Form 941X 2020

Form 941X 2020 - Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Web tax & compliance. Web about form 941, employer's quarterly federal tax return. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Complete, edit or print tax forms instantly. Try it for free now! Get instant irs status quick processing no. Which form should you file? If you are located in.

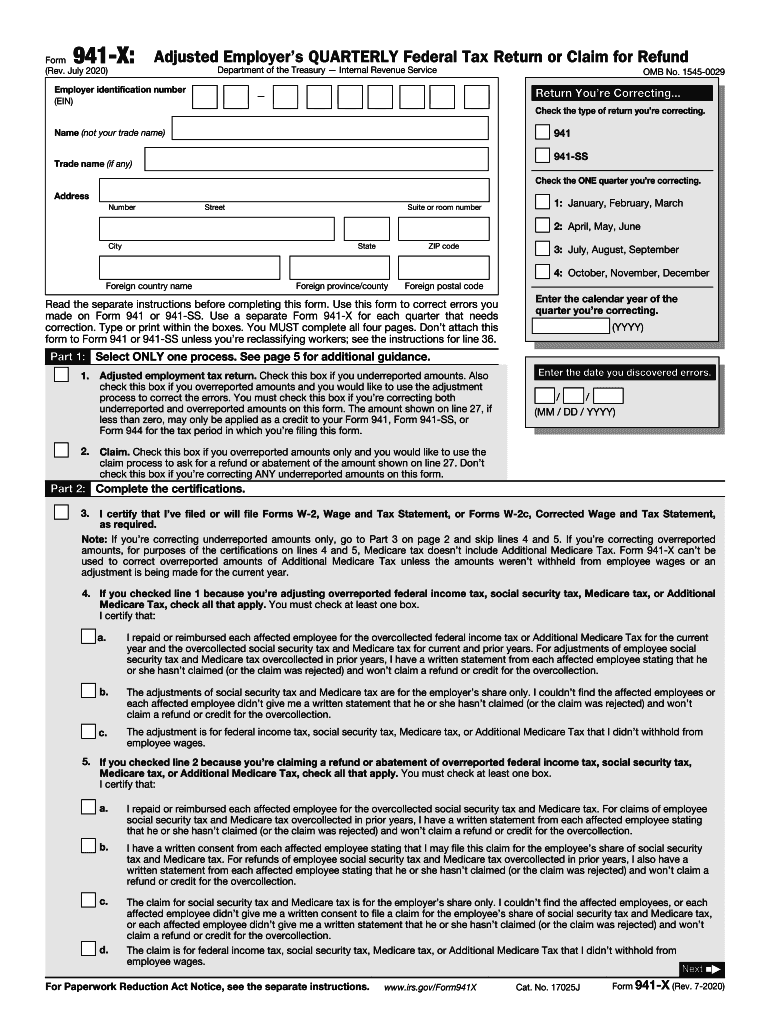

Web tax & compliance. Web click the orange get form option to begin modifying. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Get instant irs status quick processing no. The final version is expected to be available by the end of september. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Web about form 941, employer's quarterly federal tax return. Which form should you file? Complete, edit or print tax forms instantly. October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Web about form 941, employer's quarterly federal tax return. Get instant irs status quick processing no. April, may, june enter the calendar year of the quarter you’re correcting. Complete, edit or print tax forms instantly. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Which form should you file? Web tax & compliance. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. There is a draft version of the irs form 941x (rev.

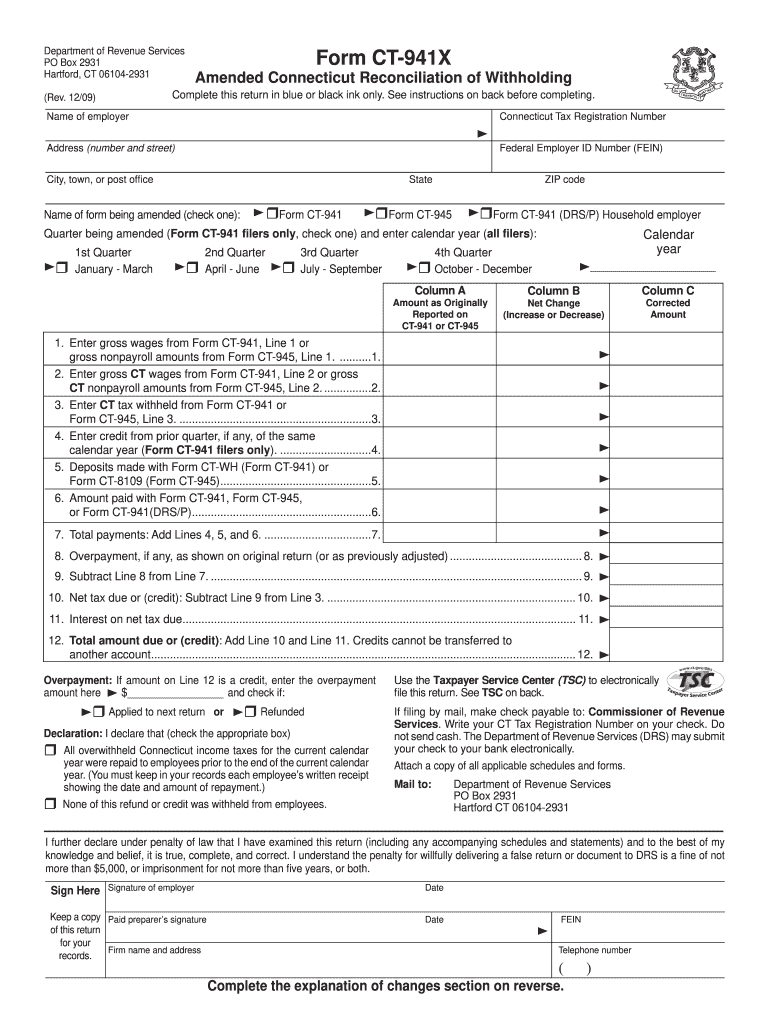

Ct Form 941 X Fill Out and Sign Printable PDF Template signNow

Complete, edit or print tax forms instantly. Get instant irs status quick processing no. Web about form 941, employer's quarterly federal tax return. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Upload, modify or create forms.

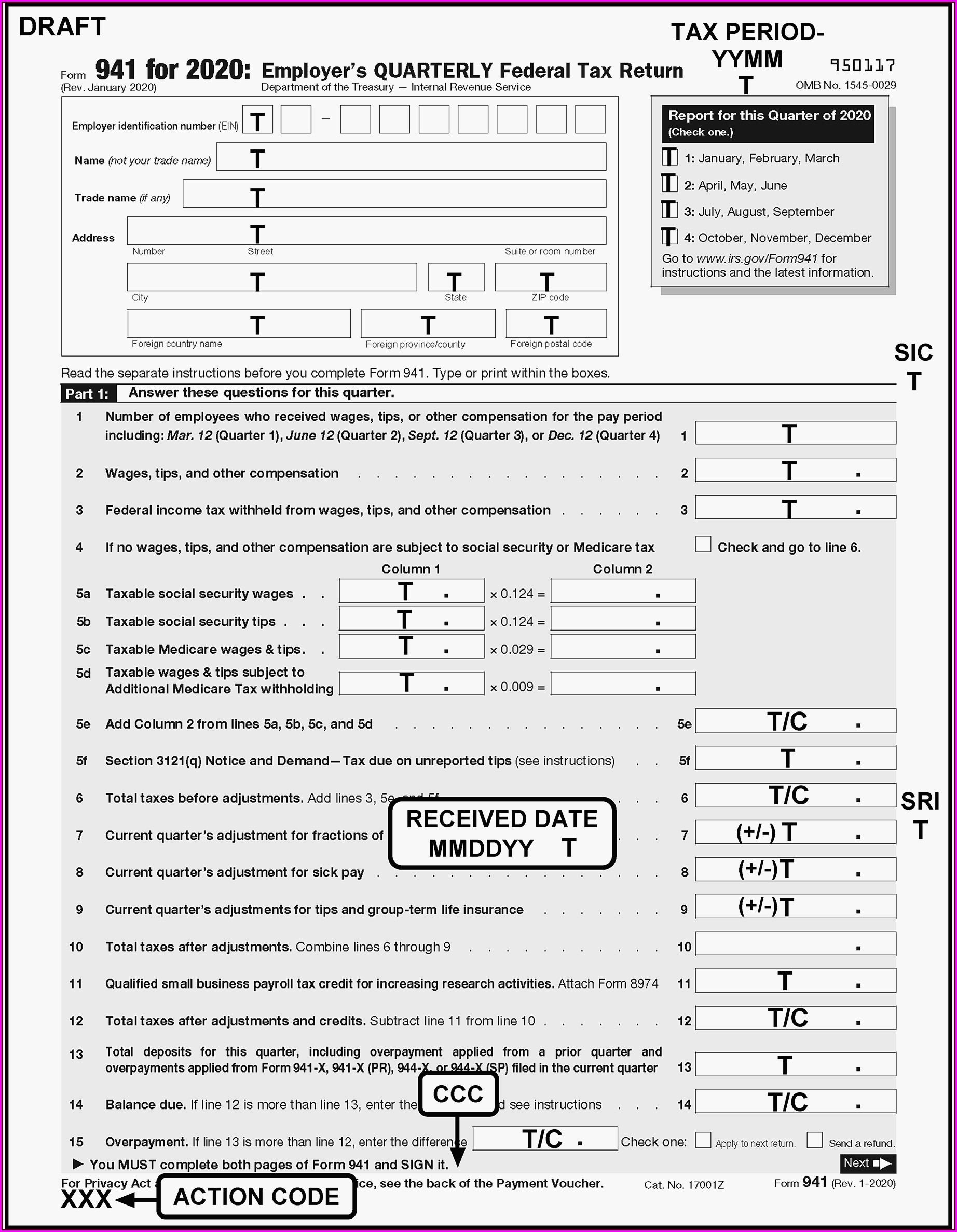

The NoWorry Guide To File Form 941 During Tax Year 2020 Blog

Switch on the wizard mode in the top toolbar to obtain extra recommendations. The final version is expected to be available by the end of september. There is a draft version of the irs form 941x (rev. Get instant irs status quick processing no. Complete, edit or print tax forms instantly.

Irs.gov Forms 941 X Form Resume Examples 1ZV8dXoV3X

October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Switch on the wizard mode in the top toolbar to obtain extra recommendations. Upload, modify or create forms. If you are located in. Web tax & compliance.

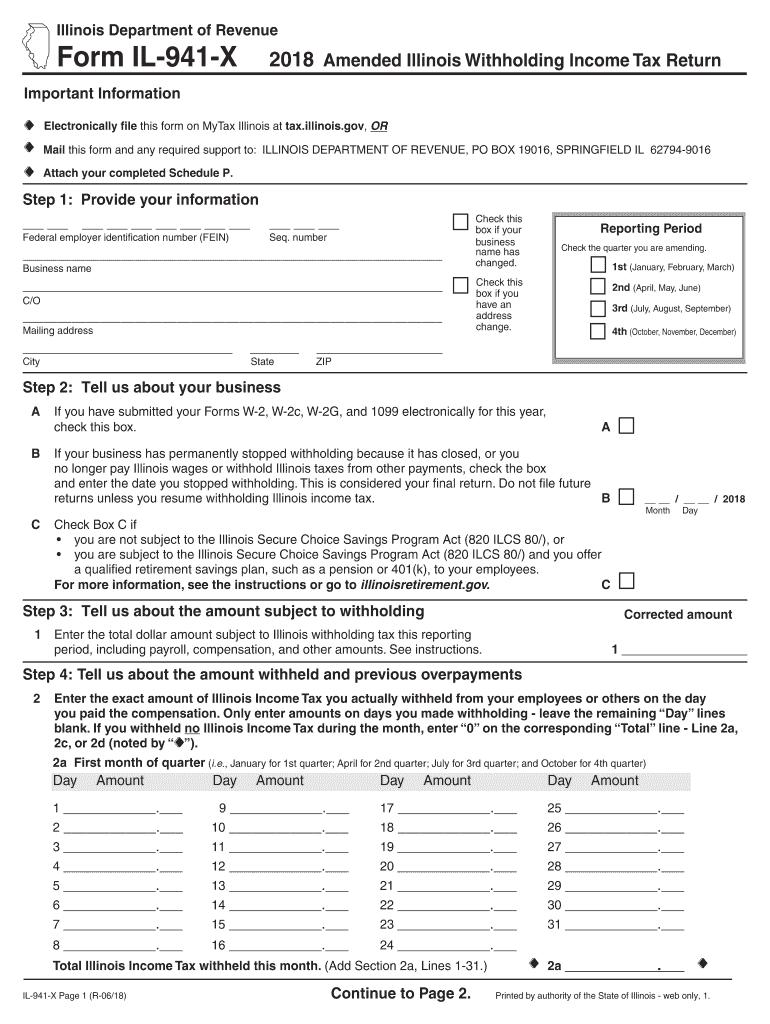

Simple Form 941X 2018 Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Upload, modify or create forms. If you are located in. April, may, june enter the calendar year of the quarter you’re correcting. October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

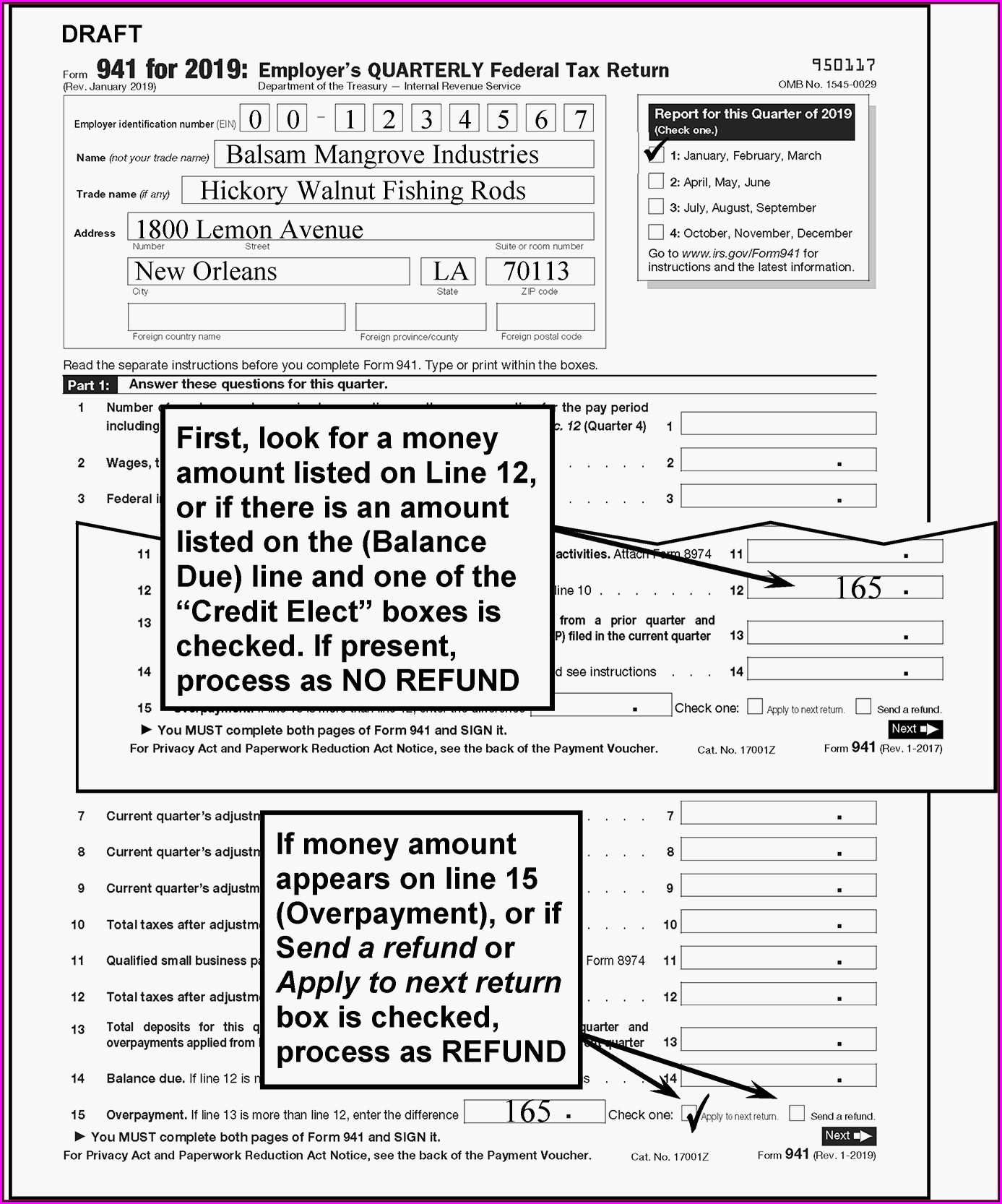

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Web tax & compliance. Upload, modify or create forms. Switch on the wizard mode in the top toolbar to obtain extra recommendations. April, may, june enter the calendar year of the quarter you’re correcting. October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

Worksheet 2 941x

Web click the orange get form option to begin modifying. Web tax & compliance. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using..

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

Which form should you file? The final version is expected to be available by the end of september. Upload, modify or create forms. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Get instant irs status quick processing no.

Irs.gov Form 941x Form Resume Examples yKVBjnRVMB

Web click the orange get form option to begin modifying. Upload, modify or create forms. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Switch on the wizard mode in the top toolbar to obtain extra recommendations. The final version is expected to be available by the end of september.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Upload, modify or create forms. Web about form 941, employer's quarterly federal tax return. Get instant irs status quick processing no. Try it for free now!

941x Fill out & sign online DocHub

Complete, edit or print tax forms instantly. Which form should you file? The final version is expected to be available by the end of september. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Web tax & compliance.

January 2020) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950117 Omb No.

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Get instant irs status quick processing no. Web tax & compliance. If you are located in.

Complete, Edit Or Print Tax Forms Instantly.

There is a draft version of the irs form 941x (rev. Switch on the wizard mode in the top toolbar to obtain extra recommendations. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Upload, modify or create forms.

April, May, June Enter The Calendar Year Of The Quarter You’re Correcting.

Try it for free now! October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web click the orange get form option to begin modifying. Which form should you file?

Web About Form 941, Employer's Quarterly Federal Tax Return.

The final version is expected to be available by the end of september. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,.