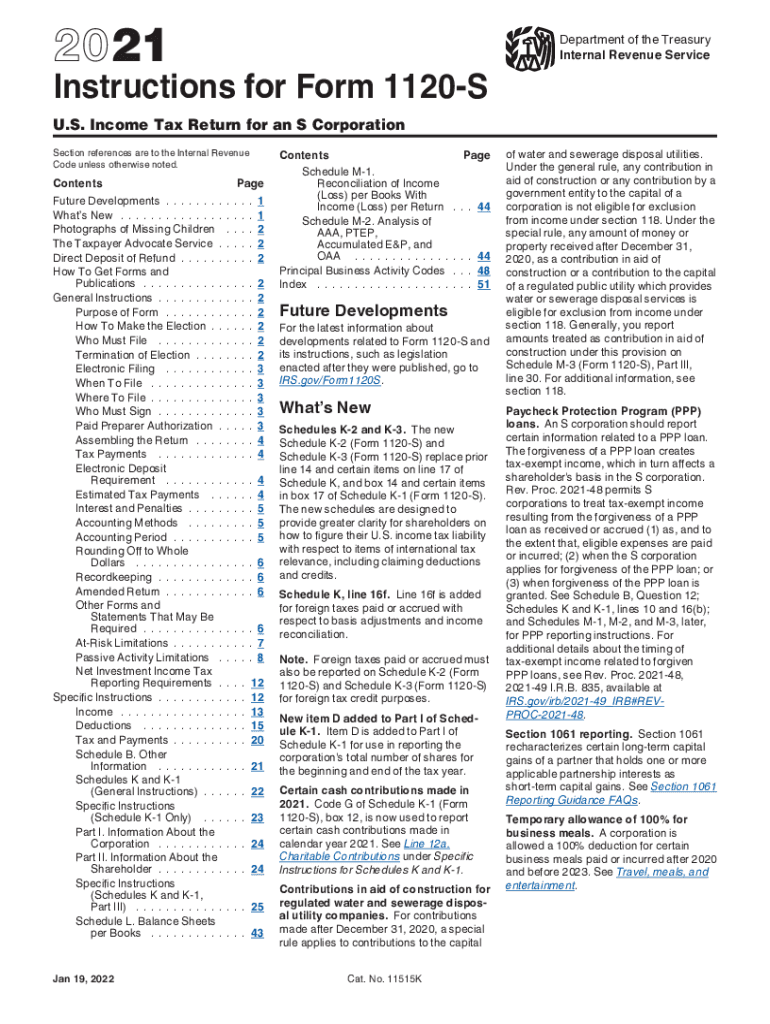

Form 8971 Instructions 2021

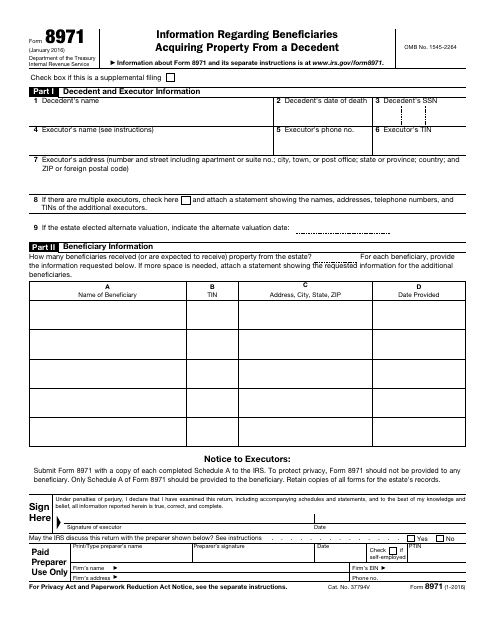

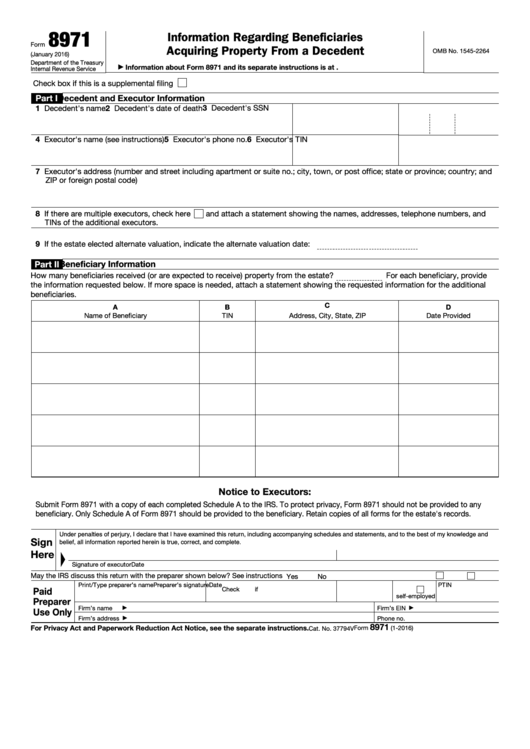

Form 8971 Instructions 2021 - Web form 8971 and accompanying schedule a are used to fulfill the section 6035 reporting obligations to the irs and the beneficiaries of estates. Web this form, along with a copy of every schedule a, is used to report values to the irs. The maximum penalty is $532,000 per year (or $186,000 if the taxpayer qualifies for lower maximum penalties, as described below). Web form 8971 instructions pdf. $260 per form 8971 (including all Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. On march 2, 2016, the irs and treasury published proposed regulations regarding sections 1014(f) and 6035. Web if you received a schedule a to form 8971 for property and part 2, column c, of the schedule a indicates that the property increased the estate tax liability, you will be required to report a basis consistent with the final estate tax value of the property reported in part 2, column e, of the schedule. Web the irs has issued a new form 8971 “information regarding beneficiaries acquiring property from a decedent” and instructions. One schedule a is provided to each beneficiary receiving property from an estate.

This item is used to assist in filing form 8971. Web when the correct form 8971 with schedule(s) a is filed. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. Web information about form 8971 and its separate instructions is at. On march 2, 2016, the irs and treasury published proposed regulations regarding sections 1014(f) and 6035. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Part i decedent and executor information. The penalty is as follows. Form 8971 is required to be filed if an estate has to file an estate tax return under form 706 after july 31, 2015. Web this form, along with a copy of every schedule a, is used to report values to the irs.

About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Check box if this is a supplemental filing. Web when the correct form 8971 with schedule(s) a is filed. The penalty is as follows. Web the irs has issued a new form 8971 “information regarding beneficiaries acquiring property from a decedent” and instructions. $260 per form 8971 (including all Form 8971 is required to be filed if an estate has to file an estate tax return under form 706 after july 31, 2015. Part i decedent and executor information. Web this form, along with a copy of every schedule a, is used to report values to the irs. Web form 8971 and accompanying schedule a are used to fulfill the section 6035 reporting obligations to the irs and the beneficiaries of estates.

IRS Form 8971 Instructions Reporting a Decedent's Property

Executor's name (see instructions) 5. The penalty is as follows. Web information about form 8971 and its separate instructions is at. Web form 8971 instructions pdf. This increases the duties of a personal representative or executor of a decedent’s estate.

New Basis Reporting Requirements for Estates Meeting Form 8971

One schedule a is provided to each beneficiary receiving property from an estate. Web when the correct form 8971 with schedule(s) a is filed. Check box if this is a supplemental filing. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Web form 8971 and accompanying schedule a are used to fulfill the section 6035.

New IRS Form 8971 Rules to Report Beneficiary Cost Basis Fill Out and

The penalty is as follows. One schedule a is provided to each beneficiary receiving property from an estate. Web form 8971 and accompanying schedule a are used to fulfill the section 6035 reporting obligations to the irs and the beneficiaries of estates. This item is used to assist in filing form 8971. About form 8971, information regarding beneficiaries acquiring property.

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. The penalty is as follows. Web this form, along with a copy of every schedule a, is used to report values to the irs. This information return reports the values from the.

IRS Form 8971 Instructions Reporting a Decedent's Property

The maximum penalty is $532,000 per year (or $186,000 if the taxpayer qualifies for lower maximum penalties, as described below). Part i decedent and executor information. This information return reports the values from the decedent’s gross estate to both the irs and to each beneficiary receiving property from the estate. Check box if this is a supplemental filing. This increases.

IRS Form 8971 Download Fillable PDF or Fill Online Information

$260 per form 8971 (including all Web if you received a schedule a to form 8971 for property and part 2, column c, of the schedule a indicates that the property increased the estate tax liability, you will be required to report a basis consistent with the final estate tax value of the property reported in part 2, column e,.

Form 12277 Instructions 2021 2022 IRS Forms Zrivo

$50 per form 8971 (including all schedule(s) a) if it is filed within 30 days after the due date. This item is used to assist in filing form 8971. Executor's name (see instructions) 5. The penalty is as follows. This increases the duties of a personal representative or executor of a decedent’s estate.

2020 2021 Irs Instructions Form Printable Fill Out Digital PDF Sample

The penalty is as follows. Web form 8971 and accompanying schedule a are used to fulfill the section 6035 reporting obligations to the irs and the beneficiaries of estates. $260 per form 8971 (including all Executor's name (see instructions) 5. Web when the correct form 8971 with schedule(s) a is filed.

IRS Form 8971 Instructions Reporting a Decedent's Property

Web when the correct form 8971 with schedule(s) a is filed. Web form 8971 and accompanying schedule a are used to fulfill the section 6035 reporting obligations to the irs and the beneficiaries of estates. This item is used to assist in filing form 8971. Part i decedent and executor information. $50 per form 8971 (including all schedule(s) a) if.

Fillable Form 8971 Information Regarding Beneficiaries Acquiring

Web the irs has issued a new form 8971 “information regarding beneficiaries acquiring property from a decedent” and instructions. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Check box if this is a supplemental filing. Web form 8971 instructions pdf. The penalty is as follows.

$260 Per Form 8971 (Including All

Executor's name (see instructions) 5. Form 8971 and attached schedule(s) a must be filed with the irs, separate from. Web the irs has issued a new form 8971 “information regarding beneficiaries acquiring property from a decedent” and instructions. One schedule a is provided to each beneficiary receiving property from an estate.

Web Information About Form 8971 And Its Separate Instructions Is At.

On march 2, 2016, the irs and treasury published proposed regulations regarding sections 1014(f) and 6035. Web form 8971 and accompanying schedule a are used to fulfill the section 6035 reporting obligations to the irs and the beneficiaries of estates. $50 per form 8971 (including all schedule(s) a) if it is filed within 30 days after the due date. Web form 8971 instructions pdf.

Web When The Correct Form 8971 With Schedule(S) A Is Filed.

This increases the duties of a personal representative or executor of a decedent’s estate. Web irs form 8971 is the tax form that the executor of an estate must use to report the final estate tax value of property of that estate. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service Part i decedent and executor information.

Check Box If This Is A Supplemental Filing.

This item is used to assist in filing form 8971. Form 8971 is required to be filed if an estate has to file an estate tax return under form 706 after july 31, 2015. Web this form, along with a copy of every schedule a, is used to report values to the irs. Web if you received a schedule a to form 8971 for property and part 2, column c, of the schedule a indicates that the property increased the estate tax liability, you will be required to report a basis consistent with the final estate tax value of the property reported in part 2, column e, of the schedule.