Form 941-V

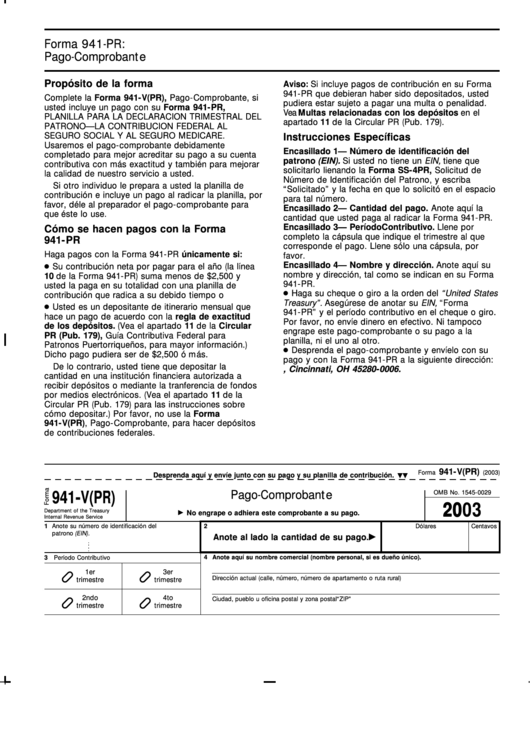

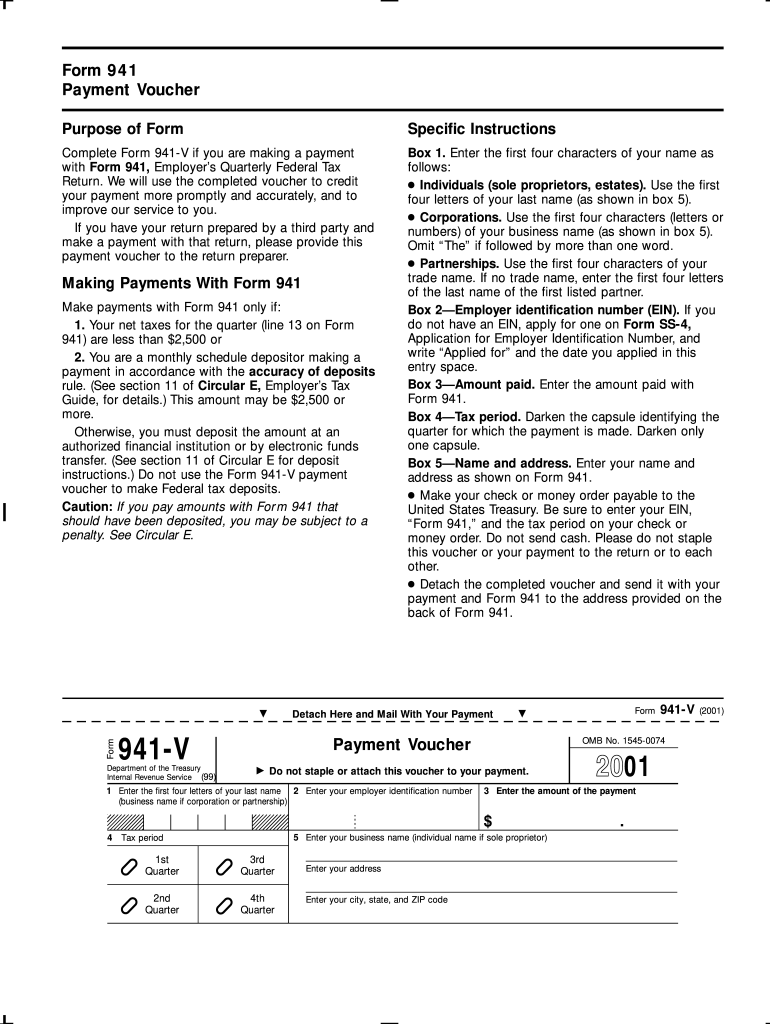

Form 941-V - If you are required to make deposits electronically but do not wish to use the. Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. You may use this web site and our voice response system (1.800.555.3453) interchangeably to make payments. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web 4506 request for copy of tax return. Filing deadlines are in april, july, october and january. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Pay the employer's portion of social security or medicare tax. If you don’t have an ein, you may apply for one online by 721vi mwk excise manufacturer worksheet.

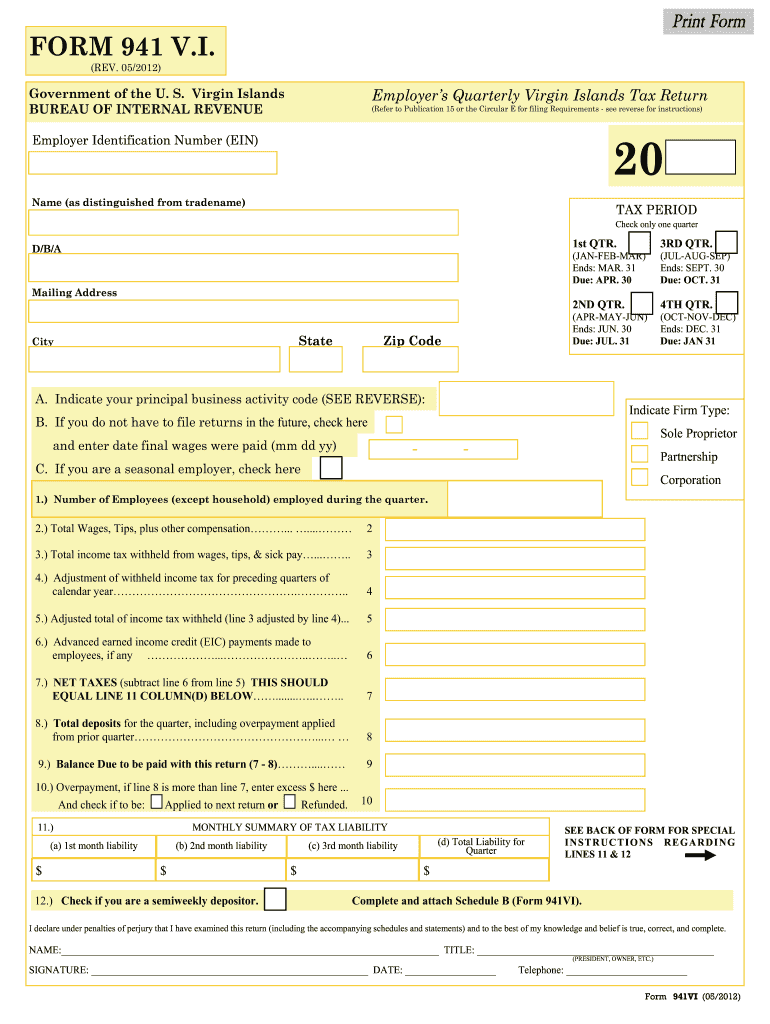

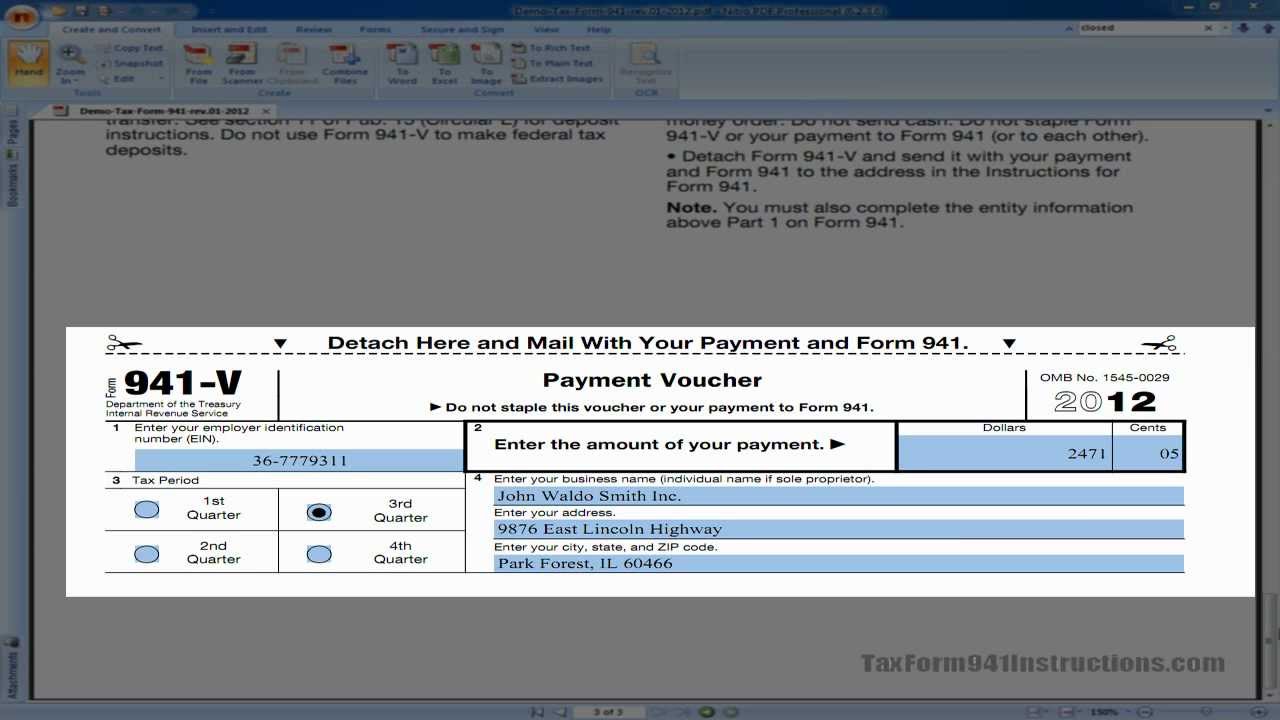

Gross receipts monthly tax return. 721vi mwk excise manufacturer worksheet. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Specific instructions box 1—employer identification number (ein). Web about form 941, employer's quarterly federal tax return. Making payments with form 941. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. Web check if you are a semiweekly depositor. Filing deadlines are in april, july, october and january.

You may use this web site and our voice response system (1.800.555.3453) interchangeably to make payments. Web check if you are a semiweekly depositor. 721vi mwk excise manufacturer worksheet. See deposit penalties in section 11 of pub. Employers use form 941 to: Web about form 941, employer's quarterly federal tax return. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. To avoid a penalty, make your payment with form 941. Gross receipts monthly tax return. Making payments with form 941.

Form 941v, Payment Voucher and Pen on Wooden Desk Editorial Image

Specific instructions box 1—employer identification number (ein). Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. Employers use form 941 to: Web 4506 request for copy of tax return. Making payments with form 941.

IRS Form 941V Payment Voucher blank lies with pen and many hundred

Web 4506 request for copy of tax return. To avoid a penalty, make your payment with form 941. • your total taxes for either the current quarter (form 941, line. Web about form 941, employer's quarterly federal tax return. You may use this web site and our voice response system (1.800.555.3453) interchangeably to make payments.

Form 941V(Pr) 2003 printable pdf download

Pay the employer's portion of social security or medicare tax. Filing deadlines are in april, july, october and january. Web check if you are a semiweekly depositor. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. We will use the completed voucher.

Form 941SS Employer's Quarterly Federal Tax Return American Samoa…

Web mailing addresses for forms 941. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Gross receipts monthly tax return. If you don’t have an ein, you may apply for one online by

IRS Form 941V Payment Voucher Blank Lies on Empty Calendar Page

• your total taxes for either the current quarter (form 941, line. If you are required to make deposits electronically but do not wish to use the. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Gross receipts monthly tax return. Web 4506 request for copy of tax return.

2001 Form IRS 941V Fill Online, Printable, Fillable, Blank pdfFiller

Pay the employer's portion of social security or medicare tax. Web 4506 request for copy of tax return. Web about form 941, employer's quarterly federal tax return. Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. If you are required to make deposits electronically but do not wish to use the.

Form 941 V I Fill Out and Sign Printable PDF Template signNow

Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. 721vi mwk excise manufacturer worksheet. Gross receipts monthly tax return. Web about form 941, employer's quarterly federal tax return. Web mailing addresses for forms 941.

form 941 v Fill out & sign online DocHub

721vi mwk excise manufacturer worksheet. Web check if you are a semiweekly depositor. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. • your total taxes for either the current quarter (form 941, line. Web about form 941, employer's quarterly federal tax return.

IRS Form 941V Payment Voucher blank lies with pen and many hundred

• your total taxes for either the current quarter (form 941, line. Filing deadlines are in april, july, october and january. Web about form 941, employer's quarterly federal tax return. However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Web check if you are a semiweekly depositor.

Tax Form 941V Payment Voucher Video YouTube

Web irs form 941 is a form businesses file quarterly to report taxes they withheld from employee paychecks. Complete and attach schedule b (form 941vi). Filing deadlines are in april, july, october and january. Making payments with form 941. Web mailing addresses for forms 941.

• Your Total Taxes For Either The Current Quarter (Form 941, Line.

Making payments with form 941. 721vi mwk excise manufacturer worksheet. Complete and attach schedule b (form 941vi). Web check if you are a semiweekly depositor.

Filing Deadlines Are In April, July, October And January.

Web this eftps® tax payment service web site supports microsoft internet explorer for windows, google chrome for windows and mozilla firefox for windows. See deposit penalties in section 11 of pub. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina. To avoid a penalty, make your payment with form 941.

Web Irs Form 941 Is A Form Businesses File Quarterly To Report Taxes They Withheld From Employee Paychecks.

Specific instructions box 1—employer identification number (ein). Employers use form 941 to: However, if you pay an amount with form 941 that should’ve been deposited, you may be subject to a penalty. Gross receipts monthly tax return.

Web Mailing Addresses For Forms 941.

You may use this web site and our voice response system (1.800.555.3453) interchangeably to make payments. Web 4506 request for copy of tax return. Web about form 941, employer's quarterly federal tax return. If you don’t have an ein, you may apply for one online by