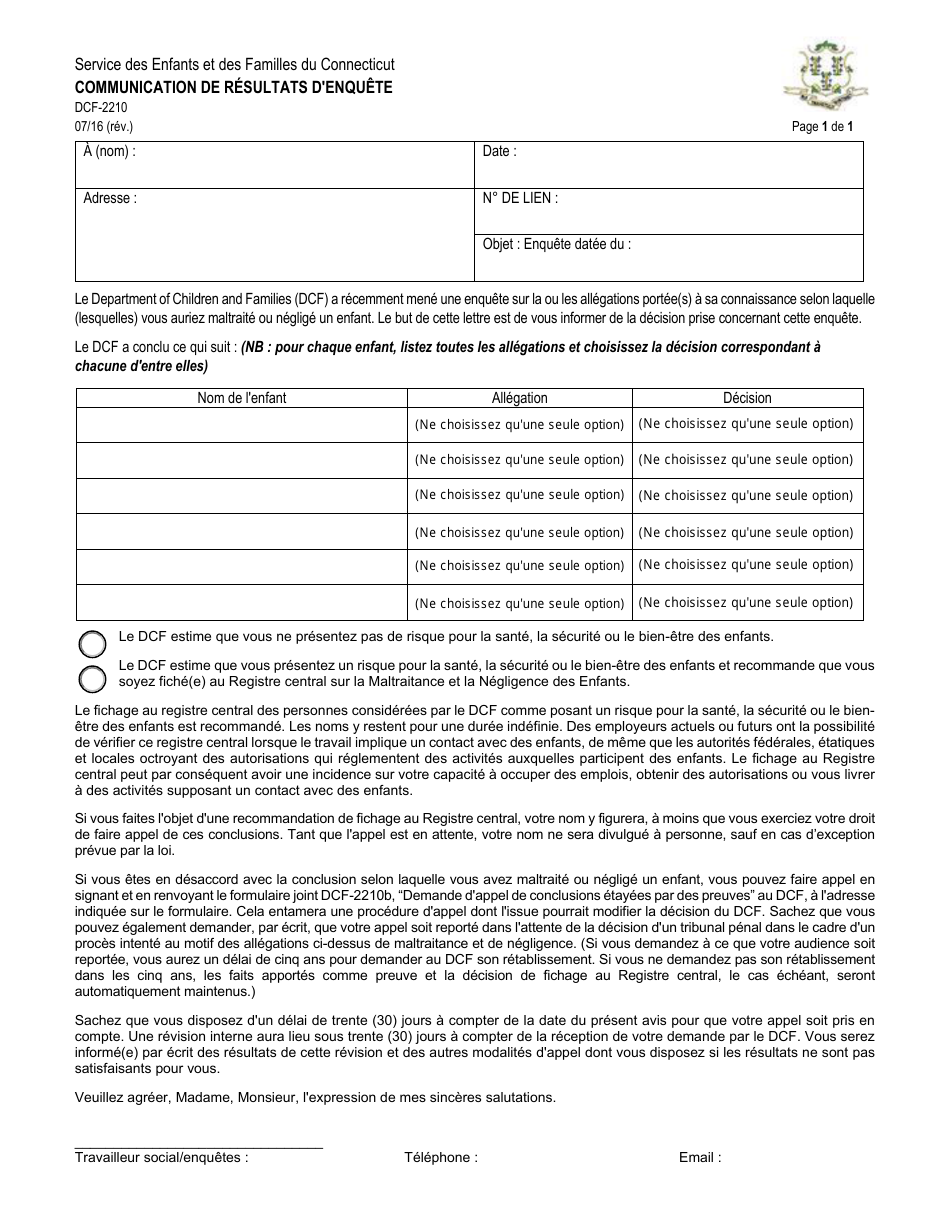

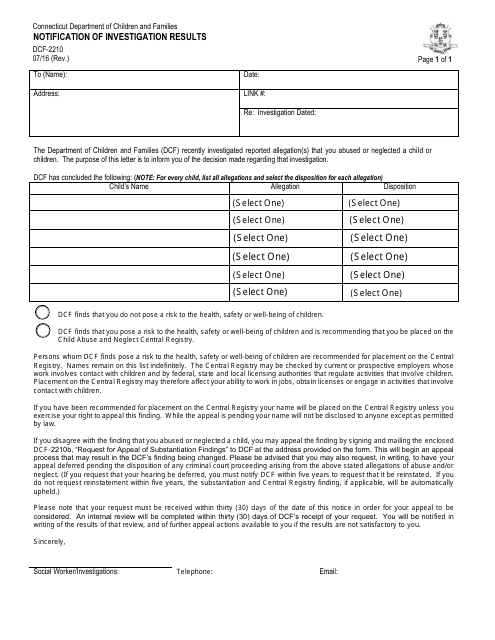

Forme DCF2210 Download Fillable PDF or Fill Online Notification of

This will begin an appeal process that may result in the dcf’s finding being. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Enter the total amount of connecticut income tax. The irs will generally figure your penalty for you and you should not file form 2210. Web use form 2210 to see if you owe a.

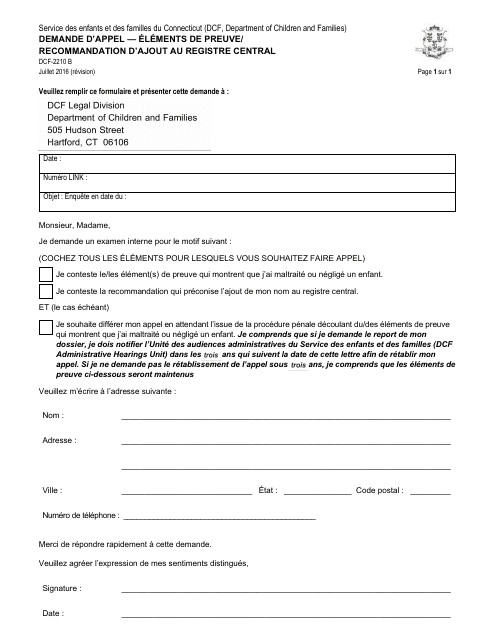

Form DCF2210 B Download Printable PDF or Fill Online Request for

Enter the total amount of connecticut income tax. Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties. The irs will generally figure your penalty for you and you should not file form 2210. This will begin an appeal process that may result in the.

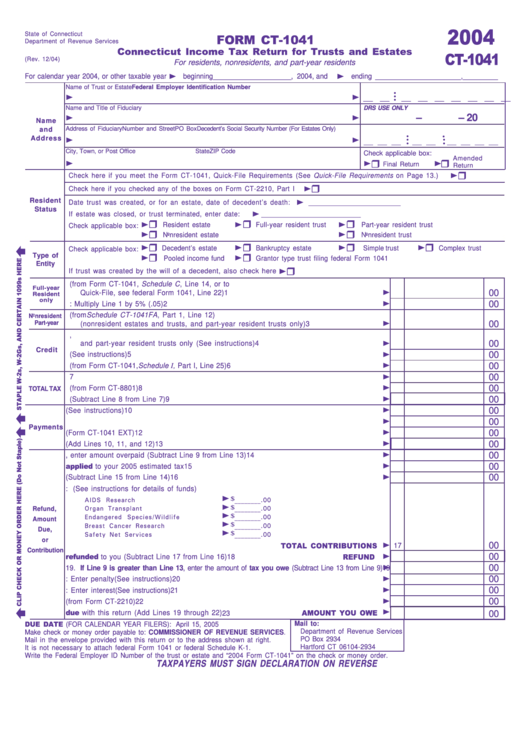

Form Ct1041 Connecticut Tax Return For Trusts And Estates

Benefits to electronic filing include: Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Simple, secure, and can be completed from the comfort of your home. The irs will generally figure your penalty for you and you should.

Form 2210 Edit, Fill, Sign Online Handypdf

Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. This will begin an appeal process that may result in the dcf’s finding being. Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut.

Form DCF2210 Download Fillable PDF or Fill Online Notification of

The irs will generally figure your penalty for you and you should not file form 2210. 12/09) underpayment of estimated income tax by individuals, trusts, and estates purpose: Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Web connecticut individual forms availability. This will begin an appeal process that may result in the dcf’s finding being.

Fillable Form Ct2210 Underpayment Of Estimated Tax By

Web please complete this form and submit this request to: Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Simple, secure, and can be completed from the comfort of your home. The irs will.

Ssurvivor Form 2210 Instructions 2018

Filers of forms ct‑1040, connecticut resident income tax return, ct‑1040nr/py, connecticut nonresident. Web file your 2022 connecticut income tax return online! Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the. Enter the total amount of connecticut income tax. Web connecticut individual forms availability.

Filers Of Forms Ct‑1040Connecticut Resident Income , Tax Returnct‑1040Nr/Py, , Connecticut.

Other (e.g., copy of your federal return, other jurisdiction etc.) do not send a paper copy. Enter the total amount of connecticut income tax. Web if you are attaching a completed: Estimated payment deadline extensions for tax year 2020 to provide relief to connecticut taxpayers during the.

Web Please Complete This Form And Submit This Request To:

The irs will generally figure your penalty for you and you should not file form 2210. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web file your 2022 connecticut income tax return online! Web use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties.

12/09) Underpayment Of Estimated Income Tax By Individuals, Trusts, And Estates Purpose:

Web connecticut individual forms availability. Benefits to electronic filing include: Simple, secure, and can be completed from the comfort of your home. This will begin an appeal process that may result in the dcf’s finding being.

Filers Of Forms Ct‑1040, Connecticut Resident Income Tax Return, Ct‑1040Nr/Py, Connecticut Nonresident.

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file form 2210.