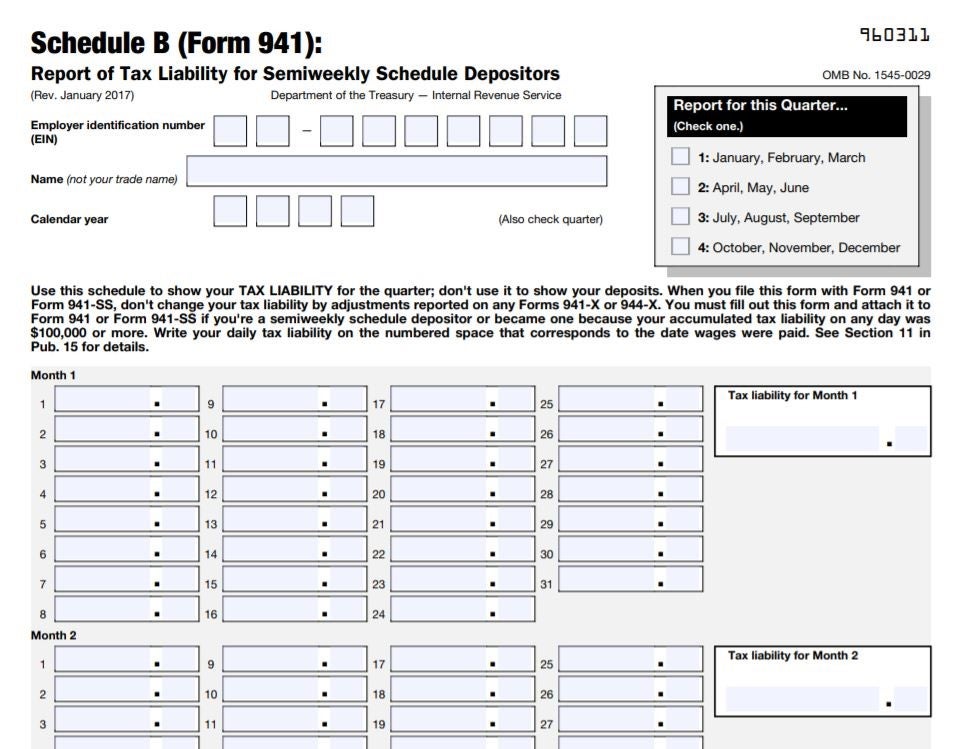

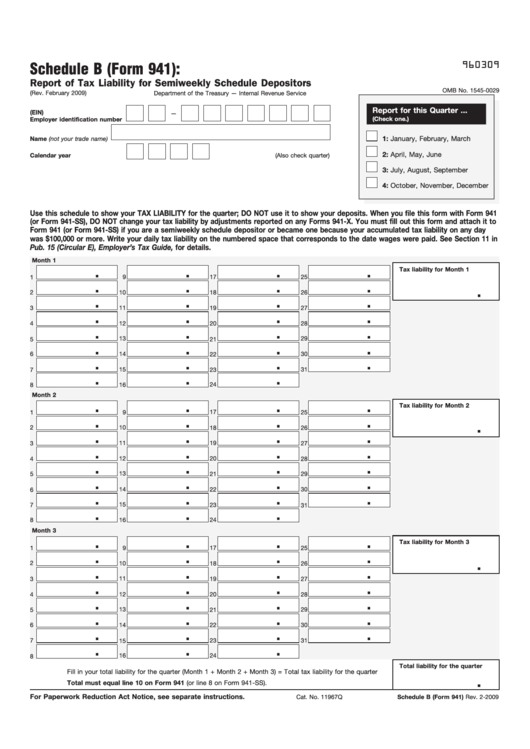

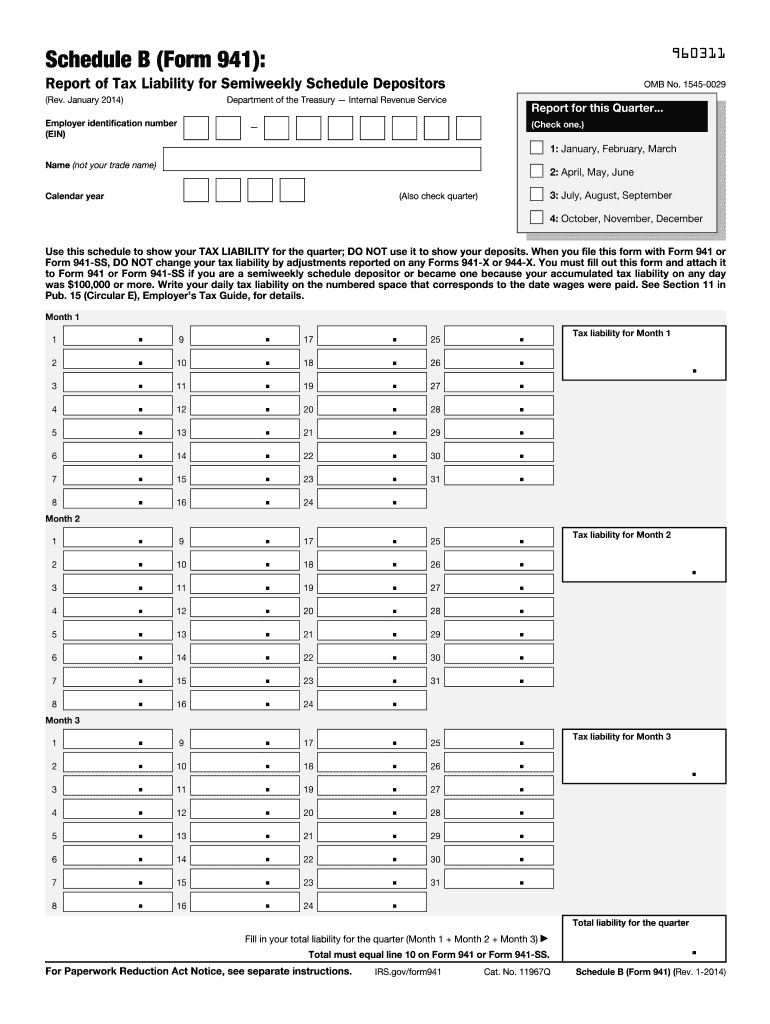

Form 941 Schedule B 2022

Form 941 Schedule B 2022 - Type or print within the boxes. Be it wages, salaries, bonuses, tips, and other variables. According to the irs drafts, the revision dates will be march 2022. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the File schedule b if you’re a semiweekly schedule depositor. Here’s a simple tax guide to help you understand form 941 schedule b. In response to stakeholder input, the draft instructions provide a new filing exception as described on page 3 of the 2022. Web semiweekly schedule depositor, attach schedule b (form 941). Web february 17, 2022 here we go again! See deposit penalties in section 11 of pub.

Reported more than $50,000 of employment taxes in the lookback period. According to the irs drafts, the revision dates will be march 2022. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Be it wages, salaries, bonuses, tips, and other variables. Make sure payroll has the updated info for filing employment tax returns for the first quarter of 2022. See deposit penalties in section 11 of pub. Web report for this quarter of 2022 (check one.) 1: Total must equal line 12. October, november, december name (not your trade name) calendar year (also check quarter) use this schedule to show your tax liability for the. Read the separate instructions before you complete form 941.

Enter your tax liability for each month and total liability for the quarter, then go to part 3. Employers are required to withhold a certain amount from their employee’s pay. According to the irs drafts, the revision dates will be march 2022. Web report for this quarter of 2022 (check one.) 1: Read the separate instructions before you complete form 941. File schedule b if you’re a semiweekly schedule depositor. Be it wages, salaries, bonuses, tips, and other variables. You are a semiweekly depositor if you: Explore instructions, filing requirements, and tips. Here’s a simple tax guide to help you understand form 941 schedule b.

941 Schedule B 2022

You are a semiweekly depositor if you: Type or print within the boxes. 3 by the internal revenue service. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the Employers are required to withhold a certain amount from their employee’s pay.

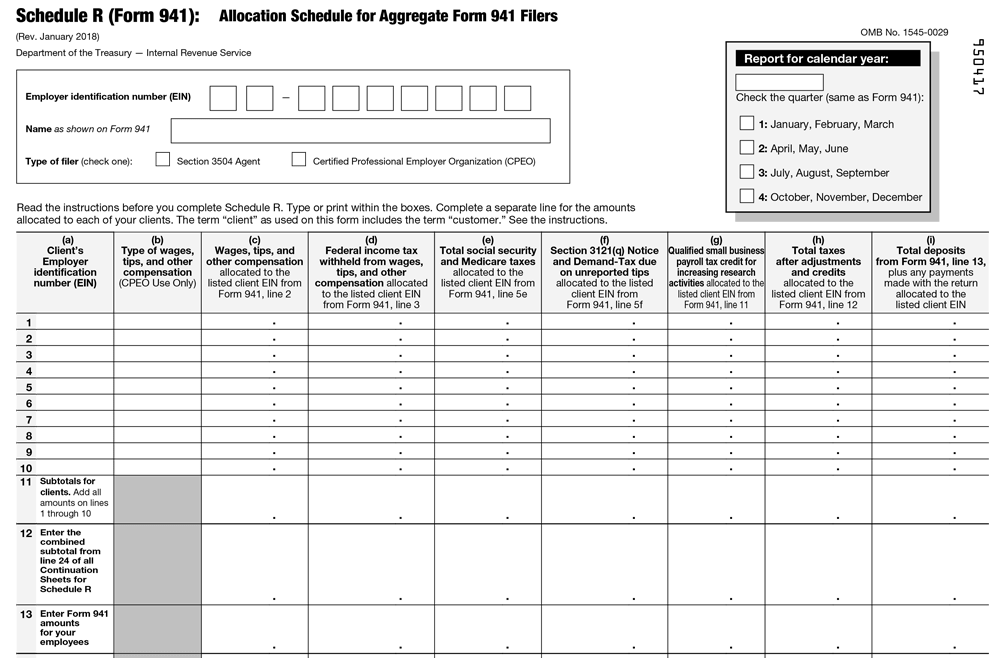

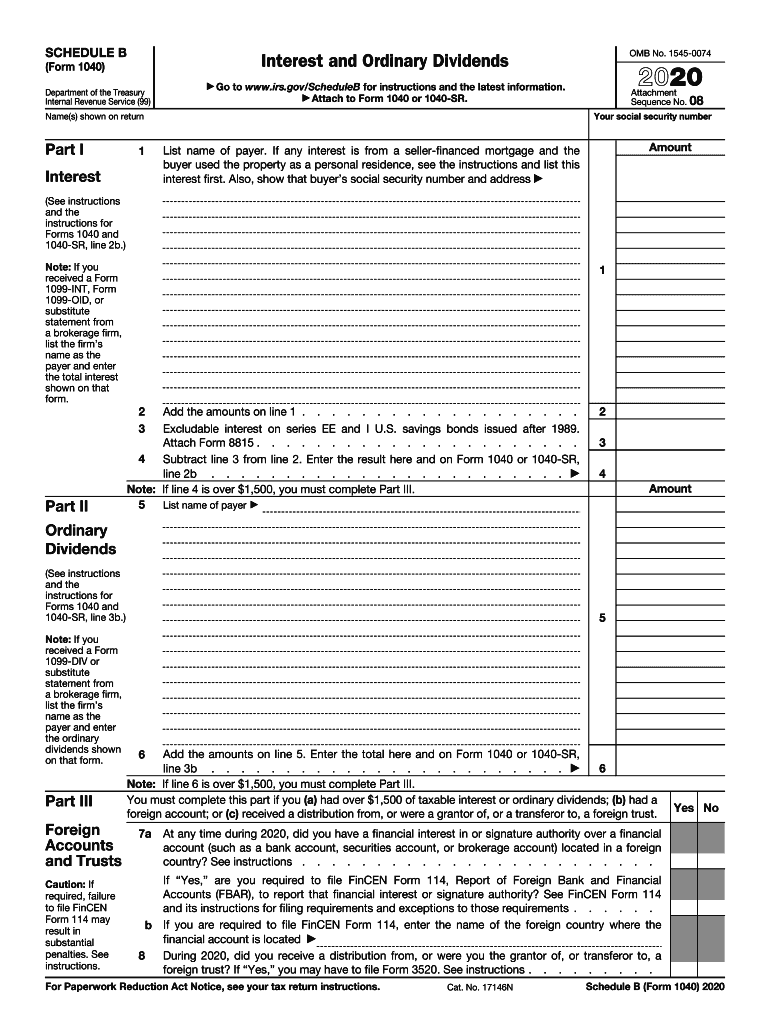

IRS Updated Form 941 Schedule R for COVID19

Type or print within the boxes. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web report for this quarter of 2022 (check one.) 1: Web semiweekly schedule depositor, attach schedule b (form 941). Reported more than $50,000 of employment taxes in the lookback period.

Schedule B (Form 941) Report Of Tax Liability For Semiweekly Schedule

Here’s a simple tax guide to help you understand form 941 schedule b. 15 or section 8 of pub. Total must equal line 12. Be it wages, salaries, bonuses, tips, and other variables. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Enter your tax liability for each month and total liability for the quarter, then go to part 3. See deposit penalties in section 11 of pub. Be it wages,.

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

Read the separate instructions before you complete form 941. October, november, december name (not your trade name) calendar year (also check quarter) use this schedule to show your tax liability for the. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Web report for this quarter of 2022 (check one.).

2018 Schedule 941 Fill Out and Sign Printable PDF Template signNow

According to the irs drafts, the revision dates will be march 2022. Here’s a simple tax guide to help you understand form 941 schedule b. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web semiweekly schedule depositor, attach schedule b (form 941). October, november, december name (not your trade name) calendar year (also check quarter).

4436 Form Fill Out and Sign Printable PDF Template signNow

Employers are required to withhold a certain amount from their employee’s pay. Explore instructions, filing requirements, and tips. Web schedule b with form 941, the irs may propose an “averaged” ftd penalty. Web semiweekly schedule depositor, attach schedule b (form 941). October, november, december name (not your trade name) calendar year (also check quarter) use this schedule to show your.

2023 Form 941 Generator Create Fillable Form 941 Online

Type or print within the boxes. Read the separate instructions before you complete form 941. See deposit penalties in section 11 of pub. Explore instructions, filing requirements, and tips. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

You were a monthly schedule depositor for the entire quarter. Web irs form 941, also known as the employer’s quarterly federal tax return, is where businesses report the income taxes and payroll taxes that they withheld from their employees’ wages — as well. Web february 17, 2022 here we go again! 3 by the internal revenue service. You’re a semiweekly.

Schedule B Fill Out and Sign Printable PDF Template signNow

Make sure payroll has the updated info for filing employment tax returns for the first quarter of 2022. You are a semiweekly depositor if you: Type or print within the boxes. You’re a semiweekly schedule depositor if you reported more than $50,000 of employment taxes in the October, november, december name (not your trade name) calendar year (also check quarter).

You Were A Monthly Schedule Depositor For The Entire Quarter.

File schedule b if you’re a semiweekly schedule depositor. October, november, december name (not your trade name) calendar year (also check quarter) use this schedule to show your tax liability for the. Web semiweekly schedule depositor, attach schedule b (form 941). Make sure payroll has the updated info for filing employment tax returns for the first quarter of 2022.

Web Schedule B With Form 941, The Irs May Propose An “Averaged” Ftd Penalty.

15 or section 8 of pub. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Be it wages, salaries, bonuses, tips, and other variables. Employers are required to withhold a certain amount from their employee’s pay.

Web February 17, 2022 Here We Go Again!

3 by the internal revenue service. Read the separate instructions before you complete form 941. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Total must equal line 12.

Web Report For This Quarter Of 2022 (Check One.) 1:

Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. The instructions for schedule b, report of tax liability for semiweekly schedule depositors, were revised to remove guidance pertaining to the expired employee retention credit. In response to stakeholder input, the draft instructions provide a new filing exception as described on page 3 of the 2022. Explore instructions, filing requirements, and tips.