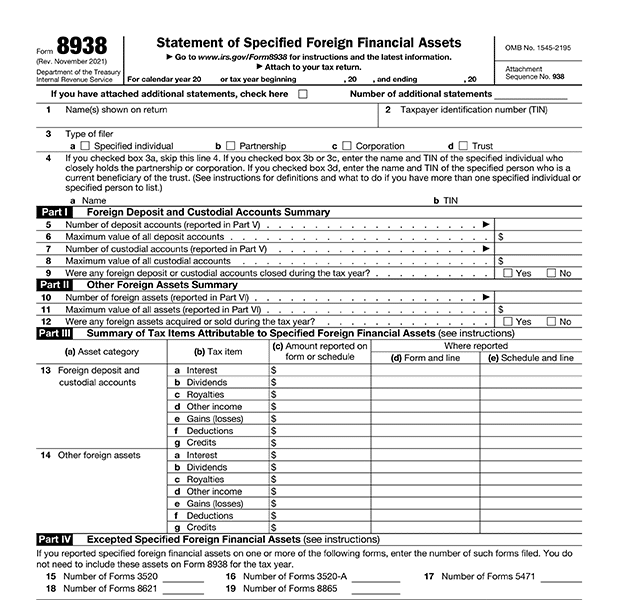

Form 8938 Reporting Threshold

Form 8938 Reporting Threshold - Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web form 8938 is used to report your foreign financial assets if the total value exceeds a certain threshold based on your filing status and the types of assets. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Form 8938 is filed if the taxpayer: Web the applicable reporting threshold. Web the form 8938 has different threshold filing requirements depending on different factors. Web 1 irs form 8938 threshold; 3 form 8938 threshold requirements for individuals; 4 taxpayers living in the united states; Web form 8938 threshold & requirements.

2 fatca reporting & form 8938; Web form 8938 is used to report the taxpayer's specified foreign financial assets. Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include. Unlike the fbar, in which a u.s. 3 form 8938 threshold requirements for individuals; Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Web the applicable reporting threshold. Web what is the form 8938 reporting threshold? Web form 8938 is required for taxpayers who are actually required to file a tax return, and meet the threshold requirements for filing.

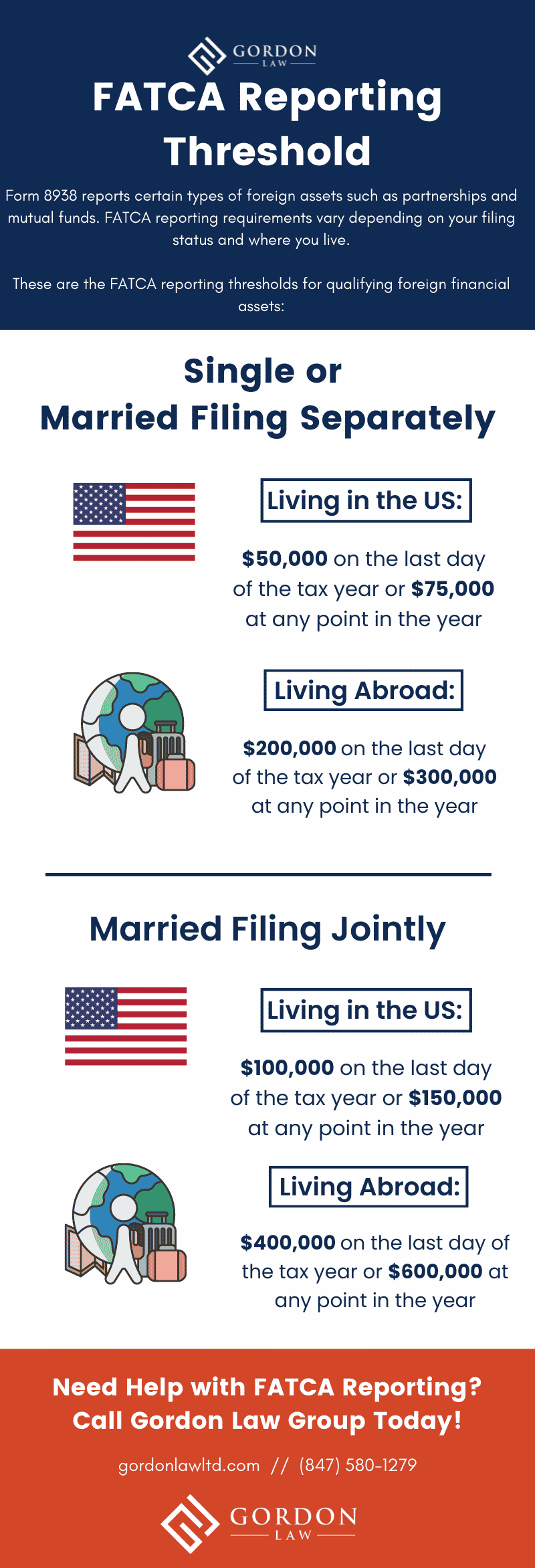

Web form 8938 threshold & requirements. Web the form 8938 has different threshold filing requirements depending on different factors. Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial. Web 1 irs form 8938 threshold; You satisfy the reporting threshold even though you do not hold any specified foreign financial assets on the last day of the tax year because you did. Taxpayers to report specified foreign financial assets and income. Web fatca requires certain u.s. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web form 8938 threshold & requirements. 2 fatca reporting & form 8938; Web you have to file form 8938. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Taxpayers who meet the form 8938 threshold and are.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

You satisfy the reporting threshold even though you do not hold any specified foreign financial assets on the last day of the tax year because you did. 3 form 8938 threshold requirements for individuals; Form 8938 is filed if the taxpayer: Web you have to file form 8938. Web taxpayers generally have an obligation to report their foreign asset holdings.

FATCA Reporting Filing Form 8938 Gordon Law Group

You satisfy the reporting threshold even though you do not hold any specified foreign financial assets on the last day of the tax year because you did. Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Web if you are not married, you.

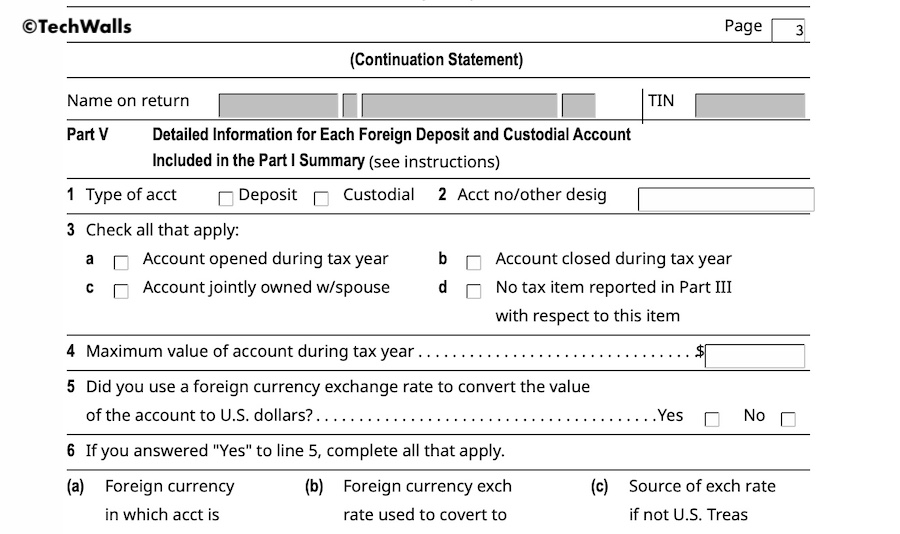

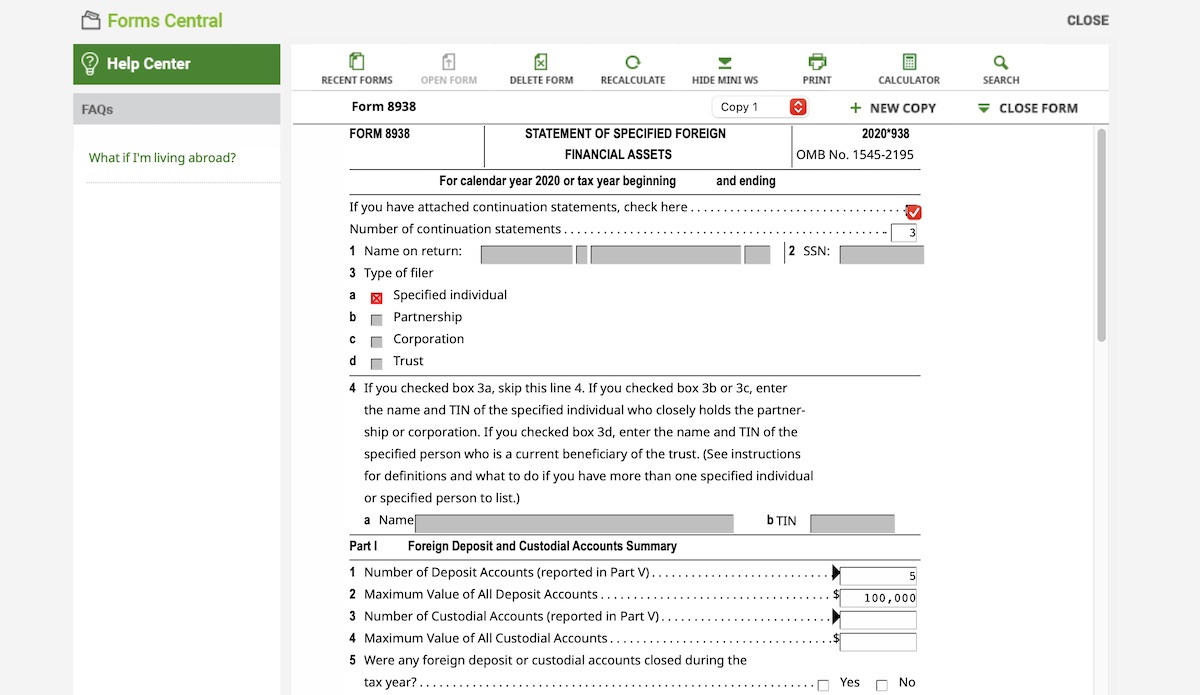

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial. 3 form 8938 threshold requirements for individuals; Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Unlike the fbar, in which a u.s. 2 fatca reporting & form 8938;

Is Form 8938 Reporting Required for Foreign Pension Plans?

Web 1 irs form 8938 threshold; Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial. Web you have to file form 8938. Web form 8938.

form 8938 threshold 2020 Fill Online, Printable, Fillable Blank

Web fatca requires certain u.s. Web form 8938 is used to report the taxpayer's specified foreign financial assets. Web form 8938 is required for taxpayers who are actually required to file a tax return, and meet the threshold requirements for filing. Web 1 irs form 8938 threshold; You satisfy the reporting threshold even though you do not hold any specified.

IRS Reporting Requirements for Foreign Account Ownership and Trust

Web form 8938 is required for taxpayers who are actually required to file a tax return, and meet the threshold requirements for filing. 4 taxpayers living in the united states; Web you have to file form 8938. Web if you are not married, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is.

FATCA Reporting Filing Form 8938 Gordon Law Group

Web this aggregate value level is also known as the form 8938 filing threshold. The applicable reporting threshold is determined based on the taxpayer’s filing status and whether the taxpayer lives outside. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web form 8938 is required for taxpayers who are actually required to file a.

Form 8938 Who Has to Report Foreign Assets & How to File

Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Web the applicable reporting threshold. Web what.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web form 8938 threshold & requirements. Web taxpayers generally have an obligation to report their foreign asset holdings to the irs on form 8938, statement of specified foreign financial. 4 taxpayers living in the united states; Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets.

Web Form 8938 Is A Tax Form Used By U.s.

Web if you are not married, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is more than $200,000 on the last day of the tax year or. 4 taxpayers living in the united states; Web this aggregate value level is also known as the form 8938 filing threshold. Form 8938 is filed if the taxpayer:

Web You Have To File Form 8938.

2 fatca reporting & form 8938; Web what is the form 8938 reporting threshold? Web under prior law, the reporting of sffas on form 8938 solely applied to individuals, provided that the value of the reportable foreign assets exceeded the. Taxpayers who meet the form 8938 threshold and are required to file a tax return will also be required to include.

Web Fatca Requires Certain U.s.

If you are required to file form 8938, you must report the specified foreign financial assets in which you have an interest even if none of. The applicable reporting threshold is determined based on the taxpayer’s filing status and whether the taxpayer lives outside. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file?

Web Form 8938 Is Required For Taxpayers Who Are Actually Required To File A Tax Return, And Meet The Threshold Requirements For Filing.

Taxpayers to report specified foreign financial assets and income. Web the form 8938 has different threshold filing requirements depending on different factors. 3 form 8938 threshold requirements for individuals; Web form 8938 threshold & requirements.