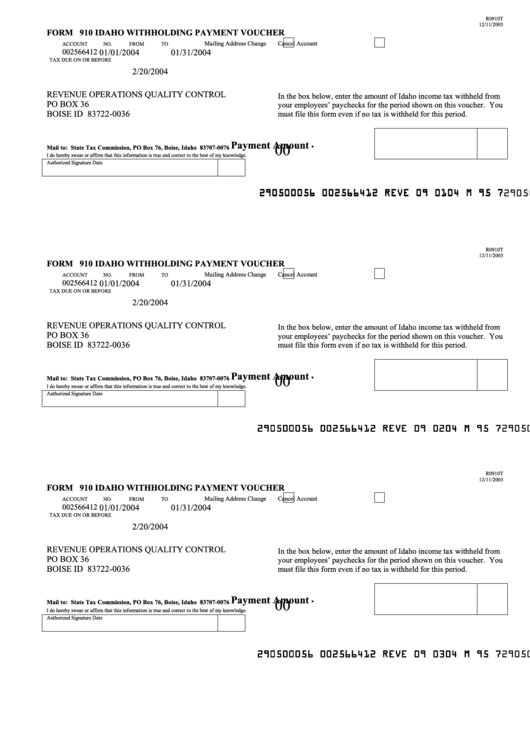

Form 910 Idaho

Form 910 Idaho - Employers are required by idaho law to withhold income tax from their employees’ wages. Web new idaho employer: Find the idaho form 910 you want. Register with the idaho department of labor. Use get form or simply click on the template preview to open it in the editor. + add to google calendar. If you’re an employee, your employer probably withholds. Double check all the fillable fields to ensure full accuracy. Web idaho form 910 instructions payment requirements. Withholdi ng form 910 (semimonthly filers) read more about withholding.

Edit, sign and print tax forms on any device with uslegalforms. 14 released instructions for filing form 910, idaho withholding payment voucher, for corporate income and individual. Find the idaho form 910 you want. Use get form or simply click on the template preview to open it in the editor. Apply a check mark to point the answer where expected. Employers are required by idaho law to withhold income tax from their employees’ wages. Web complete idaho form 910 online with us legal forms. Get ready for tax season deadlines by completing any required tax forms today. Web what is form 910 idaho, as9102 form, form 9106, us form 910, what is form 910 created date: Web farmers not required to file with the idaho department of labor can pay the taxes withheld on a yearly basis using form 910.

Apply a check mark to point the answer where expected. Web individual income tax forms (current) individual income tax forms (archive) property tax forms. If you’re an employee, your employer probably withholds. Forms 41, 41s, 65, or 66. Get ready for tax season deadlines by completing any required tax forms today. Peo paperwork letter of intent; Edit, sign and print tax forms on any device with uslegalforms. If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income. 14 released instructions for filing form 910, idaho withholding payment voucher, for corporate income and individual. They also have the option to pay the taxes withheld.

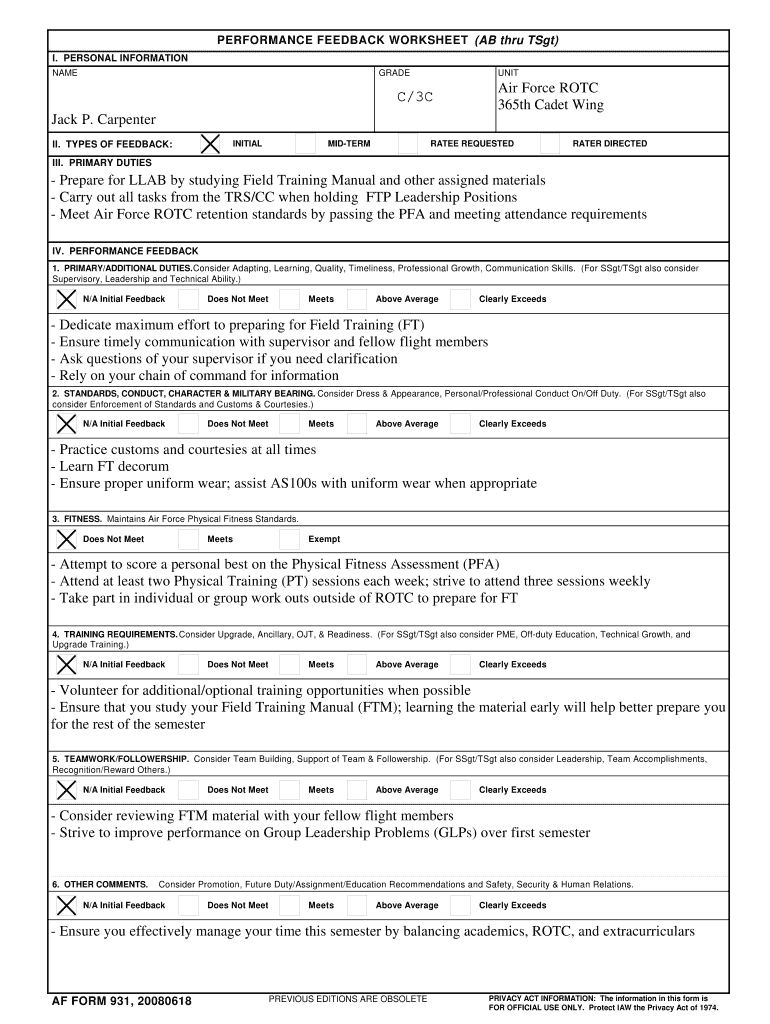

2008 Form AF 931 Fill Online, Printable, Fillable, Blank pdfFiller

If you’re an employee, your employer probably withholds. Edit, sign and print tax forms on any device with uslegalforms. Web what is form 910 idaho, as9102 form, form 9106, us form 910, what is form 910 created date: Register with the idaho department of labor. Get ready for tax season deadlines by completing any required tax forms today.

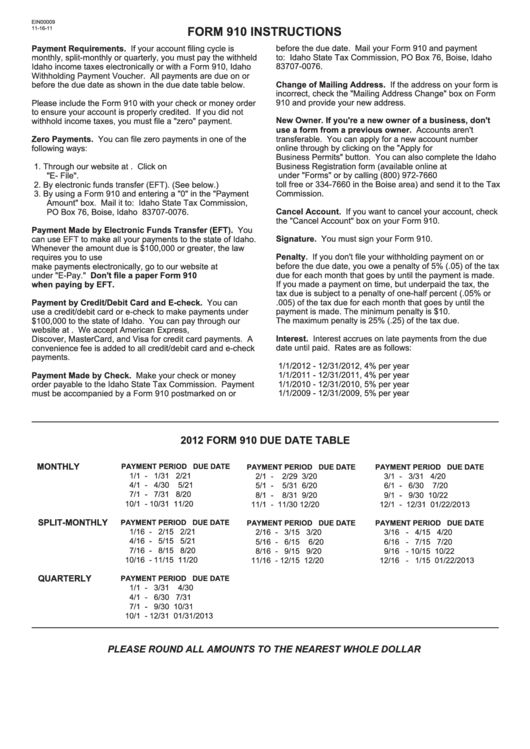

Instructions For Form 910 Idaho Withholding Payment Voucher 2012

Web complete idaho form 910 online with us legal forms. Withholdi ng form 910 (semimonthly filers) read more about withholding. Web enter your official identification and contact details. Web choose the tax type. Easily add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your paperwork.

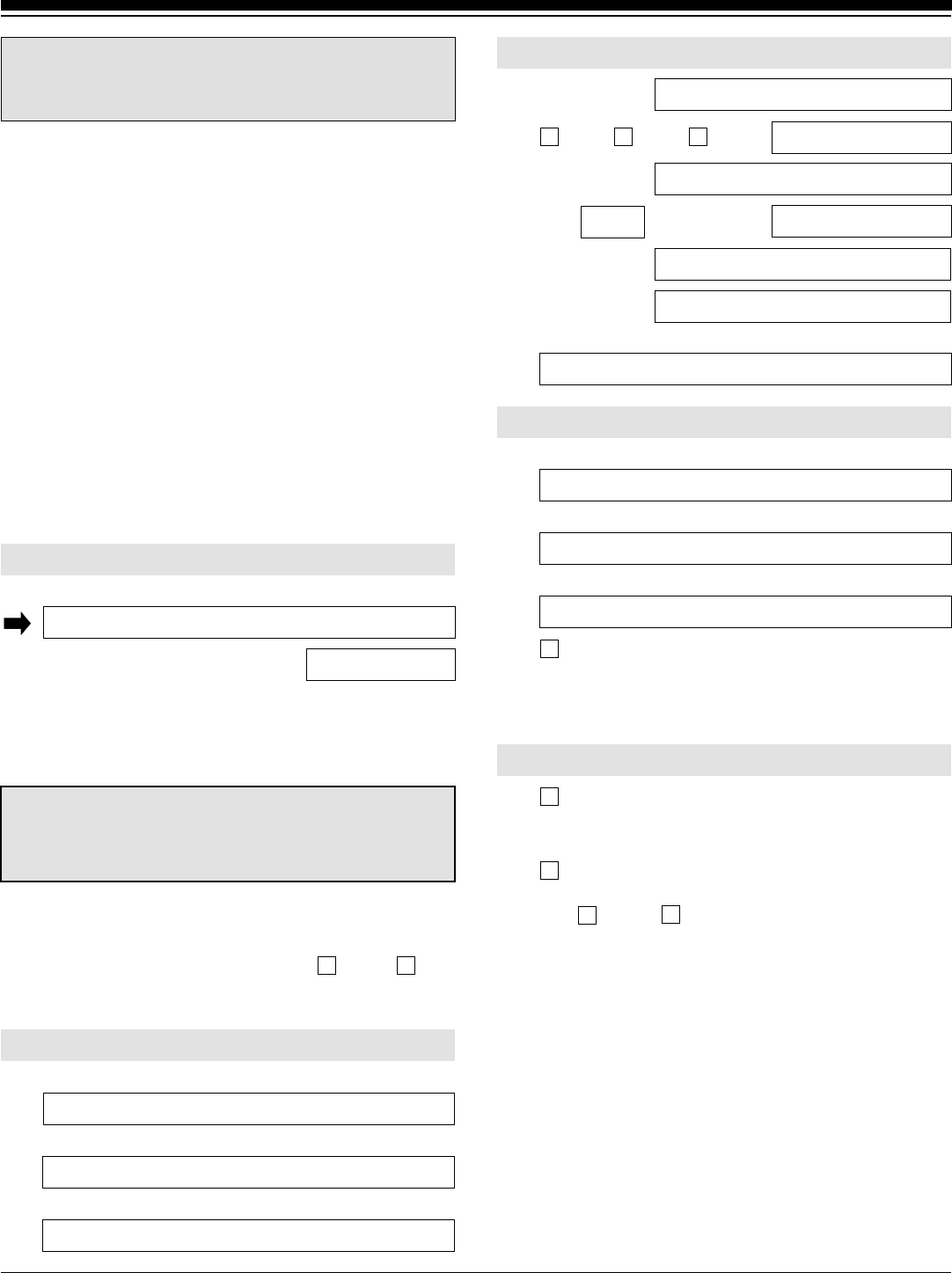

Form I910 Edit, Fill, Sign Online Handypdf

+ add to google calendar. Peo paperwork letter of intent; Web complete idaho form 910 online with us legal forms. Web by signing this form, i certify that the statements i made on this form are true and correct. Web form 910 permit 002606100 idaho withholding pa 94 po 76, in the box below, enter the amount of idaho income.

Form I910 Edit, Fill, Sign Online Handypdf

Web idaho form 910 instructions payment requirements. Find the idaho form 910 you want. Save or instantly send your ready documents. Easily add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your paperwork. Web enter your official identification and contact details.

Evaluations Training AF Form 910 YouTube

Web complete idaho form 910 online with us legal forms. Get ready for tax season deadlines by completing any required tax forms today. Employers are required by idaho law to withhold income tax from their employees’ wages. Web what is form 910 idaho, as9102 form, form 9106, us form 910, what is form 910 created date: Complete, edit or print.

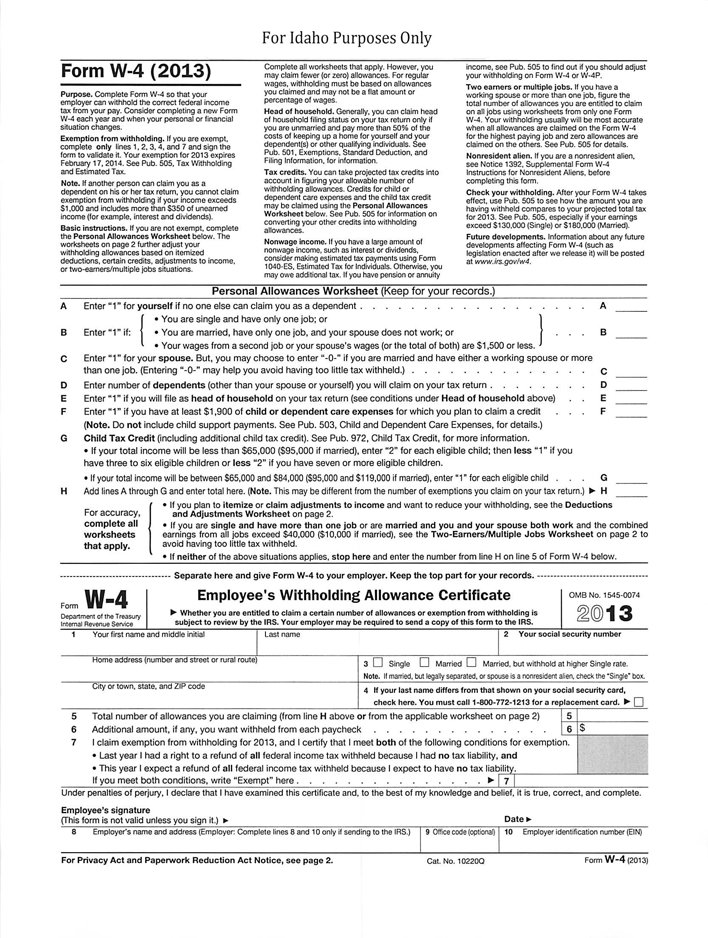

State Tax Withholding Forms Template Free Download Speedy Template

Use get form or simply click on the template preview to open it in the editor. Complete, edit or print tax forms instantly. If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income taxes electronically or. You can check your liability and register online with the idaho department of labor. They also.

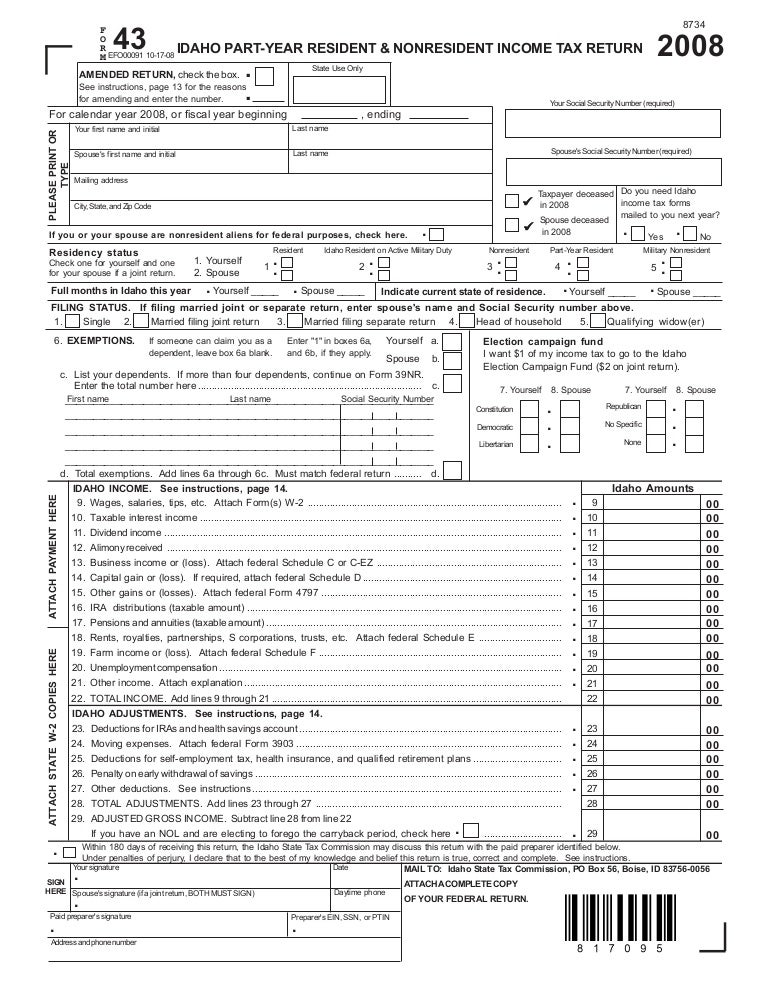

tax.idaho.gov EFO00091_10172008

14 released instructions for filing form 910, idaho withholding payment voucher, for corporate income and individual. Get ready for tax season deadlines by completing any required tax forms today. Web idaho form 910 instructions payment requirements. Web what is form 910 idaho, as9102 form, form 9106, us form 910, what is form 910 created date: Web the idaho state tax.

Idaho form 910 Fill out & sign online DocHub

Web idaho form 910 instructions payment requirements. 14 released instructions for filing form 910, idaho withholding payment voucher, for corporate income and individual. If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income taxes electronically or. Save or instantly send your ready documents. Web farmers not required to file with the idaho.

Form 910 Idaho Withholding Payment Voucher 2004 printable pdf download

Withholdi ng form 910 (semimonthly filers) read more about withholding. Apply a check mark to point the answer where expected. Edit, sign and print tax forms on any device with uslegalforms. Web individual income tax forms (current) individual income tax forms (archive) property tax forms. Register with the idaho department of labor.

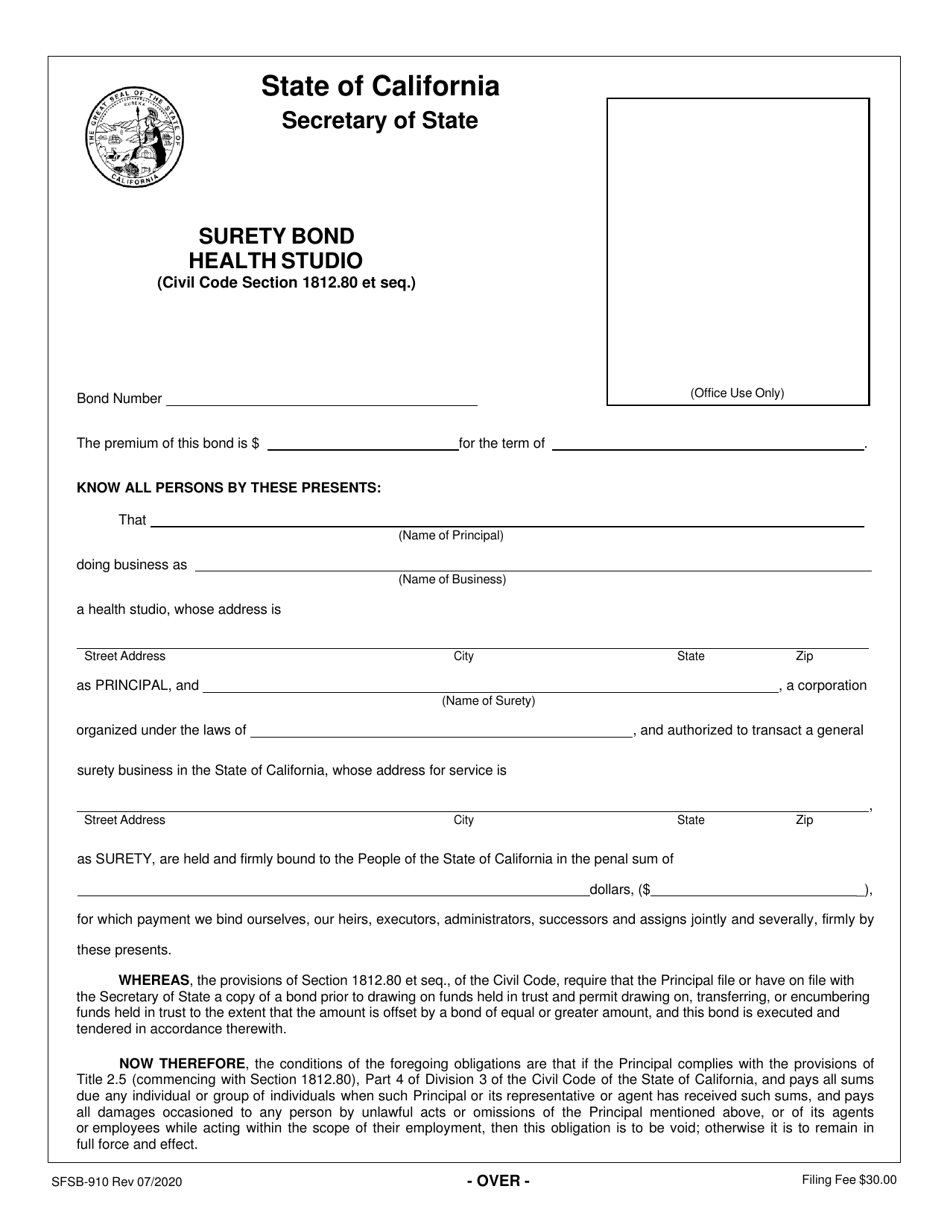

Form SFSB910 Download Fillable PDF or Fill Online Surety Bond Health

Double check all the fillable fields to ensure full accuracy. Web individual income tax forms (current) individual income tax forms (archive) property tax forms. If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income taxes electronically or. Employers are required by idaho law to withhold income tax from their employees’ wages. Web.

They Also Have The Option To Pay The Taxes Withheld.

Save or instantly send your ready documents. Get ready for tax season deadlines by completing any required tax forms today. Edit, sign and print tax forms on any device with uslegalforms. Web by signing this form, i certify that the statements i made on this form are true and correct.

Employers Are Required By Idaho Law To Withhold Income Tax From Their Employees’ Wages.

Easily fill out pdf blank, edit, and sign them. You can check your liability and register online with the idaho department of labor. Web new idaho employer: If you’re an employee, your employer probably withholds.

Web The Idaho State Tax Commission Jan.

678 idaho tax forms and templates are collected for any. Start completing the fillable fields and. Web individual income tax forms (current) individual income tax forms (archive) property tax forms. Double check all the fillable fields to ensure full accuracy.

Web Complete Idaho Form 910 Online With Us Legal Forms.

If your account filing cycle is monthly, semimonthly, quarterly, or annually, you must pay the withheld idaho income taxes electronically or. Web farmers not required to file with the idaho department of labor can pay the taxes withheld on a yearly basis using form 910. Web idaho form 910 instructions payment requirements. Web enter your official identification and contact details.