Form 926 Instructions 2021

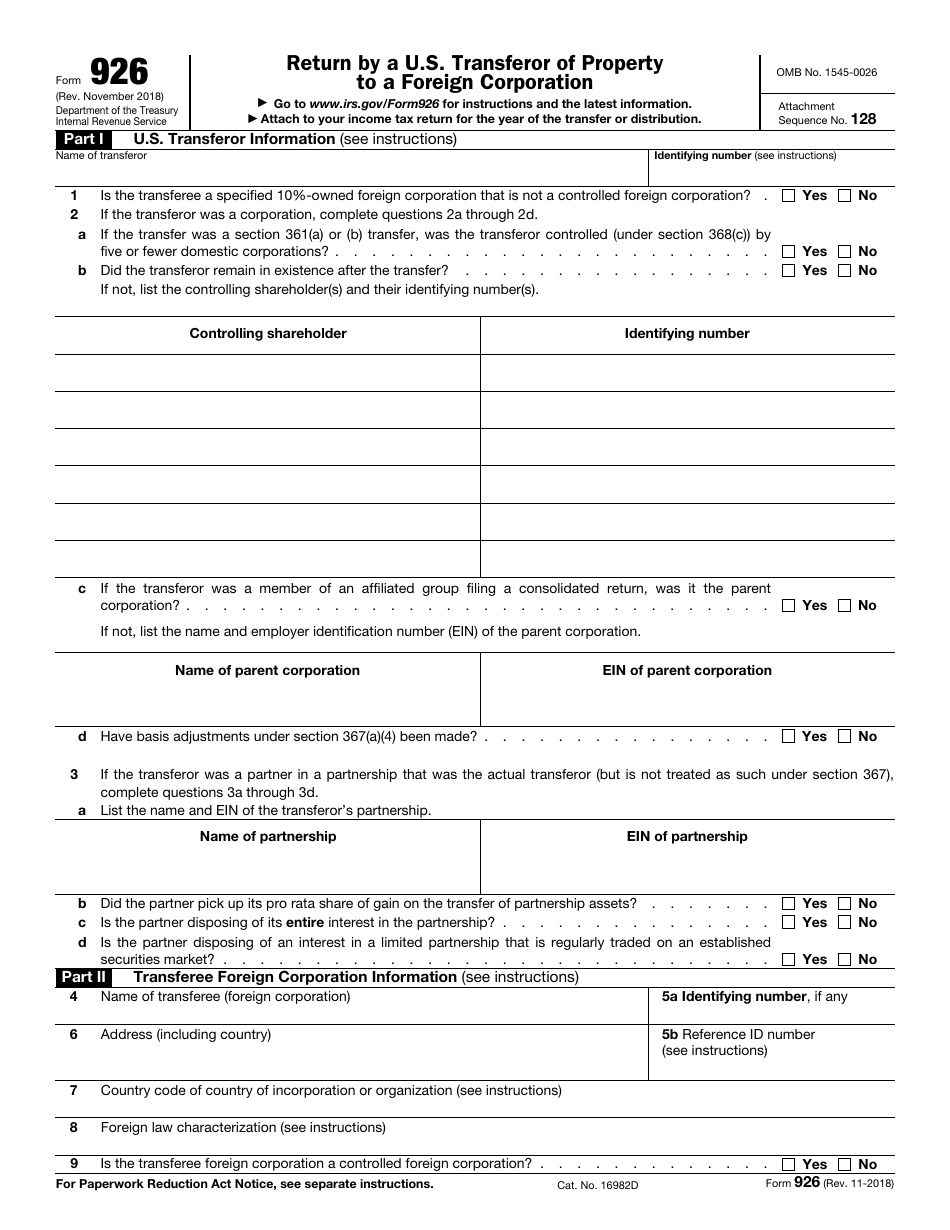

Form 926 Instructions 2021 - Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. 9 by the internal revenue service. Web 406 rows instruction in html. Edit your form 926 instructions online type text, add images, blackout confidential details, add comments, highlights and more. Instructions for form 982 (12/2021) download pdf. Sign it in a few clicks draw your. Transferor of property to a foreign corporation, to report. Web 1 best answer johnw152 expert alumni you don't appear to have a filing requirement for form 926 for tax year 2020. Web irs form 926 is the form u.s. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation.

Irs transfer of property to a. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete. Web federal return by a u.s. (new) foreign corporation property transfers 2021. Transferor of property to a foreign corporation, to report. Web sstgb form f0003 exemption certificate (revised 12/21/2021) streamlined sales tax certificate of exemption do not send this form to the streamlined sales tax governing. The mere investment of cash in a foreign. 9 by the internal revenue service. Web 406 rows instruction in html. Instructions for form 982 (12/2021) download pdf.

Web federal return by a u.s. Transferor of property to a foreign corporation form 926 pdf form content report error it appears you don't have a pdf plugin for this browser. 9 by the internal revenue service. Web irs form 926 is the form u.s. Edit your form 926 instructions online type text, add images, blackout confidential details, add comments, highlights and more. The mere investment of cash in a foreign. Citizens and residents to file the form 926: Web 1 best answer johnw152 expert alumni you don't appear to have a filing requirement for form 926 for tax year 2020. Irs transfer of property to a. Web final instructions were released in early september of 2021, and additional changes and clarifications were released on january 18, 2022.

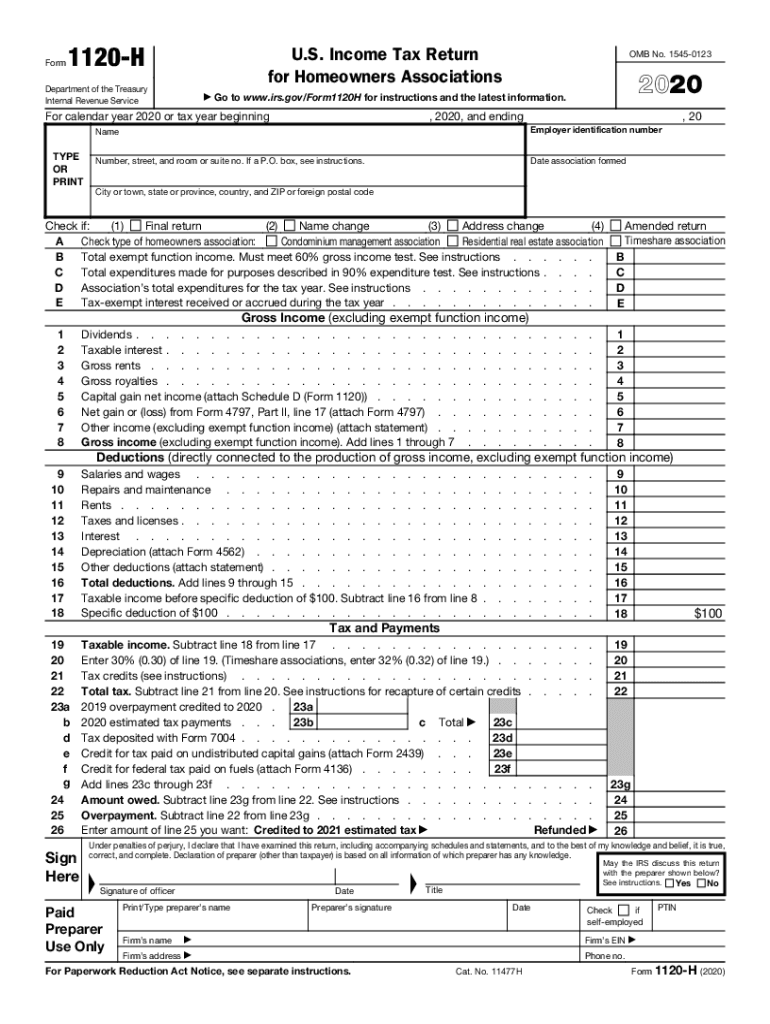

Instructions For Form 1120 H Internal Revenue Service Fill Out and

Instructions for form 990 return of organization exempt from. Instructions for form 982 (12/2021) download pdf. Web the irs requires certain u.s. The mere investment of cash in a foreign. Edit your form 926 instructions online type text, add images, blackout confidential details, add comments, highlights and more.

ICANN Application for TaxExempt Status (U.S.) Form 872C

Web how it works upload the form 926 pdf edit & sign 926 form from anywhere save your changes and share form 926 instructions pdf rate the form 926 instructions 2021 4.7. Web irs form 926 is the form u.s. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. • getting.

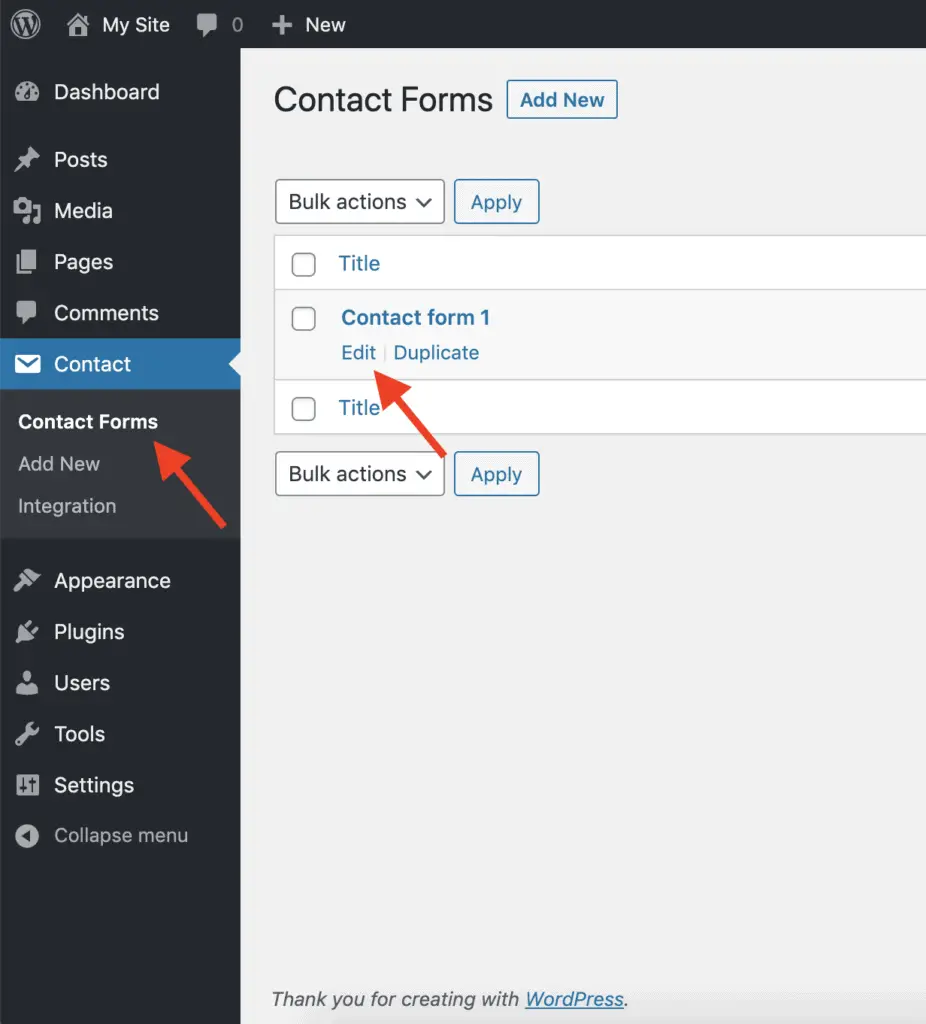

How To Add A Hidden Field In Contact Form 7? (With Default Value)

You do not need to report. Instructions for form 982 (12/2021) download pdf. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Web irs form 926 is the form u.s. Transferor of property to a foreign corporation, to report.

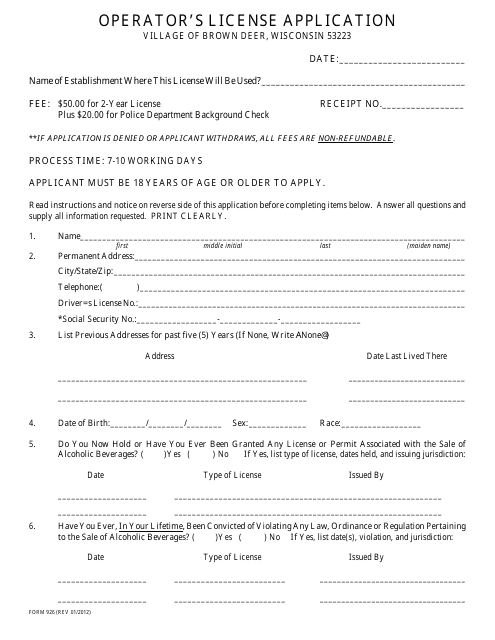

Form 926 Download Printable PDF or Fill Online Operator's License

Web the finalized publication 926, household employer’s tax guide, was released feb. Citizens or residents, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. • getting answers to your tax questions. Sign it in a few clicks draw your. Transferor of property to a foreign corporation form 926 pdf form content report error it.

8949 Form 2021

Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. The publication was updated to remind. Web the finalized publication 926, household employer’s tax guide, was released feb. Web final instructions were released in early september of 2021, and additional changes and clarifications were released on january 18, 2022. Edit your form 926 instructions.

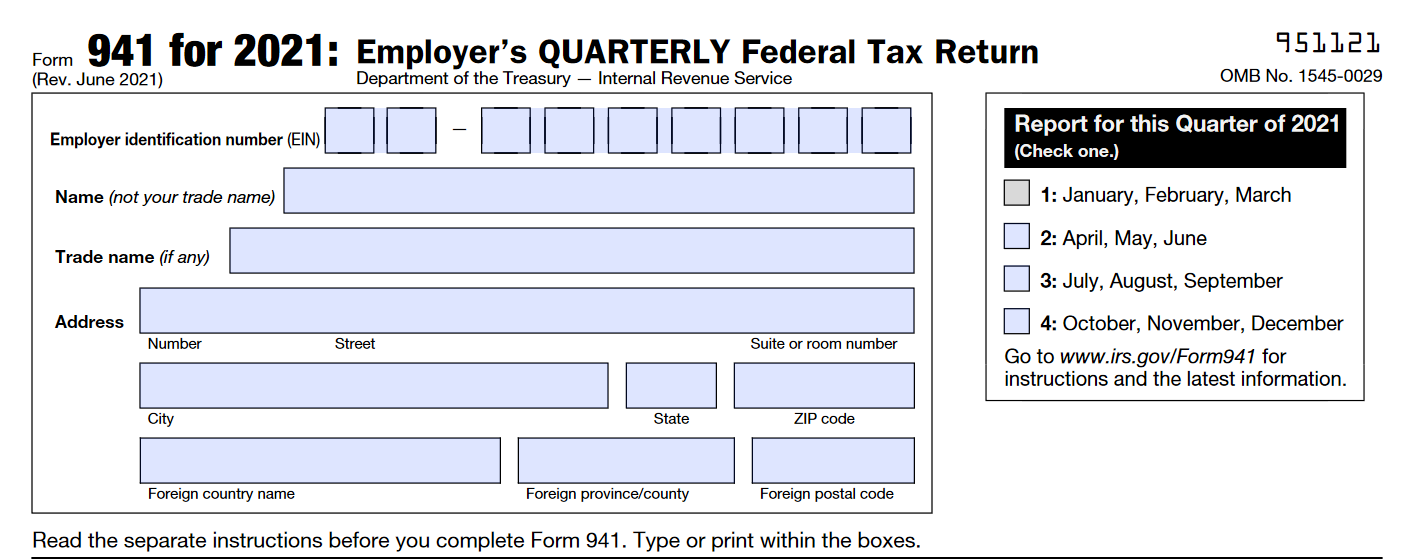

IRS Form 941 Instructions for 2021 How to fill out Form 941

The mere investment of cash in a foreign. Transferor of property to a foreign corporation, to report. Citizens and residents to file the form 926: Sign it in a few clicks draw your. Instructions for form 990 return of organization exempt from.

IRS Form 926 Download Fillable PDF or Fill Online Return by a U.S

Web sstgb form f0003 exemption certificate (revised 12/21/2021) streamlined sales tax certificate of exemption do not send this form to the streamlined sales tax governing. Web 1 best answer johnw152 expert alumni you don't appear to have a filing requirement for form 926 for tax year 2020. Sign it in a few clicks draw your. Transferor of property to a.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Transferor of property to a foreign corporation form 926 pdf form content report error it appears you don't have a pdf plugin for this browser. Instructions for form 982 (12/2021) download pdf. Web sstgb form f0003 exemption certificate (revised 12/21/2021) streamlined sales tax certificate of exemption do not send this form to the streamlined sales tax governing. Web irs form.

IRS Form 926 What You Need To Know Silver Tax Group

Web sstgb form f0003 exemption certificate (revised 12/21/2021) streamlined sales tax certificate of exemption do not send this form to the streamlined sales tax governing. The mere investment of cash in a foreign. • getting answers to your tax questions. Irs transfer of property to a. You do not need to report.

Form 926 Return by a U.S. Transferor of Property to a Foreign

Instructions for form 990 return of organization exempt from. Citizen or resident, a domestic corporation, or a domestic estate or trust must complete. • getting answers to your tax questions. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Transferor of property to a foreign corporation form 926 pdf form content report error.

Citizens And Residents To File The Form 926:

Web how it works upload the form 926 pdf edit & sign 926 form from anywhere save your changes and share form 926 instructions pdf rate the form 926 instructions 2021 4.7. Web 1 best answer johnw152 expert alumni you don't appear to have a filing requirement for form 926 for tax year 2020. You do not need to report. Sign it in a few clicks draw your.

Irs Transfer Of Property To A.

Web federal return by a u.s. Web the irs requires certain u.s. The mere investment of cash in a foreign. 9 by the internal revenue service.

Instructions For Form 990 Return Of Organization Exempt From.

(new) foreign corporation property transfers 2021. Transferor of property to a foreign corporation, to report. Web irs form 926 is the form u.s. Edit your form 926 instructions online type text, add images, blackout confidential details, add comments, highlights and more.

Transferor Of Property To A Foreign Corporation Was Filed By The Partnership And Sent To You For Information.

Web the finalized publication 926, household employer’s tax guide, was released feb. • getting answers to your tax questions. Web sstgb form f0003 exemption certificate (revised 12/21/2021) streamlined sales tax certificate of exemption do not send this form to the streamlined sales tax governing. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation.