Form 8865 Schedule K-2

Form 8865 Schedule K-2 - Persons filing form 8865, return of u.s. Return of partnership income , form 8865, return of u.s. Partner’s share of income, deductions, credits, etc. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s. Part iv information on partners’ section 250 deduction with respect to. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. With respect to form 1065, the following are the different. (updated january 9, 2023) 2. Persons with respect to certain foreign partnerships. The irs today released draft versions of schedules k.

Persons with respect to certain foreign partnerships (for u.s. Return of partnership income , form 8865, return of u.s. Persons filing form 8865, return of u.s. The irs today released draft versions of schedules k. Persons with respect to certain foreign partnerships. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s. Partner’s share of income, deductions, credits, etc. Part iv information on partners’ section 250 deduction with respect to. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s.

Persons with respect to certain foreign partnerships. The irs today released draft versions of schedules k. Return of partnership income , form 8865, return of u.s. With respect to form 1065, the following are the different. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. (updated january 9, 2023) 2. Partner’s share of income, deductions, credits, etc. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s.

Form 8865 Return of U.S. Persons With Respect to Certain Foreign

(updated january 9, 2023) 2. The irs today released draft versions of schedules k. Part iv information on partners’ section 250 deduction with respect to. Partner’s share of income, deductions, credits, etc. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s.

2021 Form IRS 8865 Schedule K1 Fill Online, Printable, Fillable

Return of partnership income , form 8865, return of u.s. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Partner’s share of income, deductions, credits, etc. (updated january 9, 2023) 2. With respect to form 1065, the following are the different.

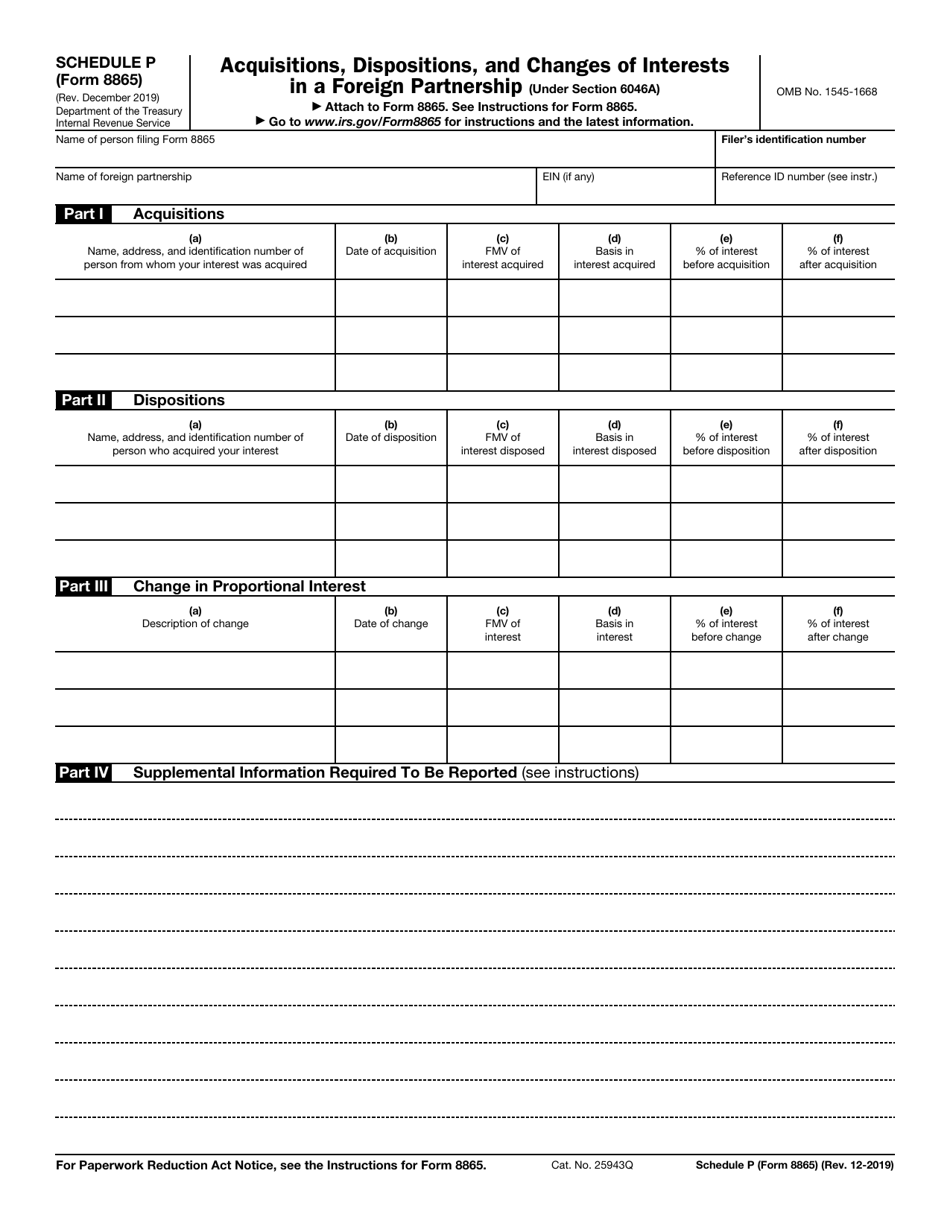

Irs Form 8865 Schedule P Download Fillable Pdf Or Fill Online

Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s. Persons with respect to certain foreign partnerships. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. The irs today released draft versions of schedules k..

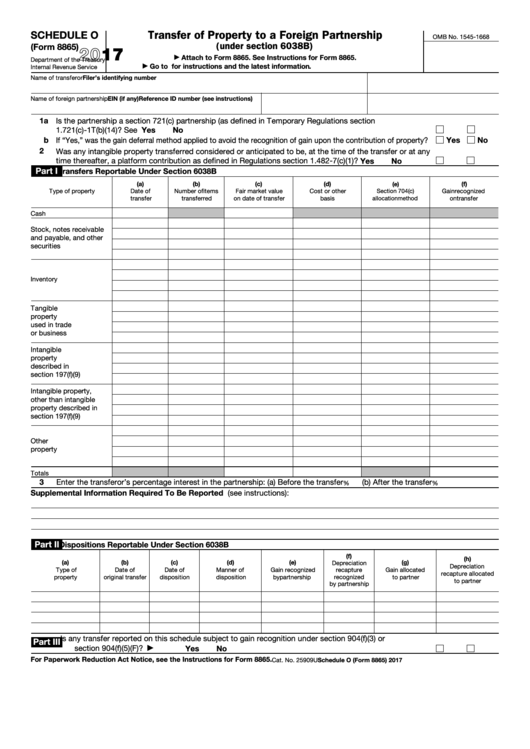

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

The irs today released draft versions of schedules k. Return of partnership income , form 8865, return of u.s. Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Web up to 10% cash back a partnership files the schedules with its form.

Form 8865 Schedule N FORM.UDLVIRTUAL.EDU.PE

(updated january 9, 2023) 2. Persons with respect to certain foreign partnerships. The irs today released draft versions of schedules k. Persons filing form 8865, return of u.s. Persons with respect to certain foreign partnerships (for u.s.

Updates to IRS Schedules K2 and K3 International Tax Relevance for

Persons with respect to certain foreign partnerships. Web beginning with tax year 2021, partnerships, s corporations, and filers of form 8865, return of u.s. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Persons filing form 8865, return of u.s. Partner’s share of income, deductions, credits, etc.

2018 8865 Fillable and Editable PDF Template

Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Persons filing form 8865, return of u.s. Return of partnership income , form 8865, return of u.s. Part iv information on partners’ section 250 deduction with respect to. Persons with respect to certain.

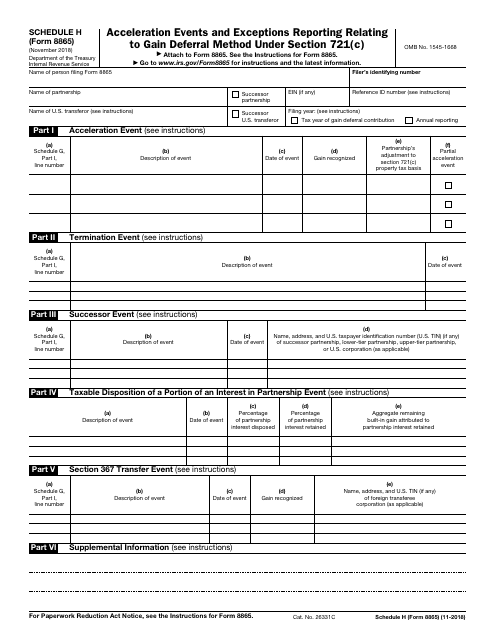

IRS Form 8865 Schedule H Download Fillable PDF or Fill Online

(updated january 9, 2023) 2. Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Persons with respect to certain foreign partnerships (for u.s. Partner’s share of income, deductions, credits, etc. Return of partnership income , form 8865, return of u.s.

Fillable Schedule O (Form 8865) Transfer Of Property To A Foreign

(updated january 9, 2023) 2. Part iv information on partners’ section 250 deduction with respect to. Return of partnership income , form 8865, return of u.s. Persons filing form 8865, return of u.s. Partner’s share of income, deductions, credits, etc.

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

The irs today released draft versions of schedules k. With respect to form 1065, the following are the different. Partner’s share of income, deductions, credits, etc. Persons filing form 8865, return of u.s. Persons with respect to certain foreign partnerships (for u.s.

Web Beginning With Tax Year 2021, Partnerships, S Corporations, And Filers Of Form 8865, Return Of U.s.

Web for the tax year beginning in 2021, the irs has implemented a new reporting requirement for partnerships, s corporations, and filers of form 8865 to include. Partner’s share of income, deductions, credits, etc. Partnership’s operations, such as foreign taxes paid, income from foreign sources, and. Return of partnership income , form 8865, return of u.s.

Persons With Respect To Certain Foreign Partnerships (For U.s.

Persons with respect to certain foreign partnerships. Part iv information on partners’ section 250 deduction with respect to. (updated january 9, 2023) 2. With respect to form 1065, the following are the different.

The Irs Today Released Draft Versions Of Schedules K.

Web up to 10% cash back a partnership files the schedules with its form 1065 or form 8865, return of u.s. Persons filing form 8865, return of u.s. Persons with respect to certain foreign partnerships.