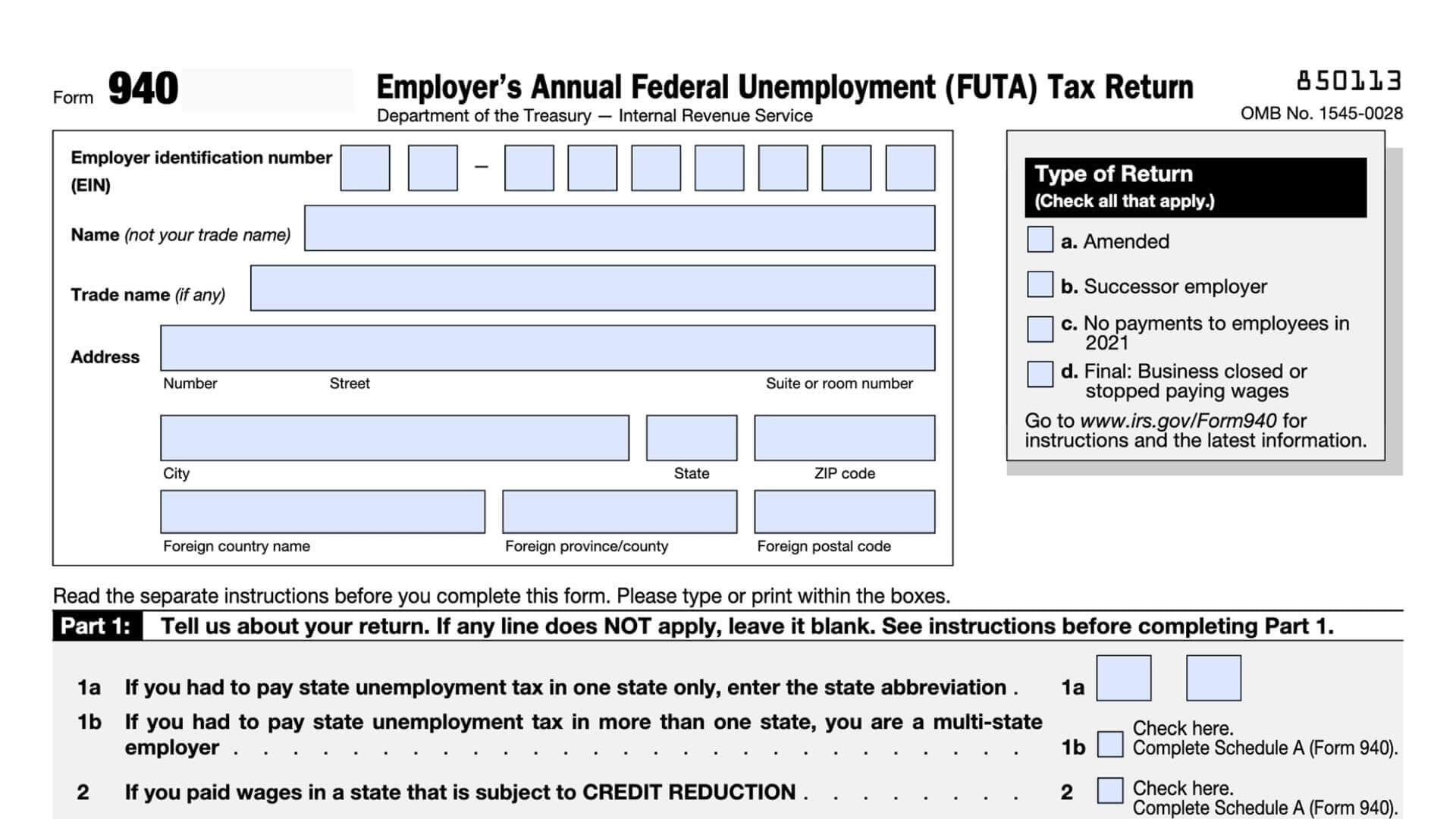

Form 940 2023

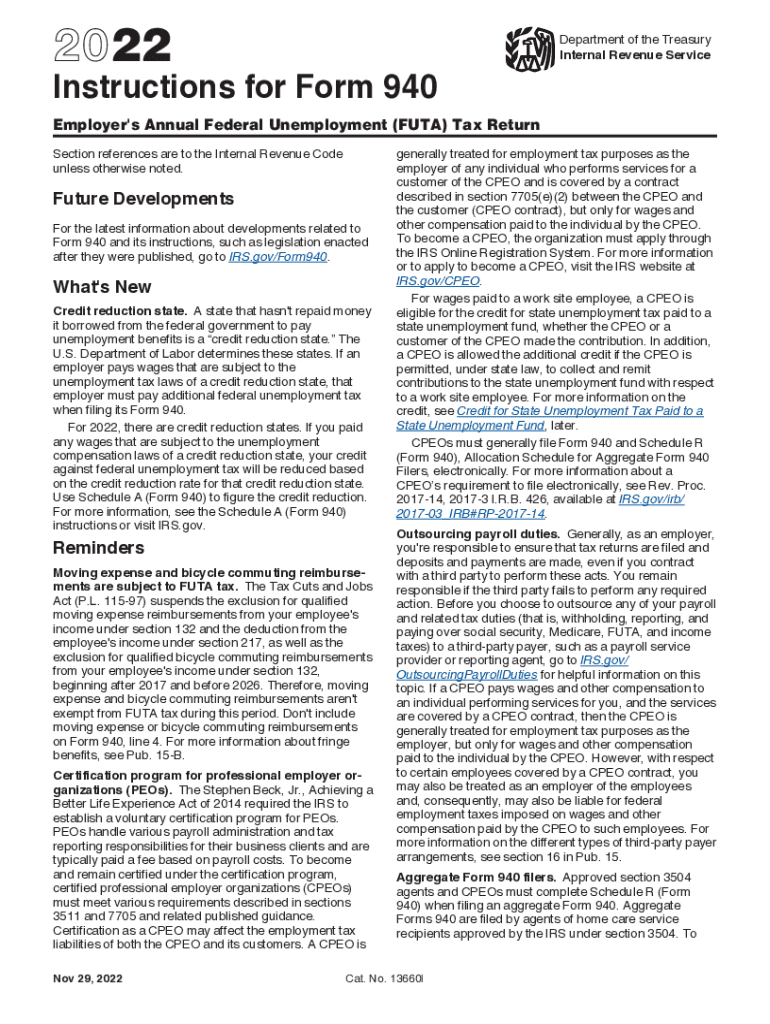

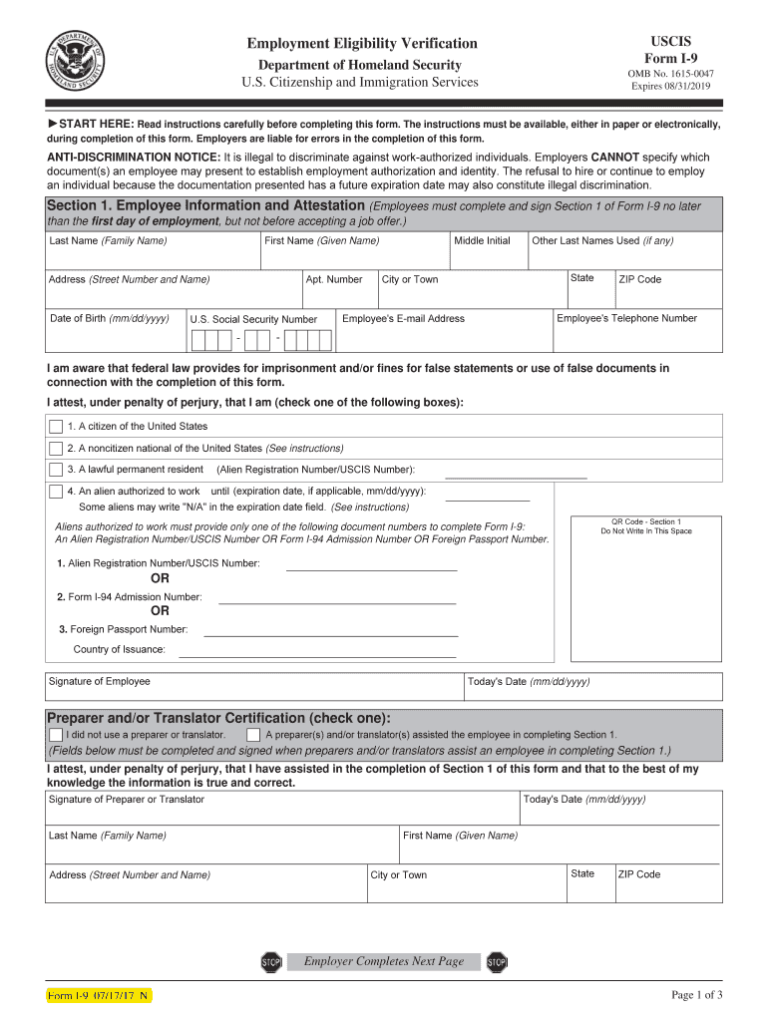

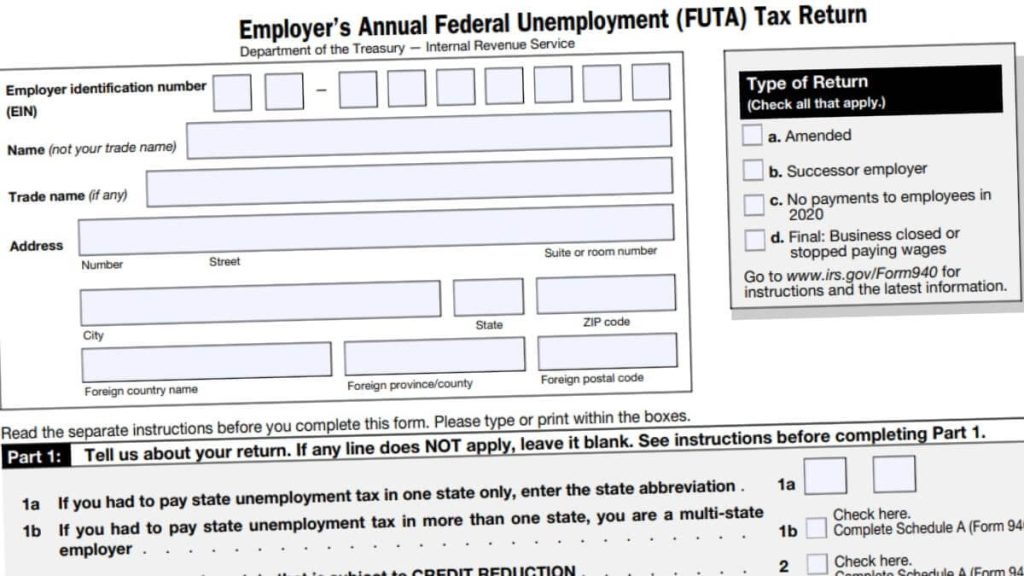

Form 940 2023 - You receive acknowledgement within 24 hours. 940, 941, 943, 944 and 945. In the instructions for form 940. If it is $500 or less, you can either deposit the amount or pay it with your form 940 by january 31, 2023. Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return, is a form used by employers to report their annual federal unemployment taxes. Web if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by january 31, 2023. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. I want to submit the forms myself

940, 941, 943, 944 and 945. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. You receive acknowledgement within 24 hours. Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return, is a form used by employers to report their annual federal unemployment taxes. If it is $500 or less, you can either deposit the amount or pay it with your form 940 by january 31, 2023. Web if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by january 31, 2023. Web form 940, employer's annual federal unemployment tax return. See when must you deposit your futa tax?

In a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of. Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. I want to submit the forms myself It is secure and accurate. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax. Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return, is a form used by employers to report their annual federal unemployment taxes. Web if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by january 31, 2023. 940, 941, 943, 944 and 945.

940 Form 2023

In a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. I want to submit the forms myself Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return,.

Payroll Tax Forms and Reports in ezPaycheck Software

Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return, is a form used by employers to report their annual federal unemployment taxes. 940, 941, 943, 944 and 945. You receive acknowledgement within 24 hours. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use.

F940 Instructions 2021 Fill Out and Sign Printable PDF Template signNow

Futa tax is a federal tax that helps fund state unemployment agencies and provides unemployment benefits to workers who have lost their jobs. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Form 941, employer's quarterly federal tax return. Web form 940 only if your futa tax for the fourth.

Pdf Fillable Form 940 I9 Form 2023 Printable

I want to submit the forms myself Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax. See when must you deposit your futa tax? Use form 940 to report your annual federal unemployment tax act.

How to Fill out IRS Form 940 (FUTA Tax Return) YouTube

I want to submit the forms myself You receive acknowledgement within 24 hours. Web if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by january 31, 2023. Web form 940, employer's annual federal unemployment tax return. In a major step in the new digital intake scanning.

940 Form 2023 Fillable Form 2023

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Futa tax is a federal tax that helps fund state unemployment agencies and provides unemployment benefits to workers who have lost their jobs. Use form.

Form 940 (Schedule A) MultiState Employer and Credit Reduction

In a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of. If it is $500 or less, you can either deposit the amount or pay it with your form 940 by january 31, 2023. In the instructions for form 940. If your total futa tax.

940 Form 2023

Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. Use form 940 to report your annual federal unemployment tax act (futa) tax. If it is $500 or less, you can either.

2020 form 940 instructions Fill Online, Printable, Fillable Blank

This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax. You receive acknowledgement within 24 hours. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax. Form 941, employer's quarterly federal.

SOLUTION Form 940 And 941 Complete Studypool

If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Use form 940 to report your annual federal unemployment tax act (futa) tax. This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax. Web if.

It Is Secure And Accurate.

Futa tax is a federal tax that helps fund state unemployment agencies and provides unemployment benefits to workers who have lost their jobs. Web form 940, employer's annual federal unemployment tax return. Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. See when must you deposit your futa tax?

In The Instructions For Form 940.

Use form 940 to report your annual federal unemployment tax act (futa) tax. Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return, is a form used by employers to report their annual federal unemployment taxes. If it is $500 or less, you can either deposit the amount or pay it with your form 940 by january 31, 2023. This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax.

Form 941, Employer's Quarterly Federal Tax Return.

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax. Web if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by january 31, 2023. Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023.

If Your Total Futa Tax After Adjustments (Form 940, Line 12) Is More Than $500, You Must Make Deposits By Electronic Funds Transfer.

You receive acknowledgement within 24 hours. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. I want to submit the forms myself In a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of.