Form 8895-A

Form 8895-A - It has four parts and four additional schedules designed to help. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. Top 13mm (1⁄ 2 ), center sides. Web how do i file an irs extension (form 4868) in turbotax online? Subsequently, at the end of august, the irs issued draft instructions for. Web how do i get to form 8895? File an extension in turbotax online before the deadline to avoid a late filing penalty. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment.

S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Web how do i get to form 8895? File an extension in turbotax online before the deadline to avoid a late filing penalty. Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. It has four parts and four additional schedules designed to help. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Top 13mm (1⁄ 2 ), center sides. Subsequently, at the end of august, the irs issued draft instructions for. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. How do i clear and.

S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. Subsequently, at the end of august, the irs issued draft instructions for. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. It has four parts and four additional schedules designed to help. Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web how do i file an irs extension (form 4868) in turbotax online? How do i clear and. Web how do i get to form 8895?

8895A Timely Hardware

Web how do i get to form 8895? Subsequently, at the end of august, the irs issued draft instructions for. Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. How do i clear and. S corporations are.

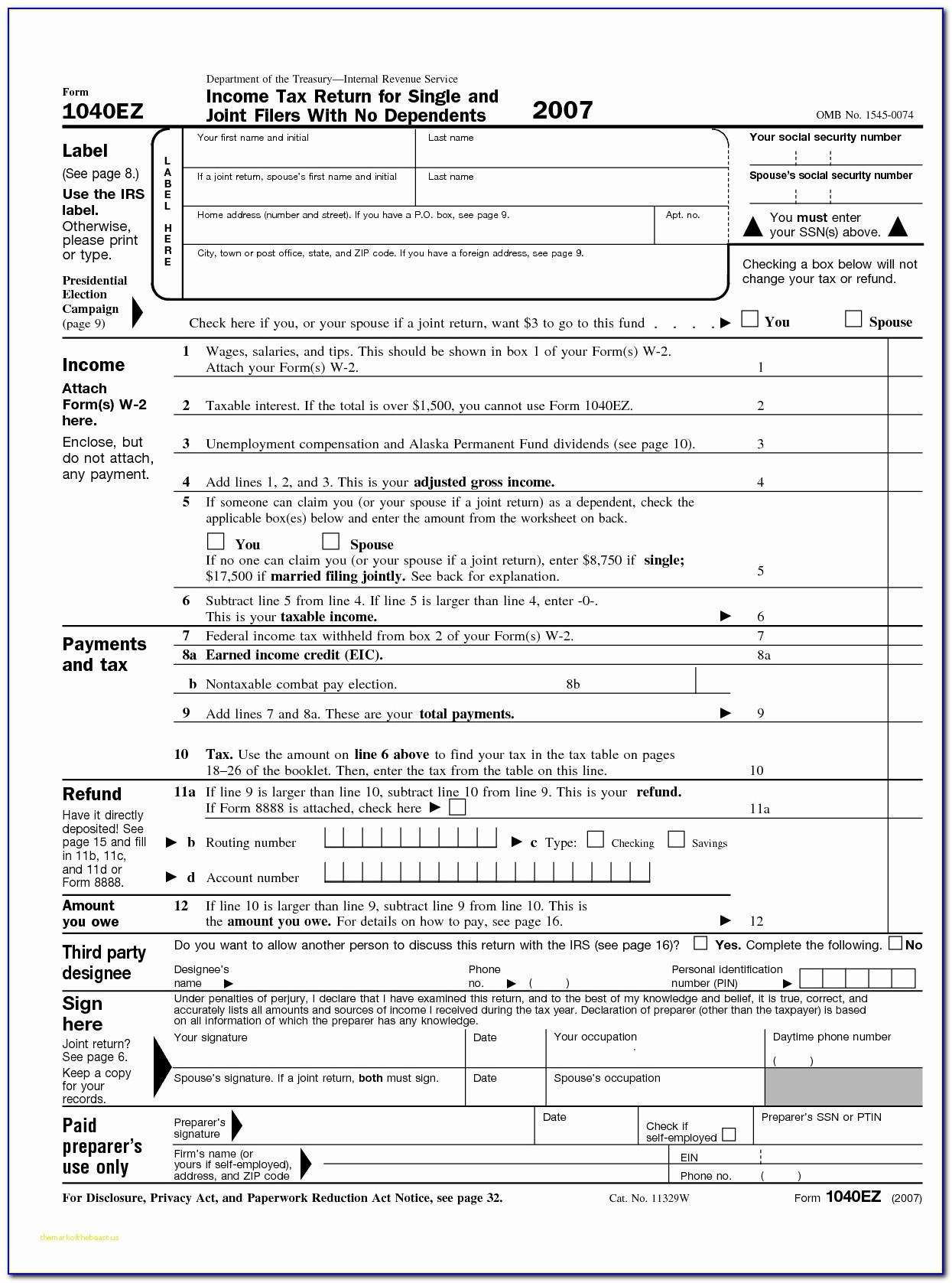

Printable Tax Form 1040 Printable Form 2022

It has four parts and four additional schedules designed to help. Subsequently, at the end of august, the irs issued draft instructions for. Web how do i file an irs extension (form 4868) in turbotax online? File an extension in turbotax online before the deadline to avoid a late filing penalty. How do i clear and.

Magic Form 8895 Tül Dantelli Sütyenli Korse Gecelik Fiyatı

File an extension in turbotax online before the deadline to avoid a late filing penalty. Subsequently, at the end of august, the irs issued draft instructions for. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. It has four parts and four additional schedules designed to.

Cisco 8845 IP Video Phone (CP8845K9) Atlas Phones

S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section. Subsequently, at the end of august, the irs issued draft instructions for. Web just finished the.

Salaş Gelin Saçı Modelleri promhairupdowithbraid Salaş Gelin Saçı

Subsequently, at the end of august, the irs issued draft instructions for. File an extension in turbotax online before the deadline to avoid a late filing penalty. It has four parts and four additional schedules designed to help. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is.

Form 8995A Draft WFFA CPAs

Web how do i get to form 8895? Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. File an extension in turbotax online before the deadline to avoid a late filing penalty. How do i clear and..

Indian and Himalayan Bactrian bronze votive Kohl container the

Web how do i file an irs extension (form 4868) in turbotax online? Top 13mm (1⁄ 2 ), center sides. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. Subsequently, at the end of august, the irs issued draft instructions for..

Vertical Cash Envelope Printable PDF INSTANT DOWNLOAD Printable

Subsequently, at the end of august, the irs issued draft instructions for. Web the final product of form 8962, how much federal subsidy you must repay or an additional tax credit, is then populated on either schedule 2 or 3 of the federal 1040. Top 13mm (1⁄ 2 ), center sides. File an extension in turbotax online before the deadline.

Magic Form 8895 Tül Dantelli Sütyenli Korse Gecelik 4488420 Morhipo

Subsequently, at the end of august, the irs issued draft instructions for. S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web how do i file an irs extension (form 4868) in turbotax.

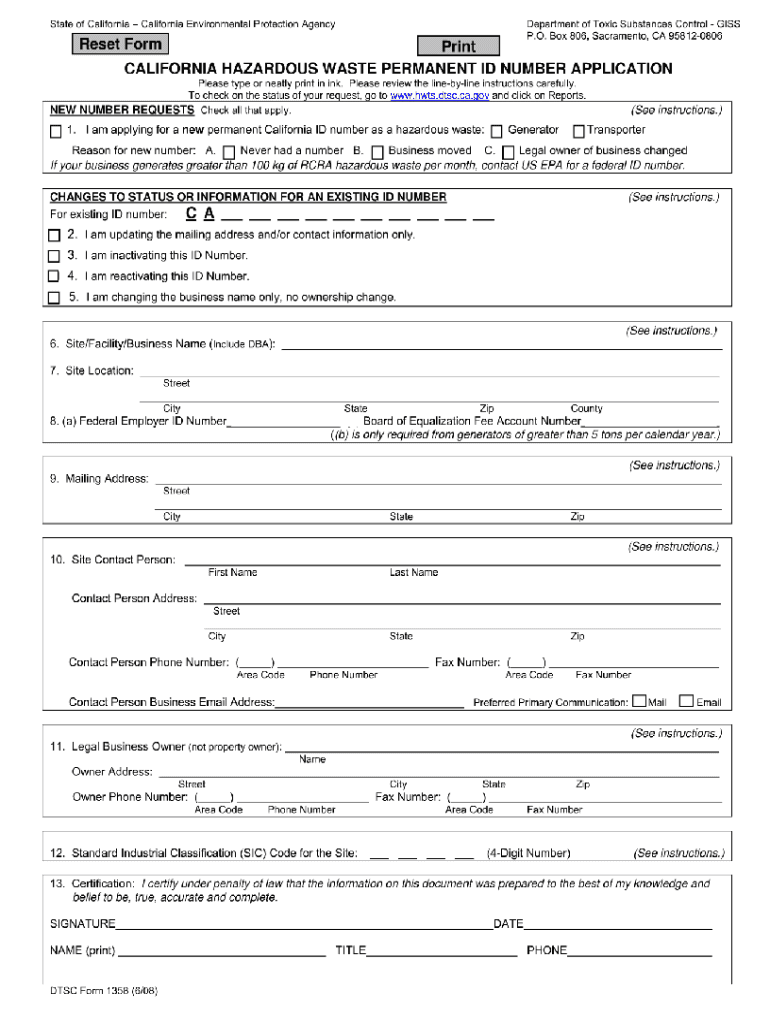

2008 Form CA DTSC 1358 Fill Online, Printable, Fillable, Blank pdfFiller

S corporations are not eligible for the deduction, but must pass through to their shareholders the necessary information on an attachment. Web how do i get to form 8895? Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached. It has four.

Web The Final Product Of Form 8962, How Much Federal Subsidy You Must Repay Or An Additional Tax Credit, Is Then Populated On Either Schedule 2 Or 3 Of The Federal 1040.

How do i clear and. Web how do i get to form 8895? Web how do i file an irs extension (form 4868) in turbotax online? Shareholder of a controlled foreign corporation (cfc) uses form 8895 to elect the 85% dividends received deduction (drd) provided under section 965 (section.

Top 13Mm (1⁄ 2 ), Center Sides.

Subsequently, at the end of august, the irs issued draft instructions for. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax rate. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web just finished the tax return and printed out the all required forms for mailing, but the 8895, qbi deduction form is marked 'do not file'(see the attached.

S Corporations Are Not Eligible For The Deduction, But Must Pass Through To Their Shareholders The Necessary Information On An Attachment.

It has four parts and four additional schedules designed to help.