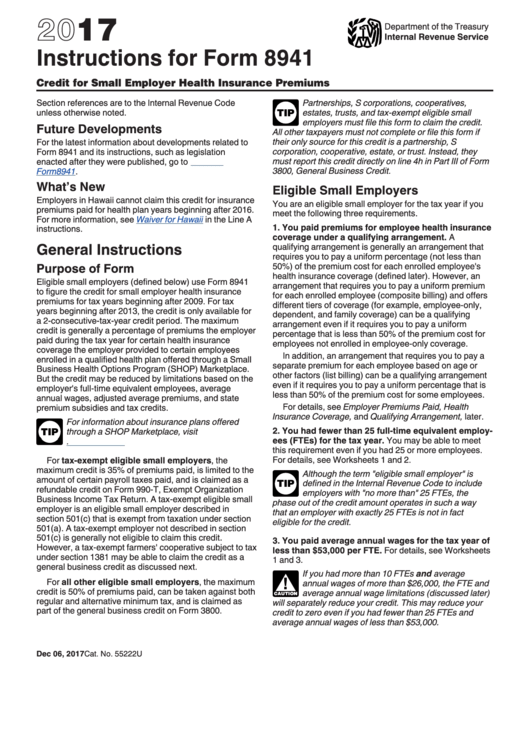

Form 8941 Instructions

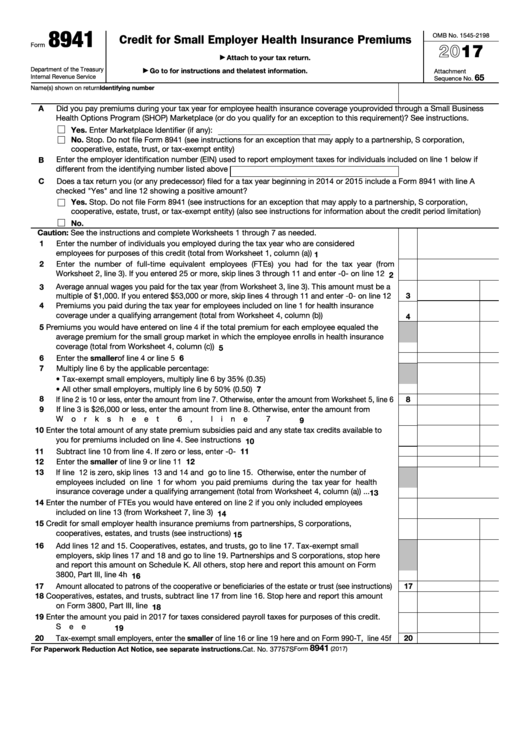

Form 8941 Instructions - Web you must use form 8941, credit for small employer health insurance premiums, to calculate your actual credit. It should be filed by small businesses that. Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums. Web unless an exception applies, only one form 8941 can be filed with a tax return. The maximum credit is based on. Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. Web in this article, we’ll go over this tax form, including: Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: Who must file form 941?

Who must file form 941? For detailed information on filling out this form, see the. Eligibility requirements for the small employer health insurance premium tax. Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums. The maximum credit is based on. Web the instructions to form 8941 include a worksheet to help you figure out the average annual salary. Web information about form 8941, credit for small employer health insurance premiums, including recent updates, related forms, and instructions on how to file. Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. Web you must use form 8941, credit for small employer health insurance premiums, to calculate your actual credit. Web attach a corrected form 8974 to your amended return.

Web unless an exception applies, only one form 8941 can be filed with a tax return. It should be filed by small businesses that. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; How should you complete form 941? Employees who qualify as full time employing more than 24. Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other appropriate forms and file it together with your tax return. Worksheets 1 through 7 can help you figure the amounts 15. Web information about form 8941, credit for small employer health insurance premiums, including recent updates, related forms, and instructions on how to file. Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums. Current year general business credits;.

Instructions For Form 8941 Credit For Small Employer Health Insurance

Web unless an exception applies, only one form 8941 can be filed with a tax return. To report on various lines of form 8941. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web attach a corrected form 8974 to your amended return. Worksheets 1 through 7 can help you figure.

Form 8941 Credit for Small Employer Health Insurance Premiums (2014

To report on various lines of form 8941. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; For detailed information on filling out this form, see the. Current year general business credits;. Instructions for form 8941, credit for small employer health insurance premiums 2011 inst 8941:

IRS Form 8941 Instructions Small Employer Insurance Credits

Don't use an earlier revision to report taxes for 2023. It should be filed by small businesses that. Worksheets 1 through 7 can help you figure the amounts 15. How to complete irs form 8941. Web you must use form 8941, credit for small employer health insurance premiums, to calculate your actual credit.

Form 8941 instructions 2016

Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949. Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other.

Form 8941 Instructions How to Fill out the Small Business Health Care

Worksheets 1 through 7 can help you figure the amounts 15. Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. Current year general business credits;. Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any.

Form 8941 Instructions How to Fill out the Small Business Health Care

Who must file form 941? Web unless an exception applies, only one form 8941 can be filed with a tax return. Web in this article, we’ll go over this tax form, including: The maximum credit is based on. See the instructions for form 8941 for additional information.

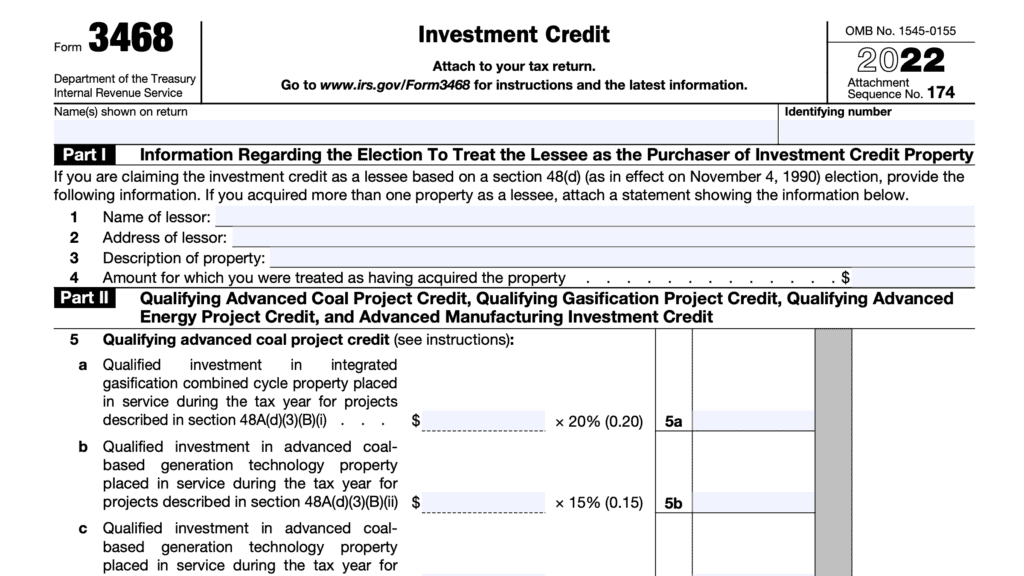

IRS Form 6765 Instructions Tax Credit For Research Activities

Eligibility requirements for the small employer health insurance premium tax. Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other appropriate forms and file it together with your tax return. Don't use an earlier revision to report taxes for 2023. Web in this article, we’ll go over this tax.

Form 8941 Instructions How to Fill out the Small Business Health Care

How to complete irs form 8941. Web unless an exception applies, only one form 8941 can be filed with a tax return. Current year general business credits;. The maximum credit is based on. For detailed information on filling out this form, see the.

Form 8941 Instructions How to Fill out the Small Business Health Care

Web unless an exception applies, only one form 8941 can be filed with a tax return. It should be filed by small businesses that. Employees who qualify as full time employing more than 24. To report on various lines of form 8941. How should you complete form 941?

Fillable Form 8941 Credit For Small Employer Health Insurance

Instructions for form 8941, credit for small employer health insurance premiums 2011 inst 8941: Web to access form 8941 in taxslayer pro, from the main menu of the tax return (form 1040) select: Employees who qualify as full time employing more than 24. Web eligible small businesses use form 8941 to figure the credit and then include the credit amount.

For Detailed Information On Filling Out This Form, See The.

Web eligible small businesses use form 8941 to figure the credit and then include the credit amount as part of the general business credit on its income tax return. Web in this article, we’ll go over this tax form, including: Web form 8941 is used by eligible small employers to calculate the credit for small employer health insurance premiums. Web instructions for form 8971 and schedule a and column (e)—cost or other basis in the instructions for form 8949.

Don't Use An Earlier Revision To Report Taxes For 2023.

Instructions for form 8941, credit for small employer health. Web eligible small employers can use form 8941 to figure the credit for small employer health insurance premiums for tax years beginning after 2009. To report on various lines of form 8941. How to complete irs form 8941.

See The Instructions For Form 8941 For Additional Information.

• use worksheets 1, 2, and 3 to figure the. How should you complete form 941? Web you must use form 8941, credit for small employer health insurance premiums, to calculate your actual credit. Web information about form 8941, credit for small employer health insurance premiums, including recent updates, related forms, and instructions on how to file.

Web Unless An Exception Applies, Only One Form 8941 Can Be Filed With A Tax Return.

Current year general business credits;. It should be filed by small businesses that. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web to determine the actual amount of the credit, you must complete form 8941 and attach it along with any other appropriate forms and file it together with your tax return.