Form 941 And 940

Form 941 And 940 - Edit, sign and print irs 941 tax form on any device with dochub. Web mailing addresses for forms 941. This form reports the business’s federal. Form 941 is a quarterly report for employers. Web staying compliant with form 941. Gather information needed to complete form 941. Connecticut, delaware, district of columbia, georgia,. In navigating the complexities of tax compliance, let taxbandits be your trusted partner, empowering. Web file a corrected federal form 941 and 940 in quickbooks desktop payroll learn how to correct or amend previously filed federal forms 941 and 940.made a. Web generally, employers are required to file forms 941 quarterly.

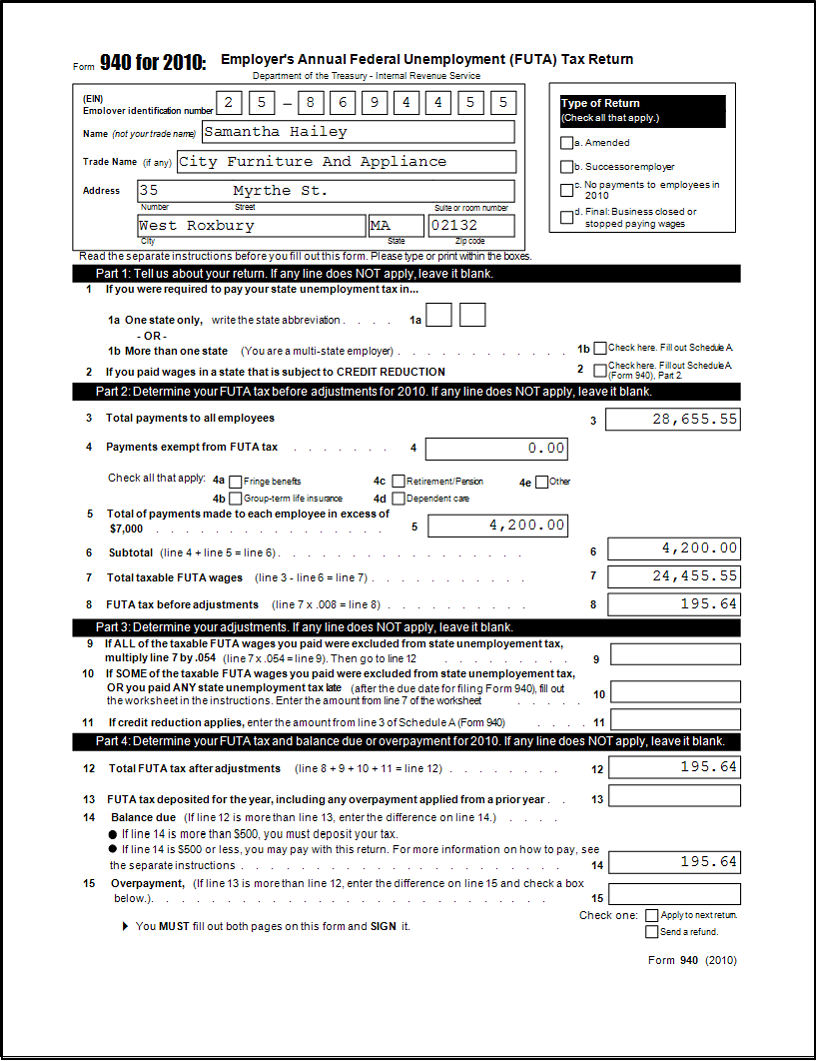

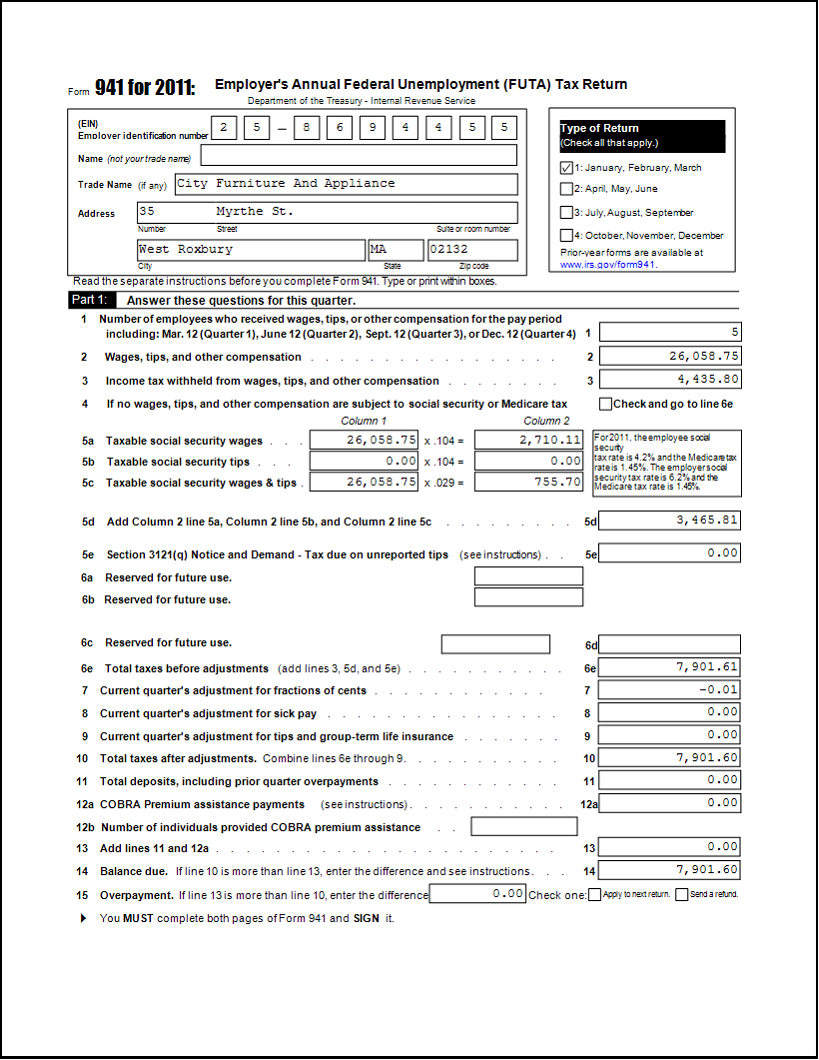

This form reports the business’s federal. Web forms 940 and 941 are irs returns where businesses report their payment of employment taxes. Form 941 getting help with your 940 tax form don’t miss a payroll form due date form 940: Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Some small employers are eligible to file an annual form 944 pdf. Web generally, employers are required to file forms 941 quarterly. We need it to figure and collect the right amount of tax. Connecticut, delaware, district of columbia, georgia,. Web what is the difference between a 940 and a 941 form?

Form 940 is the form an employer must file for reporting purposes when remitting payment of the futa tax to the irs. Web form 940 vs. Ad get ready for tax season deadlines by completing any required tax forms today. Connecticut, delaware, district of columbia, georgia,. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Form 941 is a quarterly report for employers. However, some small employers (those whose annual liability for social security, medicare, and. Web forms 940 and 941 are irs returns where businesses report their payment of employment taxes. In navigating the complexities of tax compliance, let taxbandits be your trusted partner, empowering. Don't confuse form 940, which is an annual employer return for unemployment tax purposes, with other.

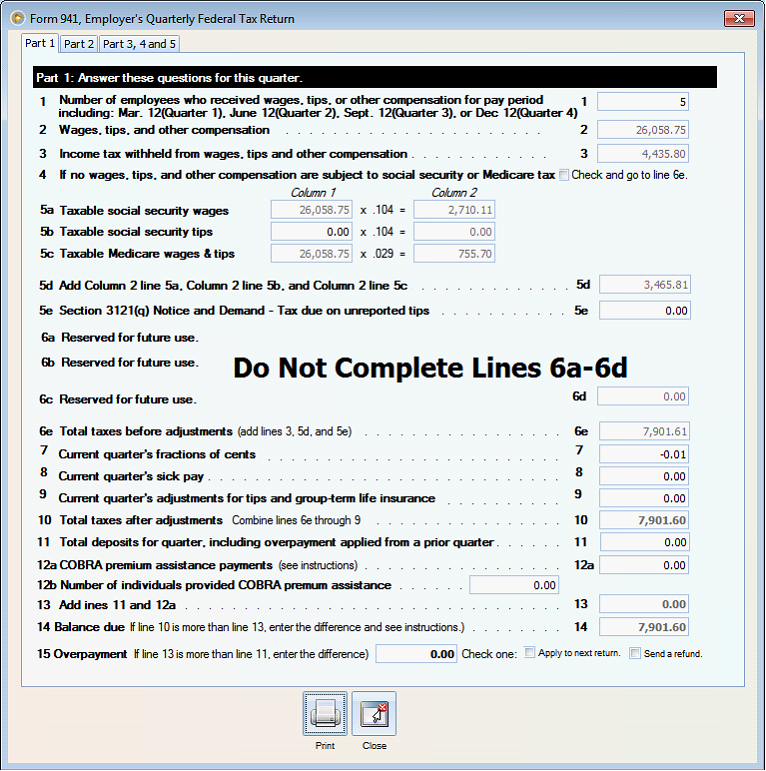

Reports > Year 2011 941 & 940 Reports

Form 941 getting help with your 940 tax form don’t miss a payroll form due date form 940: Web file a corrected federal form 941 and 940 in quickbooks desktop payroll learn how to correct or amend previously filed federal forms 941 and 940.made a. Web the two irs forms are similar. Edit, sign and print irs 941 tax form.

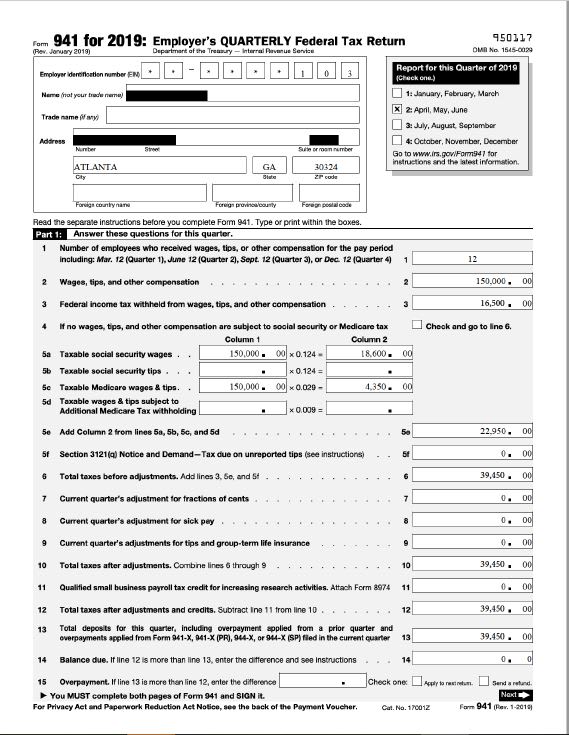

Form 941 Instructions & Info on Tax Form 941 (including Mailing Info)

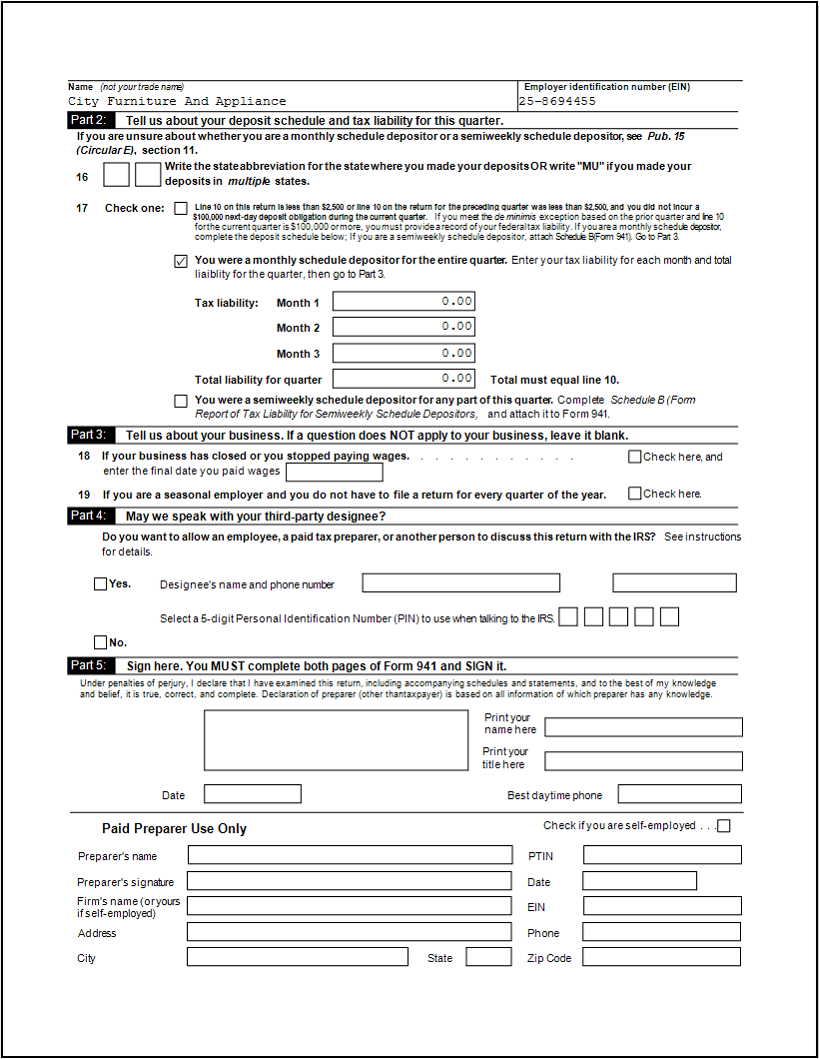

Web if you file form 941 and are a semiweekly depositor, then report your tax liability on schedule b (form 941), report of tax liability for semiweekly schedule. Form 941 is a quarterly report for employers. Web forms 940 and 941 are irs returns where businesses report their payment of employment taxes. How to file the form if you own.

Sample 11 Form Completed 11 Common Misconceptions About Sample 11 Form

Ad get ready for tax season deadlines by completing any required tax forms today. However, form 940 is filed annually and it only reports an employer’s futa taxes. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web forms 940 and 941 are irs returns where businesses report their.

Reports > Year 2011 941 & 940 Reports

Some small employers are eligible to file an annual form 944 pdf. Connecticut, delaware, district of columbia, georgia,. Web mailing addresses for forms 941. Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability. Web we ask for the information on form 941 to carry out the internal revenue laws of.

Irs.gov Form 941 Amended Form Resume Examples MW9pPdM9AJ

Form 941, on the other hand, reports federal income tax. Web what is the difference between a 940 and a 941 form? Web if you file form 941 and are a semiweekly depositor, then report your tax liability on schedule b (form 941), report of tax liability for semiweekly schedule. How to file the form if you own or manage.

Reports > Year 2011 941 & 940 Reports

Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web file a corrected federal form 941 and 940 in quickbooks desktop payroll learn how to correct or amend previously filed federal forms 941 and 940.made a. Form 941 asks for the total amount of. If you operate a business.

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Web learn more about the irs forms 940 and 941. Form 941 asks for the total amount of. Web mailing addresses for forms 941. Form 941 is a quarterly report for employers. Ad get ready for tax season deadlines by completing any required tax forms today.

Reports > Year 2011 941 & 940 Reports

Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. Web learn more about the irs forms 940 and 941. However, form 940 is filed annually and it only reports an employer’s futa taxes. Web what is the difference between a 940 and a 941 form? Form 941 is a quarterly.

form 940 pr 2020 Fill Online, Printable, Fillable Blank

Web the two irs forms are similar. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web what are irs forms 940 and 941 share irs form 940 is an annual form that needs to be filed by any business that has employees. Web form 940 vs. Web the.

Prepare 941 and 940 form by Sandeep_kc Fiverr

Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability. We need it to figure and collect the right amount of tax. Web file a corrected federal form 941 and 940 in quickbooks desktop payroll learn how to correct or amend previously filed federal forms 941 and 940.made a. Web generally,.

Section 3504 Agents Who Elect To File An Aggregate.

Ad get ready for tax season deadlines by completing any required tax forms today. Web the schedule r (form 941) allocates those aggregate wages reported on form 941 to each of the clients. The filings true up what you’ve already remitted to the irs with. In navigating the complexities of tax compliance, let taxbandits be your trusted partner, empowering.

Web What Is The Difference Between A 940 And A 941 Form?

Web generally, employers are required to file forms 941 quarterly. Web file a corrected federal form 941 and 940 in quickbooks desktop payroll learn how to correct or amend previously filed federal forms 941 and 940.made a. Gather information needed to complete form 941. Web the two irs forms are similar.

How To File The Form If You Own Or Manage A.

If you operate a business and have employees working for you, then you likely need to file irs form 941, employer’s quarterly federal tax return, four. Web learn more about the irs forms 940 and 941. Web form 940 vs. Form 941 asks for the total amount of.

Form 941 Is A Quarterly Report For Employers.

Web form 940 is an annual report for employers to file their federal unemployment tax act (futa) tax liability. Web what are irs forms 940 and 941 share irs form 940 is an annual form that needs to be filed by any business that has employees. However, form 940 is filed annually and it only reports an employer’s futa taxes. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1460.png)