Form 8960 Error

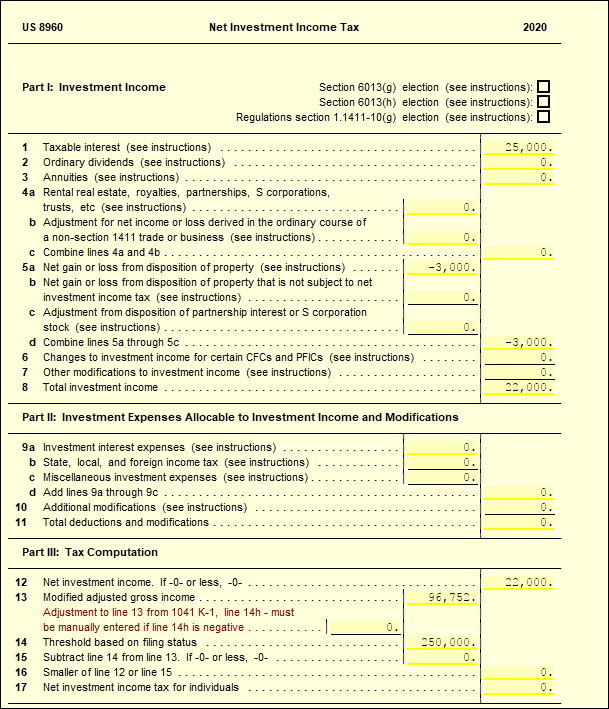

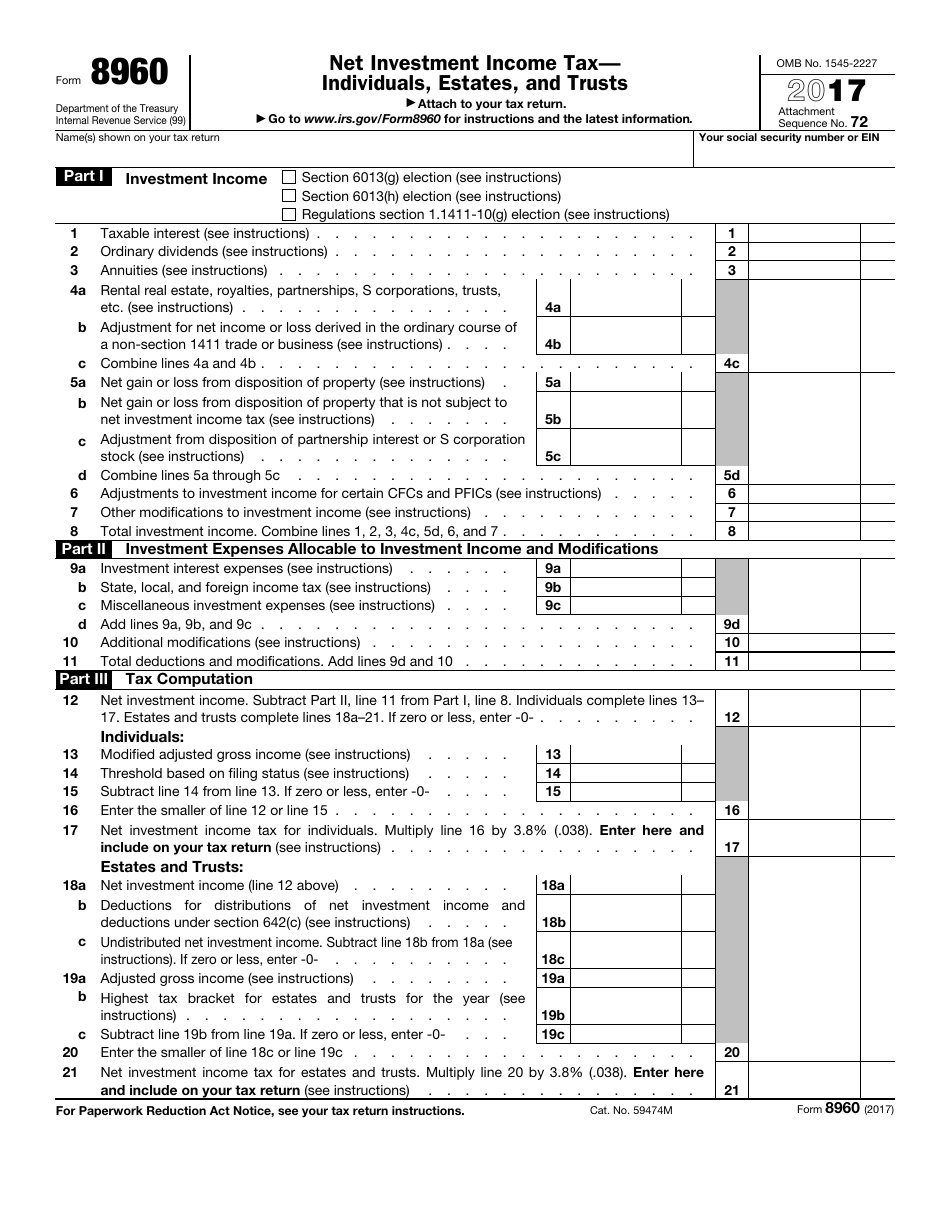

Form 8960 Error - Web home forms and instructions about form 8960, net investment income tax individuals, estates, and trusts about form 8960, net investment income tax individuals, estates,. Yes, you can only use the state, local and foreign income taxes on form 8960 if you itemize deductions on for regular tax. Web february 19, 2023 10:31 am my return was accepted on 2/19 after previous rejection. I had the same issues as everyone here. It is a plus and minus on lines 4a and 4b. Web by phinancemd » mon feb 06, 2023 5:14 pm. Web yeah, the program created form 8960 and worksheet. Did it twice to make sure but i still get these forms. Web if there are overrides on form 8960 or schedule a, you will need to remove the overrides and revert to the calculated value, and then adjust the necessary inputs. Per irs, form 8960 is not required on sale of a primary.

Web form 8960 incorrect calculation hi there, i filed my tax return in february and made a payment for the balance due. It is a plus and minus on lines 4a and 4b. Per irs, form 8960 is not required on sale of a primary. Web february 19, 2023 10:31 am my return was accepted on 2/19 after previous rejection. Yes, you can only use the state, local and foreign income taxes on form 8960 if you itemize deductions on for regular tax. Did it twice to make sure but i still get these forms. Web by phinancemd » mon feb 06, 2023 5:14 pm. Since it is listed on line 4a as. Web if there are overrides on form 8960 or schedule a, you will need to remove the overrides and revert to the calculated value, and then adjust the necessary inputs. Web yeah, the program created form 8960 and worksheet.

I had the same issues as everyone here. Yes, you can only use the state, local and foreign income taxes on form 8960 if you itemize deductions on for regular tax. Web yeah, the program created form 8960 and worksheet. I have a schedule c basically. Web instructions for form 8960 (2022) net investment income tax—individuals, estates, and trusts section references are to the internal revenue code unless. We do not have an estimate for when the problem will be. Per irs, form 8960 is not required on sale of a primary. Since it is listed on line 4a as. Web yes, i am also. In my case, my client's schedule c income is flowing over to form 8960.

irs form 8960 for 2019 Fill Online, Printable, Fillable Blank form

Yes, you can only use the state, local and foreign income taxes on form 8960 if you itemize deductions on for regular tax. Web yeah, the program created form 8960 and worksheet. I have a schedule c basically. Since it is listed on line 4a as. Did it twice to make sure but i still get these forms.

8960 Net Investment Tax UltimateTax Solution Center

Web by phinancemd » mon feb 06, 2023 5:14 pm. Web form 8960 incorrect calculation hi there, i filed my tax return in february and made a payment for the balance due. Web march 14, 2020 4:25 pm. Web february 19, 2023 10:31 am my return was accepted on 2/19 after previous rejection. Web yeah, the program created form 8960.

John Deere 8960&8970 for Farming Simulator 2017

It is a plus and minus on lines 4a and 4b. Web yes, i am also. Per irs, form 8960 is not required on sale of a primary. Web february 19, 2023 10:31 am my return was accepted on 2/19 after previous rejection. In my case, my client's schedule c income is flowing over to form 8960.

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Yesterday, unexpectedly, i received a refund check. Web if there are overrides on form 8960 or schedule a, you will need to remove the overrides and revert to the calculated value, and then adjust the necessary inputs. Web form 8960 incorrect calculation hi there, i filed my tax return in february and made a payment for the balance due. In.

What Is Form 8960? H&R Block

I had the same issues as everyone here. Web yeah, the program created form 8960 and worksheet. Per irs, form 8960 is not required on sale of a primary. Web if there are overrides on form 8960 or schedule a, you will need to remove the overrides and revert to the calculated value, and then adjust the necessary inputs. Web.

Fillable Form 8960 Draft Net Investment Tax Individuals

Web form 8960 incorrect calculation hi there, i filed my tax return in february and made a payment for the balance due. We do not have an estimate for when the problem will be. It is a plus and minus on lines 4a and 4b. I had the same issues as everyone here. In my case, my client's schedule c.

Form 8960 Edit, Fill, Sign Online Handypdf

Web if there are overrides on form 8960 or schedule a, you will need to remove the overrides and revert to the calculated value, and then adjust the necessary inputs. Web home forms and instructions about form 8960, net investment income tax individuals, estates, and trusts about form 8960, net investment income tax individuals, estates,. Web yes, i am also..

Fillable Form 8822B Change of Address for Business in 2020 Change of

Web yes, i am also. Yes, you can only use the state, local and foreign income taxes on form 8960 if you itemize deductions on for regular tax. Per irs, form 8960 is not required on sale of a primary. We do not have an estimate for when the problem will be. It is a plus and minus on lines.

Fill Free fillable F8960 2019 Form 8960 PDF form

Per irs, form 8960 is not required on sale of a primary. Since it is listed on line 4a as. Did it twice to make sure but i still get these forms. Web instructions for form 8960 (2022) net investment income tax—individuals, estates, and trusts section references are to the internal revenue code unless. Web march 14, 2020 4:25 pm.

IRS Form 8960 Download Fillable PDF or Fill Online Net Investment

In my case, my client's schedule c income is flowing over to form 8960. It is a plus and minus on lines 4a and 4b. Web form 8960 incorrect calculation hi there, i filed my tax return in february and made a payment for the balance due. Since it is listed on line 4a as. Per irs, form 8960 is.

Web Instructions For Form 8960 (2022) Net Investment Income Tax—Individuals, Estates, And Trusts Section References Are To The Internal Revenue Code Unless.

Yesterday, unexpectedly, i received a refund check. Did it twice to make sure but i still get these forms. Web home forms and instructions about form 8960, net investment income tax individuals, estates, and trusts about form 8960, net investment income tax individuals, estates,. I had the same issues as everyone here.

Web Yes, I Am Also.

Web by phinancemd » mon feb 06, 2023 5:14 pm. Yes, you can only use the state, local and foreign income taxes on form 8960 if you itemize deductions on for regular tax. Web february 19, 2023 10:31 am my return was accepted on 2/19 after previous rejection. Web yeah, the program created form 8960 and worksheet.

Per Irs, Form 8960 Is Not Required On Sale Of A Primary.

In my case, my client's schedule c income is flowing over to form 8960. We do not have an estimate for when the problem will be. Web march 14, 2020 4:25 pm. Web form 8960 incorrect calculation hi there, i filed my tax return in february and made a payment for the balance due.

Since It Is Listed On Line 4A As.

Web if there are overrides on form 8960 or schedule a, you will need to remove the overrides and revert to the calculated value, and then adjust the necessary inputs. It is a plus and minus on lines 4a and 4b. I have a schedule c basically.