Form 8938 Threshold 2021

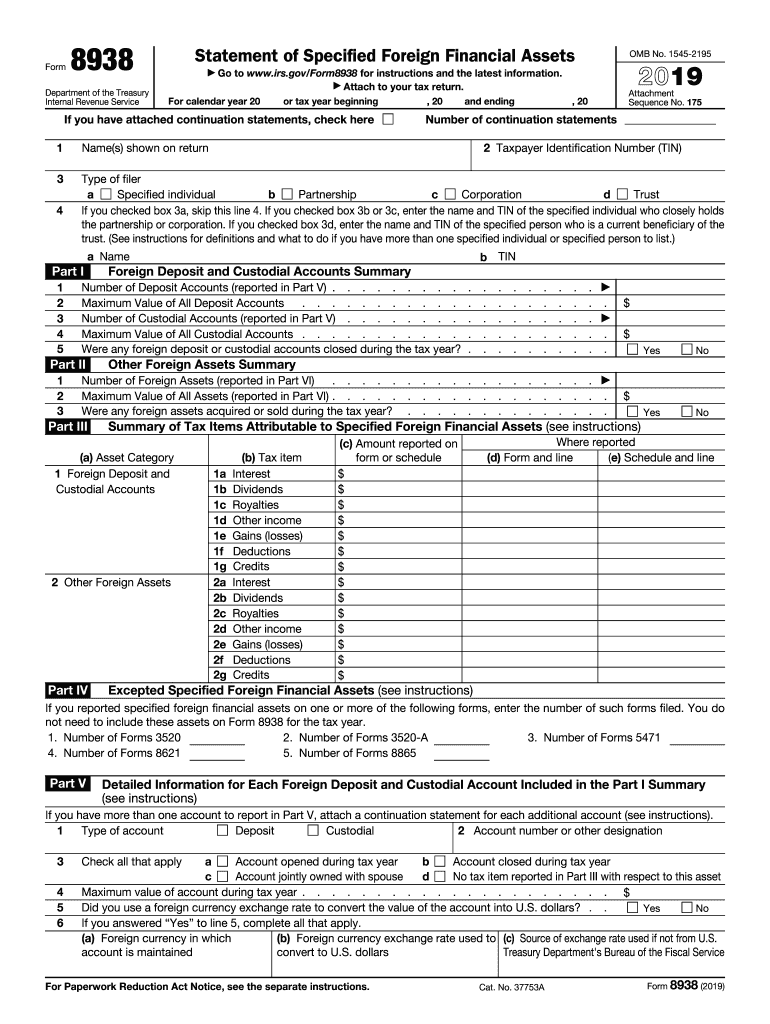

Form 8938 Threshold 2021 - Web about form 8938, statement of specified foreign financial assets. Web form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal revenue service). Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. Important irs reporting tips form 8938 is required by us taxpayers who meet the threshold filing requirements for reporting certain specified. Web in sharp contrast, a person filing married filing jointly and residing overseas may have a minimum threshold requirement of $400,000. Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Web let us help you form 8938 (2021): Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report information about those assets on new form. Web purpose of form use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an.

Web what are the reporting thresholds for form 8938? Web if you are married and you and your spouse file a joint income tax return, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web let us help you form 8938 (2021): Web in sharp contrast, a person filing married filing jointly and residing overseas may have a minimum threshold requirement of $400,000. Web usa december 13 2021 tax form 8938 filing requirements for foreign assets. Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. You can download or print. Not all assets are reported.

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal revenue service). Web in sharp contrast, a person filing married filing jointly and residing overseas may have a minimum threshold requirement of $400,000. Or at any time during the tax year is more. The form 8938 is only required by persons who are required to file a tax return. Important irs reporting tips form 8938 is required by us taxpayers who meet the threshold filing requirements for reporting certain specified. Complete, edit or print tax forms instantly. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen. Web what are the reporting thresholds for form 8938? Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you.

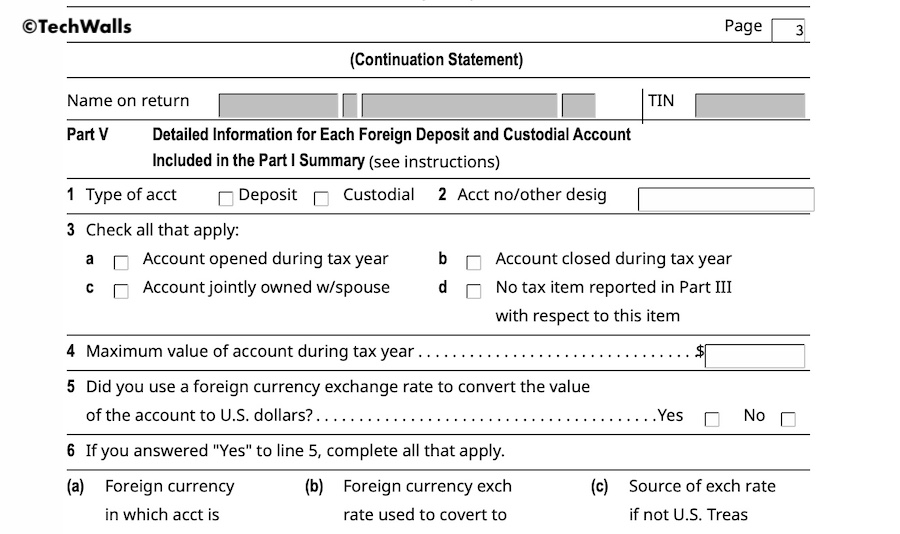

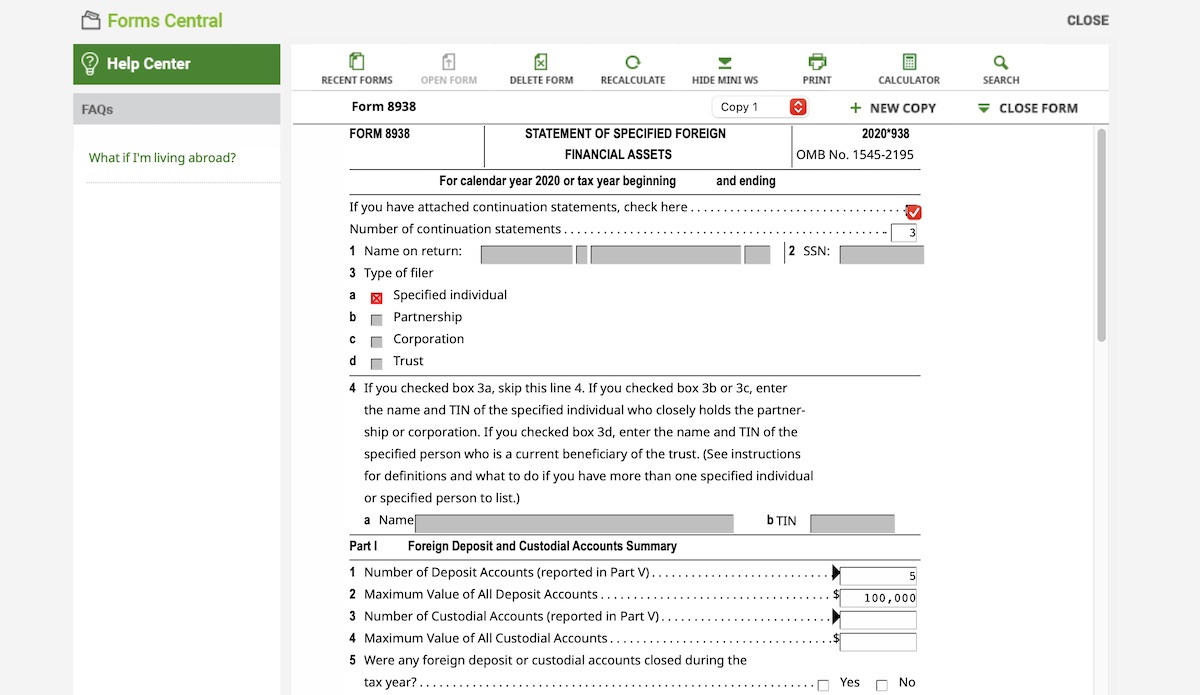

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Web if you are married and you and your spouse file a joint income tax return, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Web form 8938 filing thresholds. Web let us.

Comparison of Form 8938 and FBAR Requirements ZMB Tax Consultants

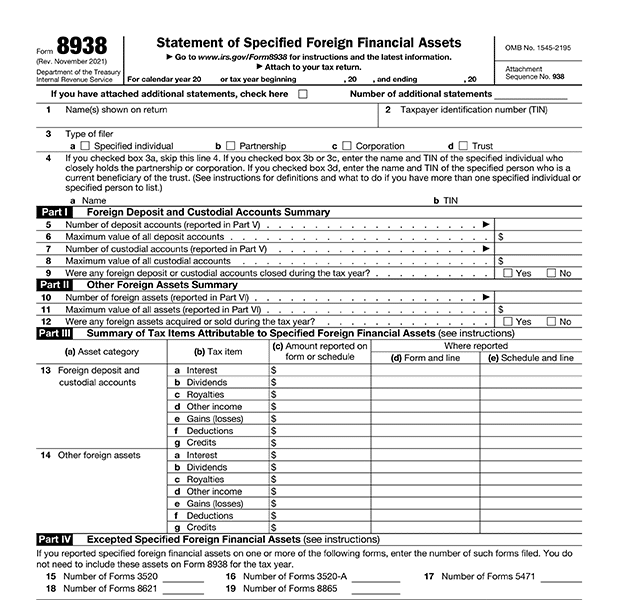

Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. Web purpose of form use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an. Web usa.

Reporting Crypto Taxes on FBAR or Form 8938 A Complete Guide mind

Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Web about form 8938, statement of specified foreign financial assets. Aggregate value of all specified foreign financial assets on last day of the tax year is more than: Web form 1138 is used by a.

1098 Form 2021 IRS Forms Zrivo

Aggregate value of all specified foreign financial assets on last day of the tax year is more than: Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets. Web we last updated the statement of foreign financial assets in february 2023, so this is the.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign. Web usa december 13 2021 tax form 8938 filing requirements for foreign assets. Complete, edit or print tax forms instantly. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign.

FATCA Reporting Filing Form 8938 Gordon Law Group

Web form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal revenue service). Web let us help you form 8938 (2021): Web about form 8938, statement of specified foreign financial assets. Once you determine that you’re an individual, business, or trust holder who might need to file form 8938,.

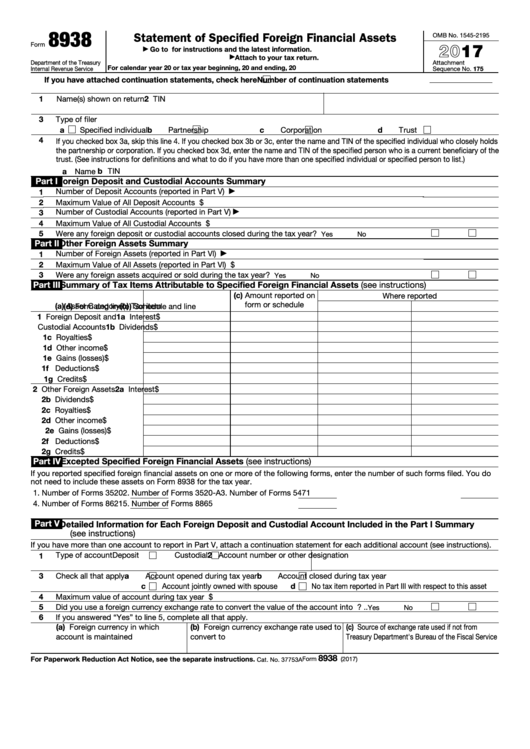

Fillable Form 8938 Statement Of Foreign Financial Assets 2017

Web usa december 13 2021 tax form 8938 filing requirements for foreign assets. Web we last updated the statement of foreign financial assets in february 2023, so this is the latest version of form 8938, fully updated for tax year 2022. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report information about those assets on.

Form 8938 Instructions 2022 2023 IRS Forms Zrivo

Web fatca requires certain u.s. Web form 8938 filing thresholds. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to.

Form 8938 Meadows Urquhart Acree and Cook, LLP

Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Web about form 8938, statement of specified foreign financial assets. Web fatca requires certain u.s. Complete, edit or print tax forms instantly. Web in sharp contrast, a person filing married filing jointly and residing overseas may have a minimum threshold requirement.

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

Important irs reporting tips form 8938 is required by us taxpayers who meet the threshold filing requirements for reporting certain specified. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report information about those assets on new form. Web fatca requires certain u.s. Web form 8938 is an irs international reporting form used to disclose overseas.

The Form 8938 Is Only Required By Persons Who Are Required To File A Tax Return.

Web what are the reporting thresholds for form 8938? Or at any time during the tax year is more. Web fatca requires certain u.s. Web form 8938 filing requirements by kunal patel “fatca” (foreign account tax compliance act) requires specified individuals to report ownership of specified foreign financial assets.

Web If You Are Married And You And Your Spouse File A Joint Income Tax Return, You Satisfy The Reporting Threshold Only If The Total Value Of Your Specified Foreign Financial Assets Is.

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web let us help you form 8938 (2021): Web form 1138 is used by a corporation expecting a net operating loss for the current year to request an extension of time for payment of tax for the immediately. Web home comparison of form 8938 and fbar requirements the form 8938 filing requirement does not replace or otherwise affect a taxpayer’s obligation to file fincen.

Taxpayers Who Hold Foreign Financial Assets With An Aggregate Value Of More Than The Reporting Threshold (At Least $50,000) To Report Information About.

Web usa december 13 2021 tax form 8938 filing requirements for foreign assets. Once you determine that you’re an individual, business, or trust holder who might need to file form 8938, you. Web form 8938 filing thresholds. Not all assets are reported.

Aggregate Value Of All Specified Foreign Financial Assets On Last Day Of The Tax Year Is More Than:

Important irs reporting tips form 8938 is required by us taxpayers who meet the threshold filing requirements for reporting certain specified. Web purpose of form use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an. Taxpayers holding specified foreign financial assets with an aggregate value exceeding $50,000 will report information about those assets on new form. Complete, edit or print tax forms instantly.