Form 8949 Instructions 2020

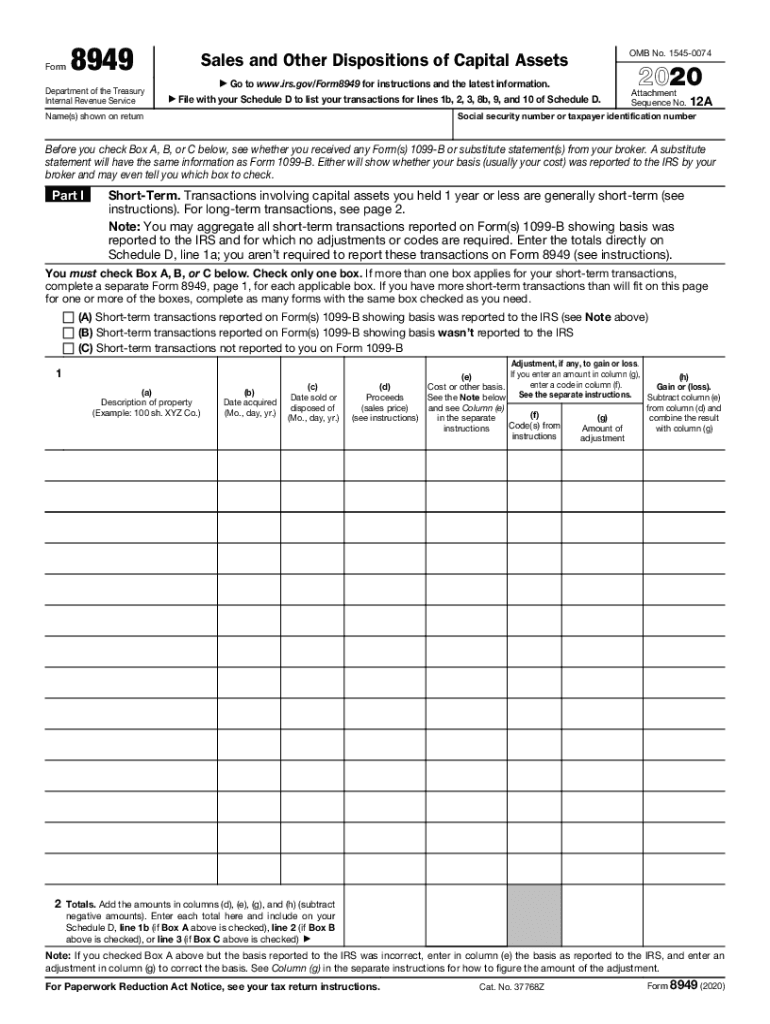

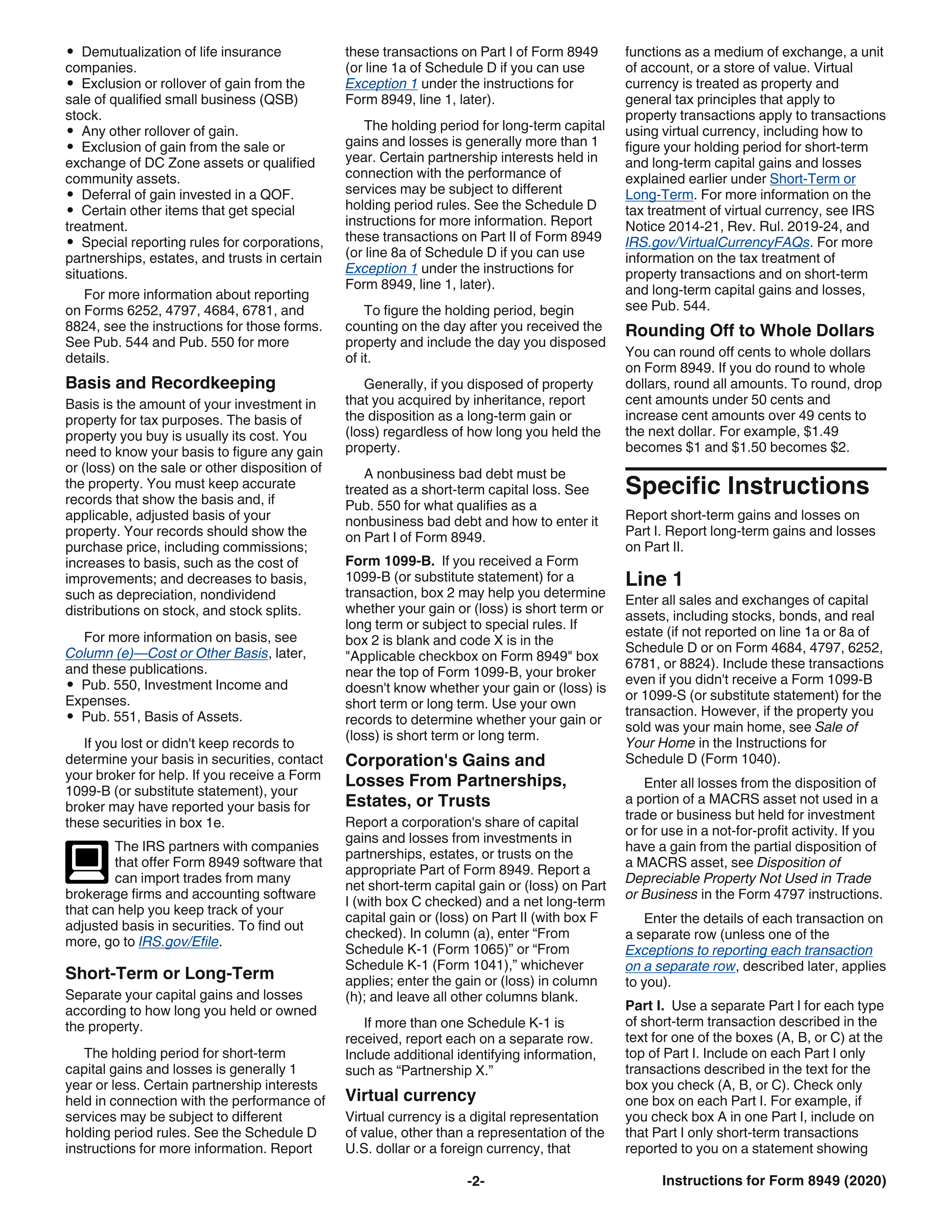

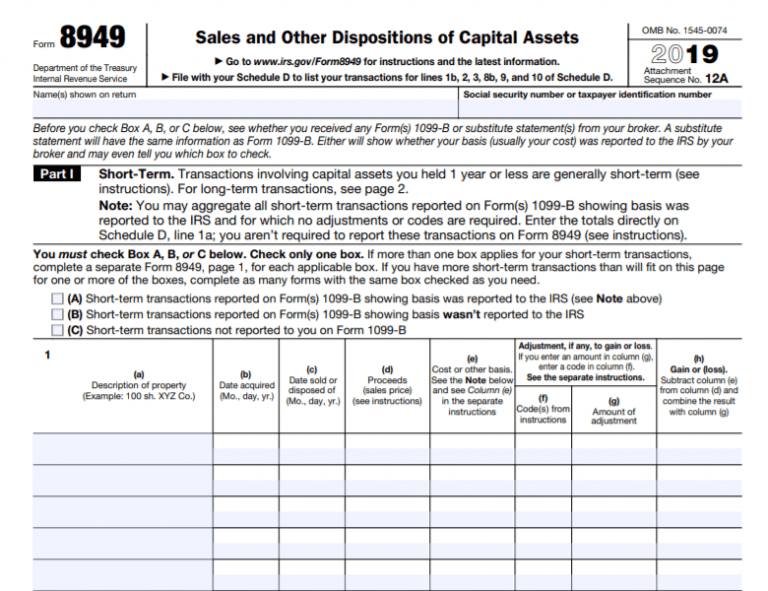

Form 8949 Instructions 2020 - Form 8949 (sales and other dispositions of capital assets) records the details of your. Web updated for tax year 2022 • june 2, 2023 08:43 am overview the schedule d form is what most people use to report capital gains and losses that. Web future developments for the latest information about developments related to form 8949 and its instructions, such as legislation enacted after they were published, go to. Web we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest version of form 8949, fully updated for tax year 2022. Do your 2021, 2020, 2019, 2018 all the way back to 2000 Web where is form 8949? Sales and other dispositions of capital assets is an internal revenue service (irs) form used to report capital gains and losses from investments. Ad irs 8949 instructions & more fillable forms, register and subscribe now! Code(s) from amount of instructions adjustment (h) gain or (loss) subtract column (e) from column (d) and combine the result with column (g). Web use form 8949 to report sales and exchanges of capital assets.

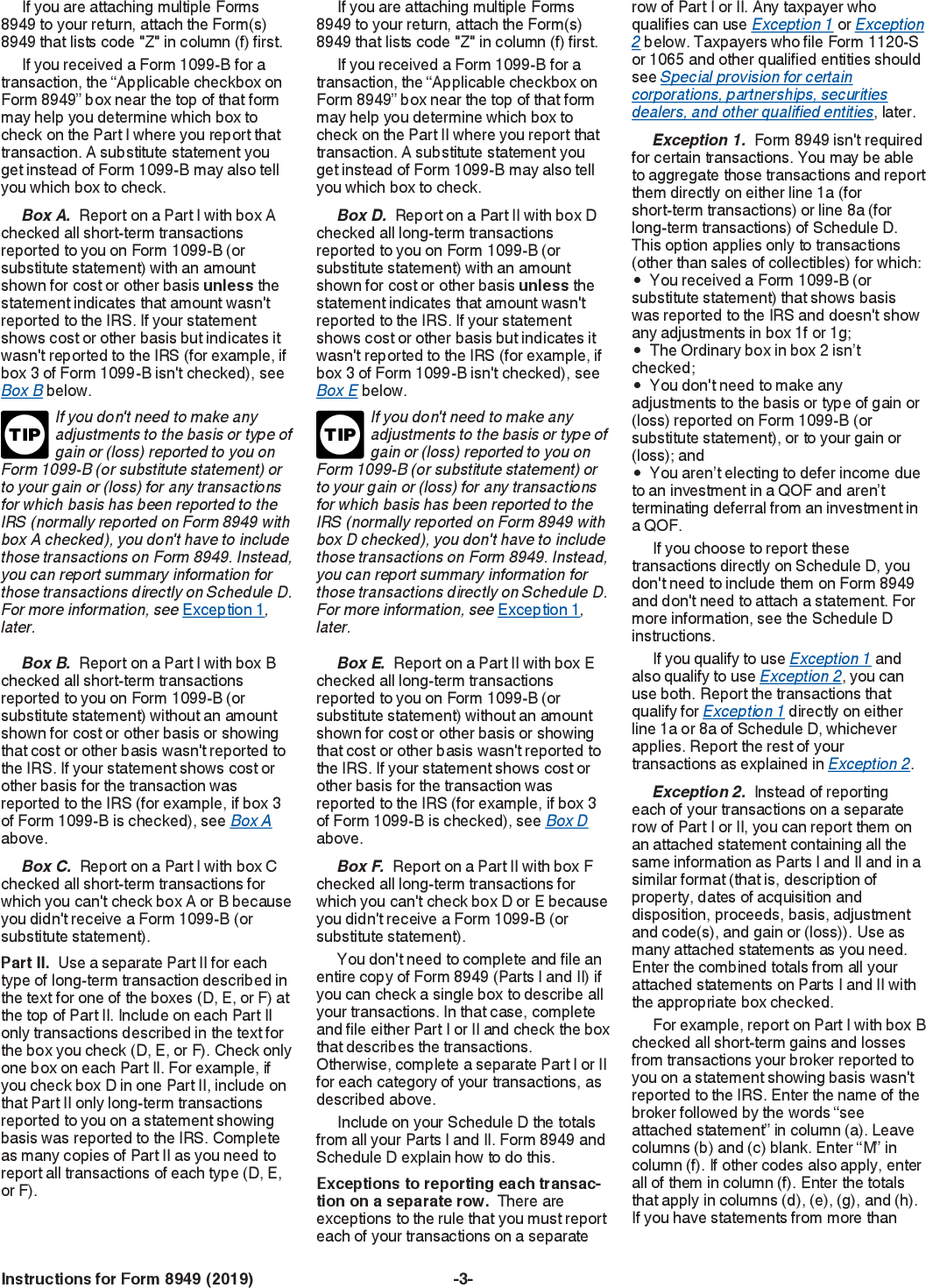

Get your online template and fill it in using progressive features. Web future developments for the latest information about developments related to form 8949 and its instructions, such as legislation enacted after they were published, go to. Sales and other dispositions of capital assets is an internal revenue service (irs) form used to report capital gains and losses from investments. Enjoy smart fillable fields and interactivity. Web on the appropriate form 8949 as a gain. Solved•by turbotax•6685•updated april 12, 2023. Web these transactions on part i of form 8949 (or line 1a of schedule d if you can use exception 1 under the instructions for form 8949, line 1, later). Web we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest version of form 8949, fully updated for tax year 2022. Instructions for form 8949, sales and other dispositions of capital assets : Code(s) from amount of instructions adjustment (h) gain or (loss) subtract column (e) from column (d) and combine the result with column (g).

If box 5 is checked, box 1f may be blank. The taxpayer’s adjusted basis in the home is $150,000. Web use form 8949 to report: Sales and other dispositions of capital assets is an internal revenue service (irs) form used to report capital gains and losses from investments. If you exchange or sell capital assets, report them on your federal tax return using form 8949: Web future developments for the latest information about developments related to form 8949 and its instructions, such as legislation enacted after they were published, go to. Web on the appropriate form 8949 as a gain. Enjoy smart fillable fields and interactivity. Web we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest version of form 8949, fully updated for tax year 2022. Web 12 rows report the gain or loss in the correct part of form 8949.

2020 Form IRS 8949 Fill Online, Printable, Fillable, Blank pdfFiller

Web use form 8949 to report: Instructions for form 8949, sales and other dispositions of capital assets : Web use form 8949 to report sales and exchanges of capital assets. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Sales and other dispositions of capital assets.

Online IRS Instructions 8949 2019 Fillable and Editable PDF Template

Web up to $40 cash back form 8949 instructions are meant to provide guidance to taxpayers on how to accurately and correctly fill out form 8949, sales and other dispositions of capital. Get your online template and fill it in using progressive features. Do your 2021, 2020, 2019, 2018 all the way back to 2000 If you exchange or sell.

IRS Form 8949 instructions.

Web irs 8949 2020 get irs 8949 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save aggregate rating ★ ★ ★. Web 24 votes how to fill out and sign undistributed online? Web what is form 8949 used for? Web use form 8949 to report sales.

IRS Form 8949 instructions.

Instructions for form 8949, sales and other. Web where is form 8949? Web use form 8949 to report sales and exchanges of capital assets. Shows the amount of nondeductible loss in a wash sale. Enjoy smart fillable fields and interactivity.

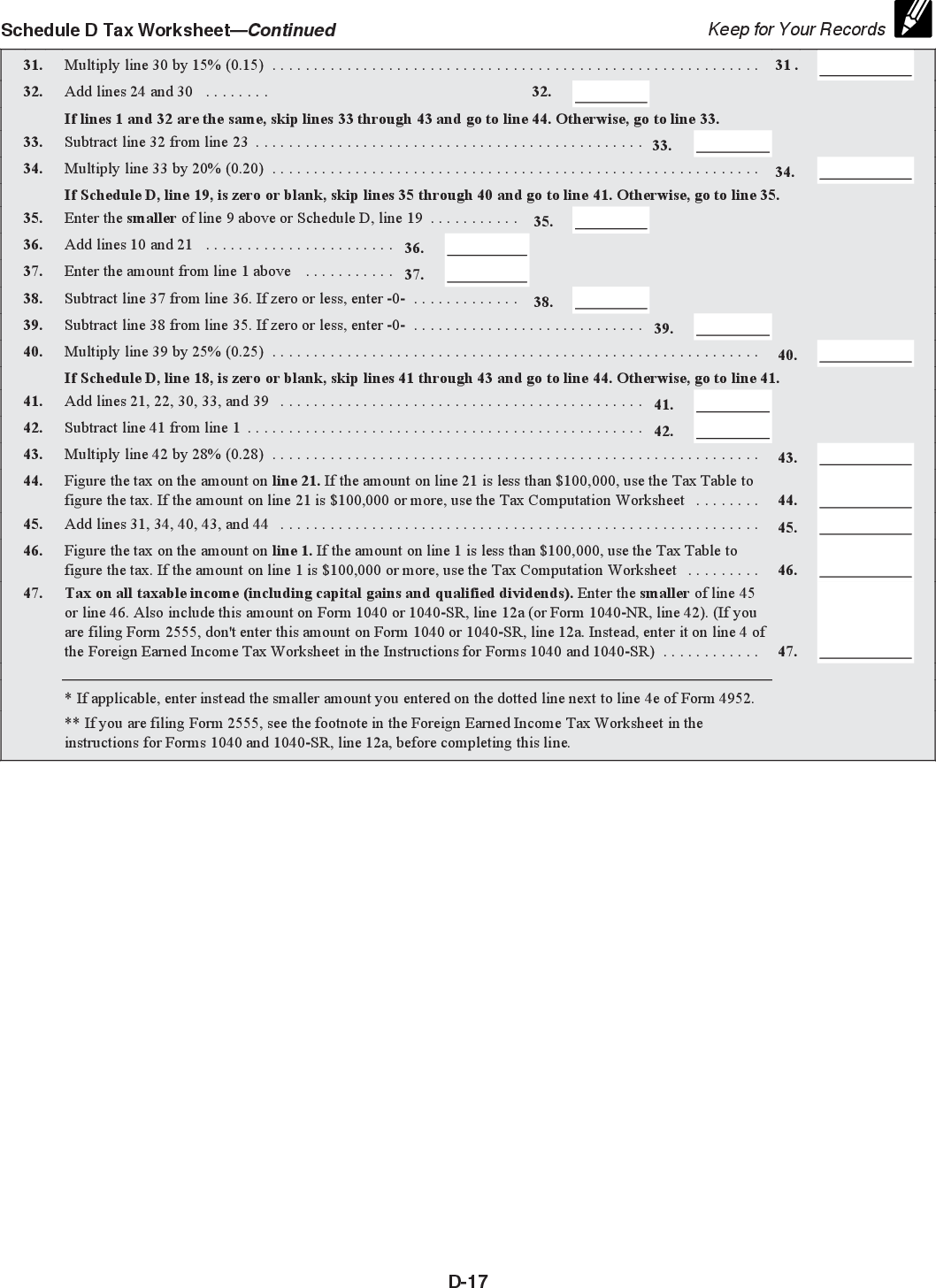

IRS Schedule D instructions.

Web 24 votes how to fill out and sign undistributed online? Solved•by turbotax•6685•updated april 12, 2023. Web use form 8949 to report: Shows the amount of nondeductible loss in a wash sale. Web instructions, the instructions for form 8949, and pub.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web up to $40 cash back form 8949 instructions are meant to provide guidance to taxpayers on how to accurately and correctly fill out form 8949, sales and other dispositions of capital. The taxpayer’s adjusted basis in the home is $150,000. Web instructions, the instructions for form 8949, and pub. Web on the appropriate form 8949 as a gain. Web.

IRS Form 8949 instructions.

Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Web we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest version of form 8949, fully updated for tax year 2022. Web up to $40 cash back form.

IRS Form 8949 instructions.

Solved•by turbotax•6685•updated april 12, 2023. Sales and other dispositions of capital assets. Form 8949 allows you and the irs to reconcile amounts that were reported to you and the irs on forms 1099. Sales and other dispositions of capital assets is an internal revenue service (irs) form used to report capital gains and losses from investments. Web where is form.

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Web on the appropriate form 8949 as a gain. Web use form 8949 to report: The taxpayer’s adjusted basis in the home is $150,000. Web general instructions file form 8949 with the schedule d for the return you are filing. Web where is form 8949?

IRS Form 8949 instructions.

Ad irs 8949 instructions & more fillable forms, register and subscribe now! Enjoy smart fillable fields and interactivity. Web irs 8949 2020 get irs 8949 2020 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save aggregate rating ★ ★ ★. Web future developments for the latest information.

Web On The Appropriate Form 8949 As A Gain.

Do your 2021, 2020, 2019, 2018 all the way back to 2000 Web up to $40 cash back form 8949 instructions are meant to provide guidance to taxpayers on how to accurately and correctly fill out form 8949, sales and other dispositions of capital. Web general instructions file form 8949 with the schedule d for the return you are filing. Web 24 votes how to fill out and sign undistributed online?

Web These Transactions On Part I Of Form 8949 (Or Line 1A Of Schedule D If You Can Use Exception 1 Under The Instructions For Form 8949, Line 1, Later).

Web we last updated the sales and other dispositions of capital assets in december 2022, so this is the latest version of form 8949, fully updated for tax year 2022. Web information about form 8949, sales and other dispositions of capital assets, including recent updates, related forms and instructions on how to file. Enjoy smart fillable fields and interactivity. Easy, fast, secure & free to try!

Solved•By Turbotax•6685•Updated April 12, 2023.

Web future developments for the latest information about developments related to form 8949 and its instructions, such as legislation enacted after they were published, go to. Instructions for form 8949, sales and other dispositions of capital assets : Web use form 8949 to report: Ad do your 2021, 2020, 2019, 2018 all the way back to 2000 easy, fast, secure & free to try!

Web Updated For Tax Year 2022 • June 2, 2023 08:43 Am Overview The Schedule D Form Is What Most People Use To Report Capital Gains And Losses That.

If box 5 is checked, box 1f may be blank. Web where is form 8949? Web what is form 8949 used for? If you exchange or sell capital assets, report them on your federal tax return using form 8949: