Form 990 Late Filing Penalty

Form 990 Late Filing Penalty - “an organization that fails to file. These penalty rates apply for the late filing of. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t. Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of form 990. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web file for multiple business and employees by importing all their data in bulk. Criteria for penalty relief 1. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with.

Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization. The same penalty is also applicable for failing to furnish. Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of form 990. Second, file the returns as soon as. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. What are the reasons for the penalty? Criteria for penalty relief 1. Web can penalties for filing form 990 late be abated? Web file for multiple business and employees by importing all their data in bulk.

Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization. The same penalty is also applicable for failing to furnish. Failure to timely file the information return, absent reasonable cause, can give rise to a penalty under section. Web a penalty of $110/day for each delayed day will be imposed. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of form 990. Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. Web file for multiple business and employees by importing all their data in bulk. What are the reasons for the penalty?

Prepare Form 990EZ

The maximum penalty amount is $56,000 or 5% of gross reciept. Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. What are the reasons for the penalty? Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including.

Form 990 Electronic Filing Requirements Atlanta Audit Firm

These penalty rates apply for the late filing of. Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization. Second, file the returns as soon as. Web a political organization that fails to file a required form 990 or fails to.

IRS Form 990 Penalty Abatement Manual for Nonprofits Published by CPA

Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day. Web the penalty.

How to Write a Form 990 Late Filing Penalty Abatement Letter

The maximum penalty amount is $56,000 or 5% of gross reciept. Second, file the returns as soon as. Web can penalties for filing form 990 late be abated? Web a penalty of $110/day for each delayed day will be imposed. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable.

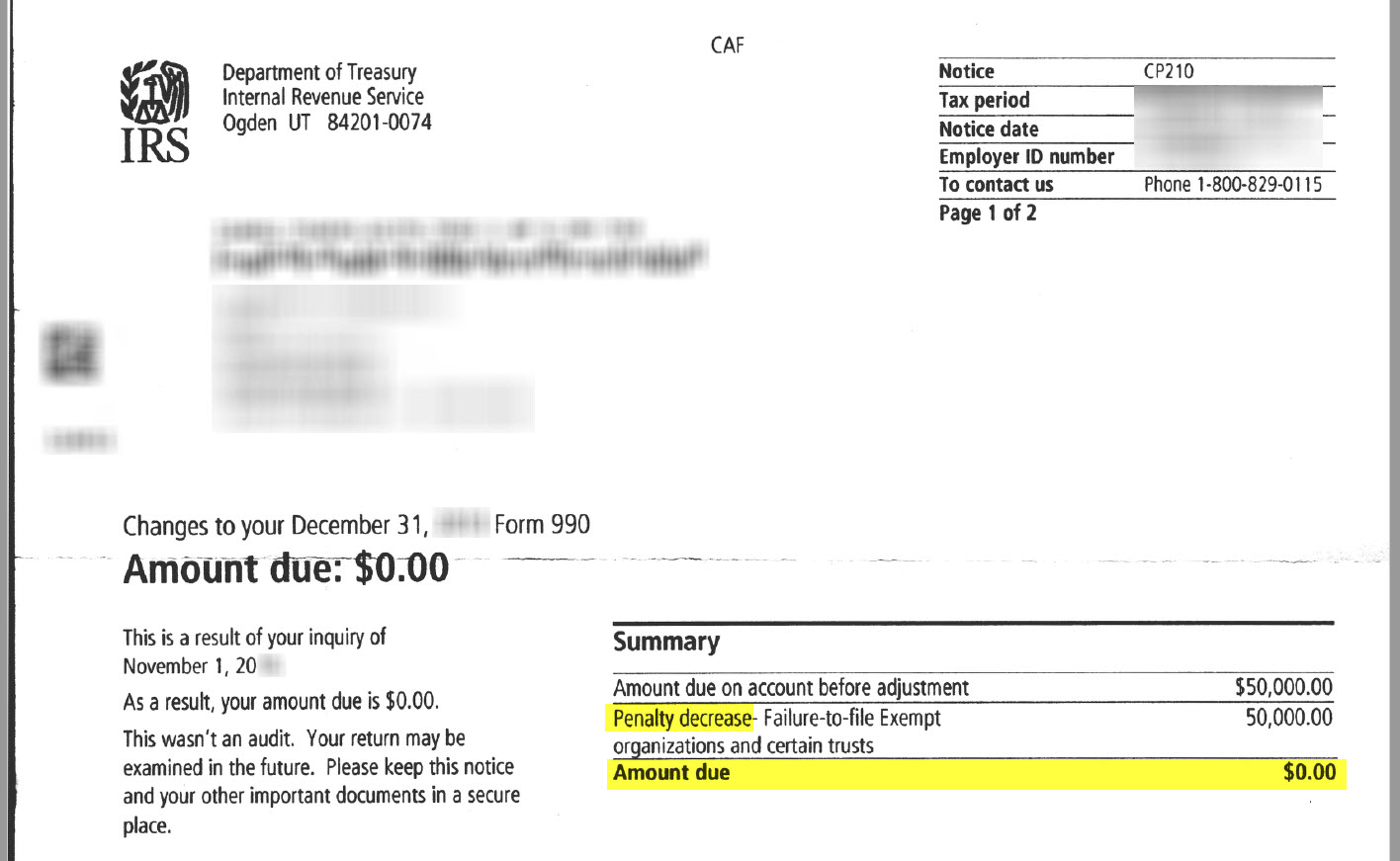

4,280 IRS Penalty Abated for LateFiled Form 990 David B. McRee, CPA

Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. Second, file the returns as soon as. Web can penalties for filing form 990 late be abated? Web a penalty of $20 a day ($105 a day for large organizations) will be imposed for the late filing of.

How to Write a Form 990 Late Filing Penalty Abatement Letter 50,000

Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. What are the reasons for the penalty? Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t. Web a penalty of $110/day.

Form 990 LateFiling Penalty Abatement Manual, Example Letters and

Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day. Web file for multiple business and employees by importing all their data in bulk. The maximum penalty amount is $56,000 or 5% of gross reciept. Failure to.

How to Write a Form 990 Late Filing Penalty Abatement Letter Form 990

Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day. The maximum penalty amount is $56,000 or 5% of gross reciept. Web file for multiple business and employees by importing all their data in bulk. Web a.

What You Need To Know About Form 990PF Penalties...

Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. “an organization that fails to file. These penalty rates apply for the late filing.

Sales Tax Penalty Waiver Sample Letter Irs Letter 1277 Penalty

Criteria for penalty relief 1. Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. The same penalty is also applicable for failing to furnish. What are the reasons for the penalty? Web a penalty of $110/day for each delayed day will be imposed.

Failure To Timely File The Information Return, Absent Reasonable Cause, Can Give Rise To A Penalty Under Section.

Web can penalties for filing form 990 late be abated? Second, file the returns as soon as. Web the penalty increases to $100 per day, up to a maximum of $50,000, for an organization whose gross receipts exceed $1,000,000. These penalty rates apply for the late filing of.

Criteria For Penalty Relief 1.

What are the reasons for the penalty? The maximum penalty amount is $56,000 or 5% of gross reciept. Web a political organization that fails to file a required form 990 or fails to include required information on those returns is subject to a penalty of $20 per day for every day. The same penalty is also applicable for failing to furnish.

Web A Penalty Of $20 A Day ($105 A Day For Large Organizations) Will Be Imposed For The Late Filing Of Form 990.

Web file for multiple business and employees by importing all their data in bulk. “an organization that fails to file. Web if an organization whose gross receipts are less than $1,000,000 for its tax year files its form 990 after the due date (including any extensions), and the organization doesn’t. Web a penalty of $110/day for each delayed day will be imposed.

Web If An Organization Whose Gross Receipts Are Less Than $1,000,000 For Its Tax Year Files Its Form 990 After The Due Date (Including Any Extensions), And The Organization.

Form 990 late filing penalties penalties for organization with gross receipts less than $1,067,000 penalties for organization with. Web you will most likely be assessed penalties, which the irs will forgive if you have what they consider reasonable cause for filing late.