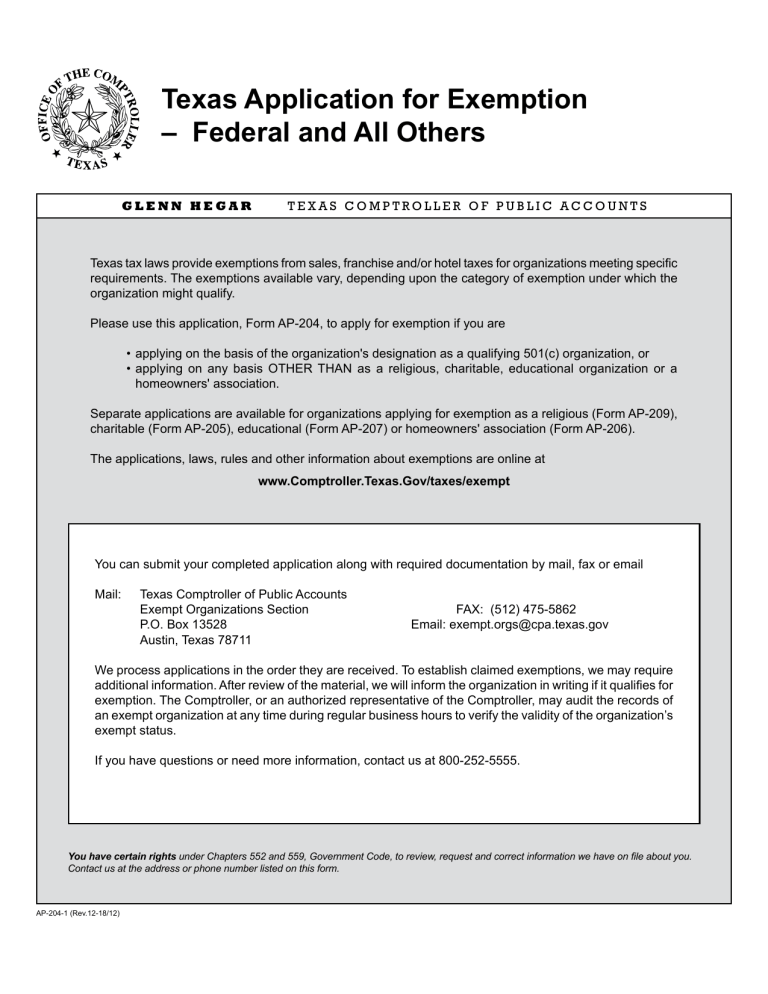

Form Ap-204 Texas Application For Exemption

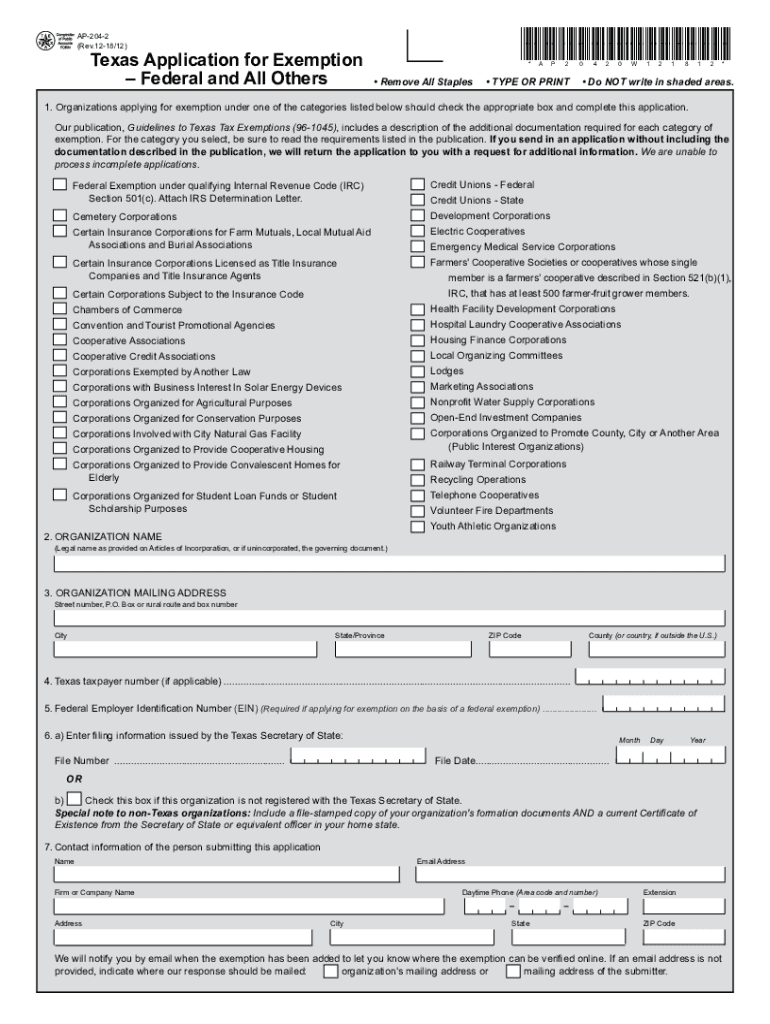

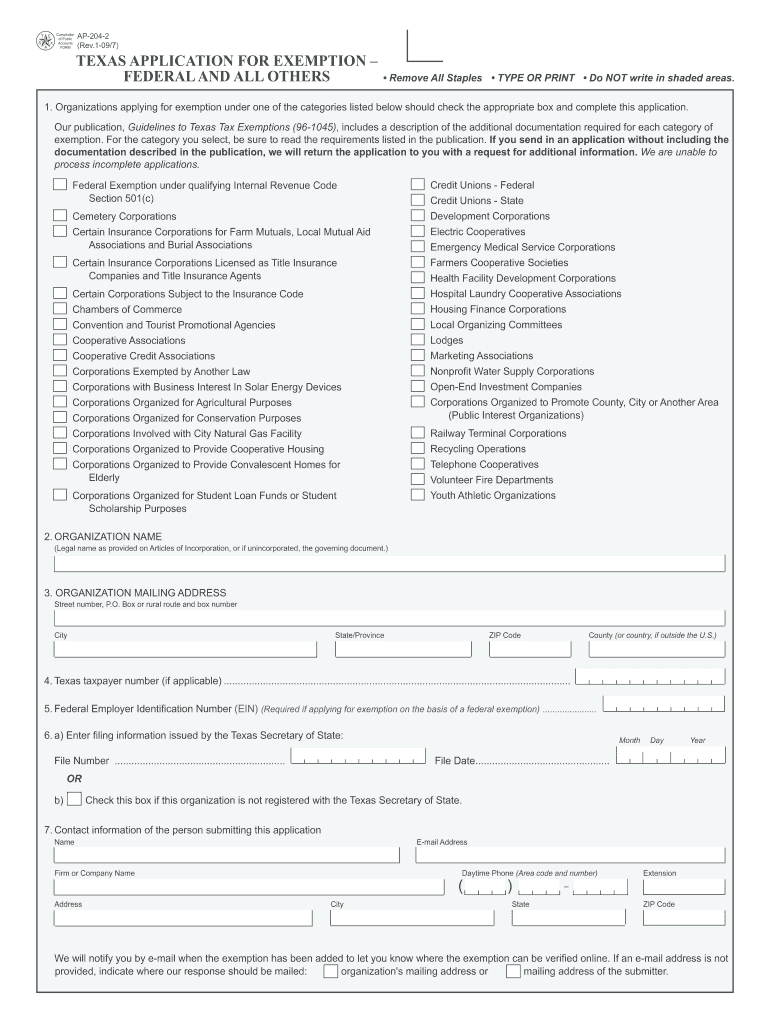

Form Ap-204 Texas Application For Exemption - • applying on the basis of the organization's designation as a qualifying 501(c) organization, or •. Web in texas, this document is filed with the texas secretary of state’s office. Web how do we apply for an exemption? How do we apply for an exemption? Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group clients seeking texas tax. The laws, rules and other information about. Web follow the simple instructions below: Get ready for tax season deadlines by completing any required tax forms today. Browse 391 texas comptroller forms and templates. Web up to $3 cash back texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements.

• applying on the basis of the organization's designation as a qualifying 501(c) organization, or •. Web a qualifying 501(c) must apply for state tax exemption. Web up to 25% cash back 10. To apply for franchise tax exemption based on the federal exempt status, complete and. Upload, modify or create forms. The laws, rules and other information about. Web how do we apply for an exemption? Get ready for tax season deadlines by completing any required tax forms today. Browse 391 texas comptroller forms and templates. The comptroller will grant a margin tax.

Web up to $3 cash back texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements. Web a qualifying 501(c) must apply for state tax exemption. Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group clients seeking texas tax. Web follow the simple instructions below: Try it for free now! • applying on the basis of the organization's designation as a qualifying 501(c) organization, or •. The comptroller will grant a margin tax. However, with our predesigned online templates, everything gets simpler. Obtain your texas state tax exemptions. Web texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements.

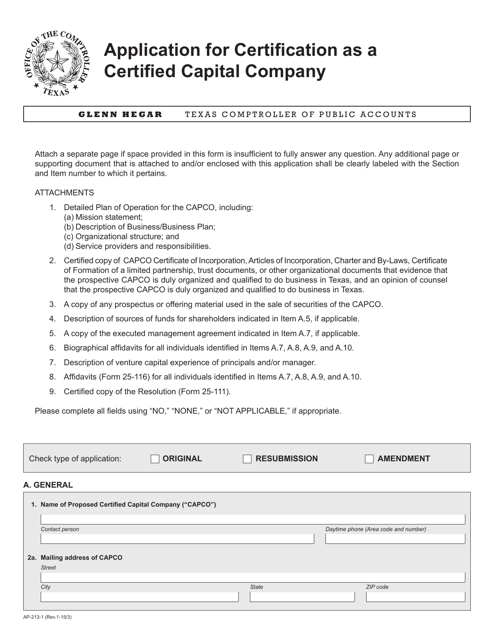

Form AP213 Download Fillable PDF or Fill Online Texas Application for

To apply for franchise tax exemption based on the federal exempt status, complete and. The exemptions available vary, depending. Web a qualifying 501(c) must apply for state tax exemption. • applying on the basis of the organization's designation as a qualifying 501(c) organization, or •. Obtain your texas state tax exemptions.

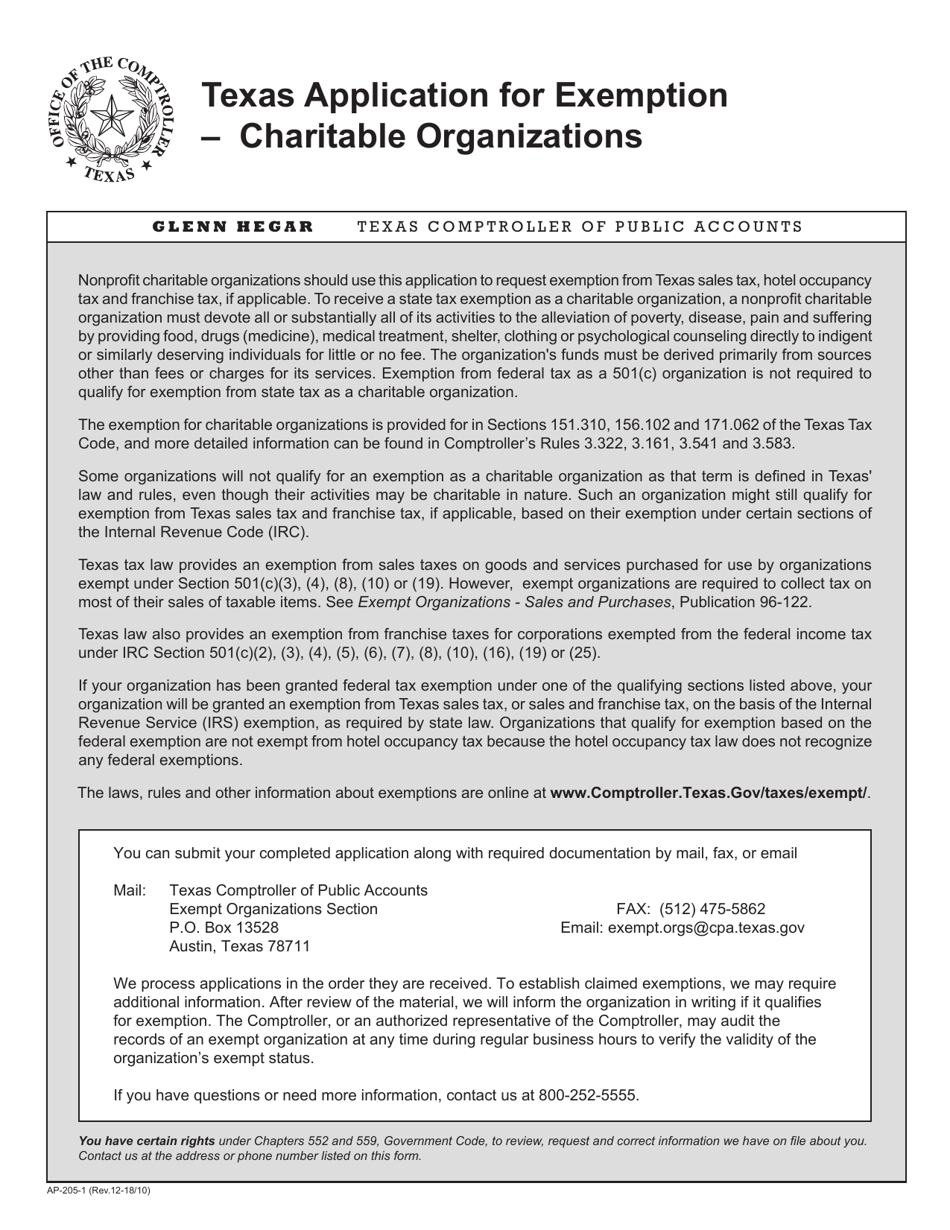

Form AP205 Download Fillable PDF or Fill Online Texas Application for

Web a qualifying 501(c) must apply for state tax exemption. You must apply to the texas comptroller of public accounts for an exemption from state sales, franchise, and hotel. Get ready for tax season deadlines by completing any required tax forms today. Web how do we apply for an exemption? The comptroller will grant a margin tax.

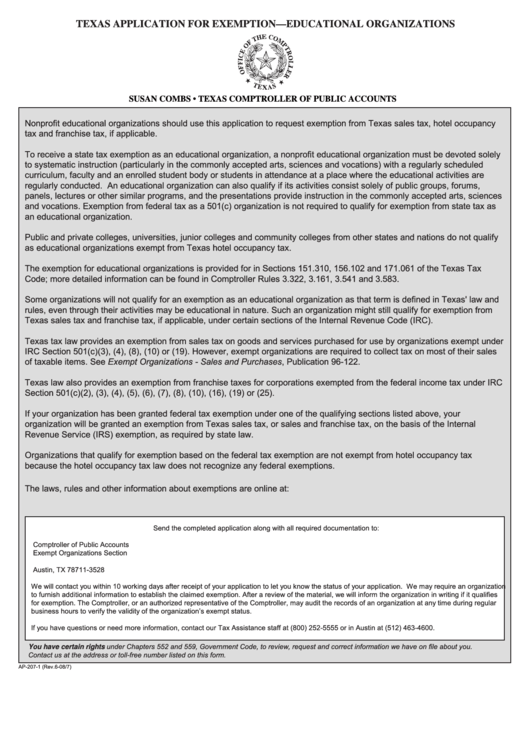

Fillable Form Ap207 Texas Application For Exemption Educational

• applying on the basis of the organization's designation as a qualifying 501(c) organization, or •. Obtain your texas state tax exemptions. The comptroller will grant a margin tax. Web up to $3 cash back texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements. Web how do we apply for an exemption?

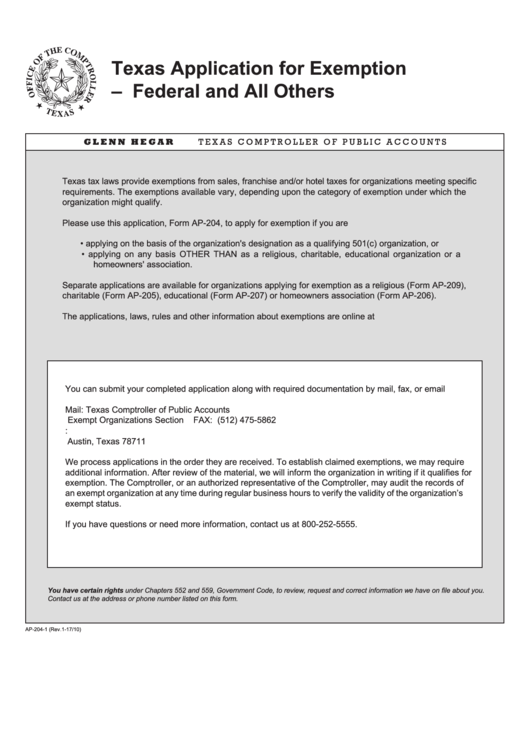

Fillable Ap204 Application For Exemption Federal And Others

However, with our predesigned online templates, everything gets simpler. Web up to 25% cash back 10. To apply for franchise tax exemption based on the federal exempt status, complete and. Upload, modify or create forms. Web texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements.

Texas Application for Exemption

Web follow the simple instructions below: Web texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements. Web how do we apply for an exemption? Browse 391 texas comptroller forms and templates. Texas application for exemption form number:

20182022 Form TX Comptroller AP204 Fill Online, Printable, Fillable

Upload, modify or create forms. Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group clients seeking texas tax. Web up to 25% cash back 10. Web up to $3 cash back texas tax laws provide exemptions from sales, franchise and/or.

TX AP2281 2020 Fill out Tax Template Online US Legal Forms

How do we apply for an exemption? Upload, modify or create forms. Web how do we apply for an exemption? Web in texas, this document is filed with the texas secretary of state’s office. Web a qualifying 501(c) must apply for state tax exemption.

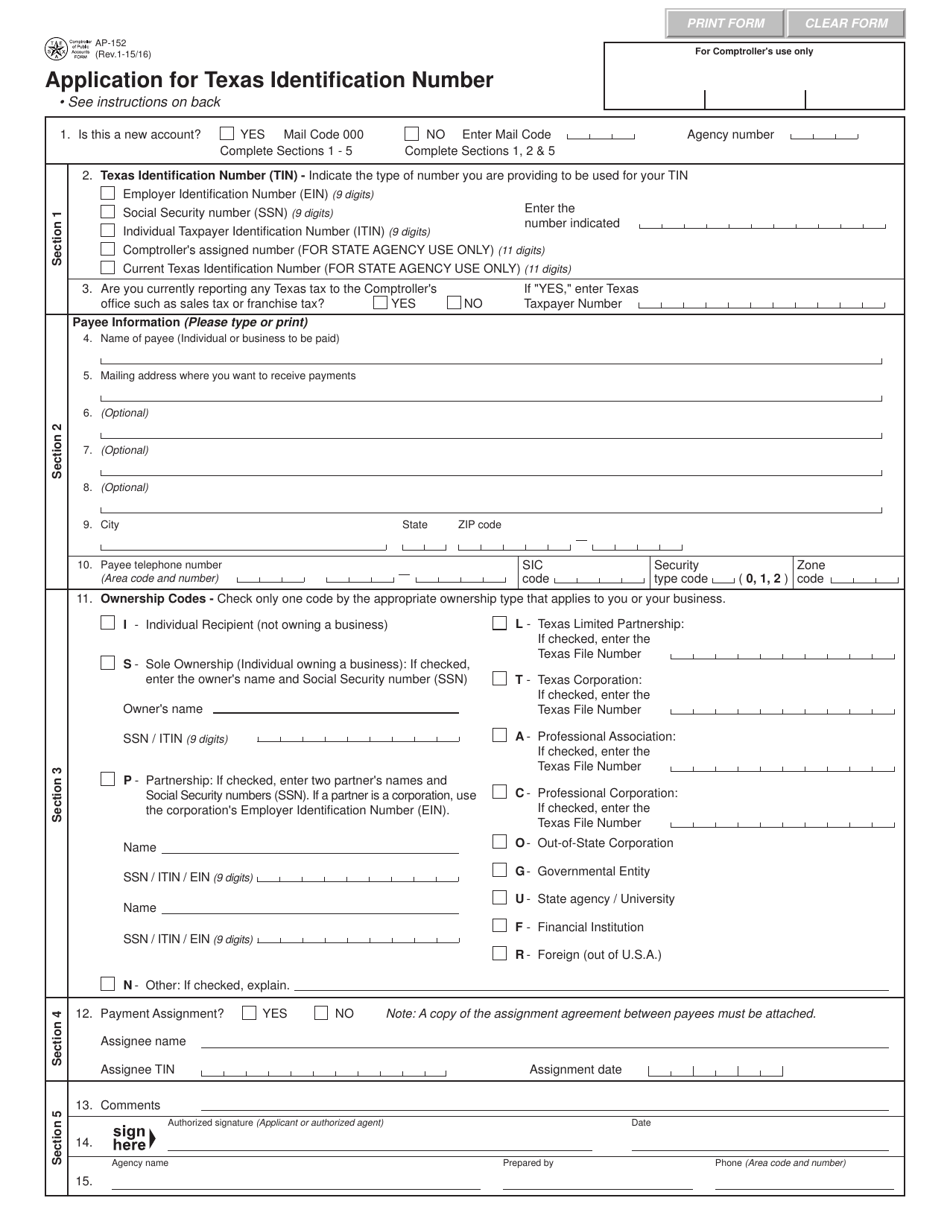

Form AP152 Download Fillable PDF or Fill Online Application for Texas

Get ready for tax season deadlines by completing any required tax forms today. How do we apply for an exemption? Upload, modify or create forms. Web due to the differing definitions used by the state of texas and the irs, this is the form that is most often filed on behalf of foundation group clients seeking texas tax. Texas application.

Form Ap 204 Fill Out and Sign Printable PDF Template signNow

You must apply to the texas comptroller of public accounts for an exemption from state sales, franchise, and hotel. Browse 391 texas comptroller forms and templates. Get ready for tax season deadlines by completing any required tax forms today. The laws, rules and other information about. Try it for free now!

Form AP169 Download Fillable PDF or Fill Online Texas Application for

Organizations that qualify for exemption based on a federal exemption are not exempt from hotel occupancy tax. Web up to $3 cash back texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements. Try it for free now! Web follow the simple instructions below: Web up to 25% cash back 10.

The Laws, Rules And Other Information About.

• applying on the basis of the organization's designation as a qualifying 501(c) organization, or •. Web up to $3 cash back texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements. Web how do we apply for an exemption? Web follow the simple instructions below:

Web How Do We Apply For An Exemption?

Texas application for exemption form number: The exemptions available vary, depending. The comptroller will grant a margin tax. Obtain your texas state tax exemptions.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Try it for free now! Upload, modify or create forms. Organizations that qualify for exemption based on a federal exemption are not exempt from hotel occupancy tax. Web texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific requirements.

You Must Apply To The Texas Comptroller Of Public Accounts For An Exemption From State Sales, Franchise, And Hotel.

Web in texas, this document is filed with the texas secretary of state’s office. Web up to 25% cash back 10. However, with our predesigned online templates, everything gets simpler. To apply for franchise tax exemption based on the federal exempt status, complete and.